Good Afternoon, I’m getting old enough that I forget how long a decade really is. After all the older you get the faster time goes. If you haven’t already discovered that you eventually will. I guess I just never realized how many of you started trading in the last 12 years. What made me realize this? The number of people who were utterly shocked that we invested in the I Fund. The dreaded step child for as long as they could remember! Lets get one thing straight. The folks that originally set up and developed TSP were smart. I know some of you aren’t feeling the same about the current crew but that’s an entirely different subject. Anyway…..the folks that originally set up Thrift put the I fund there for a reason. There was a time prior to quantitative easing that the I Fund routinely out performed the C and S Funds. Why was that and what made it tick?? Lets start here….. the I fund has been a casualty of artificial stimulus the past 12 years. Not because it was a bad fund. It’s much more complicated than that. First of all what is the I Fund? I had someone post this on Facebook “International Fund?” Well….yes that is an extremely broad description. actually the I Fund tracks the Morgan Stanley EAFE which is an Exchange Fund called the European, AustralAsian Far East Fund. So in fact the term international is probably a little too broad of a description as there are some countries that are not included in that fund. What is most important about the fund in this case is what it does not include and that is Russia and China. So you are mainly talking about Europe, Australia, and Japan. As far as I’m concerned they a little more stable the aforementioned countries. Given the conflict in the Ukraine that definitely alleviates a few of the concerns that some of you had. I understand fully that the Ukrainian conflict could affect the European Economy but it is still significant that Russia and China are not in the mix. That’s part of it but not the significant part. So again, why the I Fund? The I Fund was good Prior to 2009 because the dollar was strong. Why? It’s all about the exchange of currency. When the Dollar is high foreign goods and stocks become less expensive and US goods and stocks become more expensive. The effect is twofold. US companies are at a disadvantage to their foreign competitors and foreign stocks are at a discount when we buy them with dollars. This all works together to make the I Fund stronger. Which brings us to the current economic environment in the US. What makes it conducive to a stronger dollar? Inflation. Inflation causes the Fed to increase interest rates to fulfil their mandate to control it. What happens when interest rates go up? The money supply becomes tighter. It’s value rises. In other words the dollar gets stronger against foreign currencies. There are less dollars out there. Of course the Fed does this to decrease demand and slow the economy down. For instance people by fewer homes and cars when interest rates higher. You get the picture. So to tie it all together. The I Fund did not work well from 2009 until 2020 because the Fed kept interest rates artificially low. Now they are discontinuing the stimulus and even unwinding their balance sheet of bonds and mortgaged backed securities which is referred to as quantitative tightening. So they are doing everything they can to make bond yields and interest rates rise. The quantitative tightening is like putting a tailwind behind the whole deal. All that said, the I Fund will out perform in this rising rate environment and God willing we intend to take advantage of it! And……that’s the short version!

The days trading is giving us the current results: As of 2:20 PM EDST our TSP allotment is slightly higher at +0.16%. For comparison, the Dow is higher at +0.46%, the Nasdaq is +0.62, and the S&P 500 is up +0.58%. Praise God for a day in the green.

Dow rises more than 100 points as traders try to shake off Target’s profit warning

The days trading is generating the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/I. Our allocation is now -18.11% on the year not including the days results. Here are the latest posted results:

| 06/06/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8951 | 18.8812 | 62.6296 | 67.0526 | 35.0752 |

| $ Change | 0.0042 | -0.1186 | 0.1965 | 0.2436 | 0.1668 |

| % Change day | +0.02% | -0.62% | +0.31% | +0.36% | +0.48% |

| % Change week | +0.02% | -0.62% | +0.31% | +0.36% | +0.48% |

| % Change month | +0.09% | -1.42% | +1.63% | +2.62% | +0.70% |

| % Change year | +0.95% | -9.60% | -12.95% | -19.64% | -11.07% |

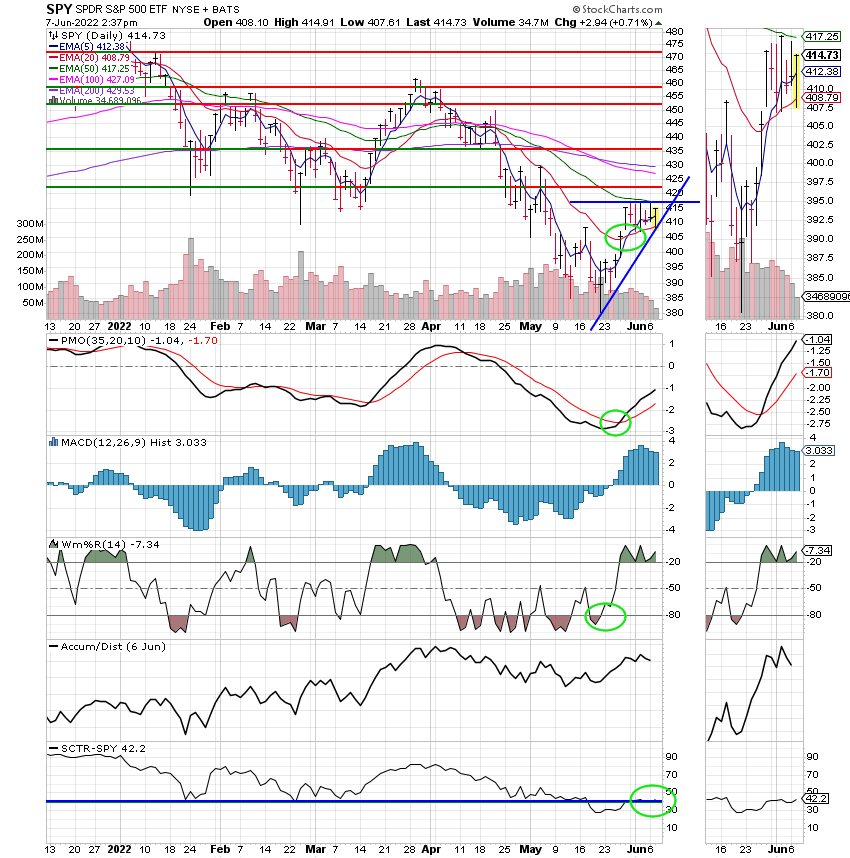

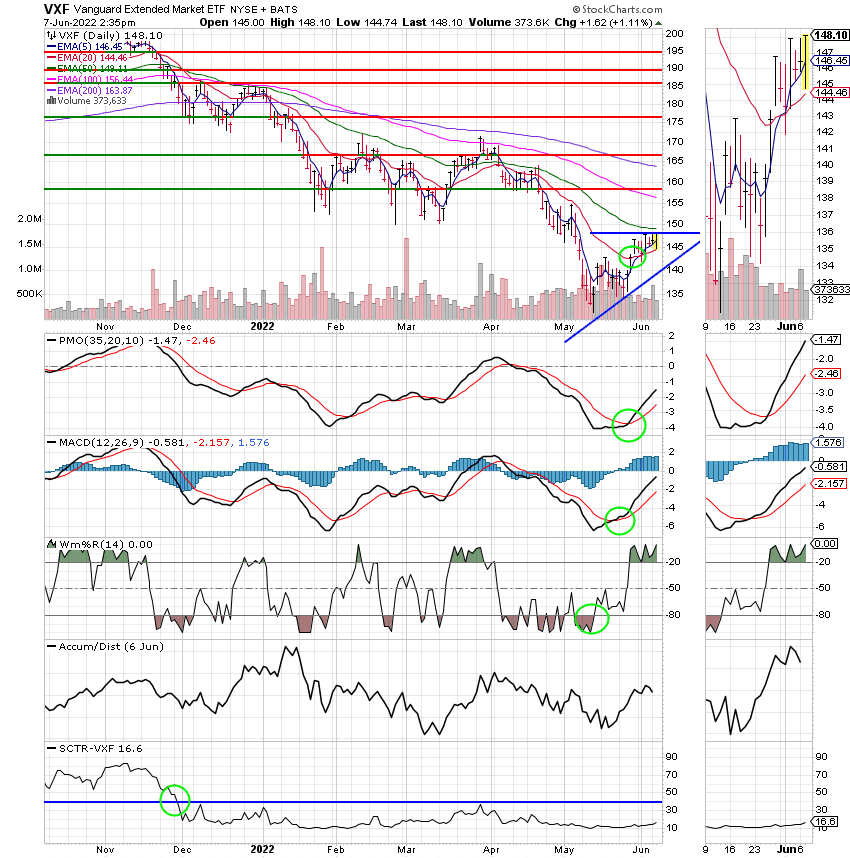

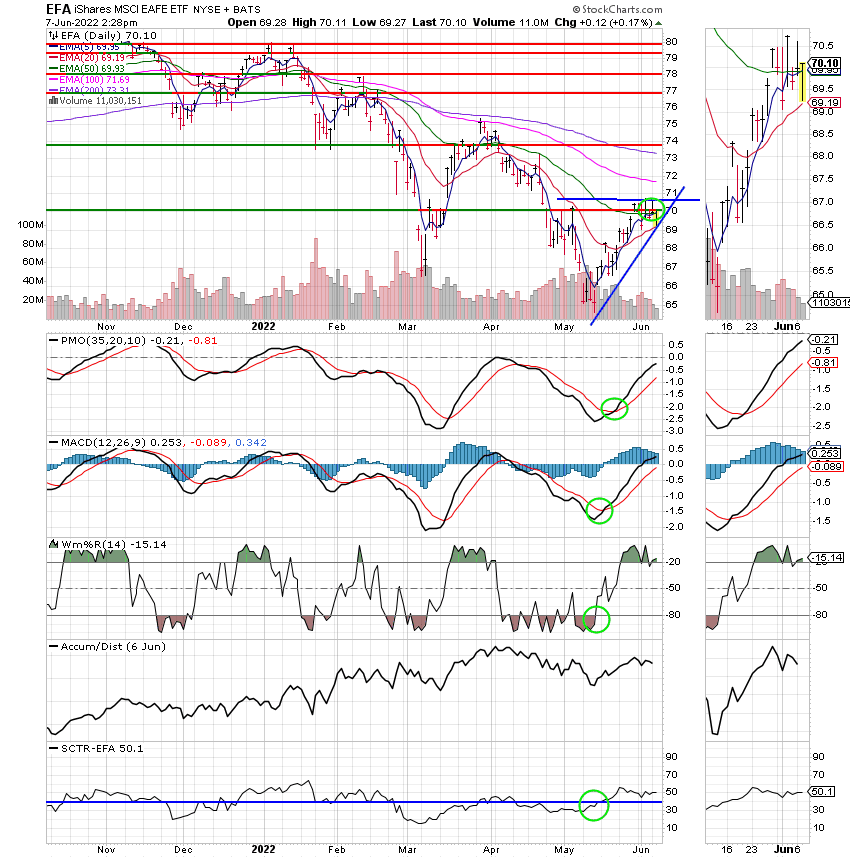

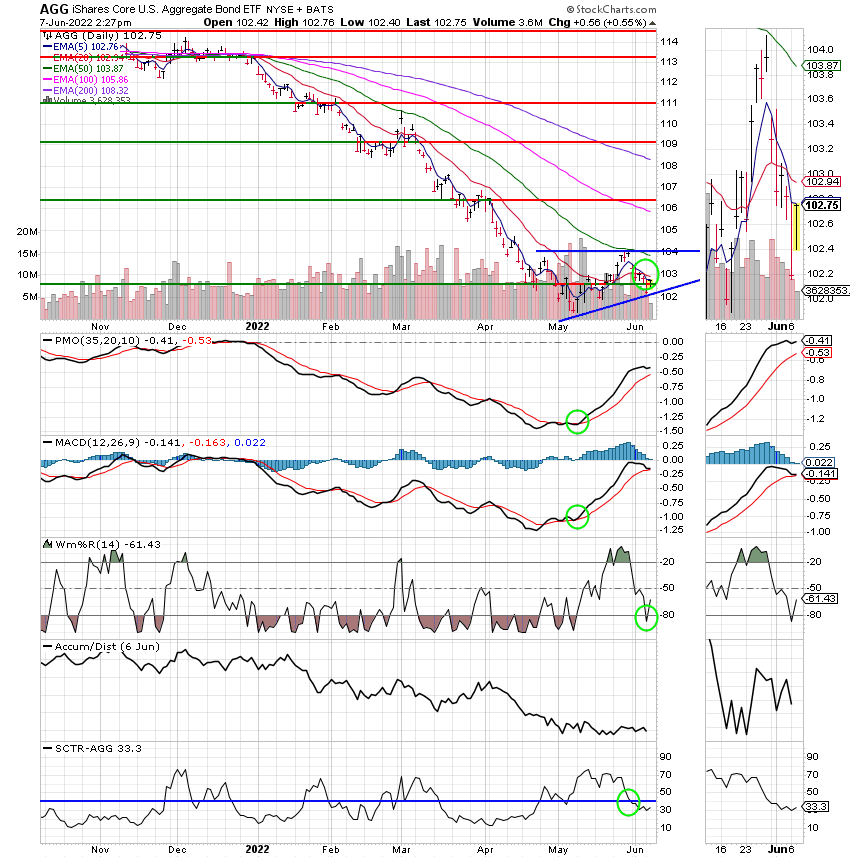

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Keep Praying! That’s all for this afternoon. Have a nice day and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.