Good Afternoon, We remain mired in a bear market and looking at a possible recession. So, I’ll say it right up front. I’m not in a hurry to get back into equities. We’ve tried three times and we’ve failed three times thanks in a great part to the algorithm traders that faked us out all three times. We discussed that last week. So if you want to know more in detail about how they did it review last weeks blog. This is a new week and I feel like that problem has been solved. We did so by moving solely to the use of long term indicators. We are not using anything at all with a short to intermediate time frame. Those indicators cannot be trusted at this point and probably into the future due to the aforementioned computer algorithm traders. To put it succinctly, they made money off of us and now it’s time for us to make money off of them…. So lets move on to the current market. I’ve spent a lot of time reviewing the charts that I use to gauge the health of the market as a whole. These are the main indicators that I use to get in and out of equities and right now even though we have had a decent little bounce, I must say that there is no evidence of an uptrend. Unless these charts change the best case scenario is that the market will trade sideways with a slightly negative bias moving into the fall and the worst case scenario is that we will drop another leg lower. Fundamentally speaking the current conditions of high inflation and slowing economic recovery with the looming threat of a recession do not favor a sustained uptrend of any kind. There simply isn’t a catalyst to move higher right now. As I have repeated virtually every week for what seems like the past year, nothing will return to normal until the rate of inflation drops to 2 percent. Nothing!! So we will continue to monitor our indicators and we will trust no bounce until our LONG TERM indicators tell us that we can. This is truly a case of better safe than sorry. We will also keep praying! Our Lord will see us though just as He always has. Psalms 9:9 says that The Lord is refuge in times of trouble. I think the current state of this market, this nation, and this world qualifies!

The days trading is producing the following results: Our TSP allotment remains steady in the G Fund. For comparison, the Dow is losing -0.59%, the Nasdaq -2.28%, and the S&P 500 -1.37%. It looks the the recovery rally is starting to fizzle.

Stocks fall, erasing early gains, as momentum from bear market bounce fizzles

We currently have the following signals: C-Sell, S-Sell, I-Sell, F-Hold. We are currently invested at 100/G. Our allocation is now -25.13% for the year not including the days results. Here are the latest posted results:

| 06/27/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.9244 | 18.5924 | 59.318 | 62.7862 | 32.54 |

| $ Change | 0.0042 | -0.0661 | -0.1748 | -0.0676 | -0.0302 |

| % Change day | +0.02% | -0.35% | -0.29% | -0.11% | -0.09% |

| % Change week | +0.02% | -0.35% | -0.29% | -0.11% | -0.09% |

| % Change month | +0.26% | -2.92% | -3.74% | -3.91% | -6.58% |

| % Change year | +1.12% | -10.98% | -17.55% | -24.75% | -17.50% |

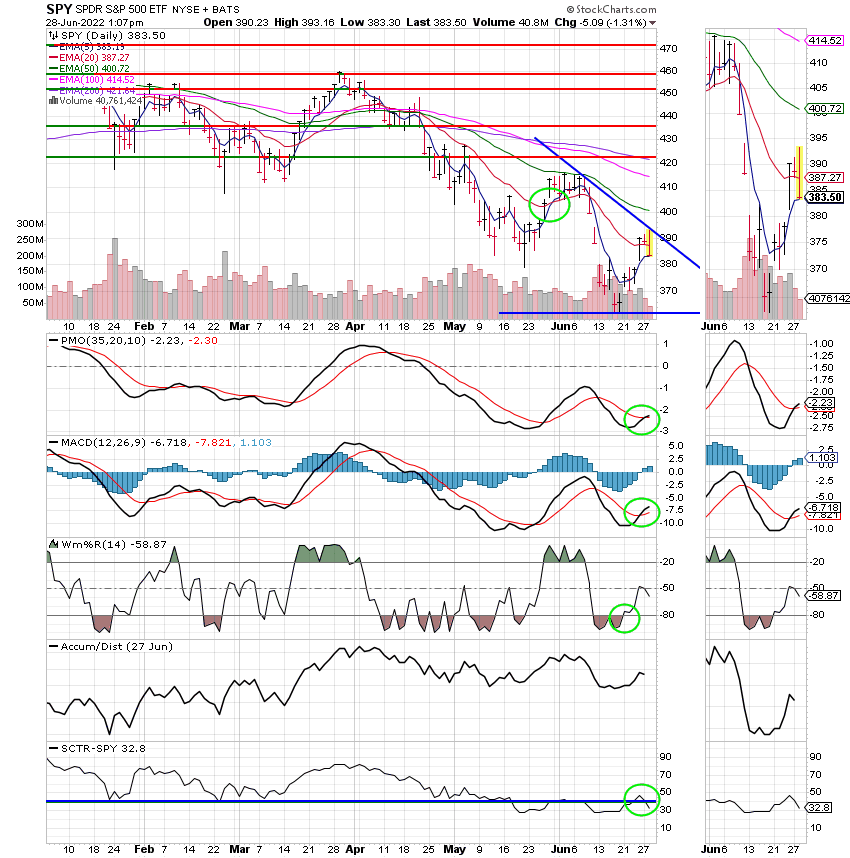

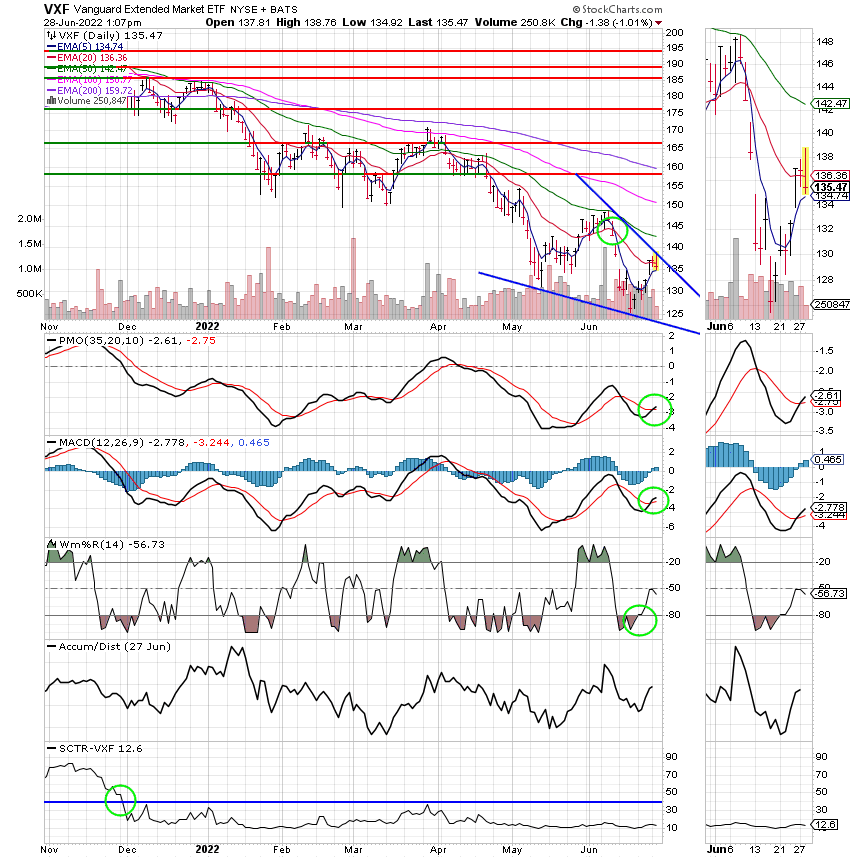

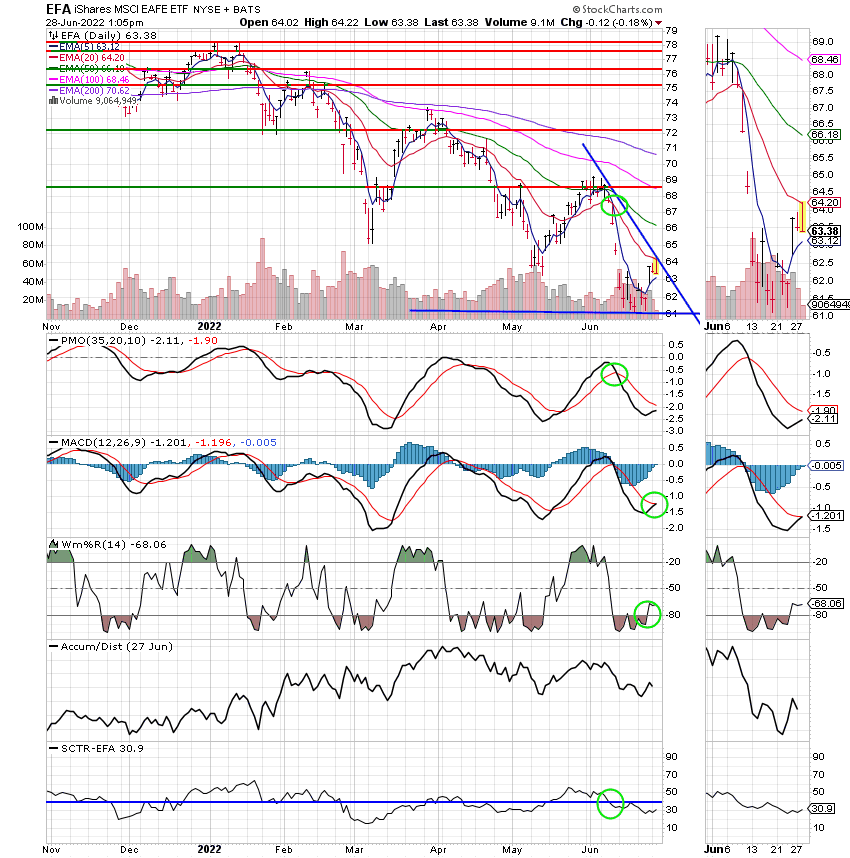

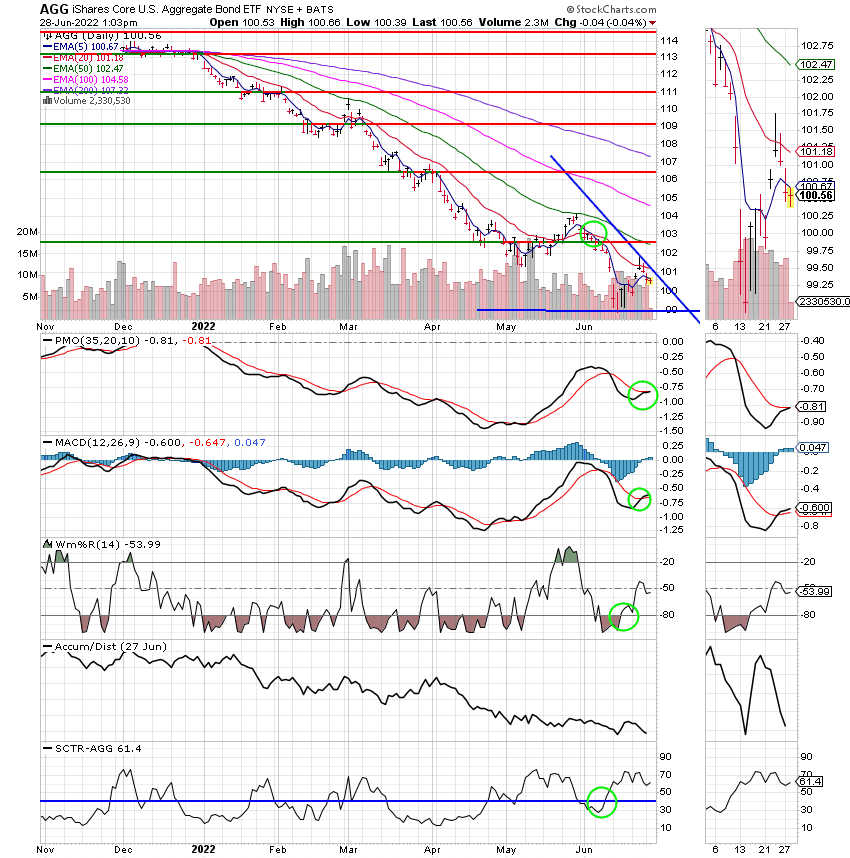

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

We’re entering the dog days of summer and we’re just going to have to be patient and tough it out. That’s all for today. Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.