Good Evening, The first thing you must remember in this market is your not down. You’ve made a lot of money in the last several years. You are off your high but your not down! I’ll be the first to admit though that we are about 4-5% off our high more than we should be. I have explained why that is a fact a couple times already so I won’t do it again. It looks like I’m making an excuse when I talk about that and I’m not. I should have listened to the initial sell signal in early January on our main indicator and I did not. I own it plain and simple. Nonetheless, If that’s the worst trade we ever make then we’ll be in great shape. We are where we are and it’s time to look ahead and not behind. This is where we start!

The market continues to be disrupted over the short term by Russia’s invasion of the Ukraine. The long term outlook, however, is all about inflation. It’s not hard to understand at all. As prices rise the Fed will raise interest rates to control the inflation. The more the rates rise the more pressure is placed on the market. The Ukrainian situation simply muddied the water. How will the war effect the recovering economy? While the media is downplaying the issue it is my thought that the effect of the conflict on the economy could be far greater than they are saying. For instance, what has more effect on inflation than energy prices? The price of oil has now risen to almost $100.00 per barrel and by the matter of fact did get to that level in intraday trading. How will the sanctions on the Russian Government and those close to that Government effect the world economy? It has been stated again and again that those sanctions will have a minimal effect on our banks here in the US. Did anyone happen to notice the price of bank stocks today? Financial stocks were some of the biggest losers on the day, with Bank of America down 3.6%, Wells Fargo off 5% and Charles Schwab tumbling more than 6%. Lower bond yields could potentially take a bite out of bank profits as investors move to the safety of bonds, while the conflict in Eastern Europe and sanctions on Russia have many traders worried about disruption in credit markets. I really hate to say it but this is a world economy. What effects them will effect us…. The oceans no longer separate us from their issues as they did in he mid nineteenth century. We will deal with it sooner or later. Someone asked me today what the next move I’m planning might be. I told them something close to this. Until inflation moderates there will not be a lot of growth in equities. I never prognosticate! I only react to what I see and right now it is day to day. So if you can tell me who will win the conflict in the Ukraine and when inflation will moderate then I’ll tell you when I’ll invest and what I’ll invest in next! Until then the current risk level is too high for my taste, but again, it can all change in a day or so. Normally we like to say here that we don’t have a crystal ball, but that what we have is more like a wind sock at the airport. Well right now the wind direction is changing from day to day and hour to hour making it hard if not impossible to plan our next move. We’re just going to have to be patient until the the weather (inflation) settles down and the skies clear (the conflict in the Ukraine ends). Until then I’m more than happy just to hang on to most of what I made in the past 10 years. The bottom line is this. We need to be patient for now but ready to move aggressively when the time comes and with God’s guidance that’s just what we’ll do.

The days trading left us with the following results: Our TSP allocation remained steady in the G Fund. For comparison, the Dow lost -1.76%, the Nasdaq -1.59%, and the S&P 500 -1.55%. There was a lot of red on the screens today!

Dow loses nearly 600 points as war in Ukraine leads to surge in oil prices

The days action left us with the following signals: C-Sell, S-Hold, I-Sell, F-Hold. We are currently invested at 100/G. Our allocation is now -13.22% on the year not including the days results. Here are the latest posted results:

| 02/28/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7826 | 20.2289 | 66.182 | 75.058 | 36.8903 |

| $ Change | 0.0026 | 0.1571 | -0.1549 | 0.4332 | -0.3226 |

| % Change day | +0.02% | +0.78% | -0.23% | +0.58% | -0.87% |

| % Change week | +0.02% | +0.78% | -0.23% | +0.58% | -0.87% |

| % Change month | +0.14% | -1.08% | -2.99% | +0.03% | -2.61% |

| % Change year | +0.28% | -3.15% | -8.01% | -10.05% | -6.47% |

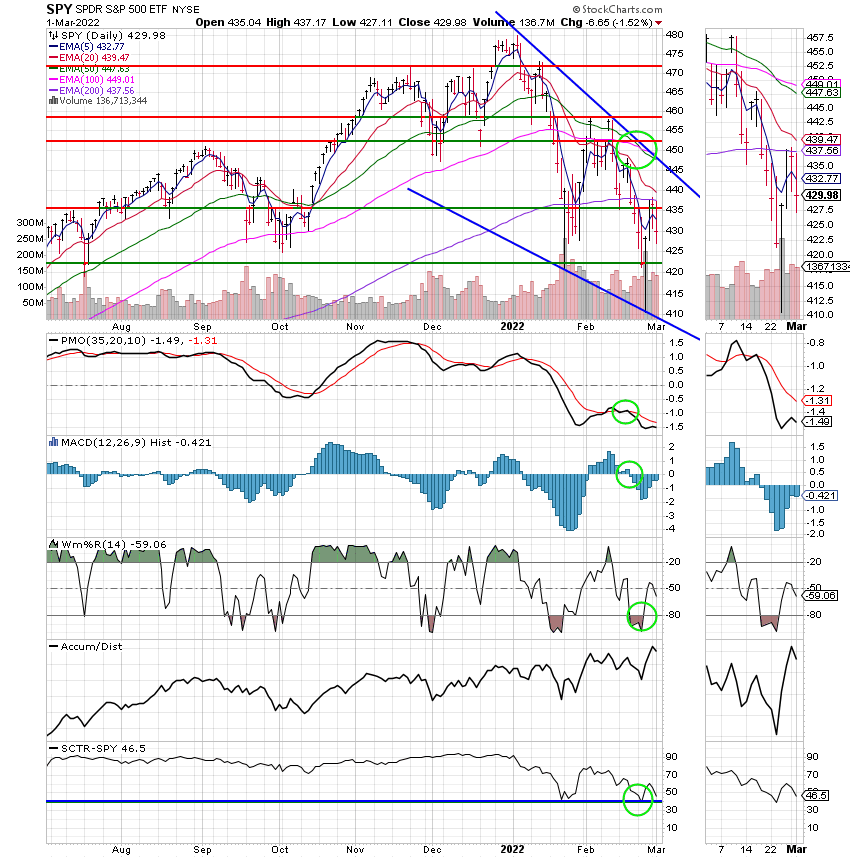

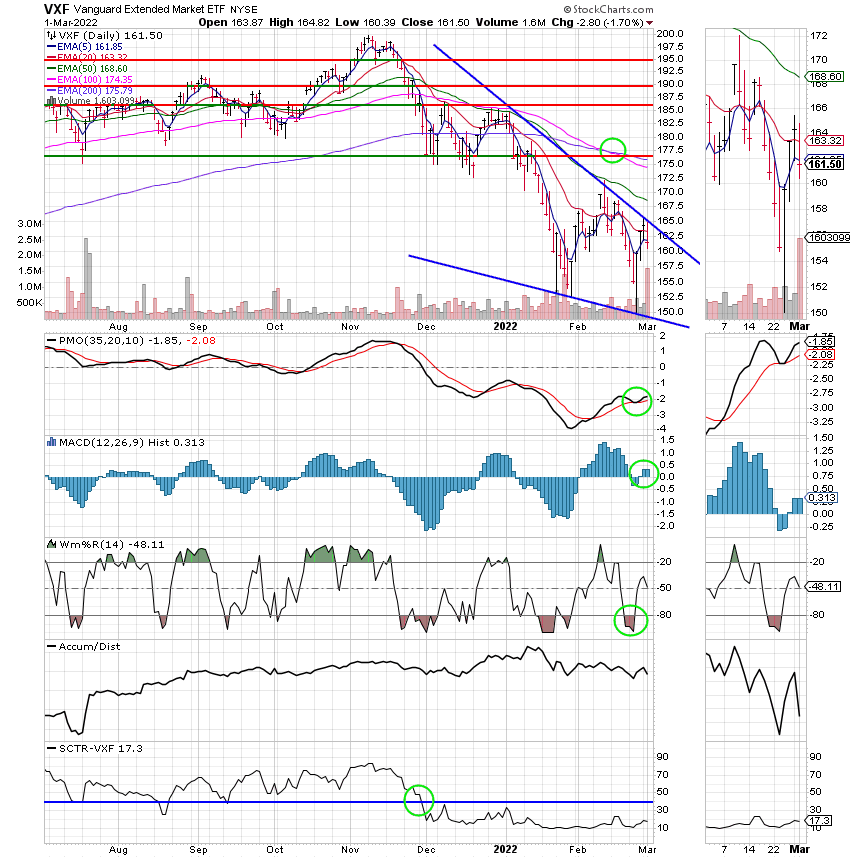

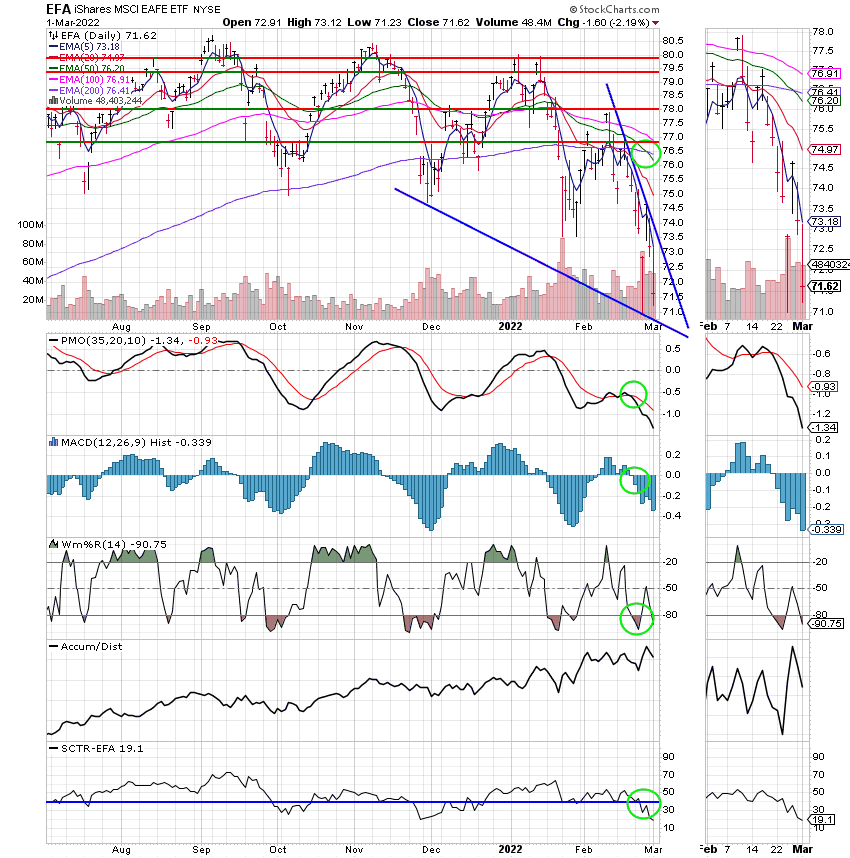

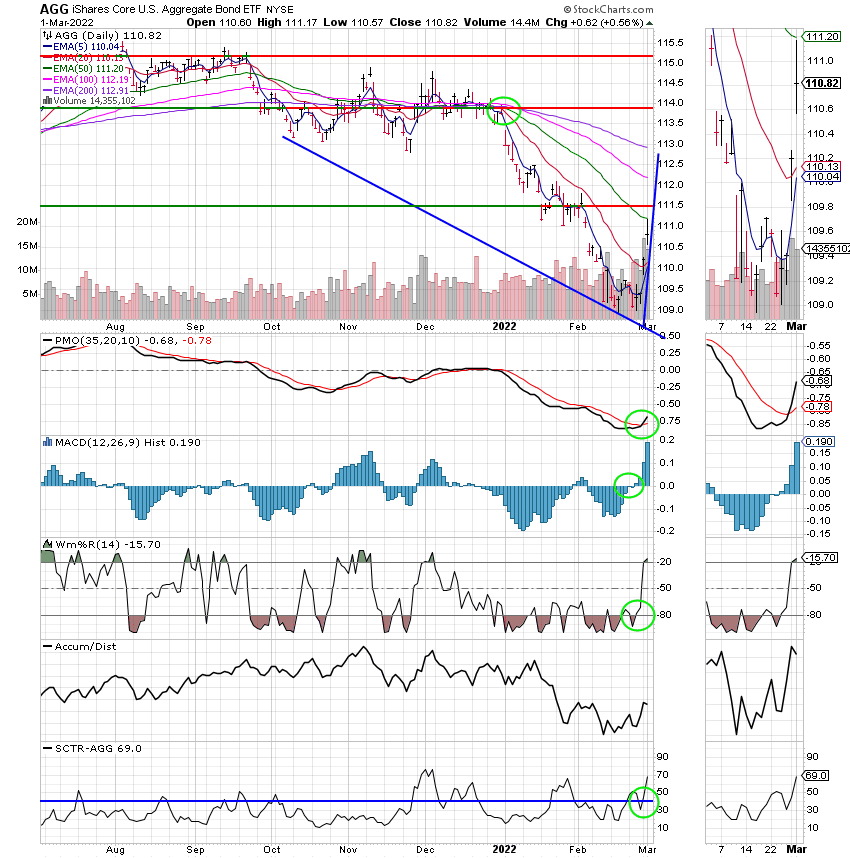

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

As I said above. We must be patient for now, but ready to move aggressively when we get the signal. Don’t forget to pray for the Ukrainian people. Pray that God will protect them and defeat their enemies. They are a peace loving people who are only fighting for their freedom. May the Lord of hosts crush their enemies!! There are many churches there that love God with all their heart and all their souls. May the peace of Jesus be upon them in this difficult time. Have a nice evening and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.