Good Afternoon, Lets keep it simple. We are in a downtrend……Now let that sink in. Technically, this market is in poor shape. Also, remember one thing. Counter trend bounces are the biggest and best, but if the main trend is down that is ultimately where price will go and if you are in the market, that is ultimately where your portfolio will go as well. Beware of the counter trend bounce! In a bear market you sell into strength and make no mistake, whether the media admits it or not, we are in a bear market. So that is what we did. We sold and we are now invested at 100% G. There are many TSP participants that are excited about buying our equity based funds (C,S, and I) at bargain prices. My thoughts on that are that if you wait those prices will get a lot better. We are not in the business of calling bottoms. We follow trends and as I already mentioned the current market trend is down. Sure, the trend could change tomorrow, but wouldn’t you want some conformation of a new uptrend before you jump back in? We are already down as bad as we have ever been. So the last thing we need is to drop another 10% and that’s entirely possible in this scenario. The Nasdaq is already down 22% which meets the technical requirements for a bear market and my experience is that the gaps that exist between the Dow and S&P 500 and the Nasdaq will ultimately be closed and if my charts are correct, I believe that will happen through more downside in the Dow and S&P. So what if it starts moving up from here? That’s probably a pie in the sky but in the unlikely event that it occurs we will react to it by moving back into equities. Simple question, simple answer. You see the trick to being successful is not to go into a trade with rigid expectations that simply must be met. In other words don’t think this or that will happen and plan on staying in the trade until it does. That’s the way small losses turn into big losses. Always, react to what you see and never be surprised. Whatever, happens is another day in the office and in God’s mighty hands. Give Him all the praise! Now don’t forget, I said it last week and the week before that, then on Facebook and then the week before that…. pretty much as far back as I can remember. The key to this market is inflation. Until inflation peeks and starts to drop the market will continue to be volatile and…I believe the current downtrend will stay in place. The closer the rate of inflation gets to 2%, the more the market will return to normal. Plain and simple.

The days trading is left us with the following results: Our TSP allotment is steady in the G Fund. For comparison, The Dow fell -2.38%, the Nasdaq -3.95%, and the S&P 500 (where we were invested yesterday) -2.81%. Praise God, it was a good day to be out of equities!

Nasdaq loses nearly 4%, hits fresh low for 2022

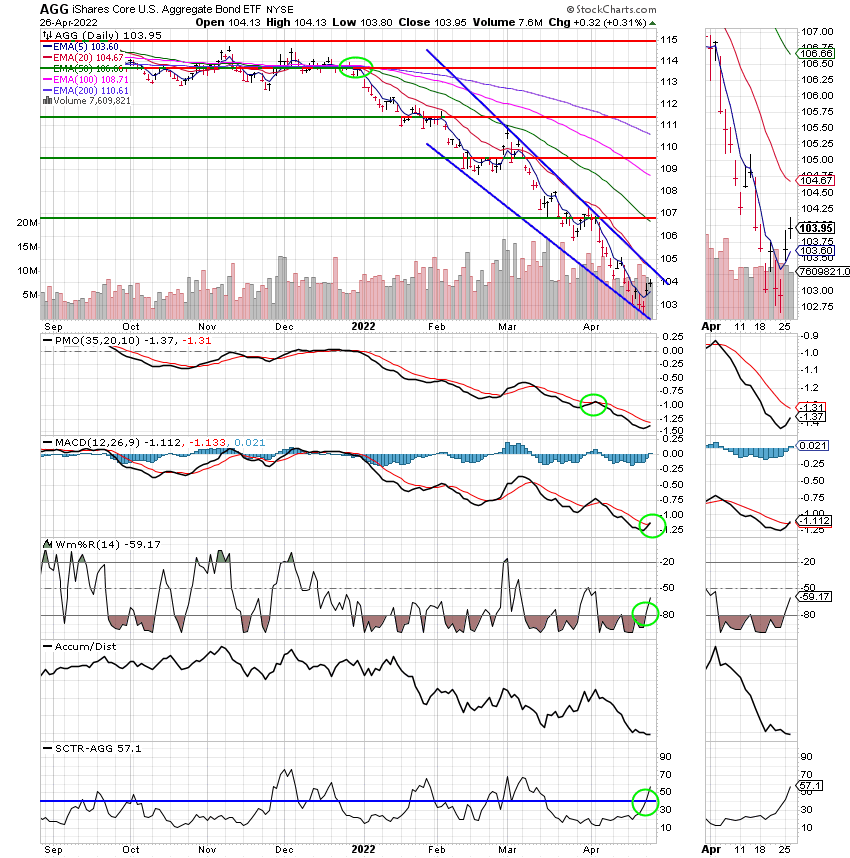

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Hold. We are currently invested at 100/G. Our allocation is now -18.75% on the year. Here are the latest posted results:

| 04/25/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8391 | 19.0399 | 65.1375 | 71.0661 | 35.0508 |

| $ Change | 0.0035 | 0.0990 | 0.3699 | 0.7568 | -0.2314 |

| % Change day | +0.02% | +0.52% | +0.57% | +1.08% | -0.66% |

| % Change week | +0.02% | +0.52% | +0.57% | +1.08% | -0.66% |

| % Change month | +0.17% | -3.24% | -5.10% | -6.16% | -4.67% |

| % Change year | +0.61% | -8.84% | -9.46% | -14.83% | -11.13% |

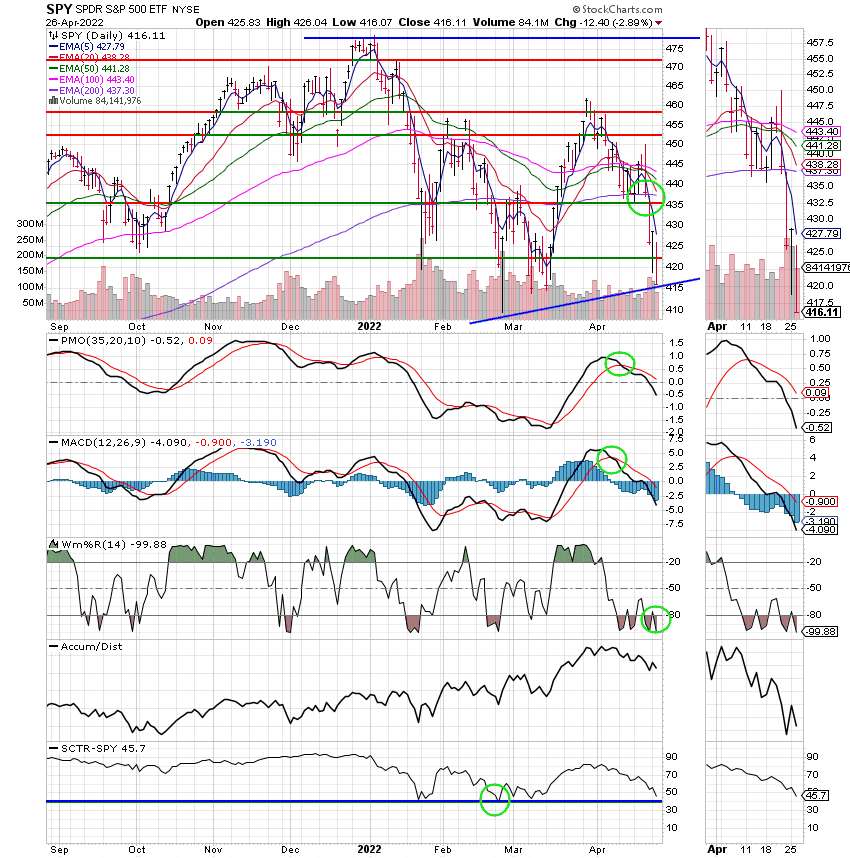

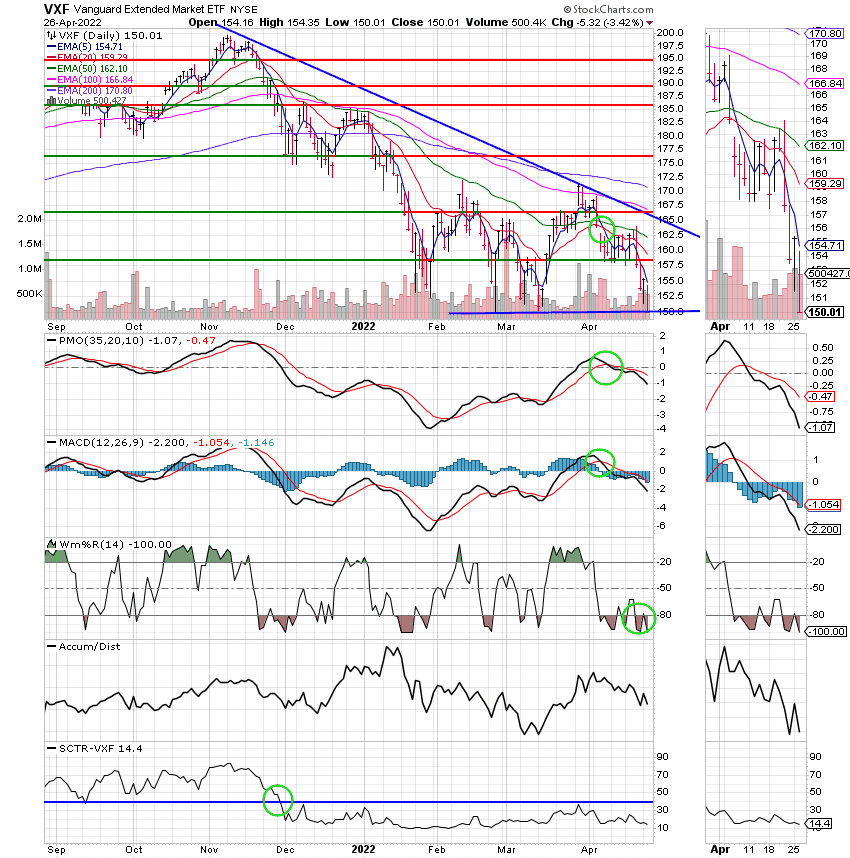

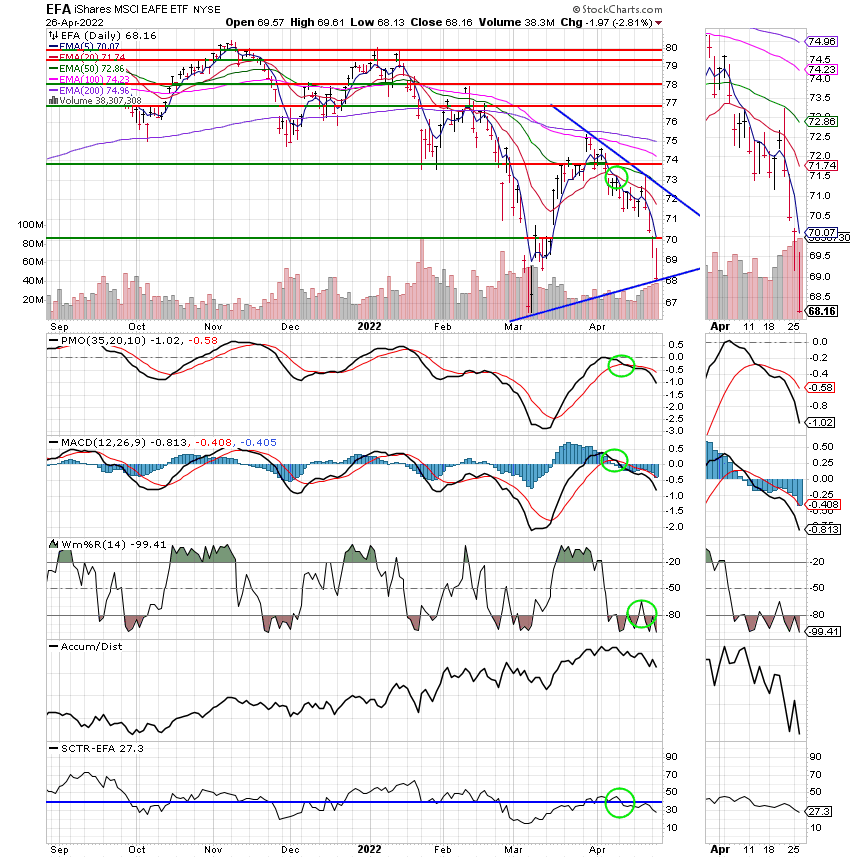

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

It’s been a tough year so far but we received a blessing today. No doubt! Give God all the praise! That’s all for today. have a nice afternoon and may God continue to bless your trades!!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.