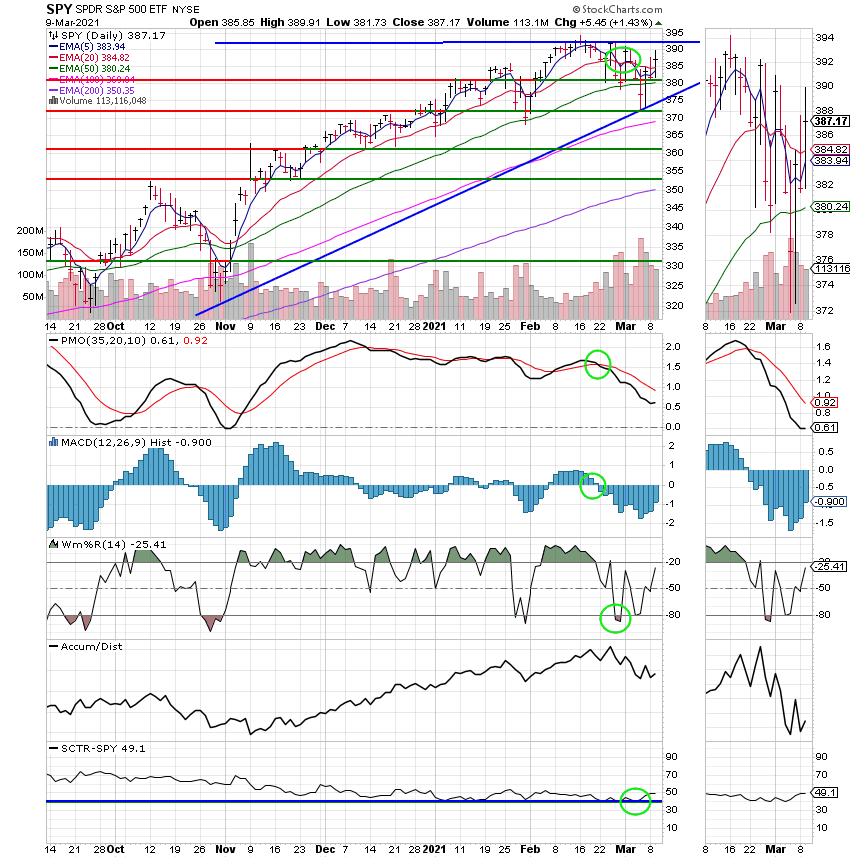

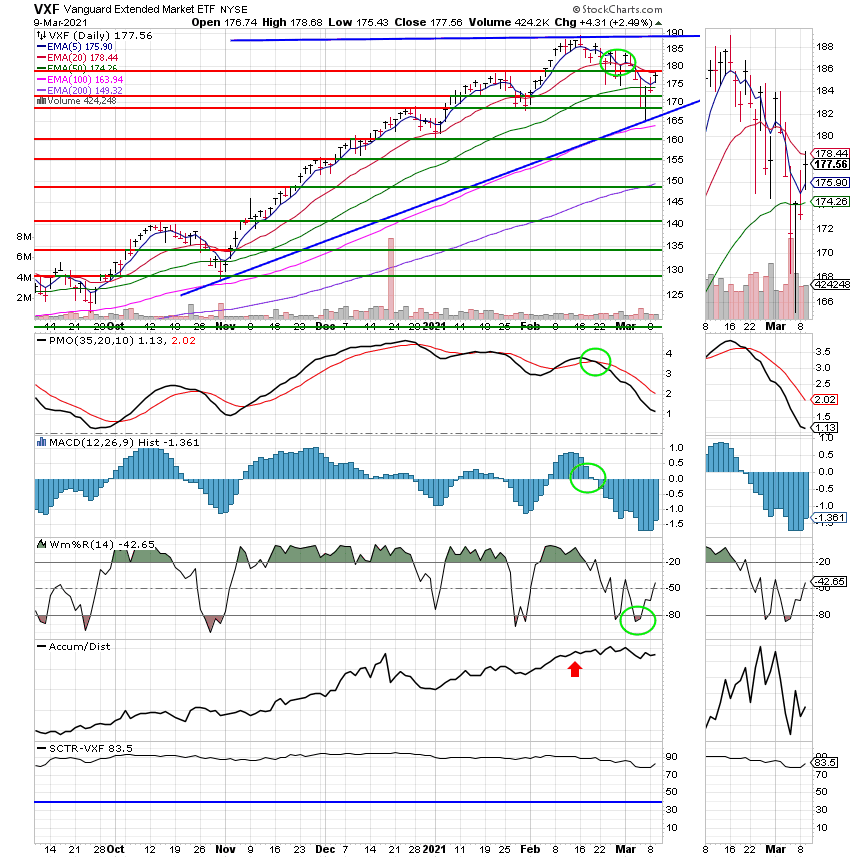

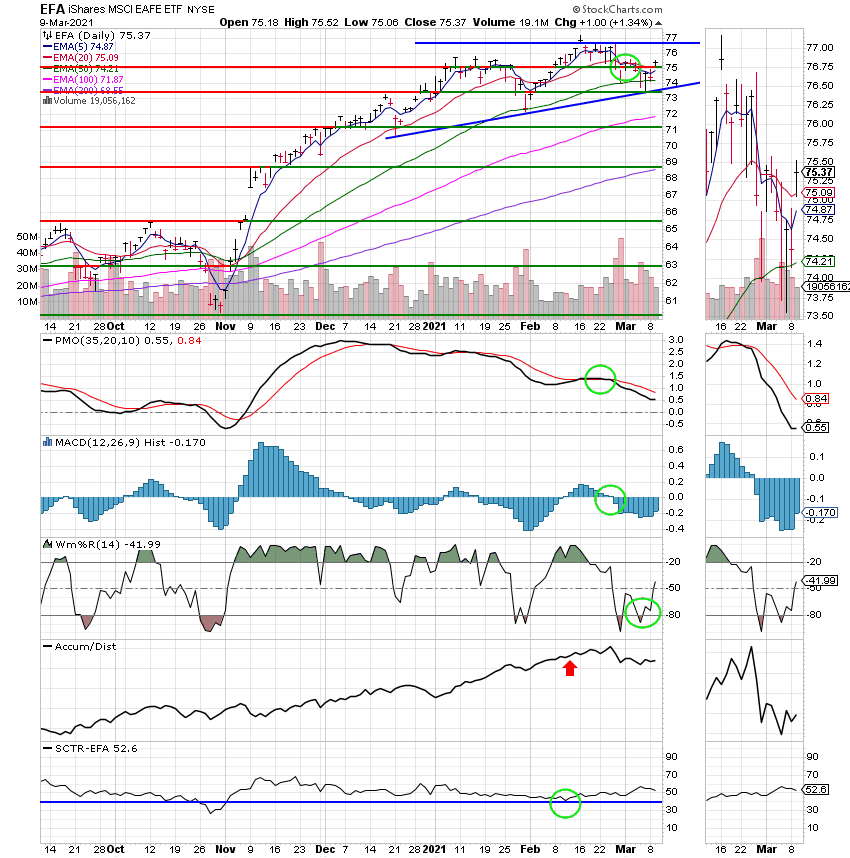

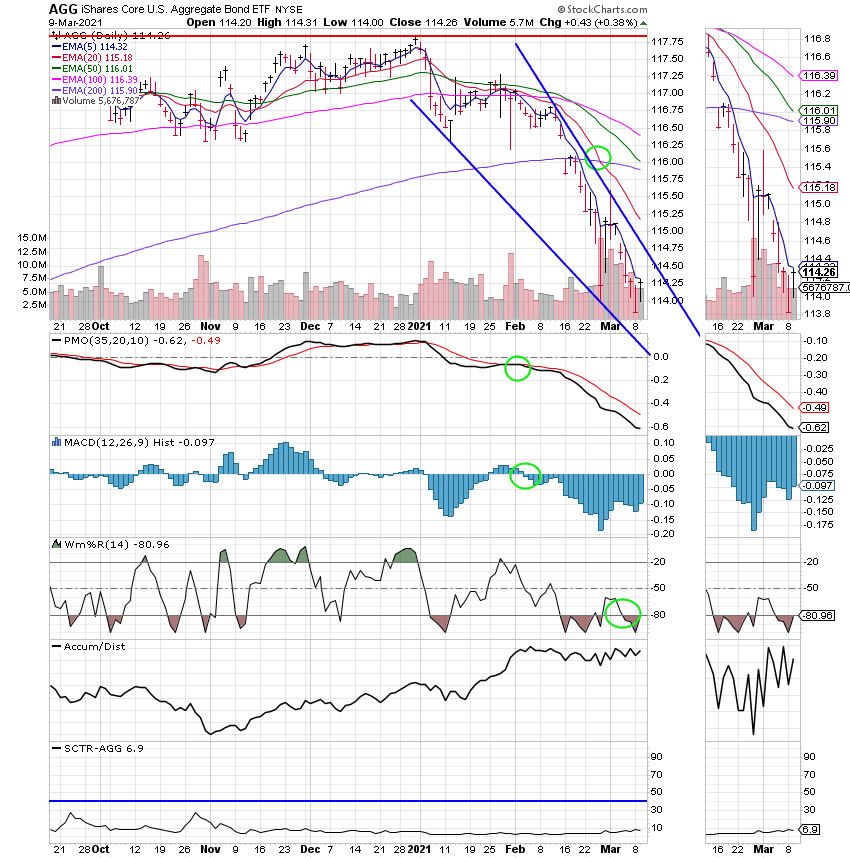

Good Evening, Praise God! We may have found the bottom to the current sell off today. By the matter of fact some of my indicators were signaling that we might be near a bottom this weekend. I posted it on our Facebook page to encourage some of you folks that might have been faltering just a bit. After all, this was a quick and painful correction that tested the conviction of many investors. Today’s bounce was a strong one. The Nasdaq posted its biggest single-day rise since Nov. 4. The Dow set a record intraday high but pulled back from earlier gains at the close. The S&P 500 had a nice day as well. I was discussing the current sell off with someone on our Facebook page today and actually gave him some of the analysis that I was going to write about tonight. Oh well, here is my current analysis one more time. Recently, the media has been going on and on about how the somewhat rapid run up in treasury rates is affecting the current market by causing tech stocks to be sold. Their contention is that rising interest rates will adversely effect the ability of tech firms to borrow money in the future. Tech firms are often valued on their future earnings which justifies their high valuations. Thus investors are selling tech and that is why you have experienced current selloff. I believe that many if not most analysts are misinterpreting this move. This is in fact a broadening of the bull market. Money is starting to flow out of tech and into other strategies like value which is in actuality a strengthening of the bull market and will play to our advantage moving forward. As far as rates go….. 3 to 3,5% has been considered normal and even with last weeks increase we are just now only close to 1.6%. The reality of it all is that this is a normal part of an economic recovery that has been overblown by a panic promoting media. Yes! This has been a painful correction. Especially if you are holding tech like I am on the street. However, the realism of this is that this is a healthy correction in a bull market with a little abnormal secular rotation resulting from a more rapid than normal rise in treasury rates. The fact is those rates are only returning to what is considered a normal range. Bottom line, when investors finally realize that is the case, prices will stabilize and the rally will continue. It is my strong opinion that process may have started today. We will see.

The days trading left us with the following results: Our TSP allotment posted a strong gain of +2.49%. For comparison, the Dow rose +0.10%, the Nasdaq +3.69% and the S&P 500 +1.42%. Don’t you wish everyday was like this?

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now +5.33% on the year not including the days results. Here are the latest posted results:

| 03/08/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5385 | 20.5137 | 57.0422 | 78.1558 | 35.9095 |

| $ Change | 0.0019 | -0.0614 | -0.3065 | -0.4382 | -0.1046 |

| % Change day | +0.01% | -0.30% | -0.53% | -0.56% | -0.29% |

| % Change week | +0.01% | -0.30% | -0.53% | -0.56% | -0.29% |

| % Change month | +0.03% | -1.09% | +0.30% | -2.67% | +0.32% |

| % Change year | +0.18% | -3.22% | +2.02% | +5.33% | +1.47% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.3835 | 11.2723 | 39.2642 | 11.7265 | 44.1335 |

| $ Change | -0.0251 | -0.0260 | -0.1143 | -0.0376 | -0.1536 |

| % Change day | -0.11% | -0.23% | -0.29% | -0.32% | -0.35% |

| % Change week | -0.11% | -0.23% | -0.29% | -0.32% | -0.35% |

| % Change month | -0.05% | -0.09% | -0.12% | -0.14% | -0.16% |

| % Change year | +0.47% | +1.01% | +1.26% | +1.36% | +1.48% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.0355 | 26.2471 | 12.7007 | 12.7006 | 12.7004 |

| $ Change | -0.0449 | -0.1038 | -0.0575 | -0.0575 | -0.0575 |

| % Change day | -0.37% | -0.39% | -0.45% | -0.45% | -0.45% |

| % Change week | -0.37% | -0.39% | -0.45% | -0.45% | -0.45% |

| % Change month | -0.19% | -0.20% | -0.15% | -0.15% | -0.15% |

| % Change year | +1.58% | +1.70% | +2.33% | +2.32% | +2.32% |