Good Morning, The market is up this morning, but I would remind you that it was up yesterday morning and you know what happened in the afternoon. It sold off! Currently socks remain in a trading zone while investors wait for resolution of the high inflation. Other issues such as the supply chain and interest rates ultimately end up at inflation. Meanwhile stocks continue to rise and fall in a wide but limited range. While it is possible that we could see another leg down, I feel that a long drawn out bottoming process has begun. Barring a surprise, the market will likely remain in the current trading range until inflation moderates. There will be a lot of volatility but very little sustained movement one way or the other. That said there still remains some risk to the downside as we are still in a bear market and surprises in a bear market always resolve to the downside. Of course, the current environment is full of potential surprises when you consider such things as the war in the Ukraine, energy, covid, and the supply chain. Also, there is one more pertinent issue that I will mention. We have talked about it in recent weeks and we shouldn’t let it fly under the radar. Identifying possible areas of movement in the market and preparing a plan to deal with them are what set successful traders apart from the rest of the crowd. That issue is the rising dollar. It is hooked into so many things and will likely impact our investment decisions. It is a direct result of rising interest rates causing a tightening money supply. It effects so many things such as the price of energy for instance. As the dollar rises, oil, a commodity which is priced in dollars becomes cheaper here in the US and more expensive abroad. If you think about it for a while the wide range of things that it effects will become evident to you. Everything, including such things as food become more expensive. Many third world economies actually struggle to feed their people as a result of commodity prices rising. However, for the purposes of this discussion we will focus on the Untied States and TSP. As the dollar becomes stronger everything becomes more expensive abroad. Inversely that means that foreign goods and stocks become cheaper which makes it harder for US multinational corporations to compete. Now consider the I Fund. As the dollar becomes stronger the rate of exchange becomes more favorable to the I Fund. It’s plain and simple. The folks that originally set up Thrift where not dummies and they put the I fund in place for a reason. It is there for a purpose and that purpose is to allow TSP investors to take advantage of this exchange rate when it favors foreign stocks. Think about it this way. Have you noticed how many folks are taking trips to Europe now? Chances are even if you are not into travel abroad yourself you have probably seen someone you know on social media visiting a foreign country. That is because it is a bargain to go right now due to the higher dollar!! Well guess what?? Stocks are no different!! They become a bargain too. Back in 2001….lets say the early 2000’s, I can’t remember the exact year off the top of my head, we had a strengthening dollar environment which led to a strong I fund. We took advantage of that I fund and had one of our best years to date with an annual return of close to 42% beating the C and S funds by over 10%. So the moral of the story is when you see a rising dollar environment such as we have now, keep a close eye on the chart for the I fund. That fund is not the stepchild of TSP Funds as many of you newer investors think it is. It is there for a reason!!!!!

The days trading so far is leaving us with the following results: Our TSP allocation remains secure in the G Fund. For comparison the Dow is trading higher at +1.45%, the Nasdaq +1.81%, and the S&P 500 +1.69%. Oh yeah, and since we mentioned the I Fund it is currently +2.48%. See what I am telling you!! Praise God for a day in the green!!

Dow rebounds more than 400 points as investors bet on better-than-expected earnings

The days action so far has left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now -25.02% on the year not including the days results.

| 07/15/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.95 | 18.8997 | 58.8073 | 61.4532 | 31.45 |

| $ Change | 0.0014 | 0.0624 | 1.1080 | 1.3099 | 0.4870 |

| % Change day | +0.01% | +0.33% | +1.92% | +2.18% | +1.57% |

| % Change week | +0.06% | +0.89% | -0.91% | -1.85% | -1.50% |

| % Change month | +0.13% | +0.63% | +2.11% | +2.18% | -1.62% |

| % Change year | +1.28% | -9.51% | -18.26% | -26.35% | -20.26% |

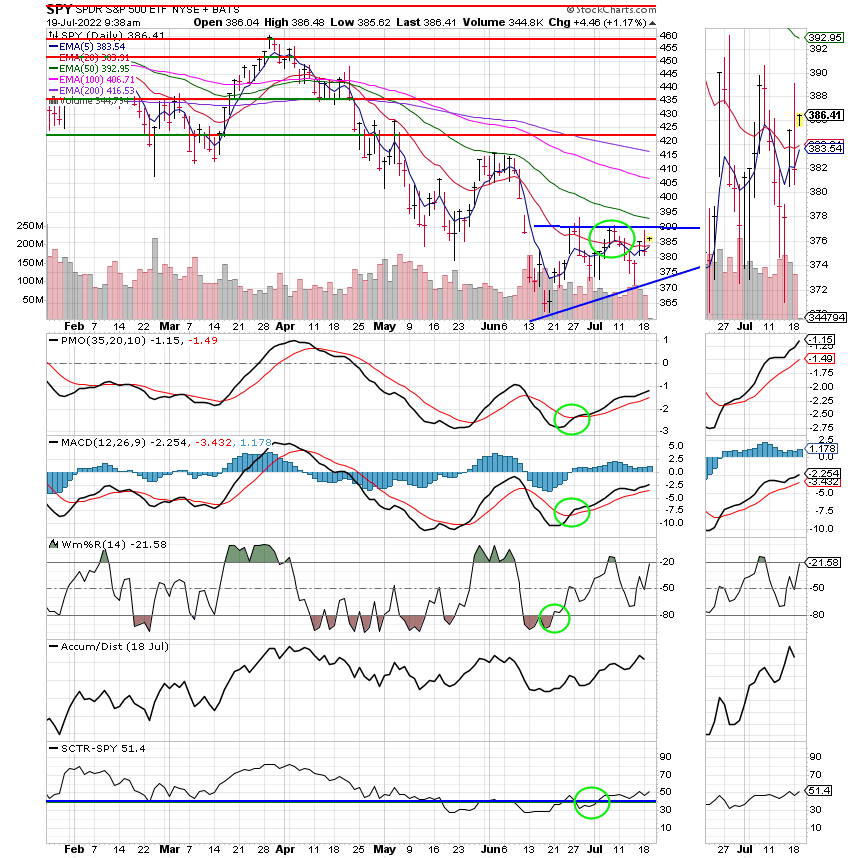

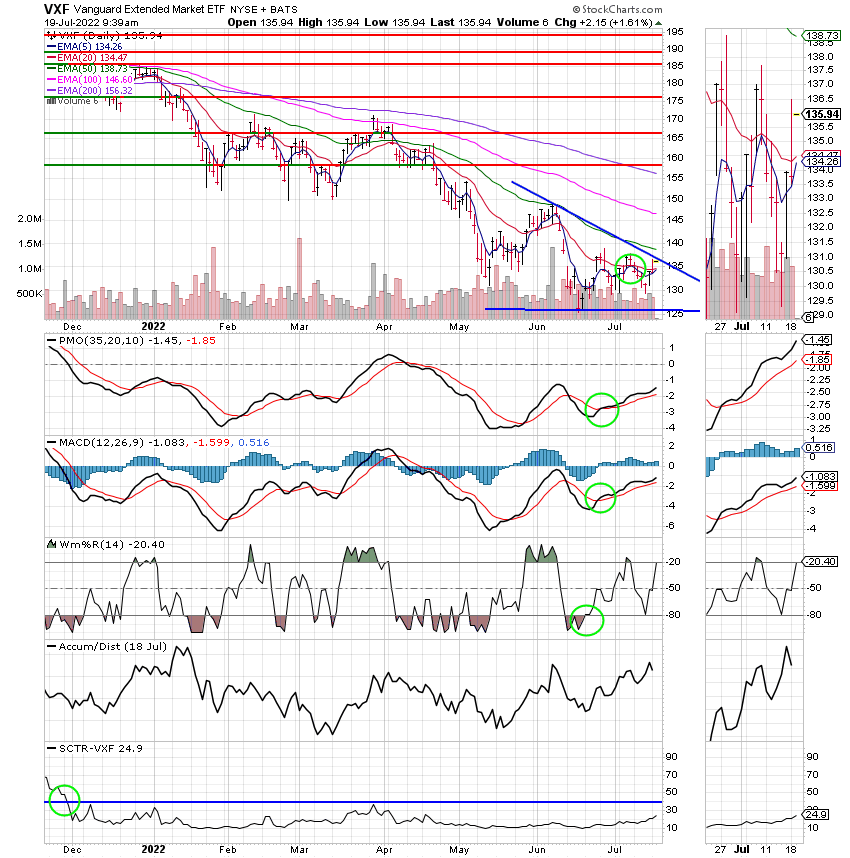

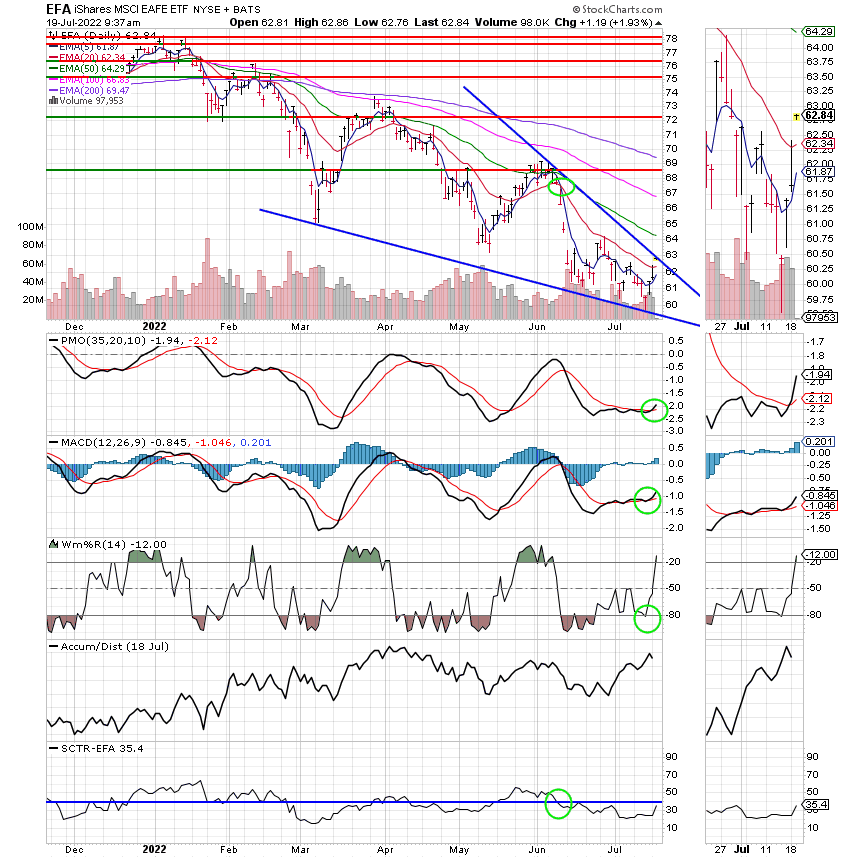

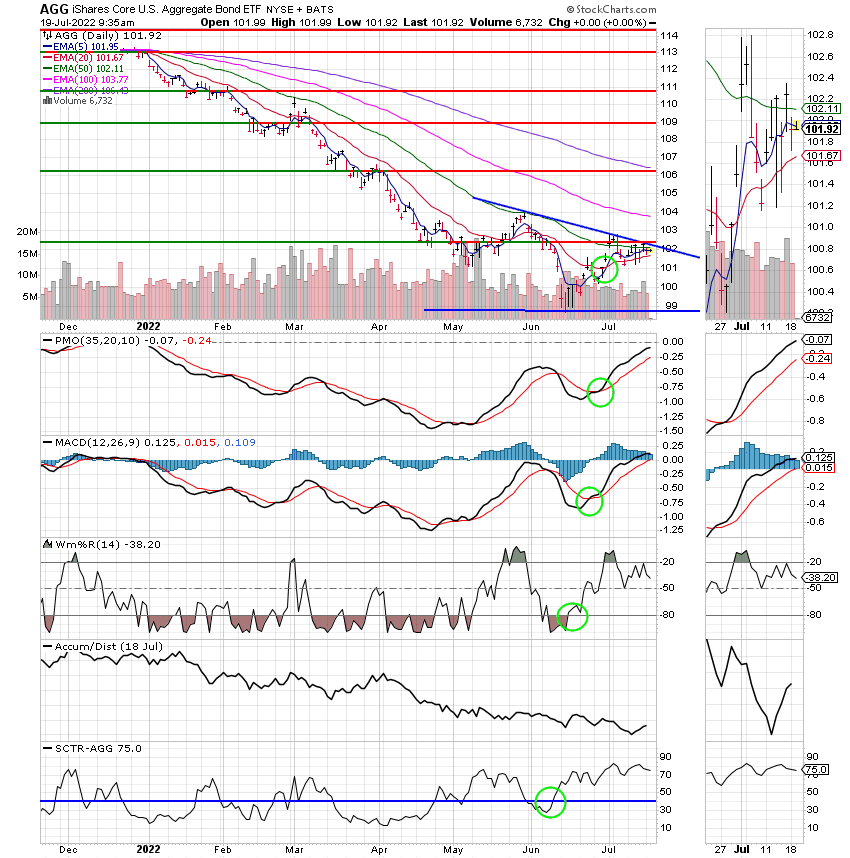

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Keep praying! God will guide our hand. That’s all for today. Have a great afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.