Good Afternoon, The market continued to rally since last week into the weekend until the jobs report was released and showed that over 500,000 jobs were created when less than 200,000 were expected. That resulted in a sell off that continues today. Also contributing to investors sour mood was a spike in treasury rates that had been falling recently. I honestly don’t know why the treasury rates dropped at all in the first place with interest rates rising. The only explanation for that is that investors were leaving safe havens such as bonds and taking on more risk by investing in stocks. The thing to understand about this is that bond prices and bond yield move in opposite directions. So any time there is selling in bonds their yields will rise. Normally, when there is a rally in the stock market bonds will sell off. I remember when I first started investing that the old timers would say “when stocks are down bonds are up” and sure enough most of them would automatically start buying bonds when the stock market sold off and and start selling them when it went up. Most of the time that is what took place. So no surprises there. I almost always watch the price of bonds when I invest in stocks. If bond prices are moving up a lot then I get concerned. The same thing with gold, utilities, consumer staples, and health care which are all considered safe havens. When those things are moving higher then stocks will usually weaken. That said the move in bond yields is no real surprise to me, but it sure has a lot of investors shook up. I don’t know what they expect with the Fed increasing interest rates? I got news for them. Their not done either!! Folks, it all ties into the battle to bring the rate of inflation lower. What has driven the market recently is belief in a Goldilocks economic scenario in which inflation is slowing, but the economy remains strong and won’t fall into a recession. Inflation is not too hot, and growth is not too cold. If the market players view the news as deviating from this scenario then they sell. When the news doesn’t agree with their “Crystal Ball Predictions” they panic, sell first, and ask questions later. It’s an enigma to me how they ever make any money in the first place. It would simply drive me nuts to be constantly trying to guess what will happen next. That is a stressful way to live…. Anyway, that’s what’s moving the market right now. At this point my charts are almost all pointing higher. It looks like the market will continue to move higher in the long run with a lot of short term volatility. At least for me that’s what’s expected until the rate of inflation has been brought down to the Fed target of 2 percent. As usual I will continue to watch my charts closely. As you already know, we moved our allocation to 100/S last week. The chart for the S fund improved dramatically as market players scooped up beaten down small caps. Given that the S Fund is a small cap/ mid cap blend it began to out perform our other thrift funds. Therefore, we made the move. Will the S Fund continue it’s out performance? That will depend on small caps and tech both of which have a big influence on the S Fund. My expectation moving forward is that investors will likely continue to cautiously accumulate these beaten down equities to be positioned for the big recovery to come. As for as their concerned they are getting in at a good price. So they will continue to accumulate more small caps and tech as the rate of inflation falls. The only things that will stop that will be a sizable spike in interest rates beyond what is expected, a recession, or if in their eye stock valuations get to high or in other words stocks are not a bargain… Stock valuations are effected by two things. The stock prices and the earnings. Their are several metrics that investors use to to determine the value of stocks. The two that are most valued are the PE (Price/Earnings) and the PEG (Price over Earnings/ Growth). PE is price divided by earnings and the PEG Price divided by earnings divided by growth. The higher the P/E the lower the value of the stock. The higher the The PEG the lower the Value of the stock. It is important to understand that sometimes investors will over look a high PE for future growth and they are willing to pay for it. That metric speculative and of a higher risk. Therefore you will usually see it used in a risk on bull market environment. Investors are like any one else when it comes to buying. They are looking for a good deal and most stocks are at basement bargain prices after a bear market. They also use metrics such as the debt to earnings ratio but for the most part they are looking for a good PE and PEG. Small caps and tech stocks often trade off of growth. The bottom line is that the lower the market the higher the stock values become. With that in mind I will mention that many investors consider the current bear market to have bottomed this past October and are now in the accumulation stage. They are buying up these beaten up small cap and tech stocks in anticipation of the upcoming market recovery. That is the reason that the S Fund has recently been outperforming our other Thrift funds. It is a small cap/mid cap blend. Therefore it has a lot of small cap and tech stocks. That and an improving chart is the reason that we made the move to 100/S this past week. As usual, we will watch the chart and react to the action that we see. We thank God for the recent run. It feels good to be in the green. 2022 was a longggg year.

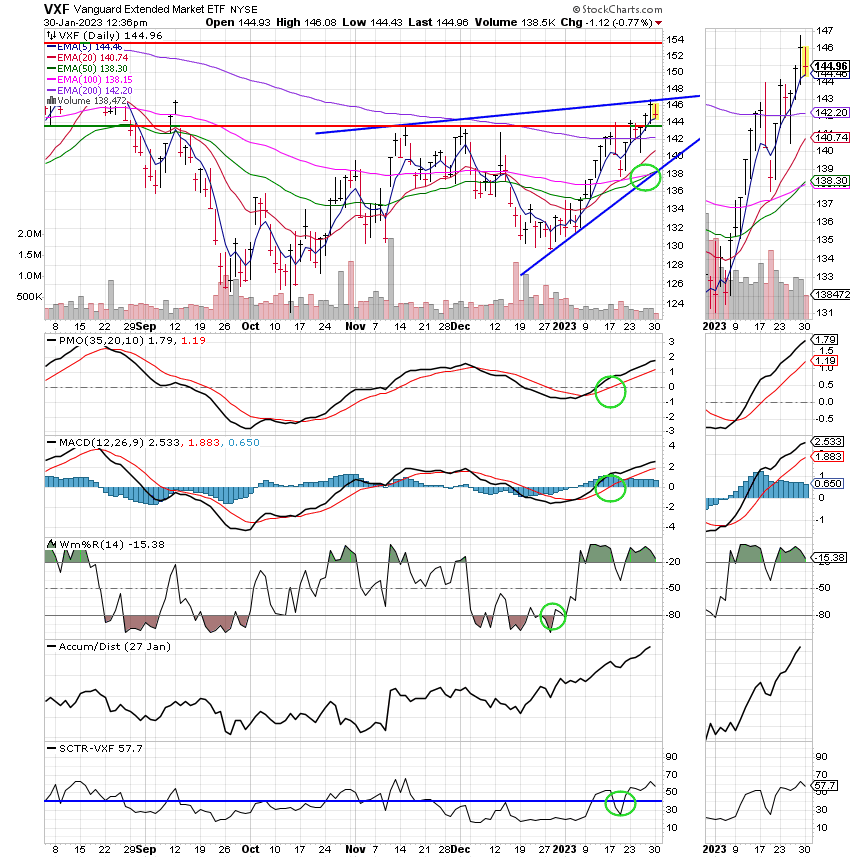

Todays trading left us with the following results: Our TSP allotment fell back -1.24%. For comparison, the Dow dropped -0.15%, the Nasdaq -1.00%, and the S&P -0.61%. For those of you who may still be in the I Fund. It posted a loss of -1.02%.

Stocks close lower Monday as higher rates rattle investors

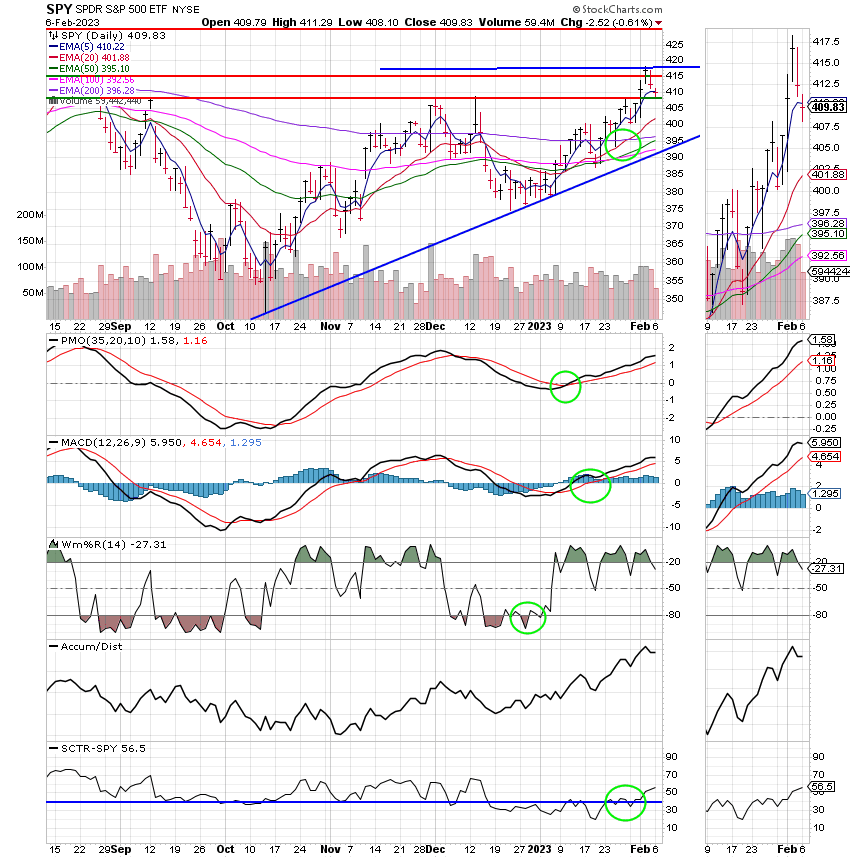

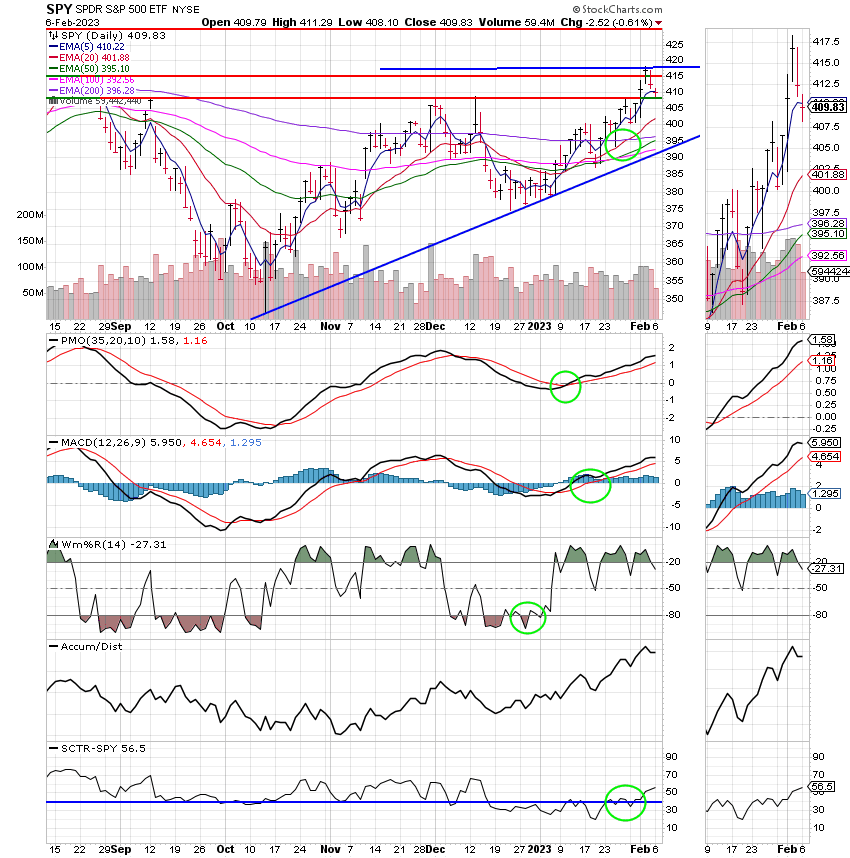

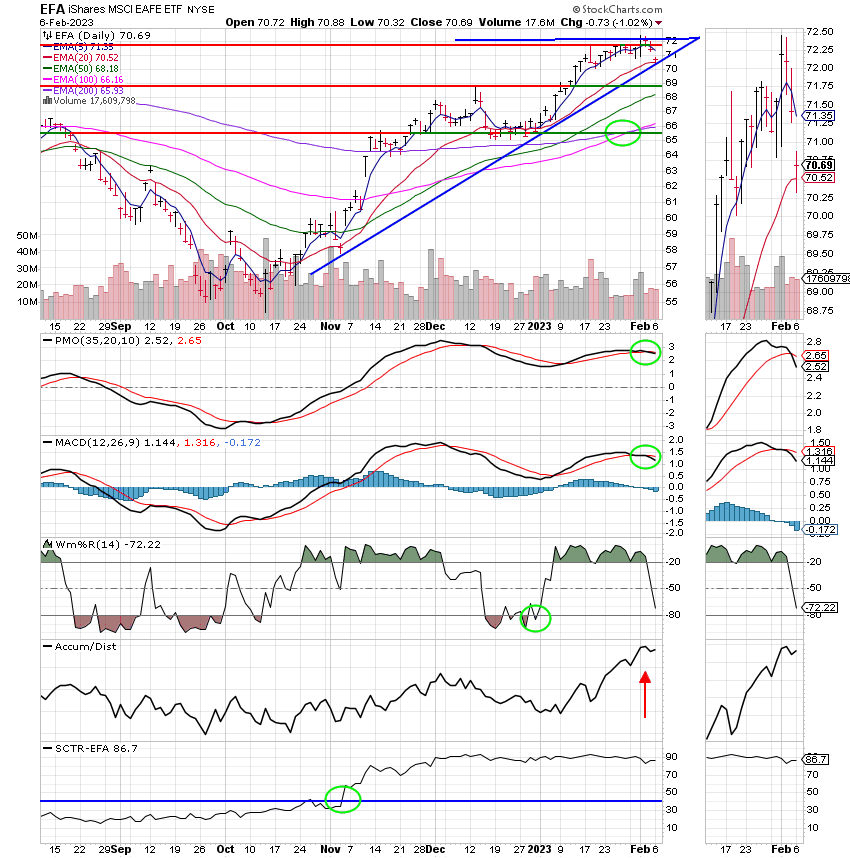

The days action left us with the following signals: C-Buy, S-Buy, I-Hold, F-Hold. We are currently invested at 100/S. Our allocation is now +8.11% for the year not including the days results. Here are the latest posted results:

| 02/03/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.2988 | 18.7903 | 63.5291 | 69.9542 | 36.7896 |

| $ Change | 0.0017 | -0.1508 | -0.6619 | -0.9117 | -0.3827 |

| % Change day | +0.01% | -0.80% | -1.03% | -1.29% | -1.03% |

| % Change week | +0.07% | +0.03% | +1.64% | +3.41% | -0.17% |

| % Change month | +0.03% | -0.05% | +1.48% | +2.59% | -0.04% |

| % Change year | +0.37% | +3.20% | +7.85% | +13.69% | +8.39% |

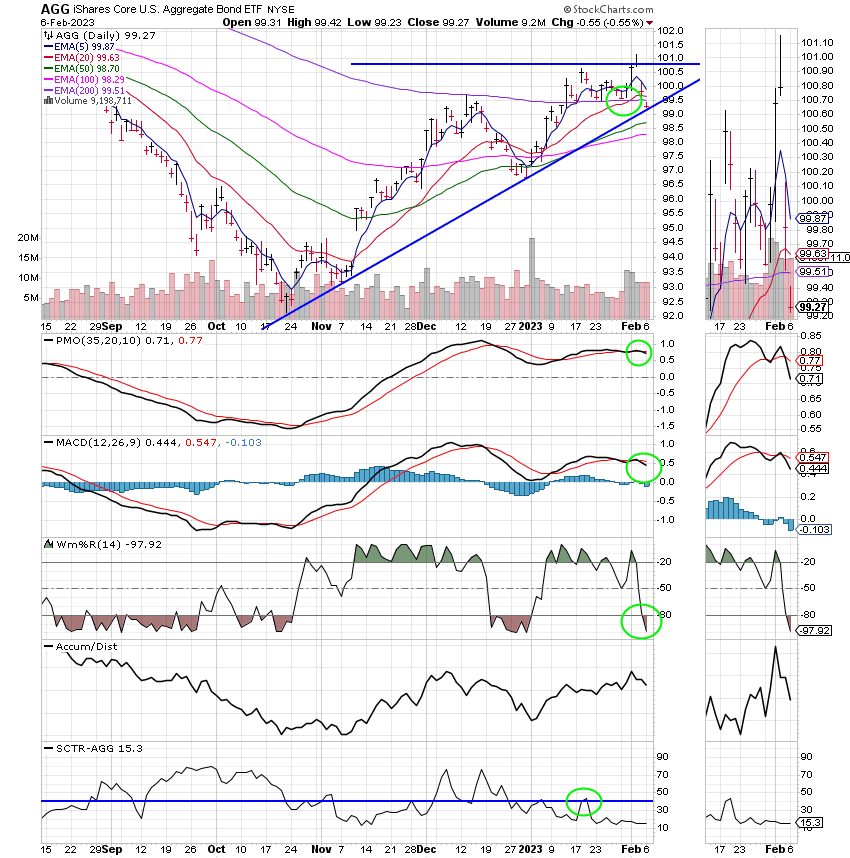

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

We’ve had a couple down da

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.