Good Evening, The two main issues moving the market are inflation and the Feds reaction to inflation. The two secondary issues are the Covid outbreak in China and War in the Ukraine. The long term market mover is, has been and will be inflation. The Fed will do whatever they have to do to get it under control but whatever they do, it will have to be goldilocks warm or the economy will have a hard landing meaning that there will be a recession. I feel like we will experience likely experience a mild recession in 2023. The big question today is how much will the Fed increase rates tomorrow. Their meeting will conclude with a press conference by Jerome Powell at 2:00 PM EDST. Right now the market is expecting a half point increase in the Fed Funds rate, but many including myself feel that a 3/4 point increase is on the table. I understand that the Fed is trying not to upset the market by raising rates too quickly, but it is my opinion that they are already behind with their rate of increases. It is pretty well accepted that there will be a rate increase at each Fed meeting for the remainder of the year and into 2023. So if inflation is this hot then why not do quickly what must be done and bring it under control? It seems like the further they go the further they get behind. It is already getting painful for us so why not just get it over with? Stop messing around and do what everyone knows needs to be done. We will see how this all goes as we watch inflation. As I have said for several weeks, the closer that the rate of inflation gets to 2% the more normal the market will become. Inflation and Interest rates are the determining factors for where the market will go in the long run.

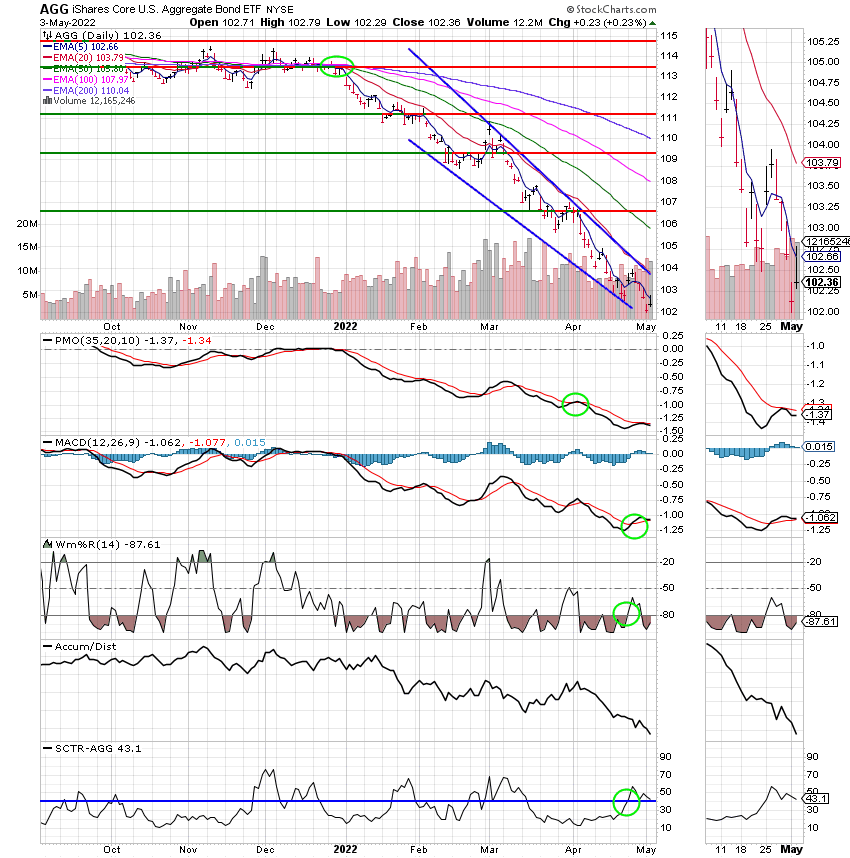

Right now, as I mentioned on Facebook, the charts for the C,S, and I funds have generated sell signals and the chart for the F Fund (bonds) is in a sustained downtrend which leaves us with the G Fund. So until things change that is where we will remain. The other thing you must remember is that recoveries for sell offs will move much slower than they have for a long while due to the the reduction of stimulus. I am repeating myself once again but do it because so many of you haven’t traded prior to 2009 when the bulk of the stimulus started to be applied. It is most important to think with a more long term mindset than it was in the last decade. This means you shouldn’t expect to gain your capital back from a sell off as fast as you did during that time. In this environment it is better to sell and keep your portfolio closer to it’s highs. It simply takes too long to make up your losses. This environment no longer favors the set it and forget it crowd.

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow added +0.20%, the Nasdaq +0.22%, and the S&P 500 +0.48%. Praise God for a day in the green.

Stocks rise for second straight day ahead of expected Fed hike

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We re currently invested at 100/G. Our allocation is now -18.71% not including the days results: Here are the latest posted results:

| 05/02/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.847 | 18.8255 | 63.0136 | 68.5319 | 34.31 |

| $ Change | 0.0022 | -0.1133 | 0.3558 | 0.7997 | -0.1099 |

| % Change day | +0.01% | -0.60% | +0.57% | +1.18% | -0.32% |

| % Change week | +0.01% | -0.60% | +0.57% | +1.18% | -0.32% |

| % Change month | +0.01% | -0.60% | +0.57% | +1.18% | -0.32% |

| % Change year | +0.66% | -9.87% | -12.42% | -17.87% | -13.01% |

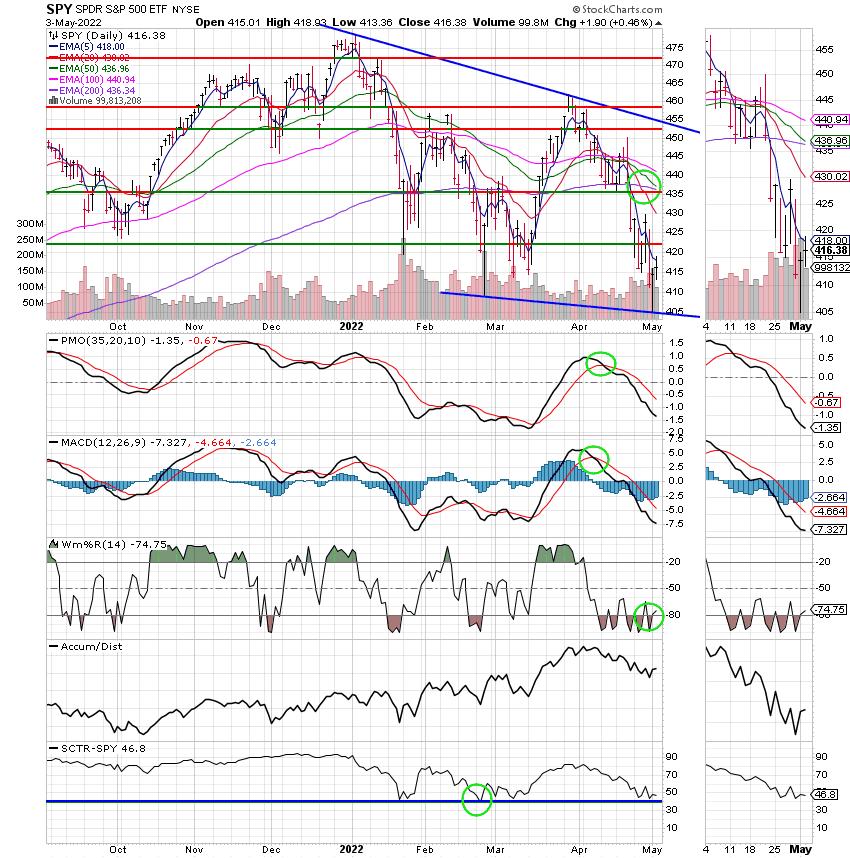

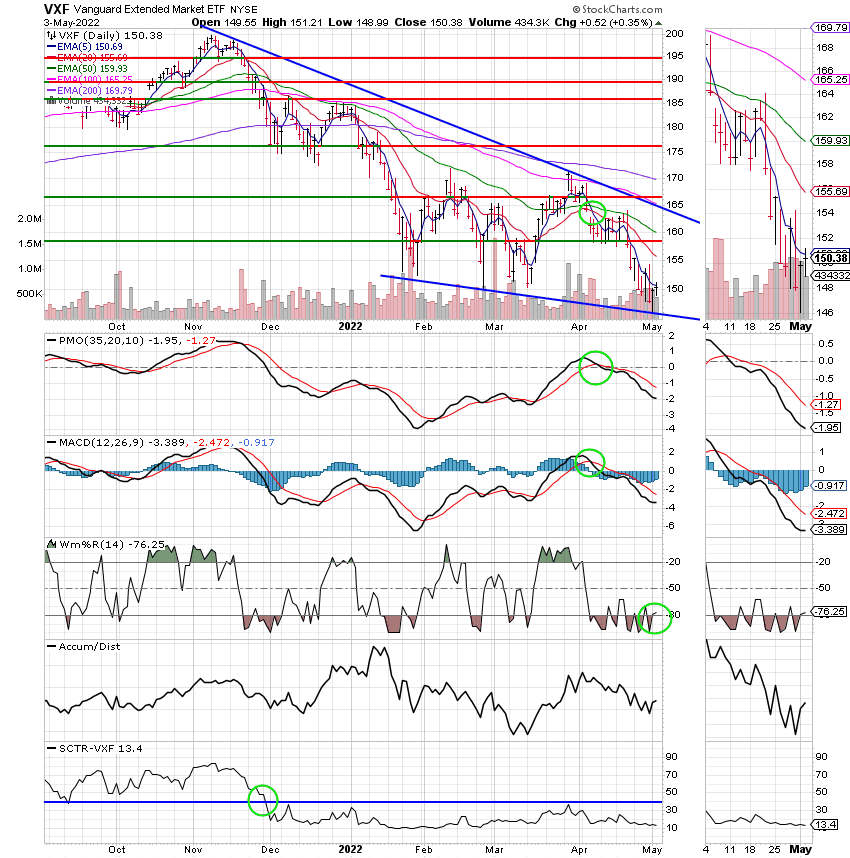

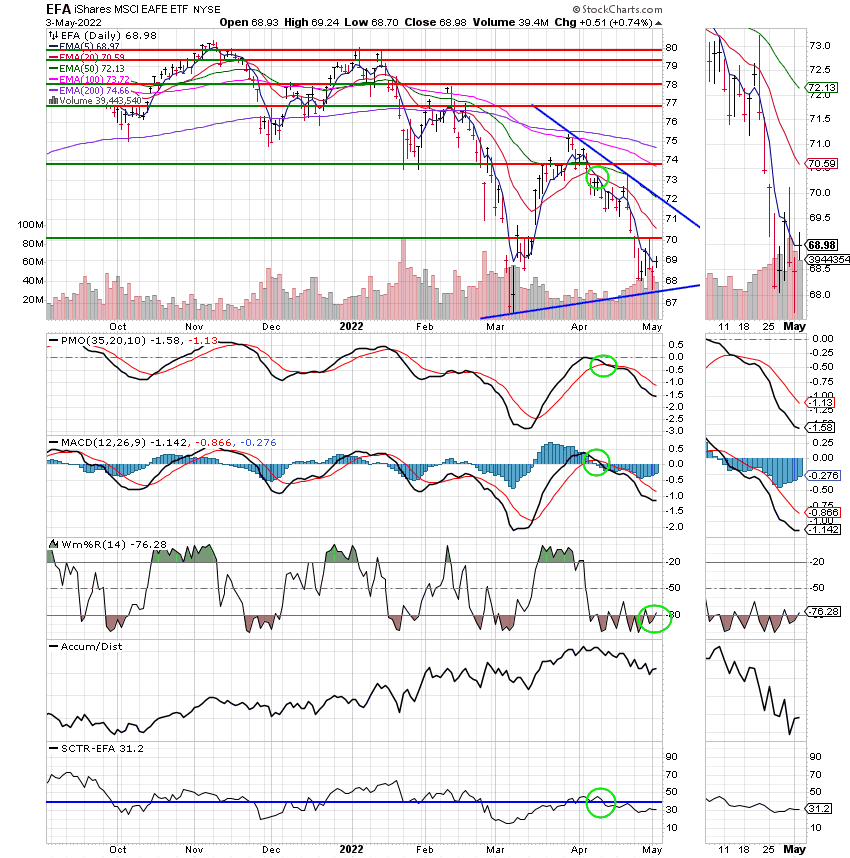

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.