Good Evening, Wow, where do I start tonight? First let me talk briefly about last Thursday’s interfund transfer. We issued the transfer alert at 11:00 AM that day and there were several folks that didn’t see it in time to make the trade before the TSP deadline of 12:00PM. Given the next days drop their were some folks that were notably upset. Let me address that now. I am very sorry that they missed the trade. The system definitely nailed it this time. The signals could not have been more accurate. We were able to get Thursdays gain and avoid Fridays loss. That said let me tell you that while the trade worked out really good for those that were able to make it, it was not our intention to time the market. We are not and have never been market timers. We are trend followers!! Our goal in every trade we make is to adjust our portfolio to take full advantage of the next trend what ever it may be. Sometimes we get the signal a day before a new trend and sometimes it’s a day late. This time it just happened to be perfect and we were able to exit equities at the best time. Of course, that’s always what we endeavor to do, but again we don’t expect that kind of perfection every time. The important thing is to be in the next trend for the majority of it’s duration. Which brings me to my point. If you are following our allocation, just make the trade whenever it’s convenient. Sometimes like this your trade will be perfect and sometimes not. It usually evens out in the end. When we make a trade we make it for the intermediate to long term. We are not trying to get out one day and get back in the next. We are trying to ride the next trend as long as we can be it a week or a month or six months. If you are invested according to the trend you will make money and reduce risk. That is what we do here. Now, all that noted, I have a recommendation. Our new system is dialed in. There is a strong possibility that it will replicate these results again in the future. One thing that you have to understand is that I cannot control when a signal is generated. In this case I got the signal at 10:50 and posted it as quickly as I could so that folks could make the trade that day if it was convenient for them to do so. Given, the late nature of the signal not everyone was going to see it. I always post them as soon as I can do so. Again, for convenience, but never for “market timing”. However, taking into account the accuracy of our new system It might be advisable to check your feed for an alert at 11:30 or so each market day in order to give yourself enough time to complete a trade that day should we issue a later alert. That’s the only way I can think of that you could follow us closely enough to meet the trade deadline on days such as Thursday when we receive a late signal. There’s simply no other way to avoid missing the deadline.

So…lets talk about the system for the benefit of those of you who are new. You old timers know the story. Prior to the pandemic we used the same system for nearly 20 years and always beat the the major indices. It was a good system until it wasn’t. I’m not sure if it was due to the pandemic and folks having more time to study or if the programs just evolved but all the sudden what had worked so good for us stopped working. Prior to that bear market we had only 3 negative years out of 20 and those three didn’t add up to 5 percent . That year we found ourselves with the first significant loss that we had ever and I mean ever experienced. By the years end we found ourselves in the hole 27.8%. It still hurts. It was a bear market year but that is no excuse. We’d never been through a bear market and took a loss like that and it was unacceptable. Then the haters came out, they analyzed every trade that we made that year and told folks that was the same results we’d always had and how our strategy was flawed. Those were dark days. At the end of that year we started praying, we wondered why the Lord had not blessed our hand as he always had. That was when the Holy Spirit led us to look at what had changed in the market. Why did everything suddenly not work? We spent hours and days and weeks pouring over every report and chart we could find and finally found that the highspeed computer algorithms had started key in on the moving averages. The same moving averages that had powered our system for years. They were absolutely eating our lunch. We exhausted every type of indicator we could find and still could not overcome what they were doing. The buy and hold systems were the only way anyone was making money and those folks continued to let us know about it. We kept praying and kept our nose to the grindstone. There had to be a way to follow the trend without the using charts based on moving averages. Finally, with God’s guidance we a found some non traditional indicators and built a new system around them. We continued to struggle the second year breaking even as we developed the new system. All the while the haters continued to attack everything we did which they do even to this day. 2024 finally rolled around and we put the new system to work. Actually, we had been putting our new system in place since late July of 2023. So we fully got it in place but still under performed as we fined tuned and learned to use. Which brings us to today. We are now up +3.80% for the year. The C Fund is roughly double that? I’m really not sure after it’s second consecutive losing day. Those same haters are still pointing out that we are behind the C Fund. Well I’m going to respond to that here and now. We underperformed early in the year as we got things in place but our system is dialed in now. Just as we had the old system dialed in for 20 years, this one is dialed in now. The old system was a good system to be sure, but this is a great system. It’s not only the best I’ve every used, it’s the best I’ve ever seen. God has truly blessed our group. Beyond measure. We give Him all the praise and all the credit. We do nothing without His guidance, NOTHING! Our market strategy never changed. It has always been to follow the trend and now we have a new system dialed in that will allow us to do it as we always have. To all those haters. We will NEVER under perform again!

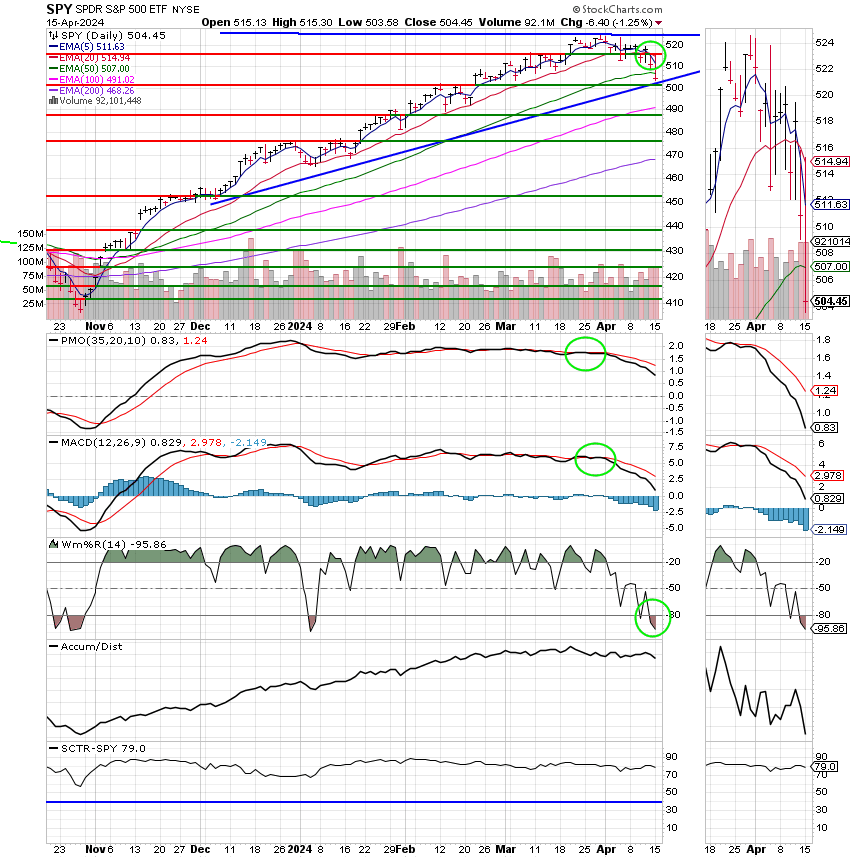

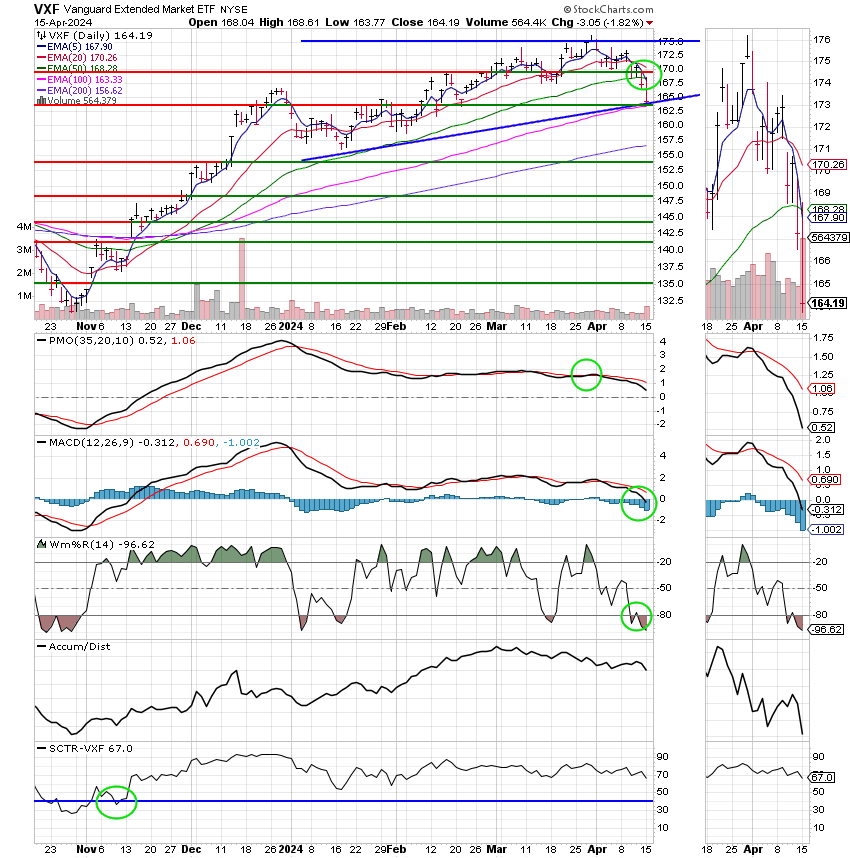

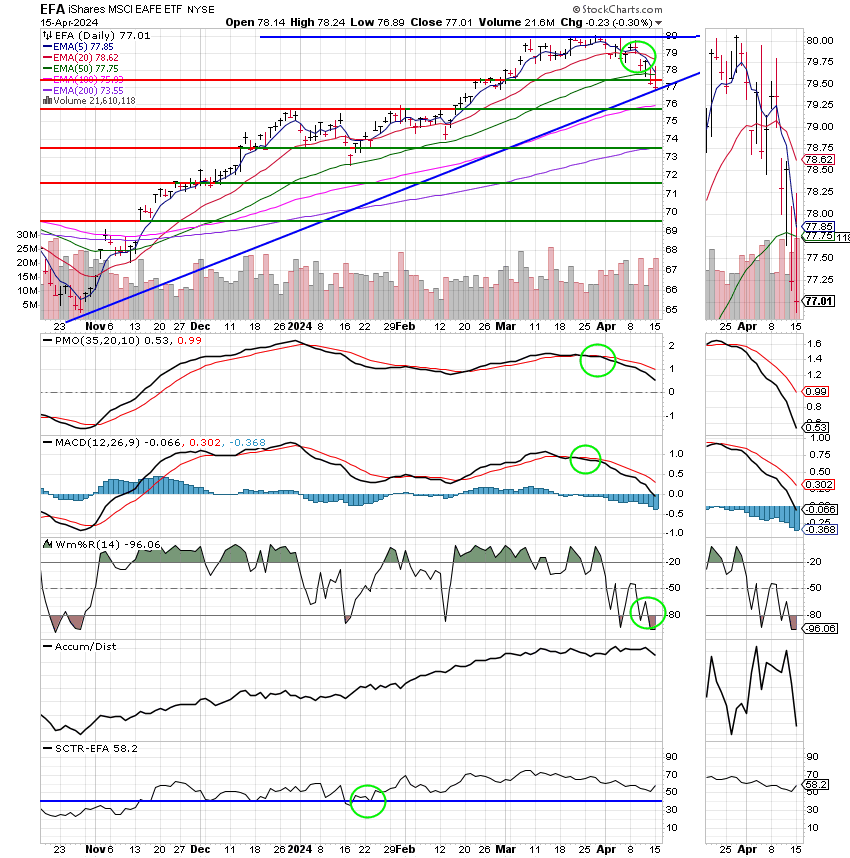

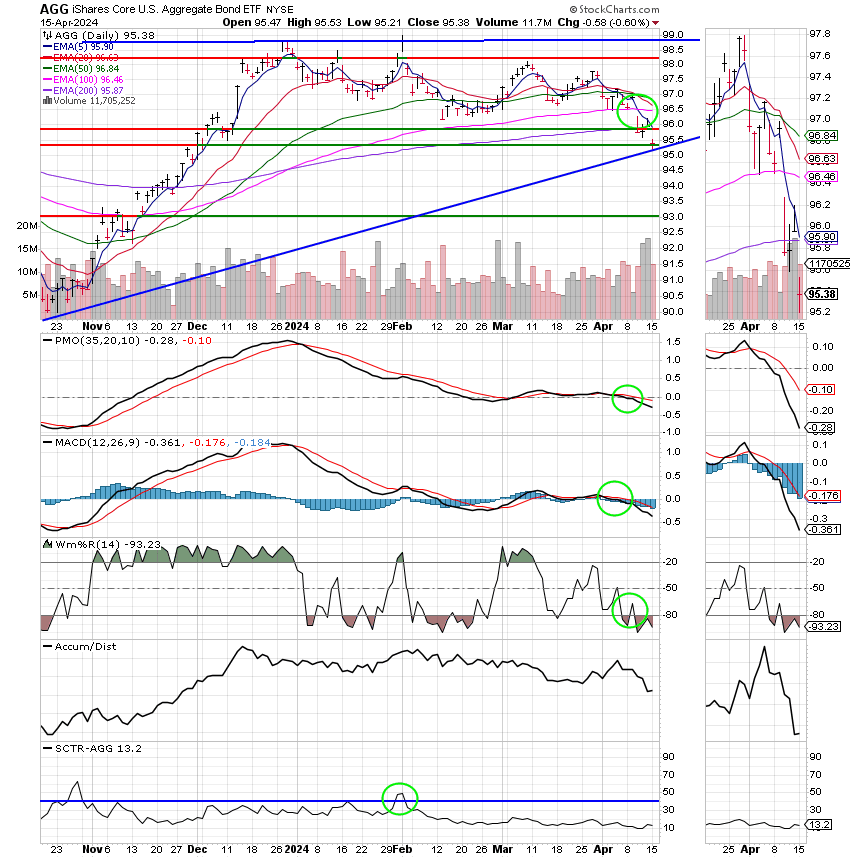

Am I going to talk about the market this week? I’ll keep it short. Last weeks Hot CPI and PPI led investors to the conclusion that the Fed may not decrease rates in June. I think that’s been the case. At least we’ve been talking about it for a while. Is the current downturn the sell off we were expecting the disappointment over a lack of rate cuts to cause. You never know but I don’t really think so. If I had to guess which to me is synonymous with predict I’d say it will be choppy until June with more selling at that time, but who knows. What I do know is that my indicators said there would be some selling now and there is. Worth mentioning is the fact the treasury rates are again rising on renewed concerns of higher interest rates for longer. As we have pointed out many times, higher treasury rates put pressure on stocks. Also, we have the situation in the middle east. Iran, intent on causing World War Three attacked Israel with 300 drones and rockets. Geopolitical events usually only cause short term pullbacks but again you never know. When you consider all this and add to it the fast approaching unfavorable seasonality for stocks (go away in May….) you get a negative environment for stocks. My expectation is that it will be choppy or trend lower until the first rate cut which I don’t think will come until September at the earliest. By the matter of fact it is beginning to look more likely that we will not see a rate cut until 2025. If that’s the case expect strong headwinds for stocks. Folks, don’t forget that you will have days when the market rises, but in the end what you are looking for is higher highs and higher lows. Don’t let the algorithms suck you into a downtrend with a high day here or there. Wait until you see an established up trend before you buy equities. As for myself I’ll be watching my charts. For the most part to me news is noise. I’ll try to stick more to the market next week. It’s just that we’re so excited by this new system. It’s simply incredible and I wanted to share just how good it is with you. Something positive for a change!

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, The Dow lost -0.67%, the Nasdaq, -1.79%, and the S&P 500 -1.20%. Oh yeah, and the S Fund dropped -1.82%. Praise God for guiding us to the G Fund. It’s been two pretty tough days.

S&P 500 and Nasdaq close 1% lower as yields jump, traders await Israel response to Iran: Live updates

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now +3.80% not including the days results. Here are the latest posted results:

| 04/12/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.1776 | 18.7566 | 80.2033 | 78.5762 | 41.2567 |

| $ Change | 0.0022 | 0.0514 | -1.1743 | -1.5371 | -0.6047 |

| % Change day | +0.01% | +0.27% | -1.44% | -1.92% | -1.44% |

| % Change week | +0.08% | -0.71% | -1.52% | -2.67% | -2.10% |

| % Change month | +0.14% | -1.69% | -2.44% | -4.68% | -3.09% |

| % Change year | +1.19% | -2.42% | +7.85% | +1.92% | +2.68% |

Leave a Reply

You must be logged in to post a comment.