Good Afternoon, Yesterday we sold our position in the C Fund and moved to the safety of the G Fund. We did so because all of our indicators (and there are many) with the exception of our primary indicator called for us to sell. Our primary indicator (which is proprietary) is still moving toward a sell signal and will likely get there in the coming days if something doesn’t change. The important thing to note here is that it has not as of yet generated that signal and that means a reversal is still possible. However, right now the current trend is down and there has been much damage to the charts that will have to be repaired before a bottom can be put it. I noted back in December that we would likely experience at the minimum a correction in the 15% range during the first quarter of this year. Right now the S&P is off around 11% but the market is still trending down. As of the writing of this blog the market is selling off again. We will be watching closely to see if the dip buyers show up again in the afternoon session. Fundamentally speaking, the thing of course that everyone is watching is today’s Fed meeting which will cumulate with tomorrow afternoons closing statement by Fed Chairman Jerome Powell. It is widely expected that Chairman Powell will outline a series of interest rate increases beginning in March. Many investors say that the market is currently pricing in as many as four rate increases before the year ends. That is not surprise and surprises are what tend to create large moves in the market. So what can cause a surprise in this Fed meeting? What could cause the selling to accelerate? Here are a couple of things that I think might upset the apple cart so to speak. Both surround the Feds monthly bond purchase program that has been in place since 2009 but was doubled during the pandemic. The first is the rate of taper (or slowing down) of bond purchases. The Fed is currently scheduled to end these purchases I believe sometime this summer. There is now some speculation that the Fed could further accelerate this schedule or possibly even abruptly end the program at this meeting in order to clear the way for interest rate increases. There are those on the Fed board who believe that inflation is a problem now and must be dealt with now. Thus they feel the the asset purchasing program must end now and interest rate increases must start now. You see, it would be counter productive for the Fed to continue to apply stimulus by purchasing bonds while at the same time tightening the money supply by increasing rates. So many believe that it is possible that they could take those measures this month which would be a change from what they telegraphed in December. The second issue that could induce some selling would be if the Fed chose to begin reducing the massive balance sheet of assets they have already purchased. It was understood in the past that the Fed would allow these assets (mostly treasury bonds but also some mortgage securities) to run off as they expire. However, there are those on the Fed governing board that believe that is not enough and that they must begin actively selling off these assets. AS I mentioned in last weeks blog that would not only end stimulus but would in fact actively remove liquidity from the market. So, think about it Folks, if you flood the market with bonds then bond prices will go down and if bond prices go down then bond yields and corresponding interest rates will rise. In the end it’s all about interest rates for the market. Higher rates make it more expensive for companies to do business and harder for new corporations to borrow the money they need to expand. That is what they mean when they say they are tightening the money supply and make no mistake that means higher rates for you as well. Higher mortgages, higher car loans etc. etc. So you get the picture. One other important aspect to all this is somewhat of a wildcard. Because this stimulus has been in place for so many years now many folks have become accustomed to trading with the safety net created by the government stimulus present since 2009. For others, it is all they have known. How will they react a cycle of the market where rates are increasing? They have become so dependent on V shaped recoveries that they may not know what to do or how to react to a market that just doesn’t turn higher from a decline as the market did back in 2000 when it took five years for investors who rode the market down to make their money back! I believe they will panic. We will see. Either way, we will continue to monitor the action from the safety of the G fund until we feel that a sufficient bottom has been put in. I already have folks asking how long that will be. I just can’t say. It might be a few days, a few weeks, or a few months. We will just have to wait patiently and find out. Also…..one more word of caution. Don’t trust the first bounce you see. Some of the biggest and best bounces occur in down trending markets. Bottoming is a process that usually takes days or weeks and requires multiple retests of the lower resistance. Never forget, you will soon be operating without the safety net that has been government stimulus….. and that changes the game altogether!

Today our allocation is steady in the G Fund. For comparison, the Dow is now off-1.38%, the Nasdaq -3.04%, and the S&P 500 -2.18%. We’ll see if the dip buyers show up and drive it higher in the afternoon session as they did yesterday. I find it unlikely ahead of tomorrow’s Fed news conference. Looking at the current action I have to give God all the praise for guiding us to the G Fund. He has been so good to our group!

Dow falls more than 400 points, Nasdaq sheds 3% as January wild trading continues

The days action has generated the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -7.65% for the year. Here are the latest posted results:

| 01/24/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7539 | 20.5114 | 66.6178 | 74.2811 | 37.7682 |

| $ Change | 0.0022 | -0.0212 | 0.1850 | 1.2775 | -0.4925 |

| % Change day | +0.01% | -0.10% | +0.28% | +1.75% | -1.29% |

| % Change week | +0.01% | -0.10% | +0.28% | +1.75% | -1.29% |

| % Change month | +0.10% | -1.80% | -7.41% | -10.98% | -4.24% |

| % Change year | +0.10% | -1.80% | -7.41% | -10.98% | -4.24% |

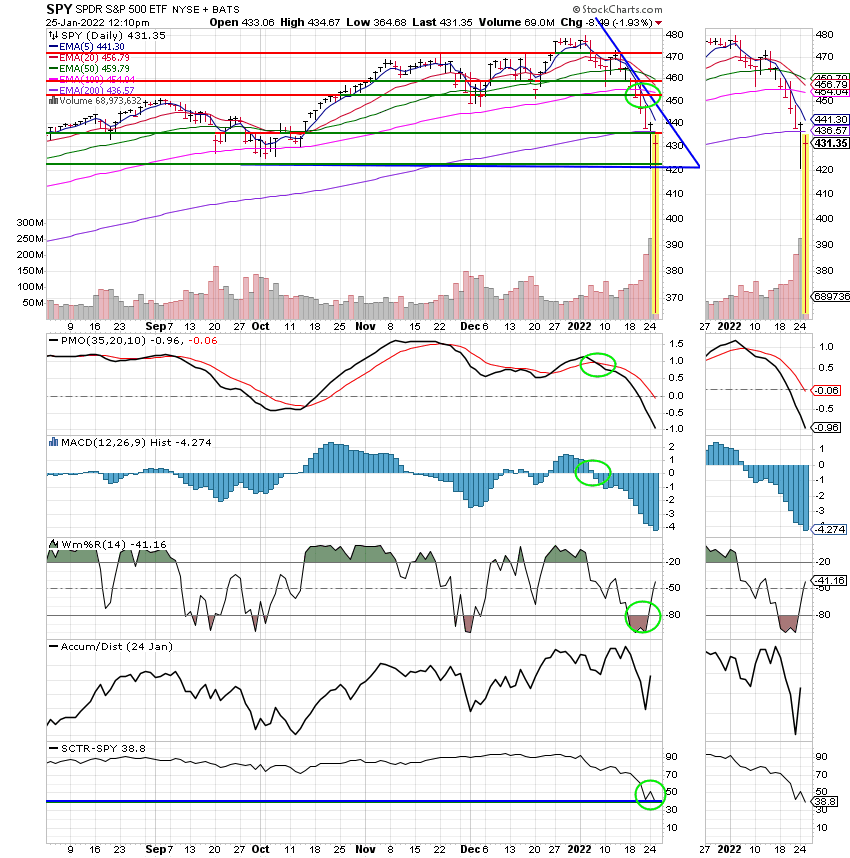

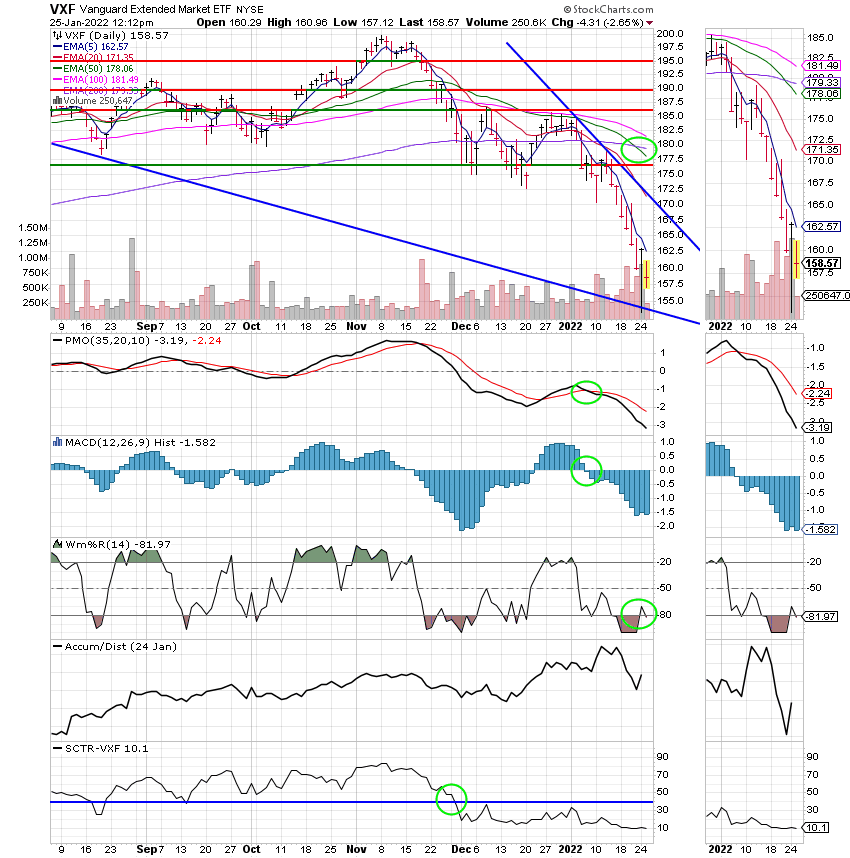

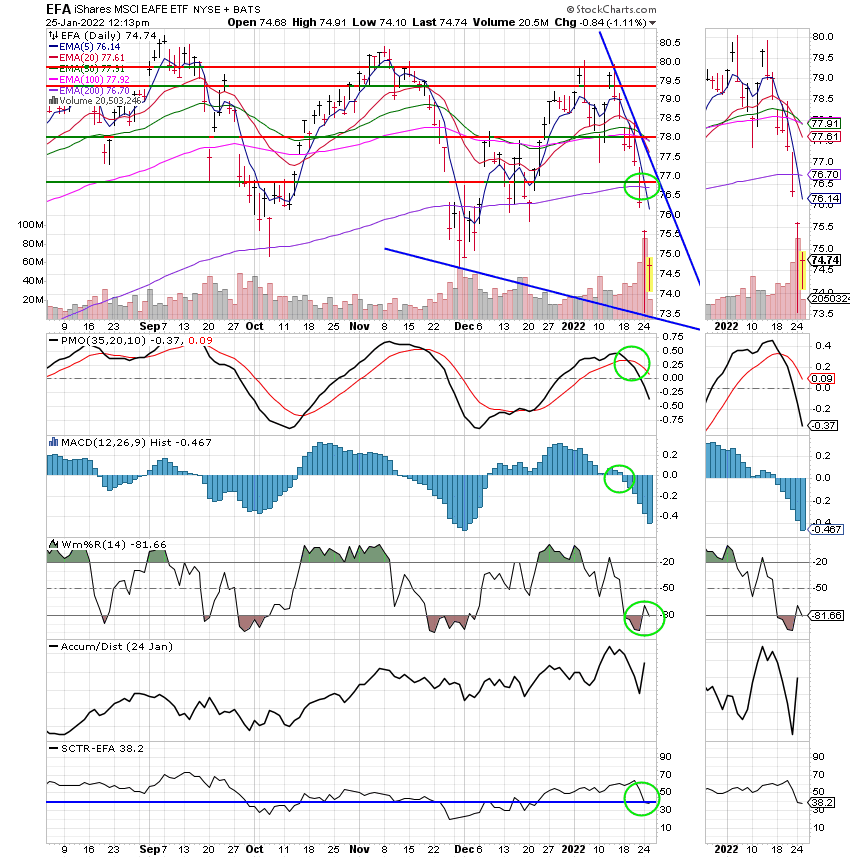

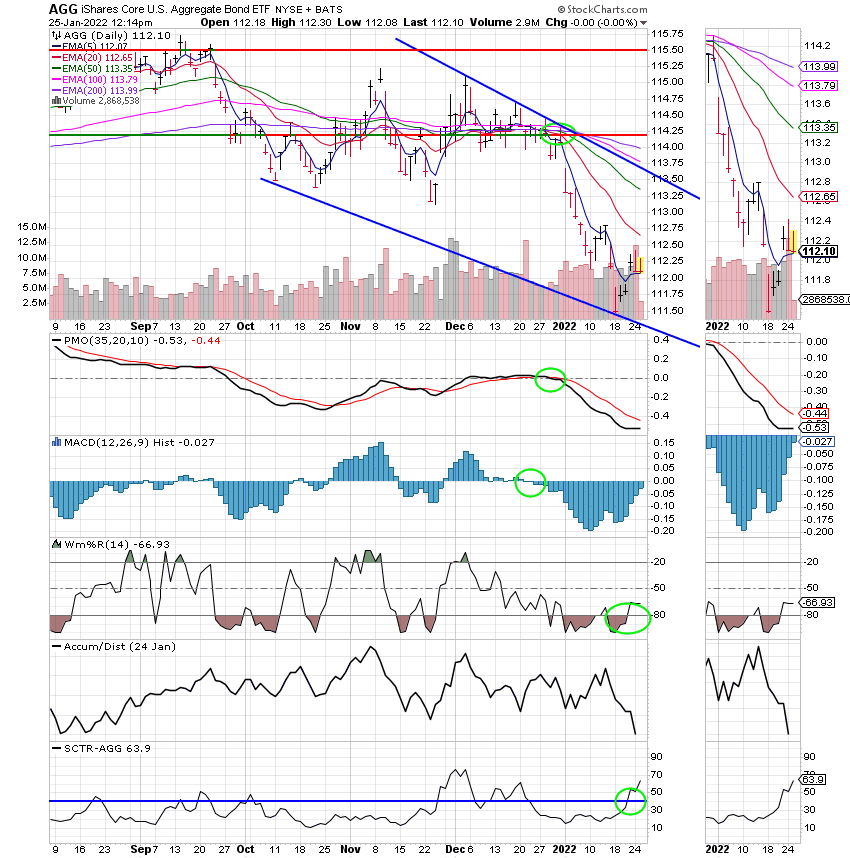

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Be patient. Tribulation brings patience. Don’t be concerned about this market. Turn it over to our Lord and Savior. He will guide our hand as He always has. We will watch our charts and react to what we see just as we always have. Have a nice day and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.