Good Afternoon, Happy New Year!! I had a really nice blog for you last week but it was lost when the website went down and I just didn’t have enough time to rewrite it given the holiday schedule. As I said on Facebook, the loss of the blog was par for the course in 2022. I say good riddance to 2022 and hello 2023. Although we face many of the same problems in 2023 the market is further along in the bear market process. Everyday that passes is another day closer to a new bull market and recovery. The problems of high inflation, a possible recession, new Covid variants, and the War in Ukraine remain with us into the new year. Right now the war in the Ukraine seems to be at a little bit of a stalemate, but as you all know that can all change in a heartbeat. So we will put it on the back burner but remain highly vigilant for any new developments in the conflict. That brings us to Covid. The Virus seems to be surging again in China and continues to threaten the supply chain and productivity of the world economy. While there appears to be fewer hospitalizations with the newer variants some of them are highly contagious and as such remain a constant threat to the world economy. The Covid, omicron XBB.1.5 variant has nearly doubled in prevalence over the past week and now represents about 41% of new cases in the U.S., according to CDC data. It is highly immune evasive and appears to bind better to cells than other members of the XBB omicron subvariant family. Scientists at Columbia University have warned that the rise of subvariants such as the XBB family could “result in a surge of breakthrough infections as well as re-infections. Click here for more on XBB.1.5. Given all those facts, it would be wise to keep a close eye on Covid. That leaves us with the two elephants in the room…. inflation and recession. There’s not a lot I can add to what we have already said about this subject. Inflation remains in the 7% plus range and the Fed will continue to raise rates until it is obvious to them that their target rate of inflation of 2% will be reached. How many of these increases that the market has and will price in is a somewhat of an uncertainty at this point. So each time the Fed increases the interest rate there will likely be more selling because as you all know the market hates uncertainty. Then there’s the issue of a recession. As we have pointed out several times over the past year the bond yield curve remains inverted and that usually precedes a recession. Most but not all of us are in agreement that there will be an recession. Some say it’s already here but that it is not been identified as a recession for political reasons. I’ll leave that to your opinion. It has in fact not been officially declared that we are in a recession as of yet. So for the purposes of this blog I will stick to that. The main problem is that each time a bad piece of economic news is released investors fear that the recession has begun. Understand, they are always trying to stay one step in front of the market and do their best to try to predict the future as futile as that might be. Their main fear is that corporate earnings will turn bad as a result of a poor economy. This is important because in the end earnings are what move the market. Investors also watch the Fed closely. Each time the Fed increases rates investors fear that they have gone too far and are forcing the economy into a hard recession (rather than the soft landing they prefer) which will result in poor corporate earnings which will in turn cause the market to decline. The end result of this is that they panic and sell. It seems as if they are either panic stricken or elated one of the other. Almost like a manic depressant if you will. Either up or down but never just satisfied. It should be noted that there are some analysts that study the psychology herd and make their investment decisions largely on what they find. I will add that some of them have had good results doing it too. As I have often said, there is more than one way to make money in the market. You just need to decide which one if best for you and stick with it. At any rate this investor behavior has and will continue to create a high level of volatility until inflation moderates and the Fed pivots from their current policy of rate increases. All of this is nothing new. Our strategy remains the same, we will try to stay positioned in equites ahead of the markets recovery whether that that comes in a week or a month or a year. As such we will remain in either the C, S, or I fund whichever has a buy or hold signal and has the best chart. That of course is currently the I fund. In the event that all our equity based funds generate sell signals we will move to the G fund or consider the F fund should it generate a strong buy signal which we feel it will not do given the current climate in the bond market. That said, we never say never, so we’re not ruling the F Fund out as an option in that scenario.

There is no trading today, but Friday’s trading left us with the following results: Our TSP allotment fell -1.00% . For comparison, the Dow was off -0.22%. the Nasdaq -0.11%, and the S&P 500 -0.25%.

Stocks fall to end Wall Street’s worst year since 2008, S&P 500 finishes 2022 down nearly 20%

The most recent results left us with the following signals: C-Sell, S-Sell, I-Buy, F-Hold. We are currently invested at 100/I. Our allocation ended 2022 at -28.28%. That is the worst year we have ever had and we’ve been doing this since 1997. Prior to this year we had only three losing years. The worst of those was -1.86% and the other two were less than 1%. Add them all together and they didn’t total 5%. In other words if you add all the losses we have experienced in the history of this group they didn’t even total 5%. That and we gave up 28.28% in one year! That demonstrates what a difficult year 2022 was. I will go even further than that and say that this was the worst year I have experienced since I began trading in 1987. So what did we learn from it. We learned that our shorter duration indicators were worthless as a result of the end of Federal Stimulus, the introduction of quantitative tightening, and the greater use of high speed algorithm trading to prey on a large population of inexperienced investors. By inexperienced in investors I am referring to investors that began trading after the financial crisis in 2008/2009. These investors had never experienced a market without government stimulus to prop it up. As a result they never experienced an extended downturn like we had in 2022. They did not know how to react. All they knew was a market that for the most part went up with small declines that were normally less than 5% and reversed quickly with (stimulus fueled) V shaped recoveries. What was the result of all this?? After the initial drop they began to buy back into the market expecting it to move straight back up as it had done so many times before. Each time they did this the high speed algo’s would sell and jerk the carpet out from under their feet. After that it was rinse and repeat as the high speed algorithm traders continued to prey upon the inexperienced traders. This scenario resulted in the most extreme volatility that we have ever experienced. We were whipsawed a total of four times until we reworked our indicators (that I had used since the early 1990’s) by increasing their time frames utilizing a longer duration. When we finished we only had a hand full of indicators that were of a mid term nature with no short term indicators left period. As I mentioned above, the short term stuff had become worthless because of the unprecedented conditions. As a result we have emerged from 2022 with what we feel are the strongest set of indicators that we have ever had. We are confident that they are as whipsaw resistant as they can be and that they will effectively deal with the unique conditions created by the reduction of government stimulus should they arise again in the future. Our indicators failed in the first six months of 2022 and as a result we underperformed plain and simple. The problem is now fixed so lets move on….. With God’s help that is exactly what we will do!

| 12/30/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.2352 | 18.2074 | 58.9043 | 61.5305 | 33.9422 |

| $ Change | 0.0036 | -0.0745 | -0.1467 | -0.1240 | -0.2276 |

| % Change day | +0.02% | -0.41% | -0.25% | -0.20% | -0.67% |

| % Change week | +0.08% | -0.82% | -0.11% | +0.23% | +0.01% |

| % Change month | +0.32% | -0.65% | -5.78% | -6.55% | -1.85% |

| % Change year | +2.98% | -12.83% | -18.13% | -26.26% | -13.94% |

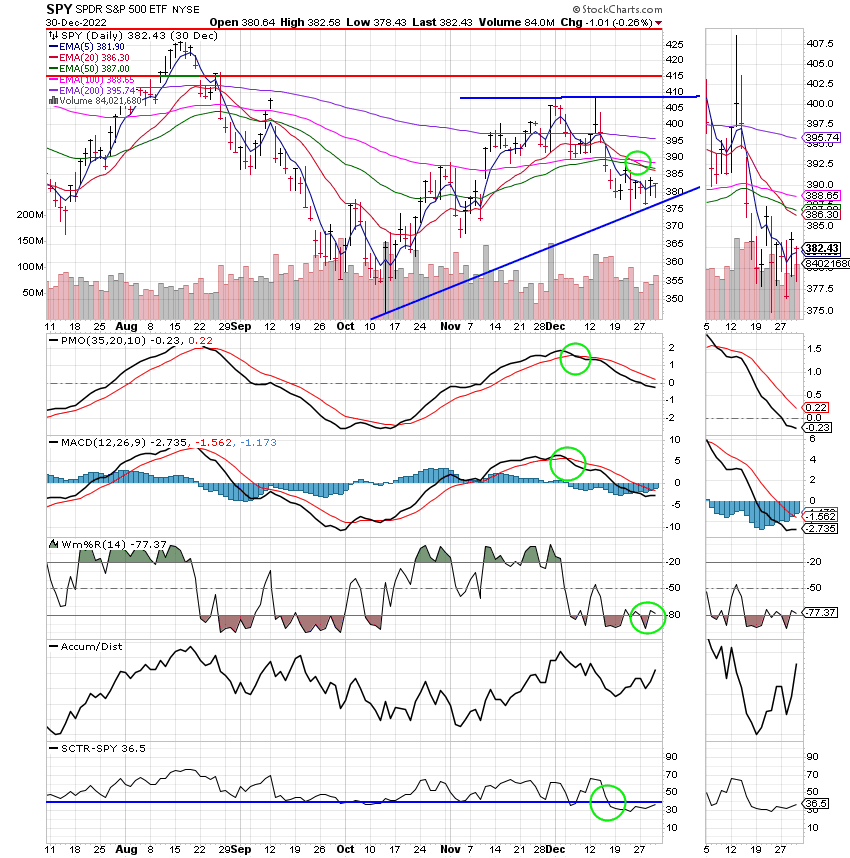

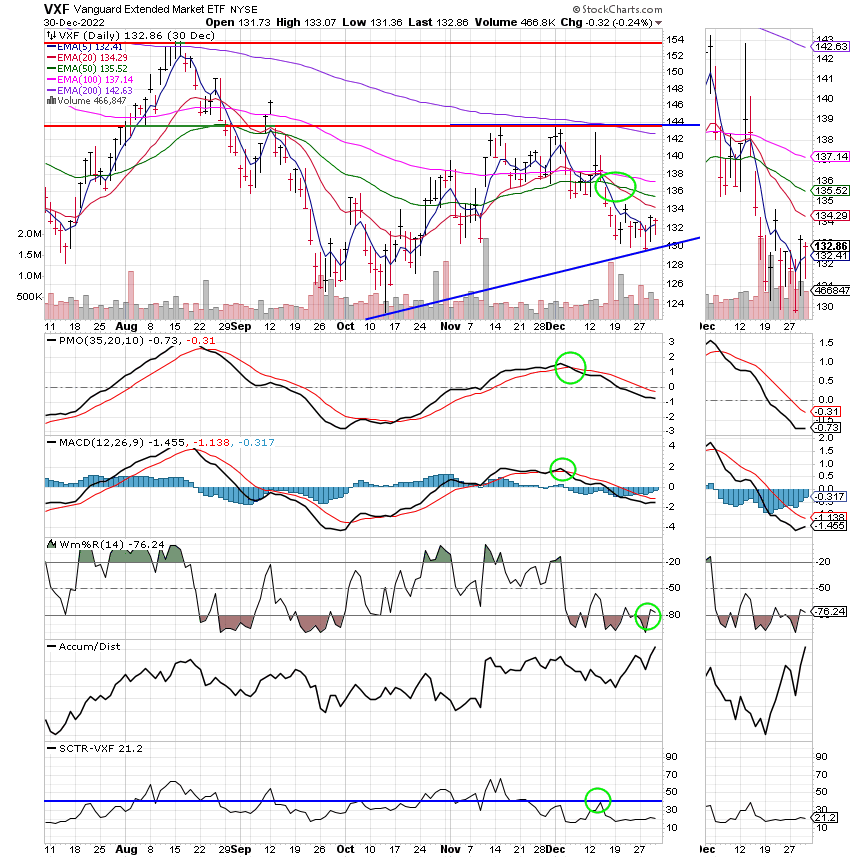

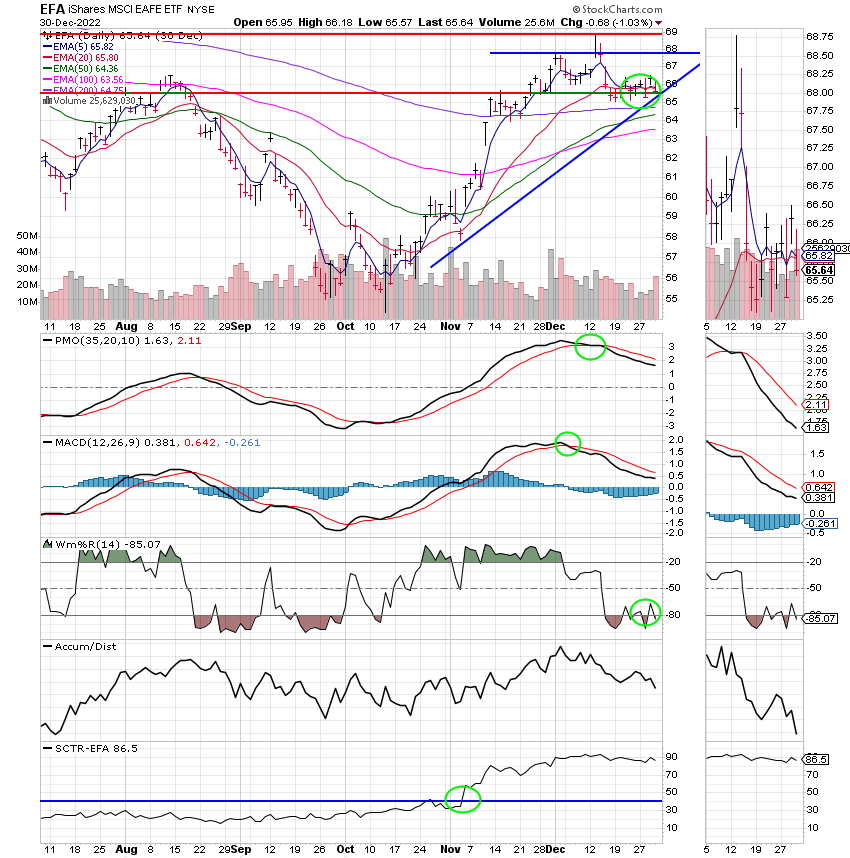

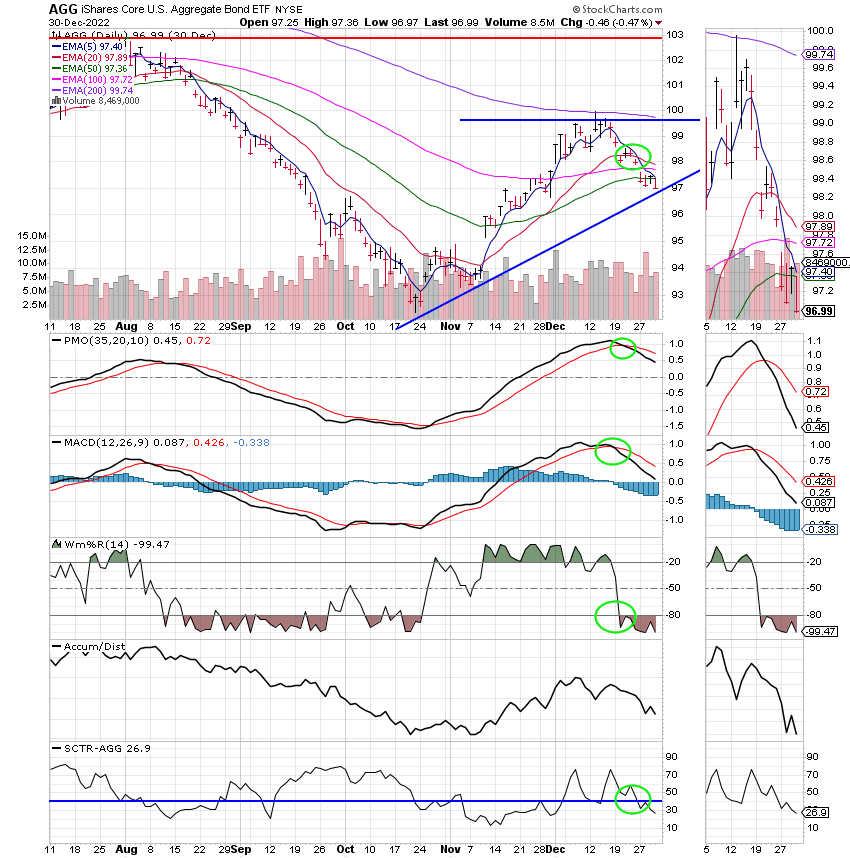

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I fund:

F Fund:

Lets all pray that God will guide our hand in 2023. That’s all for today. Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.