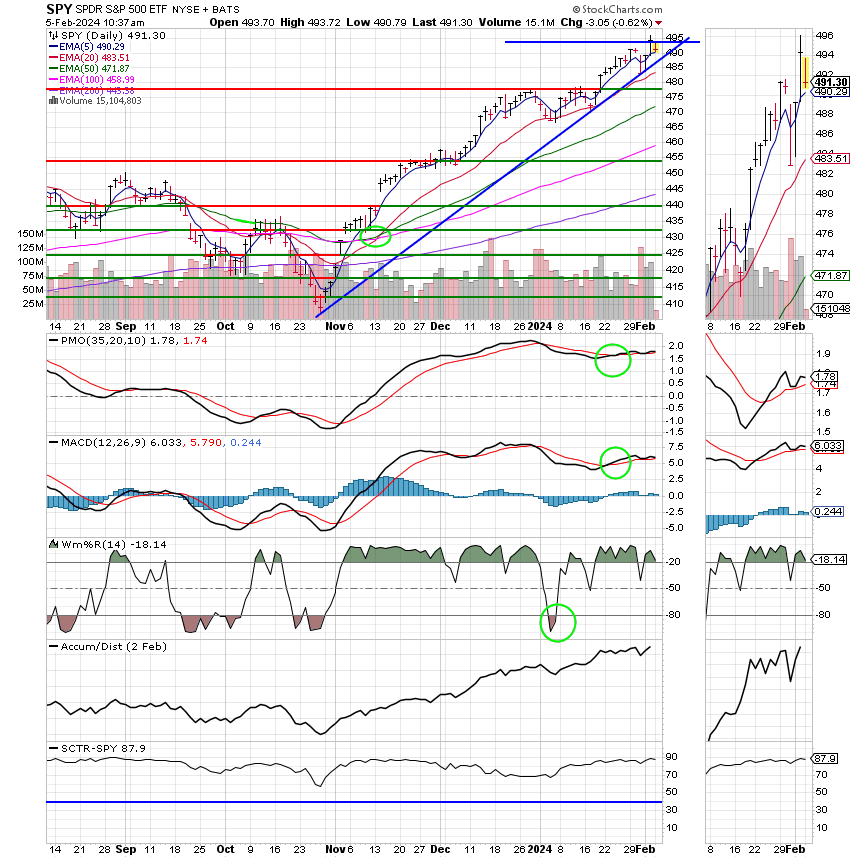

Good Morning, Last week the market was a roller coaster ending on a high note after a better than expected jobs report was released on Friday. So….this market will continue to move straight up just like it has done since 2009 right??? I don’t think so!!!! As I told you many times, the fiscal stimulus added by the government is gone. It started after the financial crisis in 2009 and was extended by the pandemic, but now it’s gone. For those of you who learned to trade during that period and think you got this now, who think that your buy and hold strategy will continue to work, you are in for a rude awakening. Buy and hold was a failed strategy before 2009 and it’s a failed strategy again now. I should say that it is failed in the aspect that it will restrict your earnings to 10-12% per year. It takes no skill to do that…. The return of volatility or shall I say movement has returned with the removal of government stimulus and by government stimulus I am referring to the purchase of bonds and mortgage backed securities by the Fed. I am not referring to the adjustment of interest rates by the Fed. That is their natural function. That is what they do to regulate the inflation and employment which is their dual mandate and the reason for their existence in the first place. The government stimulus that occurred between the financial crisis and the end of the pandemic was unprecedented in the history of our economy and market. I might add with tongue in cheek that it’s removal was responsible for our groups underperformance the past 2 years. Well that’s over and we’re back better than ever with God’s help! Someone commented recently, I think on our Facebook page, that we needed more moves because this isn’t your Grandfathers market. I agree. We need additional moves. I also agree that it is not the market of the last 12 years, but I would disagree with the Grandfather statement. This is by the matter of fact definitely your grandfathers market and the closer that the rate of inflation gets to two percent the more that fact will become apparent to you. I will add one caveat to that statement and that is with the exception of high speed computer trading. Perhaps, that is what the commenter was referring to. I will agree that algorithm trading has added to the speed and deception with which the market operates, but with that exception noted, it is the same market that existed prior to the financial crisis. The bottom line and the point that I’m trying to make is that if you treat this market as you treated the market for the past 12 years, you will underperform and possibly even lose money. Moving on, we moved our allocation back into the G Fund last week after several of our early indicators began to weaken. I want to stress the word EARLY. That doesn’t mean the market will drop the next day although that is not out of the realm of possibility. We are not timing the market!!!!! What it does mean is that the market is likely to dip in the near future and that dip is what we seek to avoid. We are operating in the precedent that “It’s not what you make that’s important, but what you keep!” If you keep most of what you make it will accumulate and in the end you will have more than the folks that made a lot but lost a lot. Just ask any of the Old Timers with our group. Plus, it’s a lot easier on your stomach over the long term. Take today for instance. The market is moving lower….. is anyone worried???

So far the days trading has left us with the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is off -0.95%, the Nasdaq -0.67% and the S&P 500 -0.62%. Praise God for our move to the G Fund!

Dow drops nearly 400 points as traders worry about the potential for fewer rate cuts than expected: Live updates

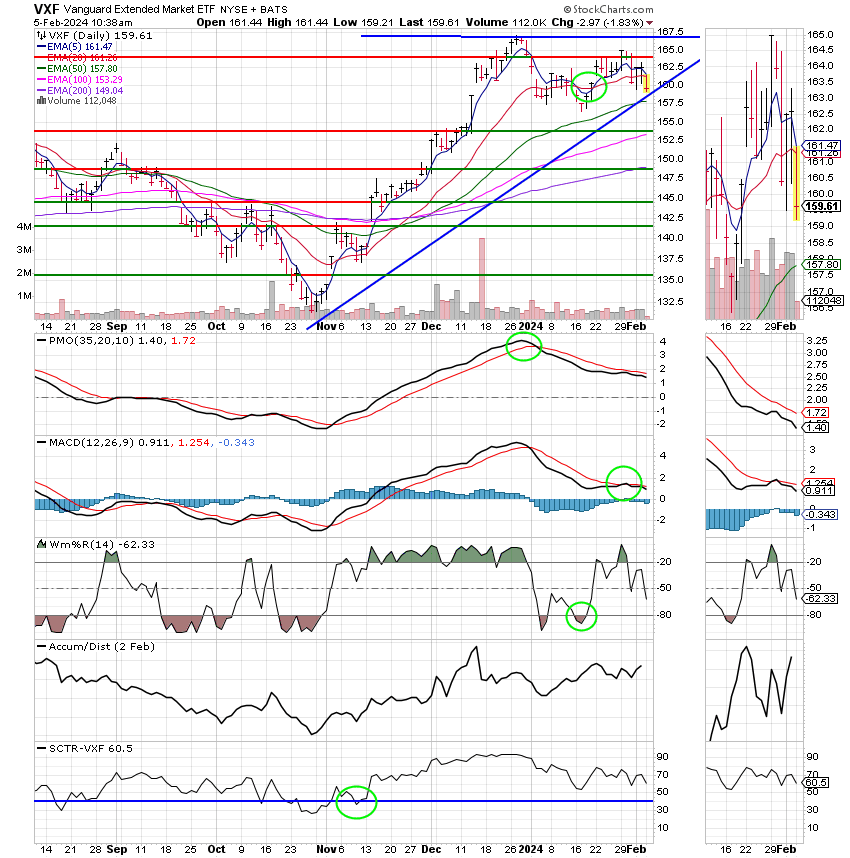

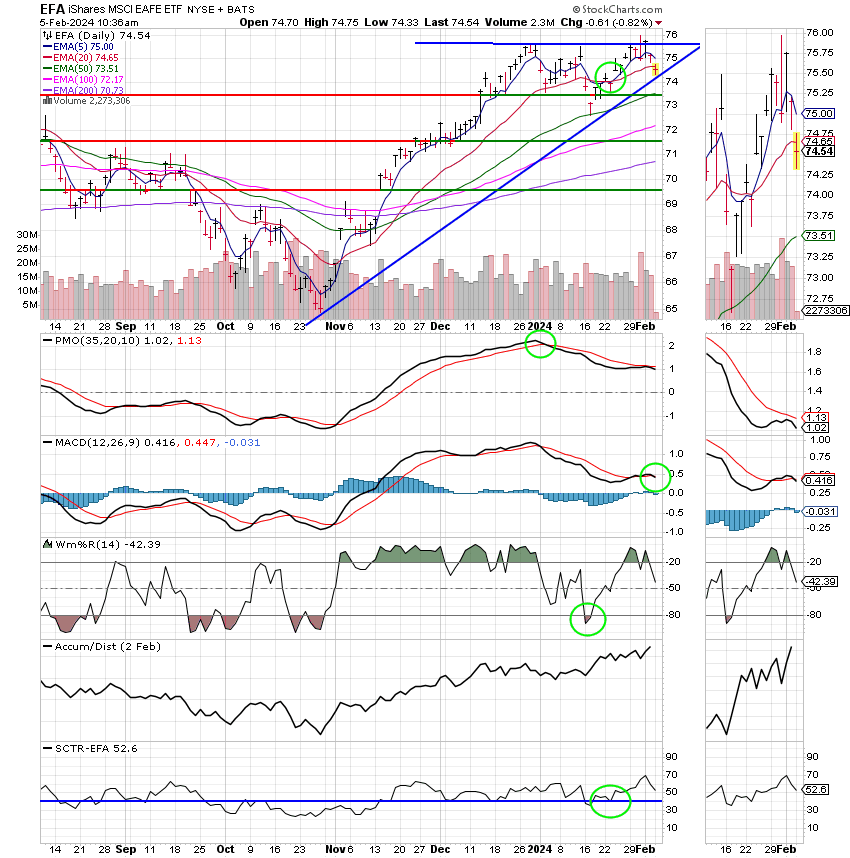

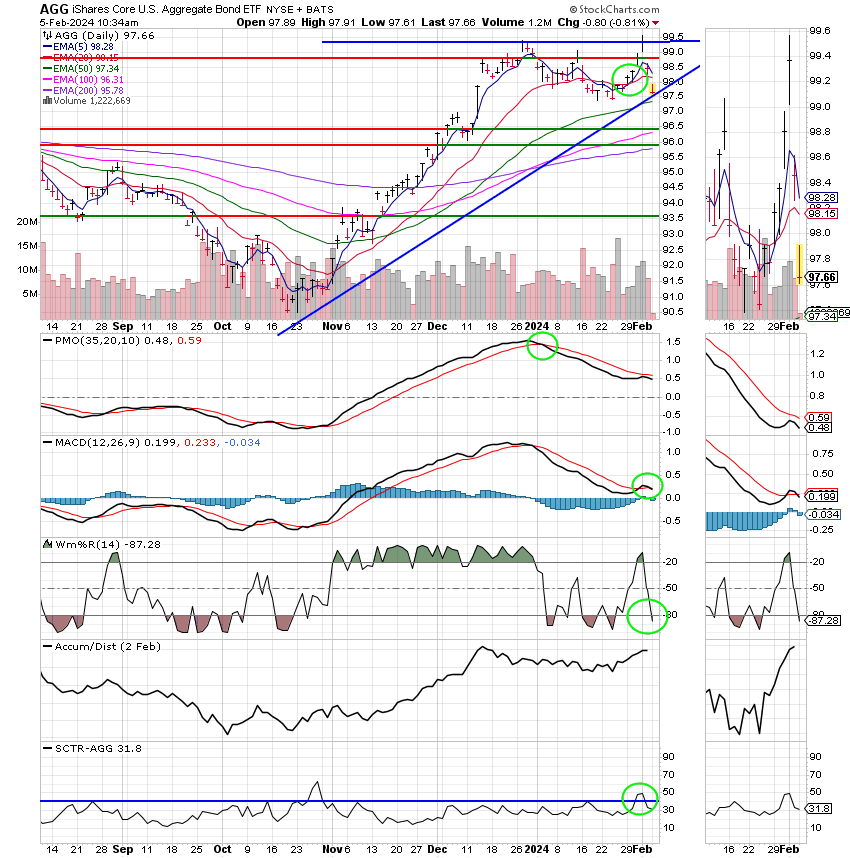

Recent trading has left us with the following signals: C-Hold, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now +2.35% for the year not including today’s results. here are the latest posted returns:

| 02/02/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.0288 | 19.1138 | 77.3819 | 76.2789 | 40.0436 |

| $ Change | 0.0020 | -0.1804 | 0.8216 | 0.0833 | -0.3175 |

| % Change day | +0.01% | -0.94% | +1.07% | +0.11% | -0.79% |

| % Change week | +0.08% | +0.65% | +1.41% | +0.22% | +0.05% |

| % Change month | +0.02% | -0.38% | +2.34% | +1.38% | -0.12% |

| % Change year | +0.37% | -0.57% | +4.06% | -1.06% | -0.34% |