Good Evening, We begin a new week with the usual amount of uncertainty that has framed this post pandemic quantitative tightened market. Of course the market hates uncertainty and in a lot of cases it causes the market to sell off even more than out and out bad news. This week we have the policy meeting of the Federal Open Monetary Committee better known as the Fed. Expectations of the majority of investors are for the Fed to increase rates another .25%. This would be in line with last months Fed statement in which they indicated that there would be two additional rate increases in 2023. You would think that would alleviate most of the confusion. After all, they said what they were going to do, right? If only things were that simple. Current economic reports continue to show that inflation is slowing and most investors do not think that a second increase will be necessary. The majority of investors now support the theory that the economy will come in for a soft landing as the rate of inflation comes under control (2%). They do not think a second increase is necessary or in other words they don’t agree with last months Fed statement. They disagree with the Fed. I believe that a quarter percent increase is already priced in for this month and will move the market very little when/if it takes place. After that is where the rubber meets the road. Starting with Wednesdays Fed statement up until the next Fed meeting there will be speculation as to whether there will be an additional increase or not. I am in the camp that believes that the Fed will do what they said they will do. They seldom change their mind and go back on their word. They will stick to it come hell or high water. Either way, I see that as being the end to rate increases. The main focus at that time will shift to how long the rates will remain at current levels before the Fed begins to decrease them. It has been my contention all along that we want to be in the market the day they actually start lowering rates. Until then there will continue to be some level of uncertainty as to when they will start to decrease rates. As usual, we will continue to watch our charts. They will always help us cut through the noise/news.

The second thing that market players will focus on this week will be the second quarter earnings reports with approximately 165 companies reporting their results. That should give us a pretty clear picture of how the Fed’s rate increases up to this point have effected the economy. Right now, the view out there is that conditions are just right for a so called soft landing and with few visible signs of a recession that just might be the case. We will see….

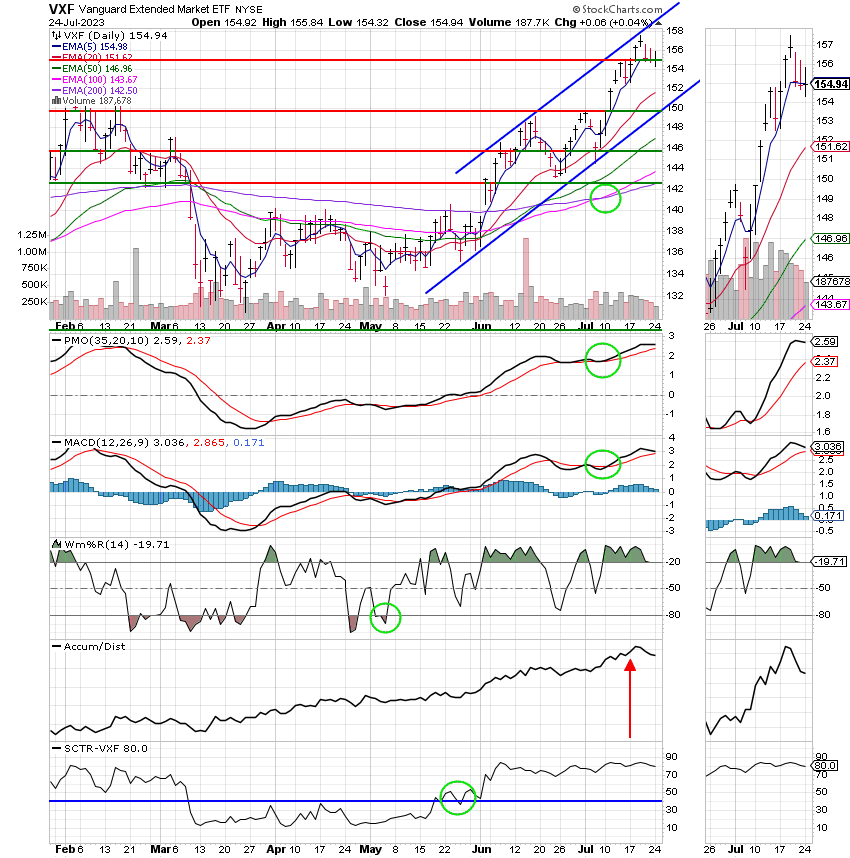

For now we will continue to stay invested at 100/C. The chart while somewhat extended is still flashing a buy signal. One notable thing about the chart for the SPY is that it has formed yet another bullish wedge pattern. Should that pattern execute the chart will rise at a minimum to 460 before it encounters resistance. We should have plenty of time to react to any change in the trend that we detect.

The days trading left us with the following results. Our TSP allotment posted a gain of +0.45%. For comparison, the Dow was up +0.51%, the Nasdaq +0.19%, and the S&P 500 +0.45%. Praise God for another day in the green.

Dow rises Monday, heads for 11th straight day of gains: Live updates

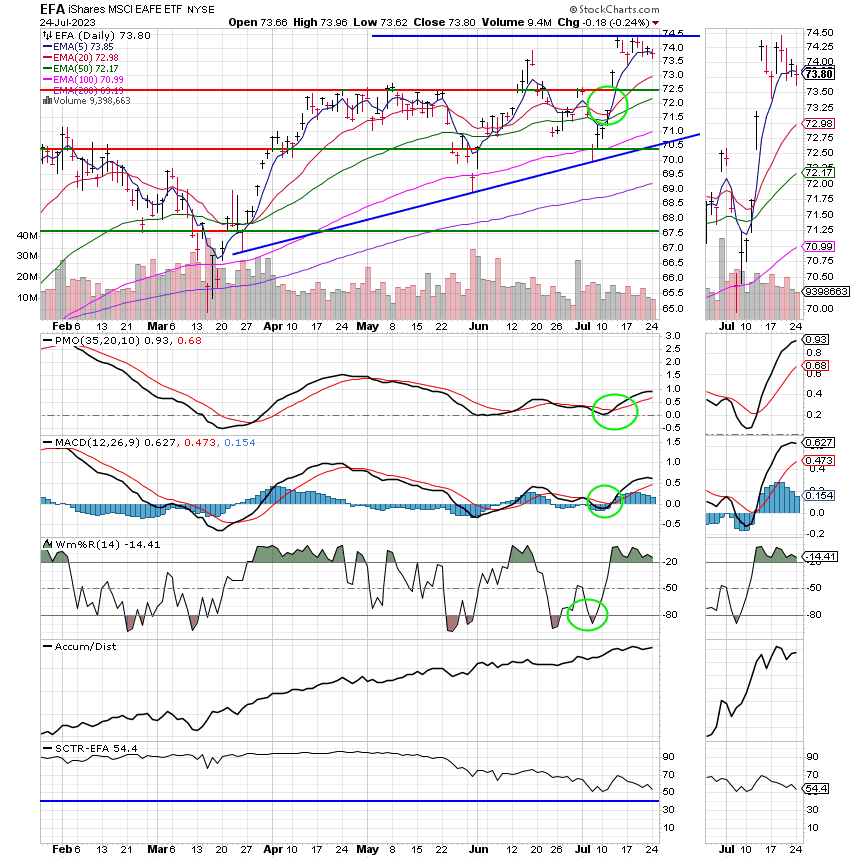

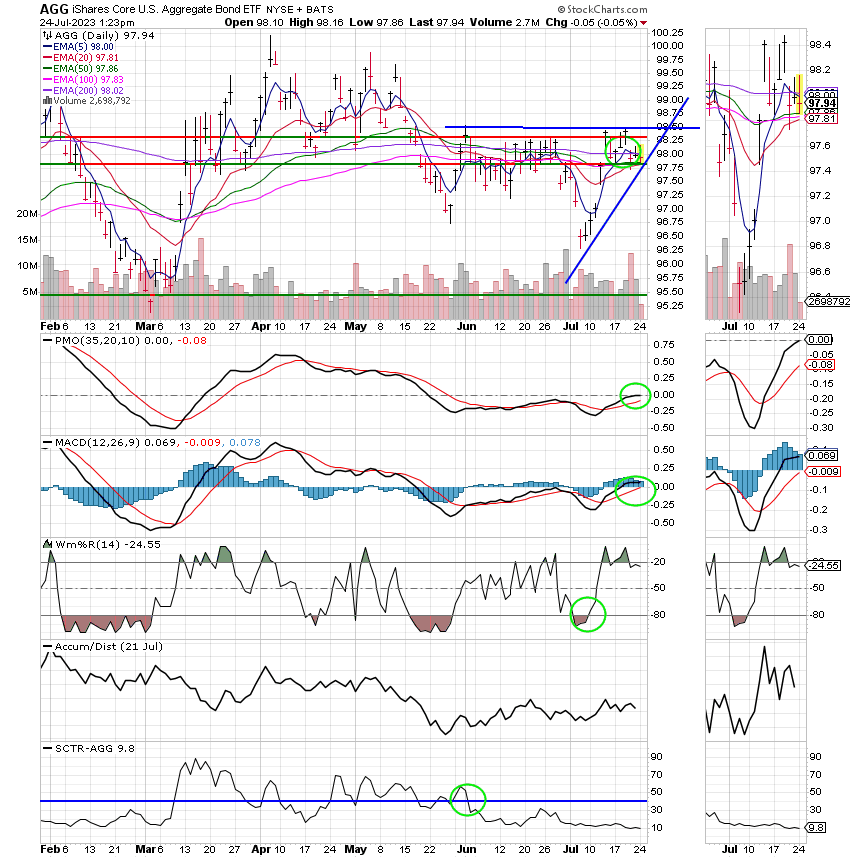

The days action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/G. Our allocation is now -0.13% for the year. Our monthly return is +2.45%. Here are the latest posted returns:

| 07/21/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.6055 | 18.6571 | 70.2201 | 72.1244 | 38.8425 |

| $ Change | 0.0019 | 0.0116 | 0.0227 | -0.1478 | 0.0207 |

| % Change day | +0.01% | +0.06% | +0.03% | -0.20% | +0.05% |

| % Change week | +0.08% | +0.01% | +0.70% | +1.10% | -0.13% |

| % Change month | +0.23% | +0.21% | +2.00% | +4.06% | +2.03% |

| % Change year | +2.15% | +2.47% | +19.21% | +17.22% | +14.44% |