Good Evening, This week the market is marking time while it waits for the Fed meeting. We have the Fed meeting on the heels of a slightly hot CPI report late last week. The media has been having a field day with that. The thing worth noting about the CPI is that while it was a little high, the core CPI which cuts out volatile energy and food prices was more in line with economists forecasts. That is truly what the Fed looks at the most. So I really think it is another case of the news being noise. It is pretty much a foregone conclusion among investors that the Fed will hold rates steady at this meeting. They are assigning a 99% chance that the central bank stays put when it releases its rate decision on Wednesday, according to the CME Group’s FedWatch tool, which gauges pricing in the fed funds futures market. That leaves us with the main question which is what are they going to do in November? You can read articles in favor of a hike or in favor of no hike. Talk about noise!!! The issue right now and what you need to focus on is the Feds message going forward. What will the Fed statement say on Wednesday afternoon? Will they favor additional hikes or not? That will determine where we will be heading in the short to intermediate time frame. There’s really no point in discussing any thing else. All that would do would distract you from the main issue which is the Fed statement moving forward.

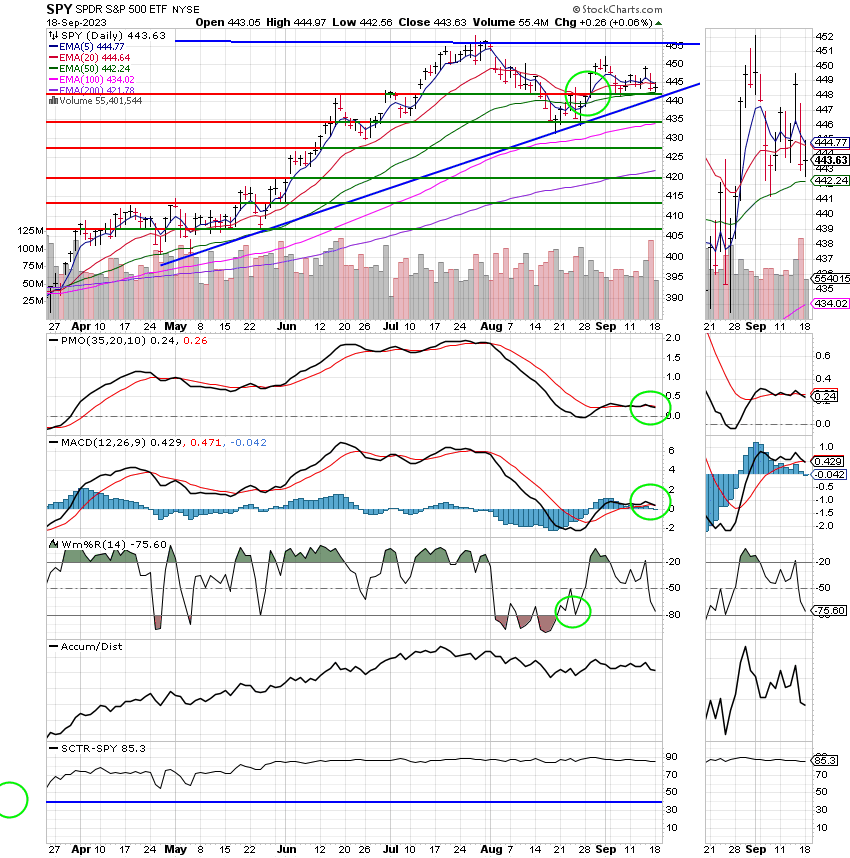

For now we remain precariously invested in the C Fund. Price continues to fall back each time it encounters resistance at the 457.36 level on the SPY but has solid support at around 443.55. As long as that support holds we will remain patient. As we said last week and the week before that and the week before that…….you get the picture…..the market will remain volatile and gains will be limited as long as the rate of inflation remains above two percent.

The days trading left us with the following results. Our TSP allotment posted a gain of +0.06%. For comparison, the Dow gained +0.02%, the Nasdaq +0.01%, and the S&P 500 +0.06%. Praise God for a day in the green! Or should I say not in the red??? I am grateful either way!!

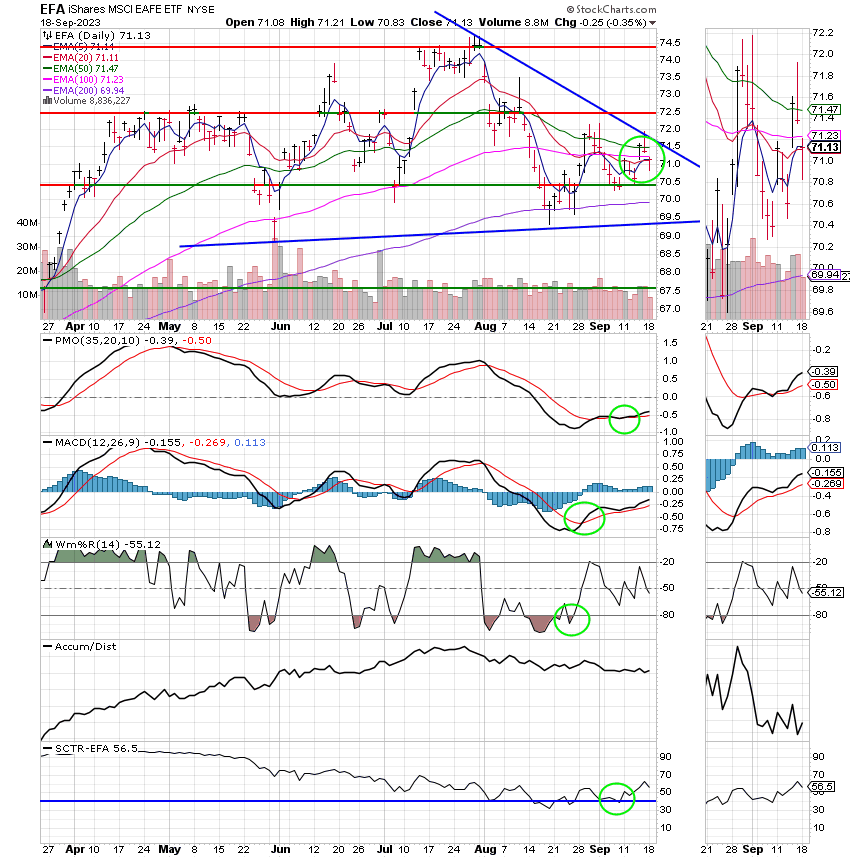

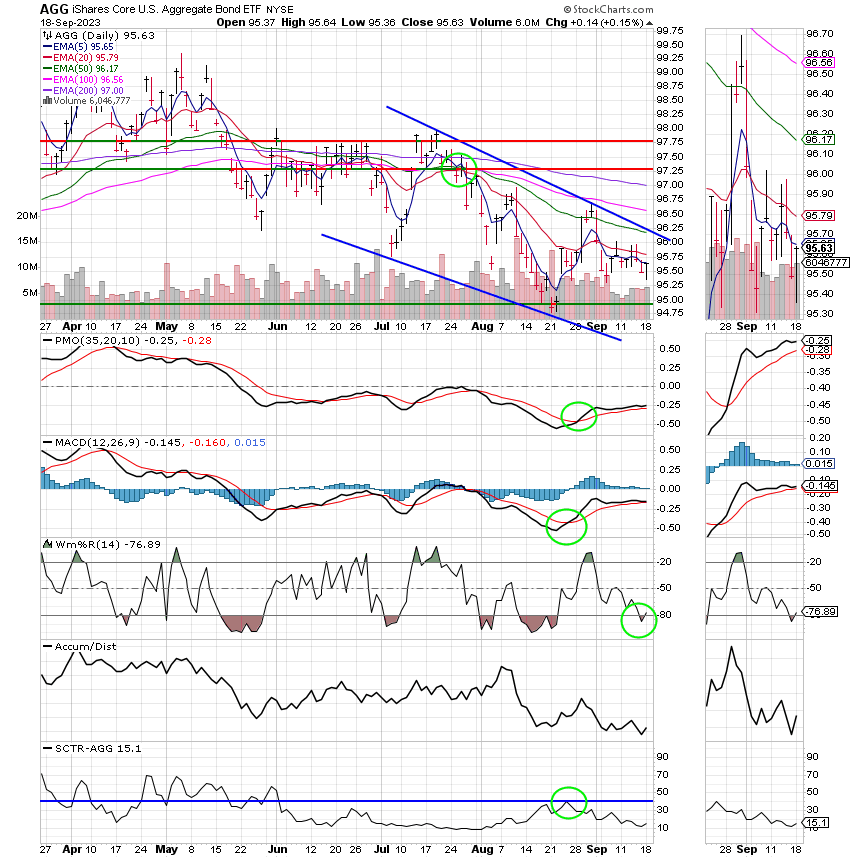

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/C. Our allocation is now -2.85% for the year not including the days results. Our current return for the month of September is -1.21%. Here are the latest posted results:

| 09/15/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.7179 | 18.285 | 69.0831 | 69.0005 | 37.5561 |

| $ Change | 0.0020 | -0.0432 | -0.8476 | -0.7009 | -0.0150 |

| % Change day | +0.01% | -0.24% | -1.21% | -1.01% | -0.04% |

| % Change week | +0.08% | -0.33% | -0.13% | -0.49% | +1.41% |

| % Change month | +0.18% | -1.09% | -1.21% | -2.02% | -0.16% |

| % Change year | +2.80% | +0.43% | +17.28% | +12.14% | +10.65% |

S&P 500 closes little changed Monday as traders await Fed policy meeting: Live updates