Good Day, Wow, what a frustrating market. We talked about this in some of our recent blogs. We discussed how the gains would be harder to come by in a rising interest rate environment. Well this is what I meant! Some of you are finding yourselves at a greater deficit than you’ve experienced in your investing careers. That’s the reason I talked about this so much in recent blogs. There’s nothing to really prepare you for investing in a market like this until you actually experience it. I tried my best to warn you but there is really no substitute for experience. Why is this market different? The interest rates are rising. Many if not most of you have never invested in an economy with rising inflation. It’s really not all that hard to understand. A plentiful money supply creates higher demand for goods and services. Therefore the prices rise. That’s inflation. So the Federal reserve tightens the money supply. In other words they make less money available. They do this by raising interest rates which they control. That is one of the tools they have to control inflation. Just for your information the Feds target rate for inflation is 2.00%. The current rate of inflation is now over 7.00%. Enough said about that!! The tighter money supply negatively affects the market because it increases their cost of doing business and in the case of small growth oriented companies makes if harder for them to get the capital they need to grow. Thus when the market hears that interest rates are being raised it sells off. Secondly, the market is different because the Federal Reserve is now decreasing stimulus that has been in place to one degree or the other since 2009. I won’t go into the various kinds of stimulus. I have written about that a lot in the past and you can review previous blogs to refresh your memory. All you need to understand now is that stimulus put in place to increase the money supply in tough economic conditions is now being taken away which adds even more to the effect of tightening the money supply. So there you have it. Money is getting tighter. Now, how does that make things different aside from the obvious? This is what it does. Dips, corrections, sell offs, and bear markets become more intense and take longer to resolve. I wrote about that (I think last week) when I told you about the bear market of 2000 taking 5 years to recover. That ladies and gentlemen is what I’m talking about. Last question….How do we deal with it? We sell quicker when our charts point to a decline. We no longer assume that the glorious V shaped recovery is going to come riding to our rescue. Bottom line, it takes more skill to do this and the buy and hold crowd will no longer be able to make the money that they have in the past 10 or so years. Welcome to the new world!!

As far as the market this week goes…..it continues to struggle between good earnings reports and higher inflation and interest rates. It depends on the news of the day as to which direction the market will move. Pretty much everything is run through the filter of whether or not it will cause the Fed to raise rates and if so by how much. The good news is that hot inflation is a result of a strong economy which will ultimately down the road resolve itself. Our task now is to find the road of less resistance to get there……..

On a personal note I must confess to you all that I cost us some money last Tuesday when I put in the IFT. I entered it one day early because I knew I was going to be on the road. The market turned higher on Tuesday afternoon and my plan was to watch it the next morning and get back in if technical support held on the charts. We had received the buy signal we were looking for on Tuesday afternoon but I had wanted to watch the next morning before I actually made the move. I received news that afternoon that my 90 year old Dad (Charles H. Grimes, Henderson Kentucky) was being put on comfort orders. For those of you that may not be familiar with what that is it is basically the hospital version of hospice… He has been given a short time to live and it is now day to day. I knew I was going to be on the road so I went ahead and moved the money that afternoon instead of waiting until the next morning. That ended up being the wrong decision. I apologize for that error. I covet your prayers for my Dad. He was a career Marine. He was what they call a mustang in that he started as a PFC and worked his way to being a commissioned officer. He retired as a 1st Lieutenant after over 20 years of service. He served in Vietnam where he was highly decorated most notably receiving the Navy Commendation Medal with a combat V. Since then he was an over the road truck driver. One of his trucks “Purple Passion” won best of show at the Mid America truck show in 2001, 2003, and 2005. The funny thing is that he did it on a dare. Somebody told that old Marine he couldn’t do that and you never tell a Marine what he can’t do! When I was a child I received more than one tongue lashing for using that word. Anyway he took his working class truck and starting with a Semper Fidelis license plate and eventually won the national championship three times. He has been married to the same women for 71 years and of course he has been a Dad for 63! I will miss him. All that noted I have investments too and will keep monitoring them as best as I can during this difficult time. If the money needs moving I will move it. Thank you all for your patience. God bless you all.

The days trading is currently giving us the following results: Our TSP allotment is up +0.60%. For comparison, the Dow is now +0.77%, the Nasdaq +0.88%, and the S&P 500 is +0.60%. I thank God we are up today.

Stocks rise slightly, Dow up 100 points as investors sift through corporate earnings

The the action is giving us the following signals: C-Hold, S-Hold, I-Hold, F-Sell. We are currently invested at 100/C. Our allocation is now -9.27% not including the days results. Here are the latest posted results:

| 02/07/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7648 | 20.2753 | 67.7616 | 74.609 | 38.1859 |

| $ Change | 0.0026 | 0.0101 | -0.2508 | 0.2465 | 0.2101 |

| % Change day | +0.02% | +0.05% | -0.37% | +0.33% | +0.55% |

| % Change week | +0.02% | +0.05% | -0.37% | +0.33% | +0.55% |

| % Change month | +0.03% | -0.86% | -0.68% | -0.57% | +0.81% |

| % Change year | +0.17% | -2.93% | -5.82% | -10.58% | -3.18% |

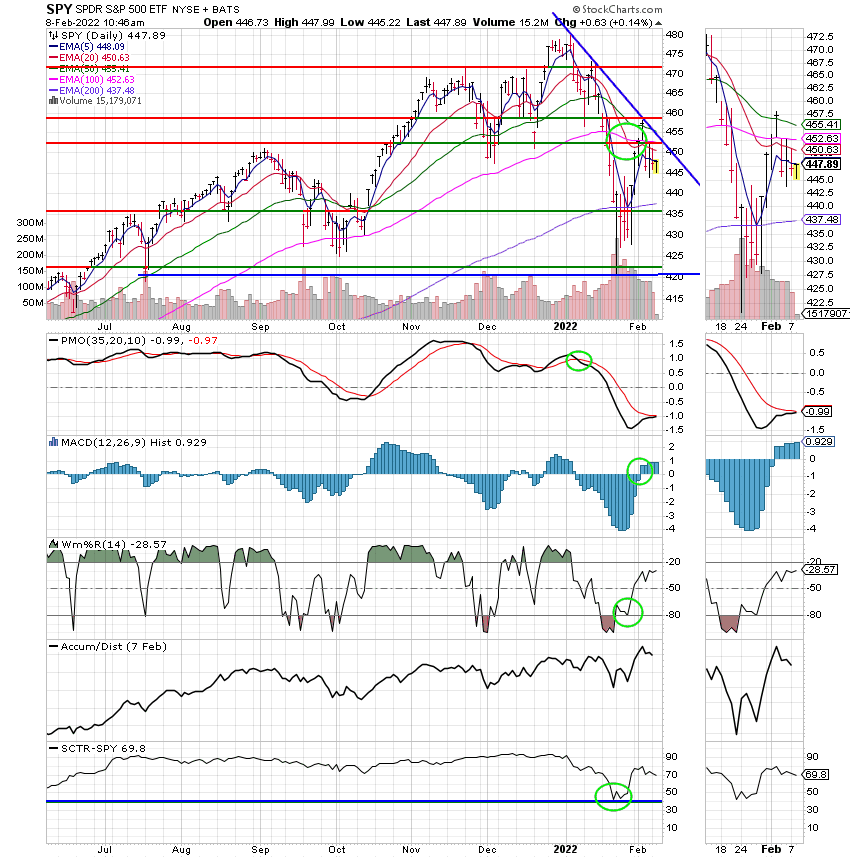

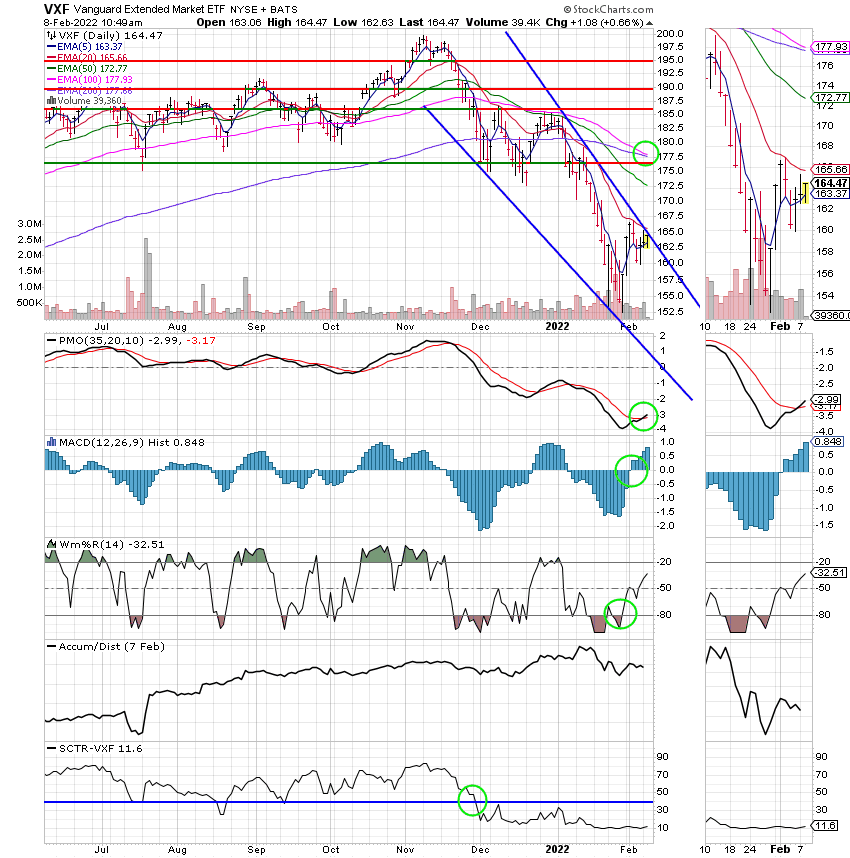

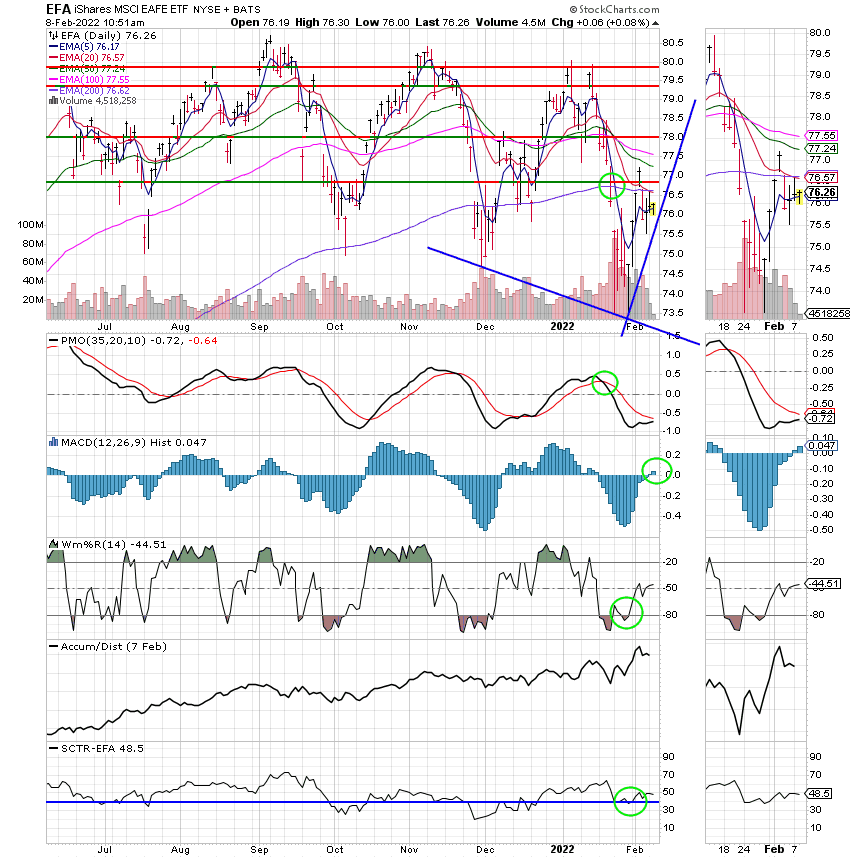

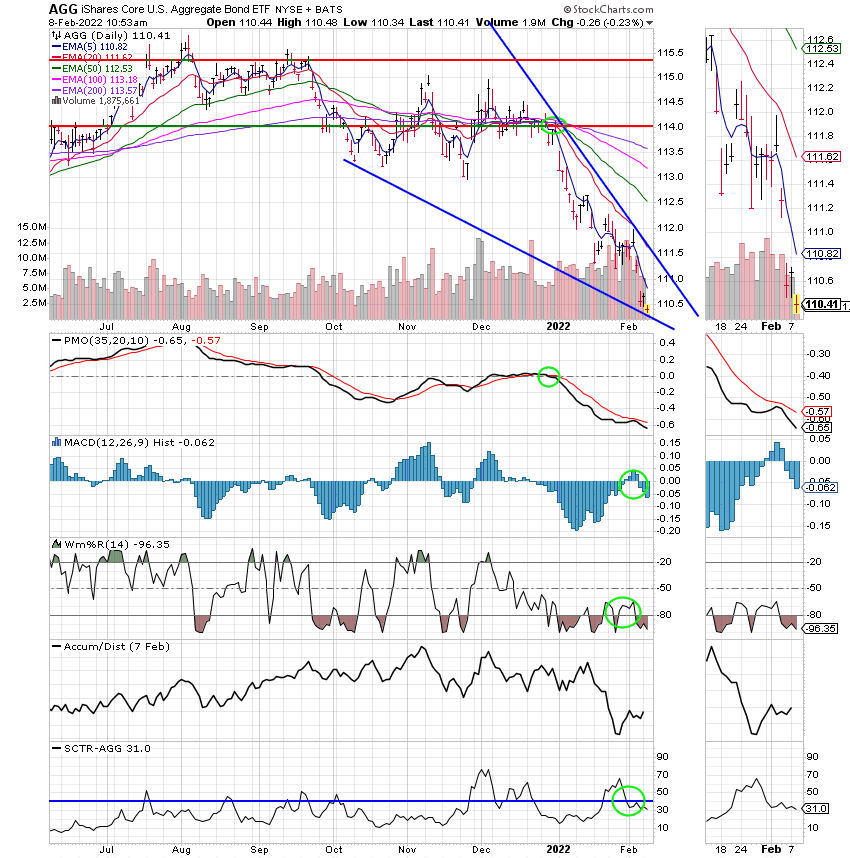

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Keep praying for our group and I covet your prayers for my family. That’s all for today. Have a nice day and may God bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.