Good Evening, It’s been a tough week since we last discussed the state of the market. All the major indices are down significantly since we moved to the G Fund. This time our analysis was dead on. The termination of stimulus which has been a curse has also been a blessing to us as our indicators can see clearly now. The problem earlier in the year as I have already mentioned was that we just couldn’t tell exactly when the reduction of stimulus would effect the market or rather when the market would go back to the way it used to be prior to stimulus. So we got out a few times and the market whipsawed and moved higher, but as the stimulus was reduced it came time to pay the piper so to speak and that is where we find ourselves now. I’ve been calling this a bear market for a few months now. The media and many of the so called professionals have yet to do so. They are waiting for the major indices to decline by 20 percent or more which is the technical definition of a bear market. Well I got news for them. We’ve been feeling the pain on the street for a while. Many tech and growth stocks are already off by 50 percent or more. I’ll grant you that there usually isn’t the great divide between small caps, tech and growth stocks and the major indices as there has been during this cycle. The stimulus being removed and it’s effect on interest rates have a lot to do with that but that’s another discussion for another day. Nevertheless, I have never seen a the gap between the two groups fail to be closed either by large caps moving lower or by small caps, tech, and growth stocks moving higher. Right now, as of today, the gap still remains and until you see one or the other put in a firm bottom the process of closing that gap will not begin and as long as this gap remains we’ll likely move lower. My indicators confirm that we have probably not found a bottom yet. Your best bet is to watch the Russell 2000. When it bottoms the Dow and S&P 500 won’t be far behind. I’m not in the business of calling bottoms though. That is risky business. that I’ll leave to the fortune tellers….. We react to the action we see here and now and try to plan for the future as best we can. However, we never ever make decisions based on what we think might happen. We base our decisions on what we see happening here and now on our charts. It’s not perfect. No system is, but it and our faith in God have served our group well over the years and we’ve been doing this a long time!

Tomorrow morning all eyes will be on the CPI report. It is going to be another sizable number, but the hope of bulls is that it will be less than the last number and create a narrative that inflation is hitting a peak. That could give us some support, but we will have to wait and see how the market reacts. It is going to be tough to gain strong upside momentum right now, given how buyers are acting.

Keep it firmly in mind that this is a bear market, and you cannot approach it like you would a normal market. Stay patient and protect your capital.

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow slipped -0.26%, the Nasdaq gained +0.98%, and the S&P 500 edged up +0.25%.

Dow slips for a fourth day ahead of key inflation data

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -18.66% for the year. Here are the latest posted results:

| 05/10/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8579 | 18.8625 | 60.6936 | 62.5908 | 32.9225 |

| $ Change | 0.0013 | 0.0473 | 0.1488 | -0.0616 | 0.2071 |

| % Change day | +0.01% | +0.25% | +0.25% | -0.10% | +0.63% |

| % Change week | +0.03% | +0.70% | -2.96% | -5.14% | -2.19% |

| % Change month | +0.08% | -0.40% | -3.13% | -7.59% | -4.35% |

| % Change year | +0.73% | -9.69% | -15.64% | -24.99% | -16.53% |

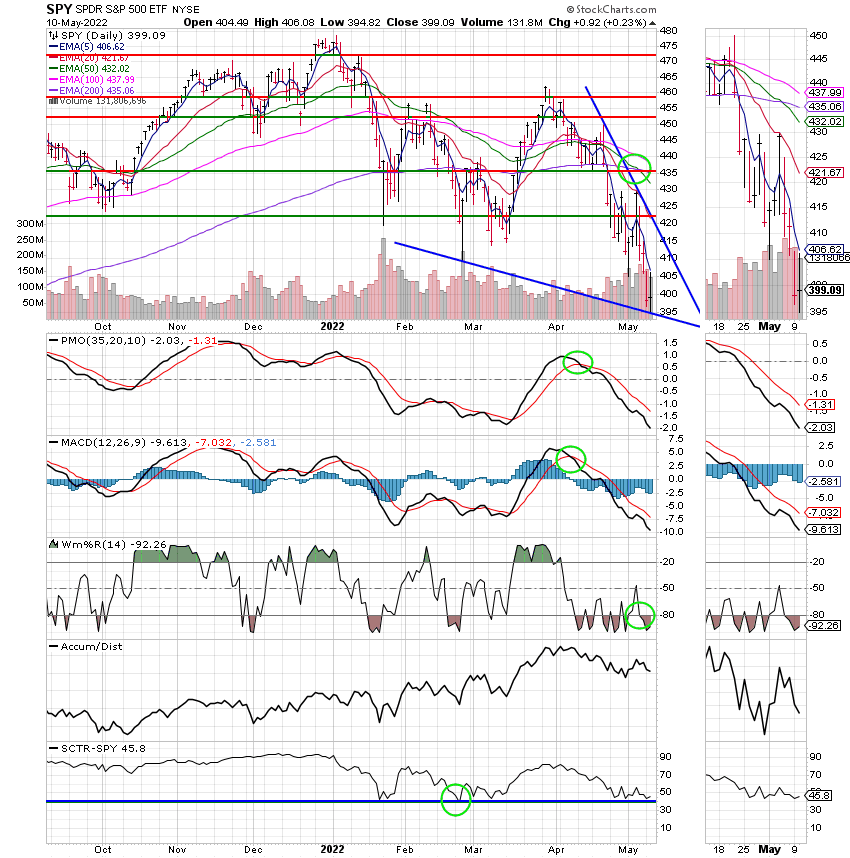

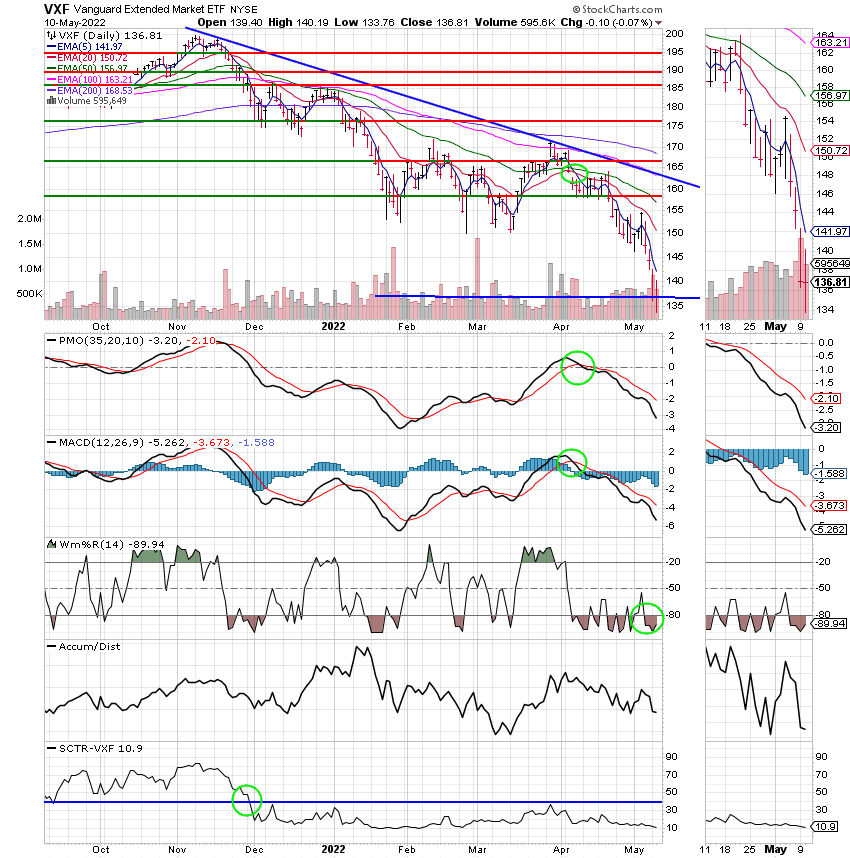

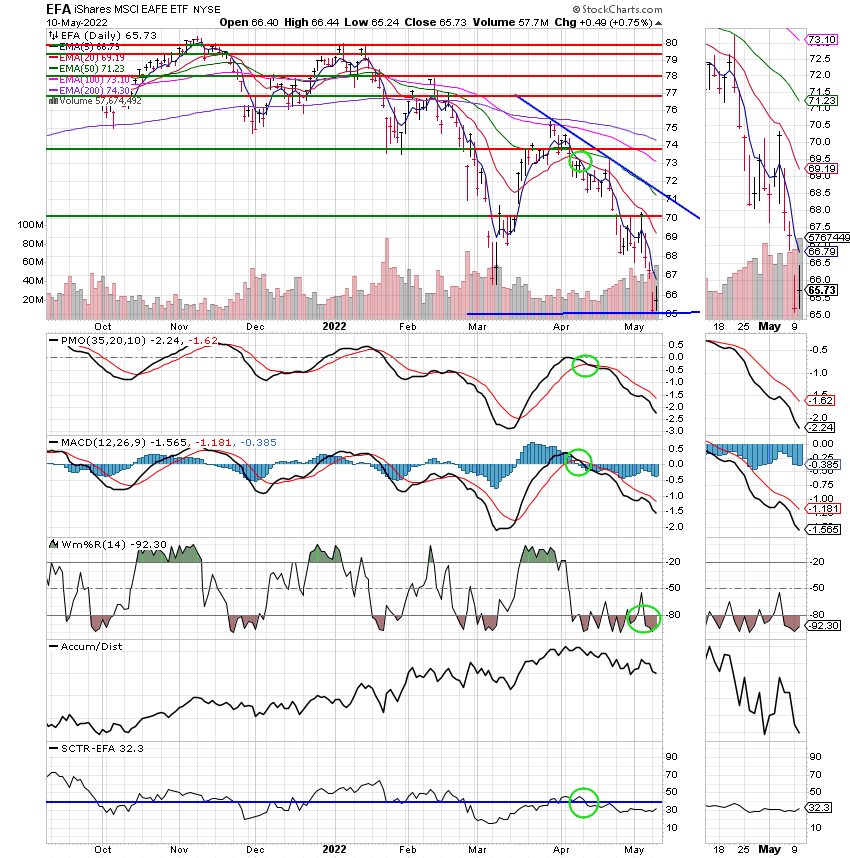

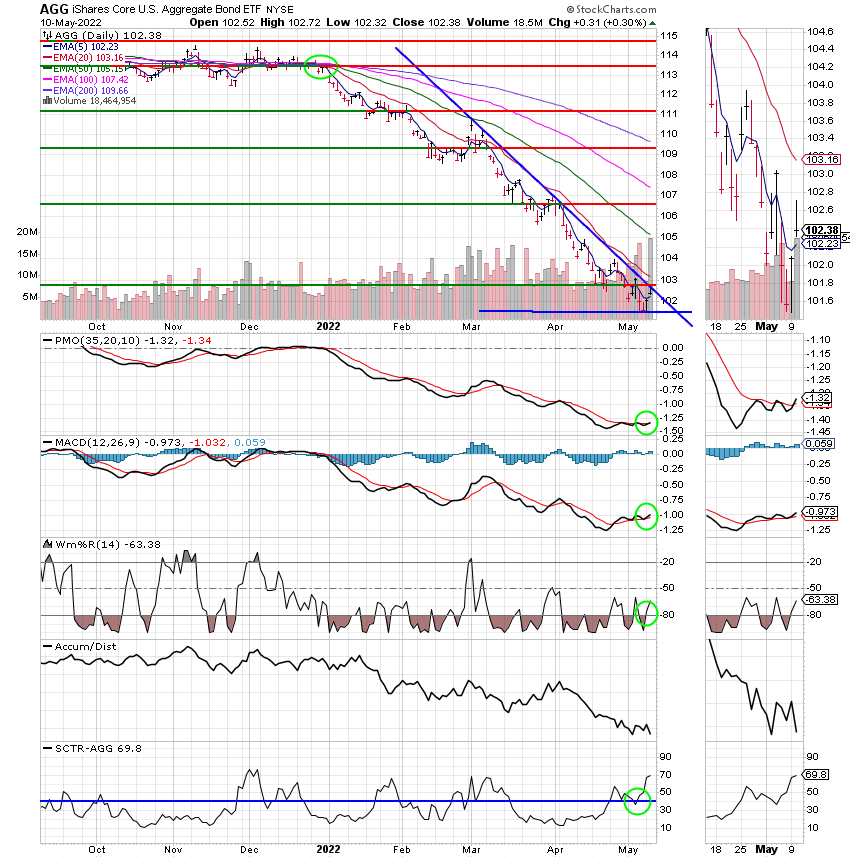

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

I believe there will be more selling based on what I see on my charts. I am prepared mentally if that’s the case but will welcome it if it’s not. As I explained briefly to someone on our Facebook page this week. I am not saying it will. What I am saying is it could. My opinion and $1.00 will buy you a cup of coffee (should I allow for inflation?) but what my charts say is what will make the next good trade. I’m dealing only with the here and now. I’ll leave the future to the fortune tellers with crystal balls. They can have all the fame and notoriety that goes along with being right. Speaking of being right what is it they say? Oh yes, Even a broken clock is right once a day. That’s how I feel about all the serial bottom callers or those that say the S&P 500 will be certain level within a certain time. Their just like a broken clock. I will keep praying to the God that continues to bless me even when I don’t deserve it and I’ll keep a close eye on the charts that tell me what’s going on here and now. That’s all for today. Have a great evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.