Good Morning, Stocks dipped at the end of the week as both corporate guidance and economic reports came in mixed. You could take away about anything you wanted to take away from last Fridays jobs report. 275,000 jobs were created last month which led to most of the selling that occurred. However, unemployment moved up from 3.7 to 3.9% and wage growth moderated as well with Wages rising only 0.1% on the month, one-tenth of a percentage point below the estimate, and were up 4.3% from a year ago. I look at it like this, the jobs report is short term data, but unemployment and wage growth are longer term data. Jobs may have spiked in February but unemployment and wage growth show that the Feds rate increases have been effective and that the they will be able to start reducing rates in 2024. The market is fickle like that. Even the smallest piece of data that it doesn’t agree with will cause it to panic and sell. Well you know what we say about that here. Panic is not a strategy! That is not to say that you should never sell. That is the buy and hold philosophy. We have a saying about that here as well. Actually we borrowed it from TSPTalk.com. So let me give credit where credit is due. “Friends don’t let friends buy and hold”. We view selling as a tool that should be used strategically based on our charts and nothing else. Emotions will get you killed in this business. There is a time to sell and a time not to sell and only your charts can tell the difference. So back to the main subject. The market continues to move from report to report. Up on one then down on another. This is what I talked about when Federal stimulus was ending and I told you that there would be volatility and that the market would no longer move steadily higher as it had done the past 12 years. Remember?? It’s in the archives if you don’t. This week we have two more reports that investors will pay special attention to. The CPI and PPI reports which will be released on Tuesday and Thursday respectively. They shouldn’t need any explanation at this point. You can either look in the archives or google them if you are new or forgot what they are. The thing to remember with these and all reports at this time is what do they they tell us about inflation? If they are hot then the market will sell off. If they are cool it will rally. Heretofore we have ultimately had a series or higher highs and higher lows. By seeing this on our charts we know that the overall trend is higher. If and when we see a new lower high accompanied by a lower low we will know that the trend is changing and that we need to strategically sell. It is worth noting that it is painful to be invested in a market with high volatility such as this one. Each time the market moves lower you just assume that it could set a new low and thus make it necessary for you to strategically sell. You can’t just set it and forget it. You must in fact watch your charts closely each time the market drops and it’s a lot more work! That is the reason that a market with a lower level of volatility is preferable for everyone concerned, but right now it is what it is and that gives us three choices. You can sit on the side lines and wait until things settle down. You can stay invested, watch your charts and do the extra work or….. you can set it and forget it (buy and hold) and take what the market gives you. That’s it. Those are your choices. You can get out, roll with it, or try to beat it. Conventional Wallstreet will tell you that you can’t beat it. Why?? because they need you to stay invested so they can make money. They will give you the crumbs off the table to keep you satisfied. One other thing is that they are counting on you will be too lazy or too busy to do the work. However, better future is indeed out there if your willing to put in the work. One other thing. I would be amiss not to add that you must first pray to your Heavenly Father from whom all blessings flow. You must get first things first!! So set your priorities! Seek first the kingdom of God and His righteousness…….

The days trading is leaving us with the following results: Our TSP allotment is trading lower at -0.62%. For comparison, the Dow is off -0.33%, the Nasdaq is -0.46%, and the S&P 500 is -0.33%.

Stocks fall for a second day as AI-fueled rally pauses, Nvidia slides: Live updates

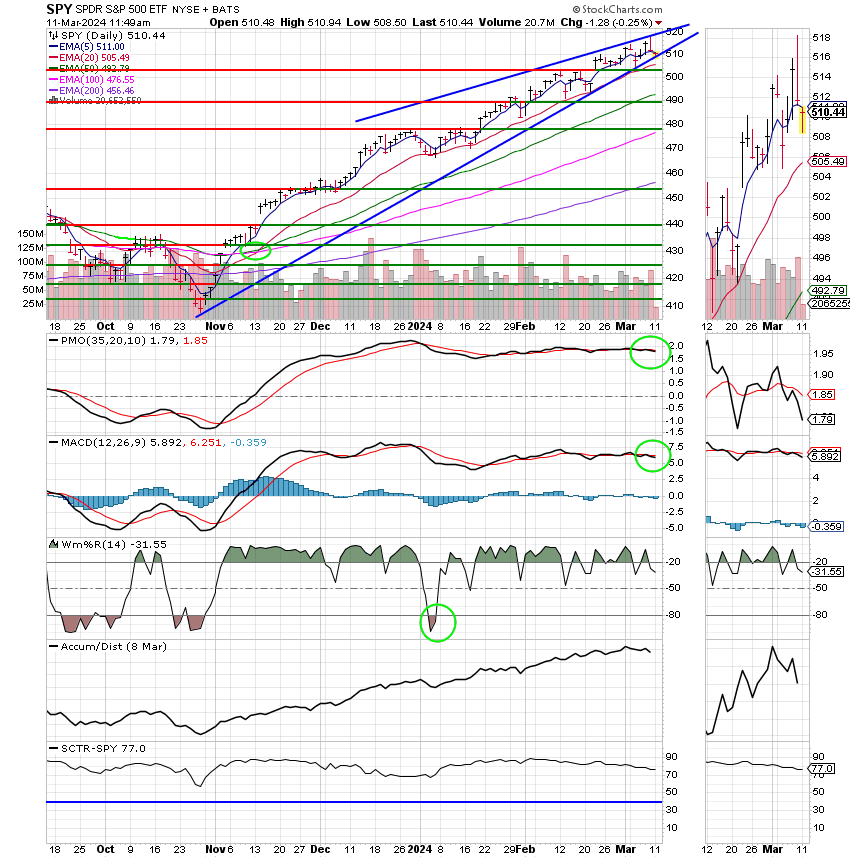

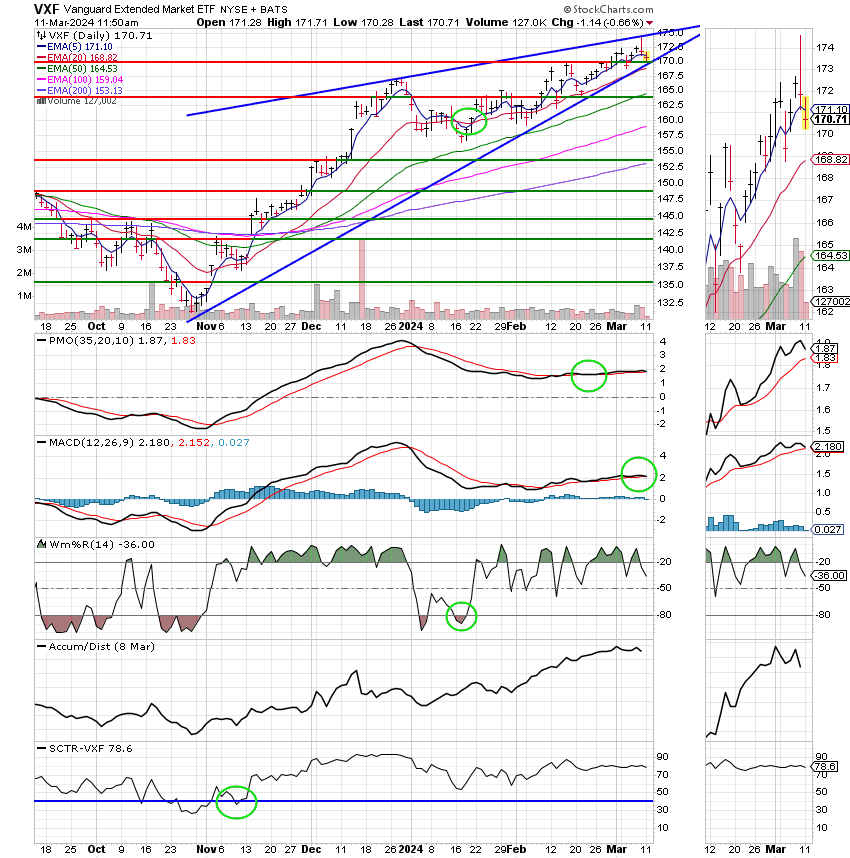

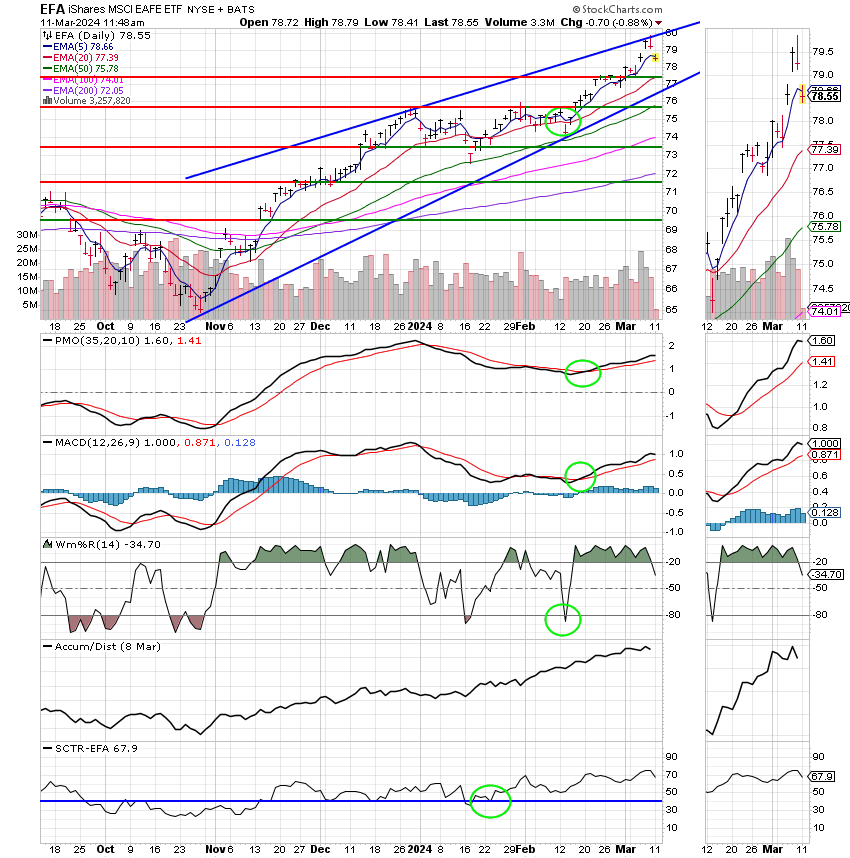

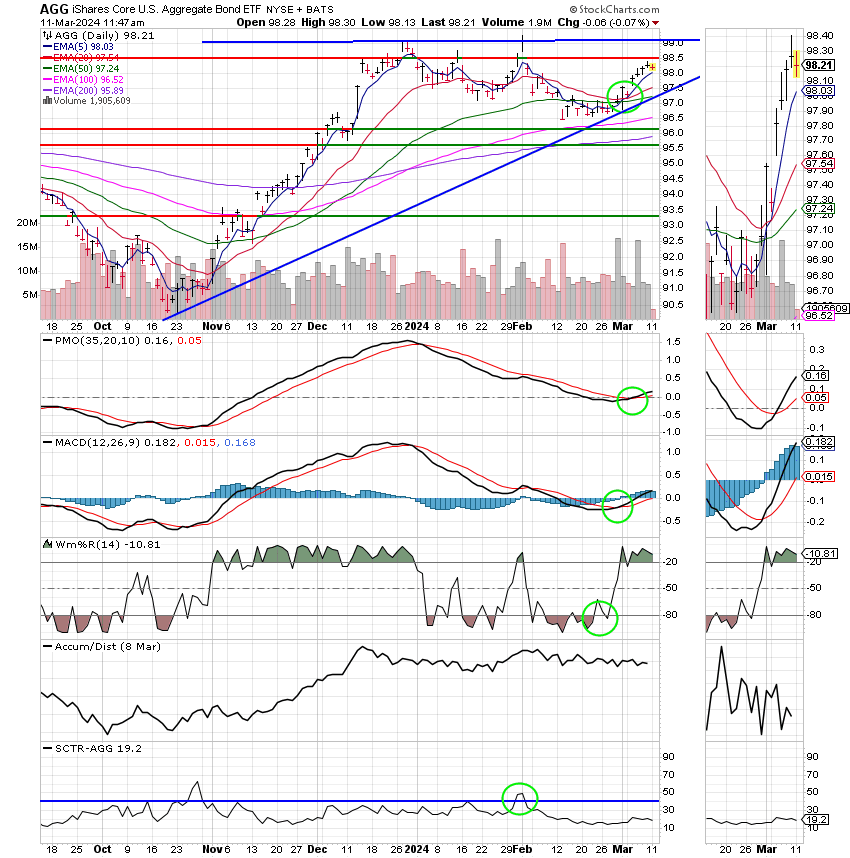

Recent action has left us with the following signals: C-Buy, S-Buy, I-Hold, F-Buy. We are currently invested at 100/S. Our allocation is now +4.64% on the year. Here are the latest posted results:

| 03/08/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.1015 | 19.1458 | 80.1061 | 80.5414 | 42.3527 |

| $ Change | 0.0022 | 0.0261 | -0.5211 | -0.3223 | -0.0653 |

| % Change day | +0.01% | +0.14% | -0.65% | -0.40% | -0.15% |

| % Change week | +0.08% | +0.82% | -0.23% | +0.15% | +1.79% |

| % Change month | +0.10% | +1.22% | +0.58% | +0.96% | +2.82% |

| % Change year | +0.77% | -0.40% | +7.72% | +4.47% | +5.40% |