Good Evening, Before I get started on this crazy market tonight I wanted to take time to introduce you to a good friend of mine who I work closely with and have come to trust over the years. For some of you this will be a reintroduction because he helps many folks in our group before, during, and after retirement. As most of you already know I am not nor do I want to be a certified financial advisor. I am a technical analyst and I help investors to be successful in the market by using technical analysis. Periodically, I’ll get a call or message from someone in need of a financial advisor that they can trust. For a long time that was a problem for me because working in the criminal justice system I had a tough time trusting anyone myself let alone recommending them to someone else. Also, and most importantly, that person needed to be someone that loved and trusted in the Lord. In other words I wanted someone who was going to be blessed so that the folks I sent to him would in turn be blessed!! I would like to take the time to introduce my friend and brother in Christ, Todd Dudley. He is either advising or has advised many many folks in our group and does it for the right reasons. Having known Todd over the years I can tell you that his idea of a vacation is a mission trip to Honduras. I once visited him at his office. The entrance to it as well as the adjacent rooms where filled up with used and new tools and building materials. I said Todd, this place is a mess! This is going to look strange when a potential client comes calling. I got to be honest with you. The place looked more like a garage sale than the office of a successful financial advisor! His response was simple. He was collecting new and used tools and building materials to fill a shipping container to be sent to Honduras. He told me how he had been on several mission trips there and was sending the tools to help people there in need to build homes, churches and schools. I was taken back. I have known several brokers in this business and have found most of them to be wealthy and in pursuit of even more wealth. Not Todd. No Sir/Maam! He was more interested in building a new church in a mosquito infested jungle in South America than he is going on a trip to Florida in a BMW. For the record, I know for a fact that he drives a Toyota Tundra pickup. That’s what he hauls the tools in!!! When he’s not doing that he spends the rest of his vacation time helping in places like Joplin Missouri when it was leveled by a tornado or New Orleans when it was destroyed by hurricane Katrina. You get the picture. If you want to know where a mans heart is just look where he spends his money and time. Enough said. So why am I introducing those of you who don’t already know him to Todd?? To get him new clients?? Well no, I am introducing you to Todd because he is going to to filling in for me when I go to visit my daughter in New Mexico. She got a job in the Presbyterian Hospital system there the year before the pandemic hit and I will be going to visit her for the first time since then in May. The pandemic has taken a lot from all of us. I have been unable to see her or my grandchildren for the better part of two years as a result. So Todd, not that he doesn’t already do enough for our group, has graciously offered to fill in for me for a couple weeks. He is not a technical analyst, he is a fundamental investor and his message will be different than mine. Nonetheless, he is a very skilled investor and there is much you can learn from him. Of course, I’ll still be watching the allocation! I’ll remind you all again before I go but in the meantime be praying that God will give Todd a good message.

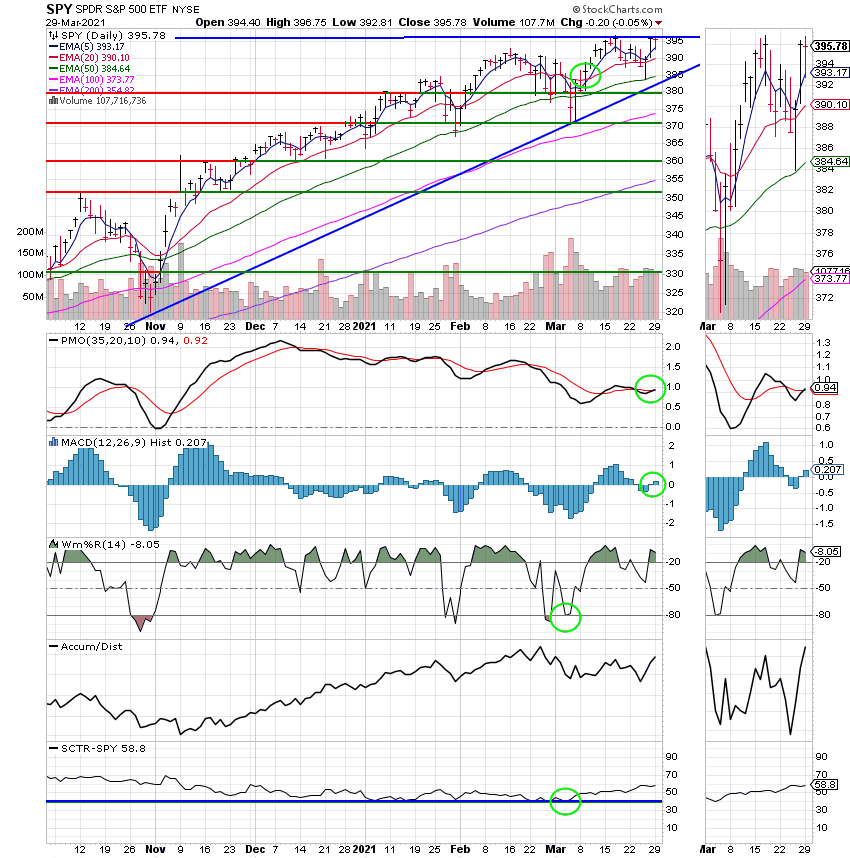

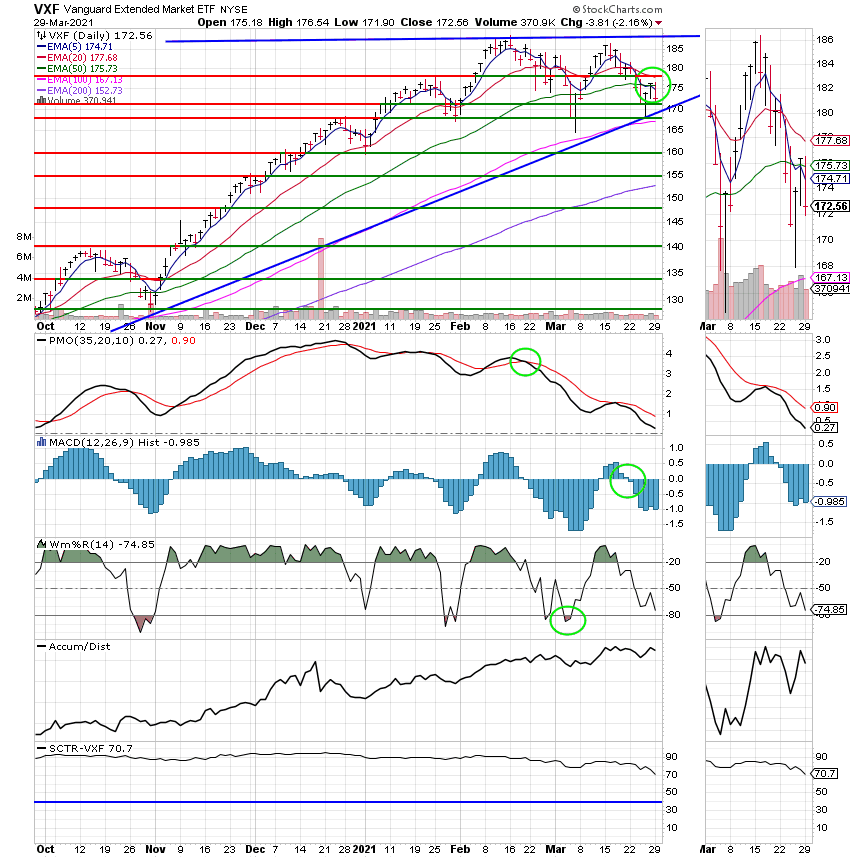

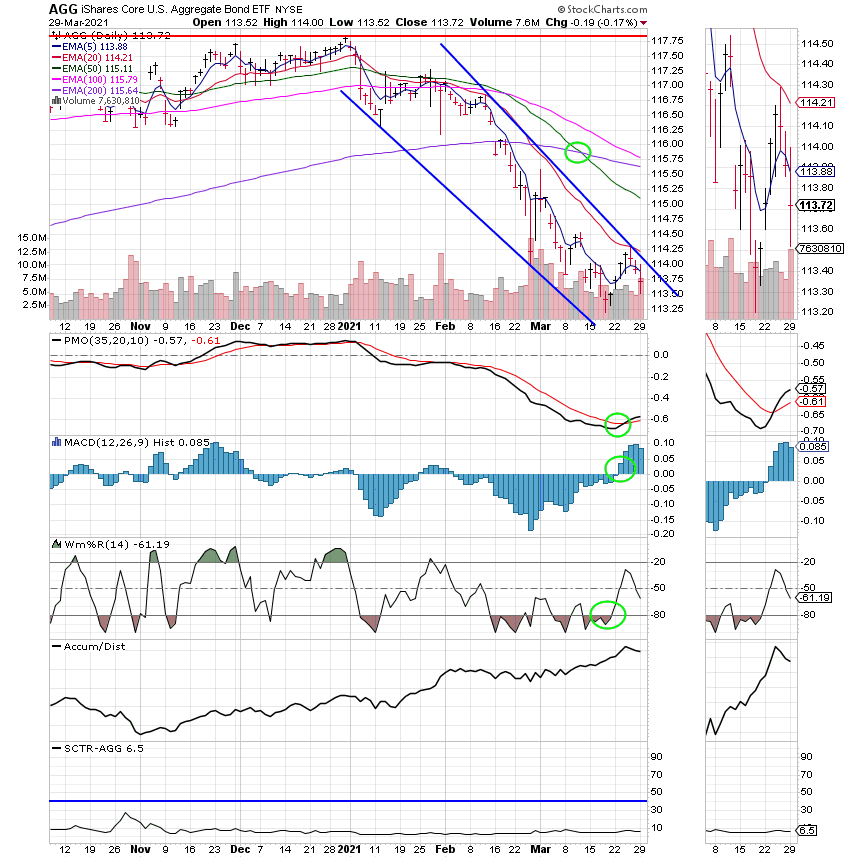

OK, on the market. We have a new crisis today! Imagine that. It seems that a large hedge fund defaulted on a margin call and now investors are worried about US bank exposure. What banks and how many. The market wasn’t in panic mode but it most definitely took notice as evidenced by the days negative breadth with decliners outpacing gainers for a 1.93:1 ratio on the NYSE. According to Reuters: “Nomura and Credit Suisse are facing billions of dollars in losses after a U.S. hedge fund, named by sources as Archegos Capital, defaulted on margin calls, putting investors on edge about who else might have been caught out. Shares of big U.S. banks and even regional banks fell on the news. The KBW Nasdaq Bank stock index ended 2.3% lower after falling nearly 3.5% during the session. “There’s still chatter as to whether or not, and which, American banks may be affected. That is a question that’s lurking. But so far the market has taken (the news) in stride essentially,” said Quincy Krosby, chief market strategist at Prudential Financial in Newark, New Jersey.” Of course we also still have bond yields rising and tech selling off, that stuff. All these events combined are putting a lot of pressure on equities. Especially, on small caps and pressure on small caps means pressure on the S Fund. We continue to remain fully invested in the S Fund and are doing so because we believe that the market is very close to a bounce. The Wms%R indicator on the chart for the S Fund is starting to become very oversold indicating that a sustainable bounce may be coming soon. My plan is to stay put as long as support holds at 167. These things are always the same in that the most pressure to make a move comes right before a bounce. The only way to know for sure is to wait it out and have your exit plan ready to go in case it does in fact move lower. All the indicators I follow for the market as a whole are still flashing buy signals although I must admit that some of them are a little weaker this week than they were a at the beginning of last week. That is to be expected with all the volatility, but it does tell us to raise our level of vigilance. We have noted that and that is what we are doing. We will remain put for now but will not hesitate to pull the trigger and sell should it become necessary. Our main task is to watch the chart for the S Fund to see if support at 167 holds.

The days trading left us with the following results: Our TSP allocation posted a drop of -2.16%. For comparison, the Dow gained +0.30%, the Nasdaq fell -0.60%, and the S&P 500 slipped -0.09%.

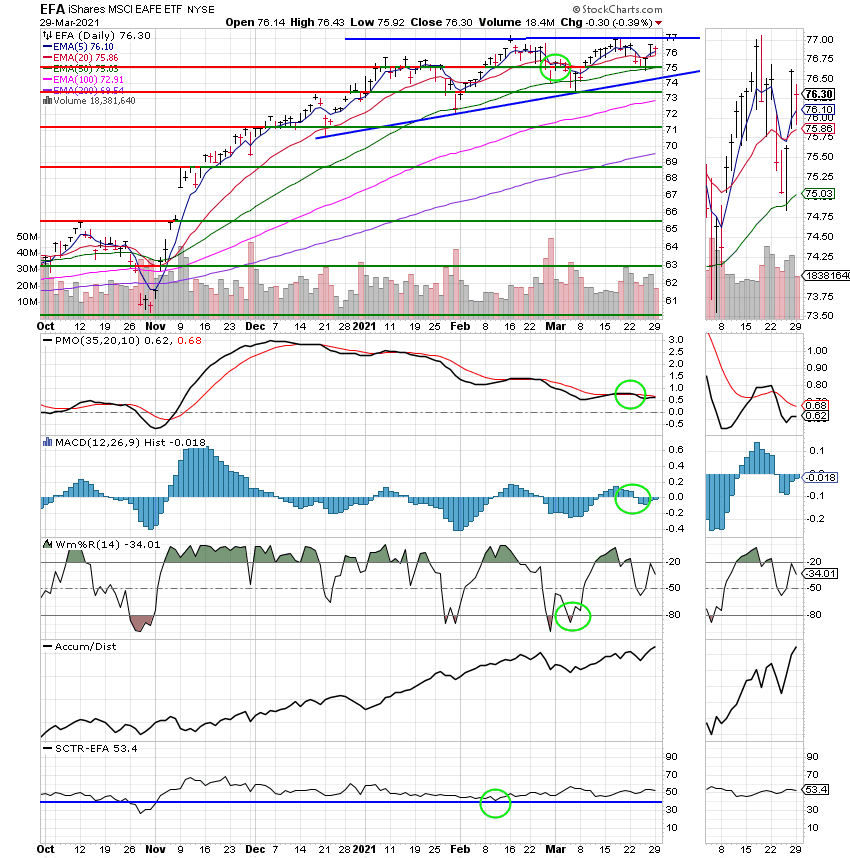

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/S. Our allocation is now +7.56% on the year not including the days results. Here are the latest posted results.

| 03/26/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5496 | 20.5049 | 59.3752 | 79.8087 | 36.9235 |

| $ Change | 0.0007 | -0.0305 | 0.9714 | 1.1997 | 0.6210 |

| % Change day | +0.00% | -0.15% | +1.66% | +1.53% | +1.71% |

| % Change week | +0.03% | +0.35% | +1.58% | -2.24% | +0.05% |

| % Change month | +0.10% | -1.13% | +4.40% | -0.61% | +3.15% |

| % Change year | +0.25% | -3.26% | +6.19% | +7.56% | +4.34% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.5658 | 11.4583 | 40.0728 | 11.9901 | 45.2083 |

| $ Change | 0.0831 | 0.0894 | 0.3933 | 0.1289 | 0.5281 |

| % Change day | +0.37% | +0.79% | +0.99% | +1.09% | +1.18% |

| % Change week | +0.17% | +0.30% | +0.35% | +0.38% | +0.39% |

| % Change month | +0.76% | +1.56% | +1.94% | +2.10% | +2.27% |

| % Change year | +1.29% | +2.68% | +3.34% | +3.64% | +3.96% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.3474 | 26.9694 | 13.1227 | 13.1225 | 13.1223 |

| $ Change | 0.1540 | 0.3581 | 0.2119 | 0.2118 | 0.2118 |

| % Change day | +1.26% | +1.35% | +1.64% | +1.64% | +1.64% |

| % Change week | +0.40% | +0.41% | +0.45% | +0.45% | +0.45% |

| % Change month | +2.40% | +2.55% | +3.17% | +3.17% | +3.17% |

| % Change year | +4.22% | +4.50% | +5.73% | +5.72% | +5.72% |