Good Evening, The market rallied and setting new records in the major indices last week after the Fed assured investors that they are still on course for at least three rate cuts in 2024. That met or exceeded expectations so it was rally on. Today finds the market digesting it’s gains from that rally. After all, each time it reaches a new high it’s a record. Personally, it feels like there is greater resistance to move higher when this is the case. At any rate, the action continues to be driven by reports that the Fed uses to determine how inflation is behaving. Next up is the CPE or Consumer Personal Expenditure report which is said to be the Feds favorite inflation gauge. It is due on Friday which is a shortened trading day due to “Good Friday”. It is my expectation that whatever the markets reaction to that report is, that it will not be fully felt by the market until Monday. A lot of investors take that day off and make it a long weekend. I’m not making any predictions on the CPE report. We’ll just see what it is and deal with it when it comes.

One thing is for sure. It’s been a while since we’ve had a meaningful pullback. So I’d be surprised if we didn’t see one before the summer is over. How long has if been? The S&P 500 has officially gone 100 sessions without a pullback of at least 2% from a closing high, according to data from Bespoke Investment Group. That doesn’t mean we’ll have one tomorrow, but I wouldn’t be surprised if we did. After that the market will move on to a new quarter and a new earnings season. The focus will be back on how the economy is holding up with higher for longer rates. Up to now the economy has been surprisingly resilient and I really don’t expect that to change.

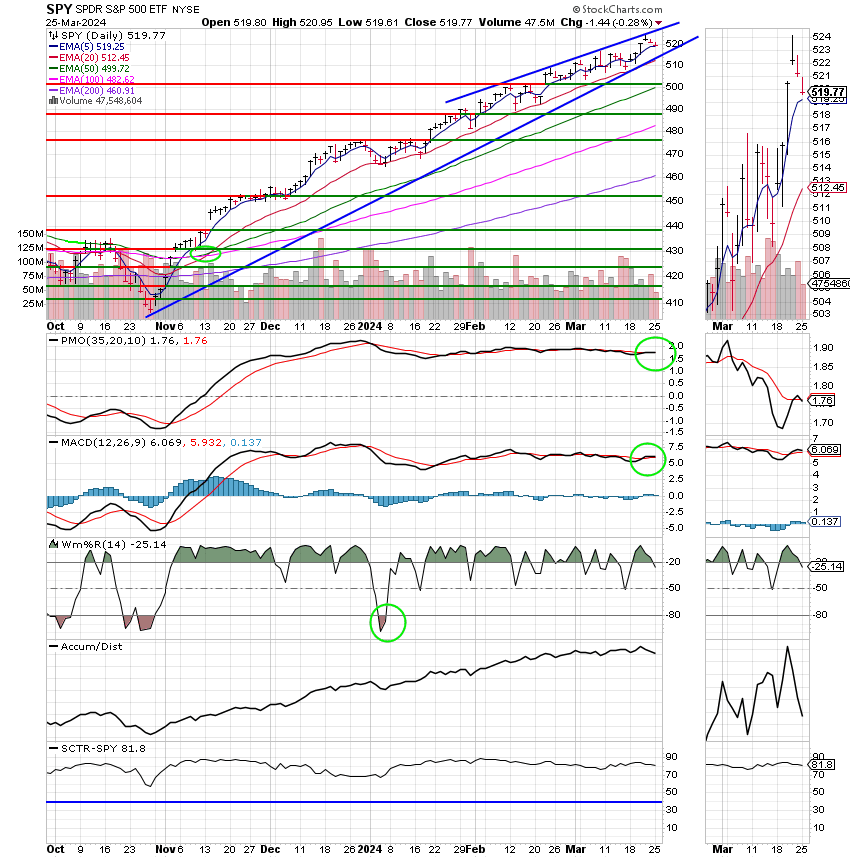

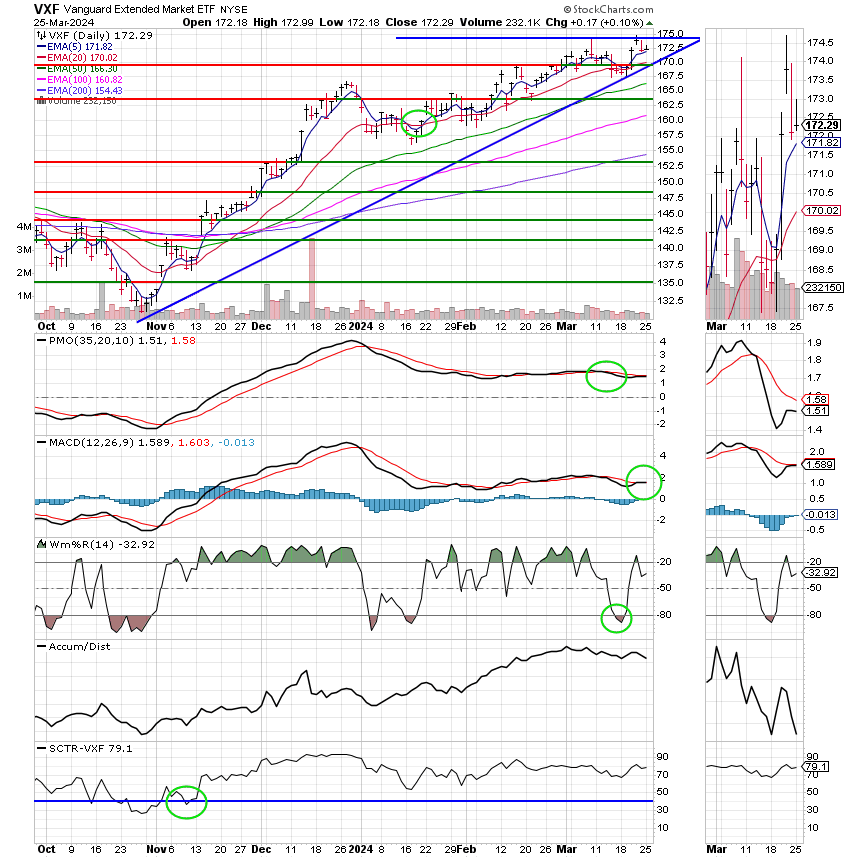

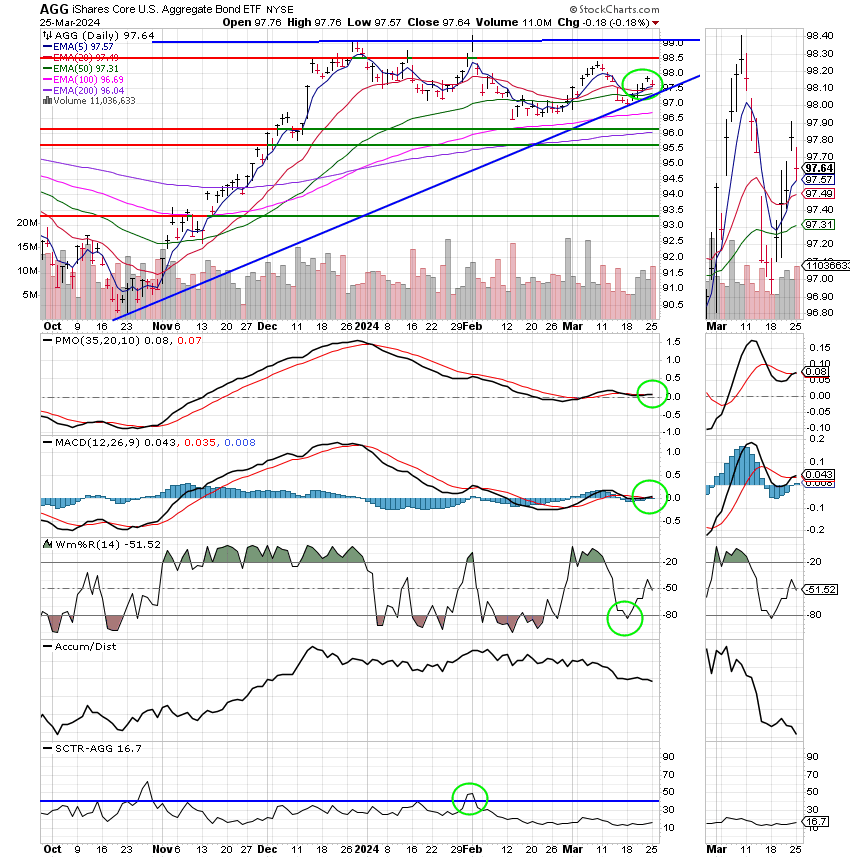

The C Fund continues to have the strongest chart. So we remain invested at 100/C. Should that change…..then we will change. There were some interesting comments made by analysts concerning small caps this week. For instance, Morgan Stanley said that small-cap stocks could feel the pressure if U.S. Treasury yields continue to increase. “While large caps have exhibited declining rate sensitivity over the past few months, small caps’ correlation with rates remains meaningfully negative, suggesting to us that they are more at risk than large-caps if UST yields move higher,” the bank wrote. Let me translate for those of you that are new to the game. If Treasury rates go up then small caps will go down and if small caps go down then the S Fund will feel that pressure. The message from that is keep an eye on treasury yields. Given those dynamics, I would expect us to remain in the C Fund for a while, but I’ve been wrong before. So we will see……..

The days trading left us with the following results: Our TSP allotment slipped -0.28%. For comparison, the Dow dropped -0.40%, the Nasdaq -0.27%, and the S&P 500 -0.28%. Praise God! So far we’ve hung on to most of our gains from last week.

Dow falls more than 100 points as rally to records pauses: Live updates

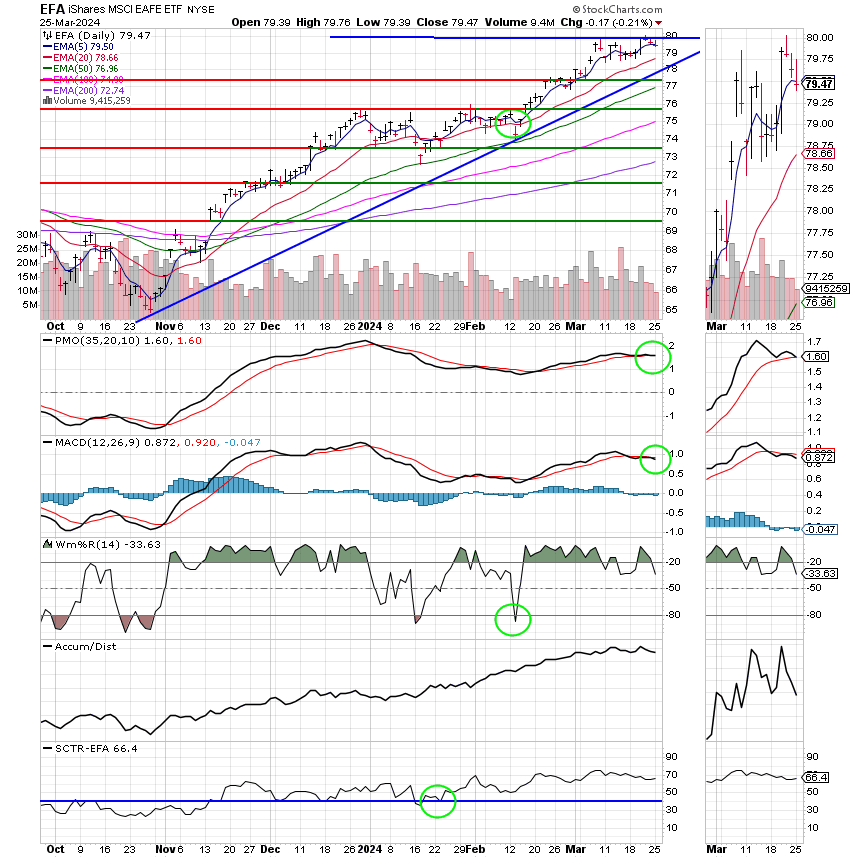

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/C. Our allocation is now +4.42% for the year not including the days results. Here are the latest posted results:

| 03/22/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.1322 | 19.0485 | 81.8807 | 80.9329 | 42.4713 |

| $ Change | 0.0022 | 0.0636 | -0.1105 | -0.7740 | -0.1041 |

| % Change day | +0.01% | +0.33% | -0.13% | -0.95% | -0.24% |

| % Change week | +0.09% | +0.73% | +2.31% | +2.17% | +1.07% |

| % Change month | +0.27% | +0.70% | +2.80% | +1.45% | +3.11% |

| % Change year | +0.94% | -0.91% | +10.11% | +4.98% | +5.70% |