Good Afternoon, So what does the market think about the Fed today? It depends on the day. Either the average market player is way smarter than I am or they are not. I honestly can’t figure out why they think what they think. Panic appears to drive their thought process and as far as I’m concerned panic has never been a strategy. Not ever! Stocks fell again on fears that the Federal Reserve may continue tightening until it steers the economy into a recession. Really, give me a break, and that’s changed significantly from yesterday? They just really want and need something to worry about. Today they decided to panic because a hotter-than-expected reading of November ISM Services further fueled concerns that the Fed will continue hiking. The index posted a 56.5% reading, topping the Dow Jones estimate of 53.7% and increasing from October. Folks it has always been a forgone conclusion that the Fed would increase rates until the economy slows down sufficiently to decrease inflation and that’s probably going to be painful. Quit jumping in and out the market every time the wind blows. The Fed board is made up of professionals and they all know that there is a certain amount of lag time involved in seeing the results of their rate increases. They’ll do their best not to crash the economy, but ultimately it will or it won’t crash. The risk is there. If the kitchen too hot then get out and stay out. We’ve already experienced the majority of the downside to this sell off. Sure we could drop another 10% or so in the worst case scenario. I don’t think we will but we could and I’ll do my best to say positioned for the next run whenever it comes and eventually it will come. Those of you that are still conditioned for a market that continually rises with little or no drama get over it. The past dozen years were an aberration to the overall market. We aren’t going back there! You must understand that just because you started trading during that aberration doesn’t mean that is the way it should be. Again, get over it! That is not the way it should be. There is no more stimulus. It is gone!!! If you are not comfortable with a market that sells off and takes a while to recover then get out and stay out. Get into the G Fund and stay there. Your stomach will never take this. This is the new normal. Actually, this is the old normal. This is normal!!!!!! So here we are. As long as our charts will support it, we intend to stay invested until things improve. So what we’ll happen if we are wrong and we get a sell signal? It’s not a novel concept, we will sell. Sell is not a dirty word! Yes we’ll sell and start the process over again until we get it right. Our primary goal of of course capital preservation and our secondary goal is to make money. So where are we now??? We are waiting for the all important December Fed meeting. Which brings us to today’s selling. On December the 13th and 14th the Fed will meet and make their policy decision on the size of the rate increase for December. There will definitely be an increase. There is no doubt about that and there is little doubt that it will be either 0.5% or 0.75%. There in lies the root of todays debate. Every piece of news that comes out indicating the economy is good leads to selling as investors begin to panic and believe that the Fed will continue to make larger rate increases until they run the economy into the ground. That would be considered a hard landing……;. Then when a price of news comes out about the economy that fails to match expectations then market players start to buy as they believe that the Fed will reduce the rate of their rate increases to 0.50% as inflation is finally beginning to moderate. So we’ll know on the 14th at 2:00PM. Do me a favor and stay out of the market if you feel insecure about this. There will be plenty of time to jump in later if you so choose. The bottom line is that you either have the faith that God will guide your hand in this or you do not. For the record I do! If you are unsure then scripture says you are unstable and you will have no success. “For a double minded man is unstable in all his ways!” You have to be sure of what your doing. Scripture also tells us that if we seek first the Kingdom of God then all those other things will be added unto us. It further says that you won’t gain one inch of height from worry. Put it all together and you have the recipe for success. Don’t worry! Keep your attention on God and ultimately you will get where you are going….. Call me crazy if you want but that is how I did it all these years.

The days action has so far left us with the following results: Our TSP allotment is currently off -2.52%. For comparison the Dow is is in the losing -1.16%, the Nasdaq -1.57%, and the S&P 500 -1.42%. It’s rough out there today.

Dow slides more than 200 points on fears the Fed will keep tightening into a recession

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now -24.77% on the year not including the days results. Here are the latest posted results:

| 12/02/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.1833 | 18.5728 | 62.4016 | 66.0443 | 34.7731 |

| $ Change | 0.0019 | 0.0622 | -0.0695 | 0.1070 | -0.0416 |

| % Change day | +0.01% | +0.34% | -0.11% | +0.16% | -0.12% |

| % Change week | +0.08% | +1.45% | +1.19% | +1.60% | +1.66% |

| % Change month | +0.02% | +1.34% | -0.18% | +0.30% | +0.55% |

| % Change year | +2.67% | -11.08% | -13.27% | -20.85% | -11.84% |

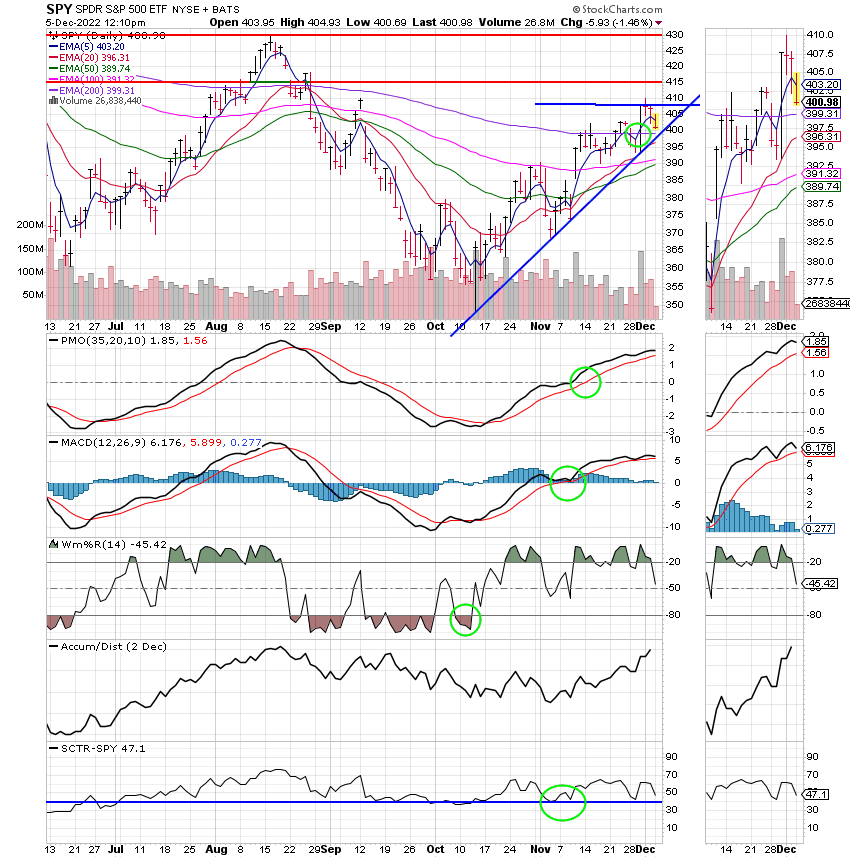

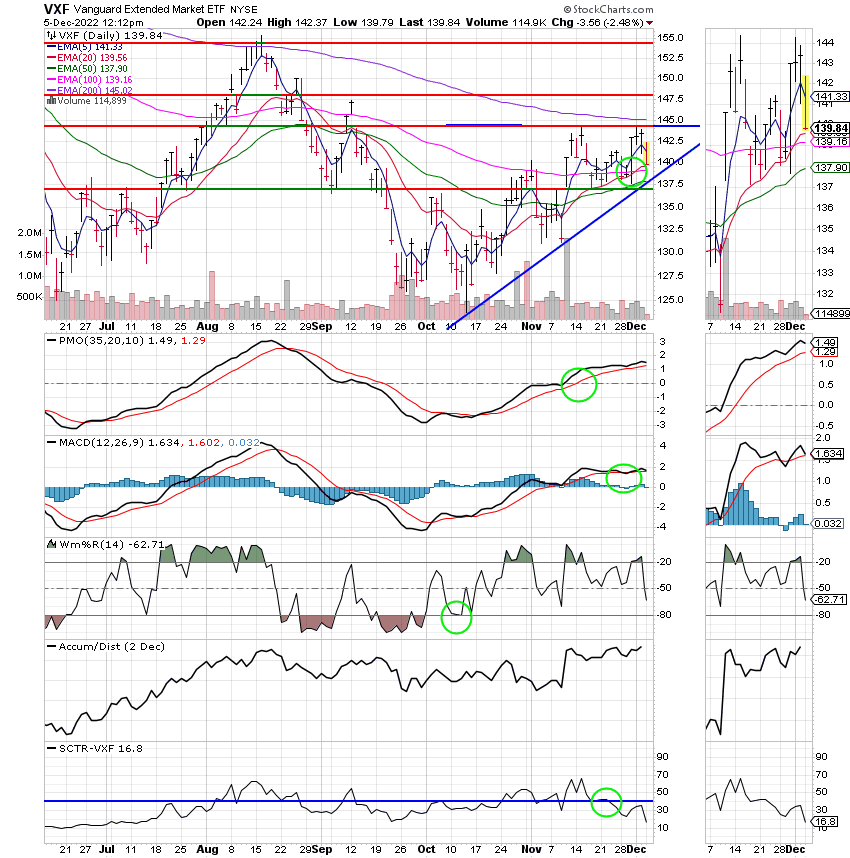

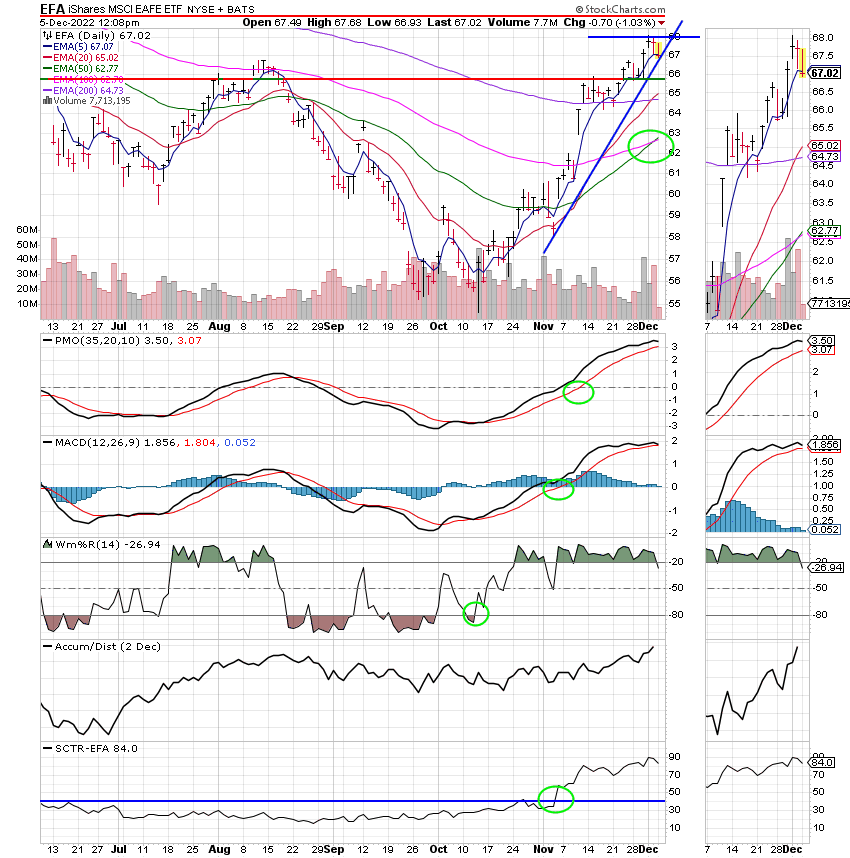

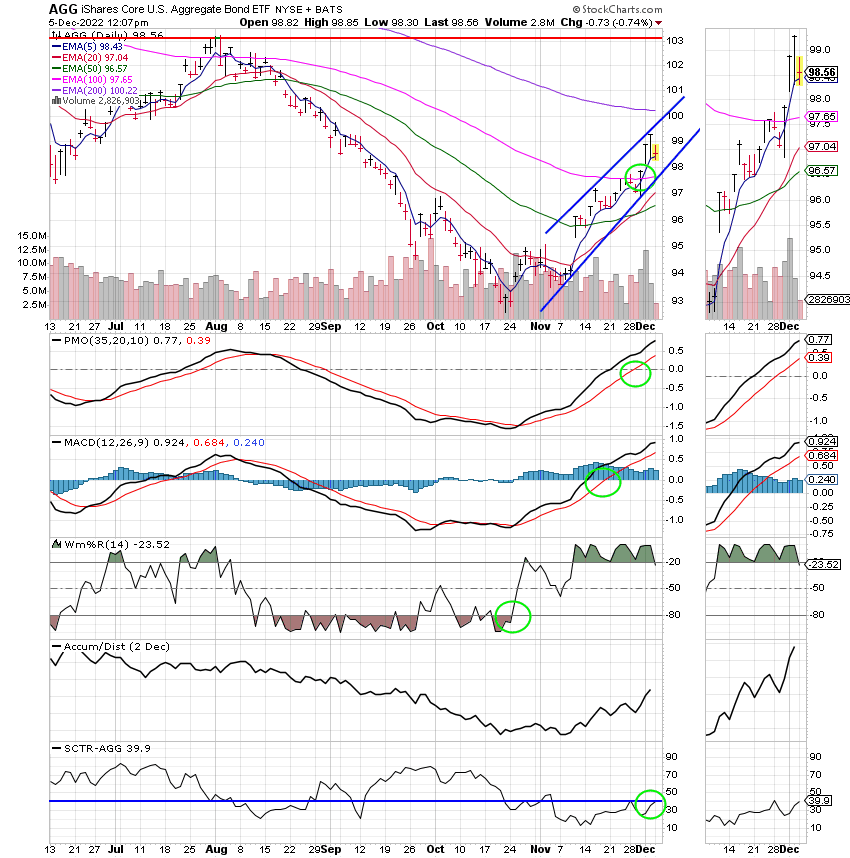

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Will 2022 ever end? I am anxious to move on……. That’s all for today! Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.