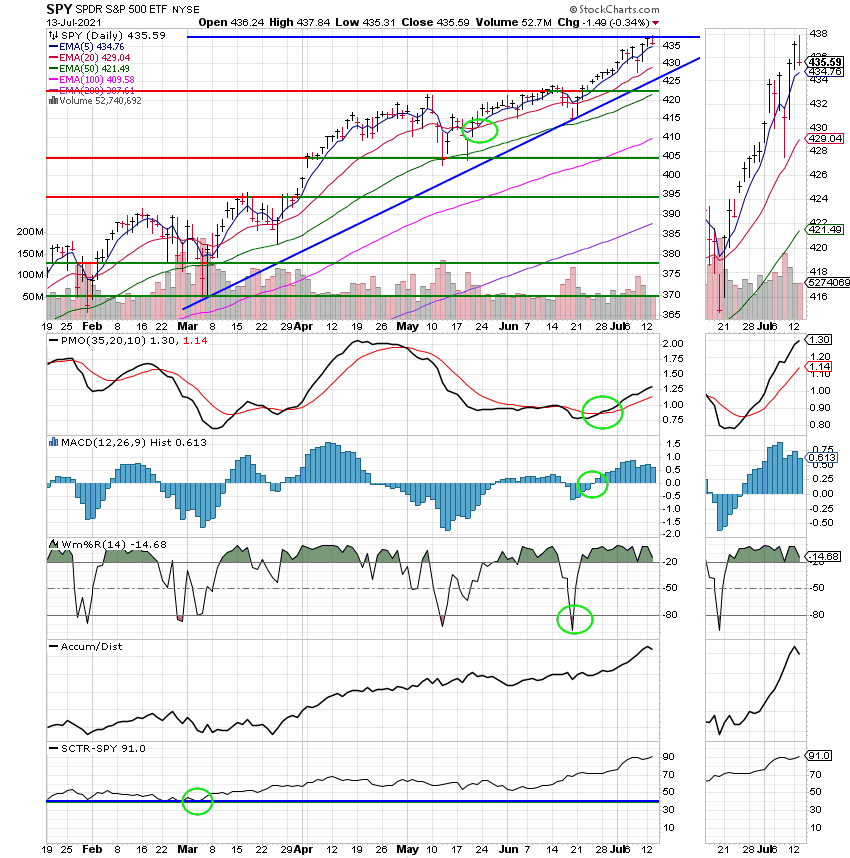

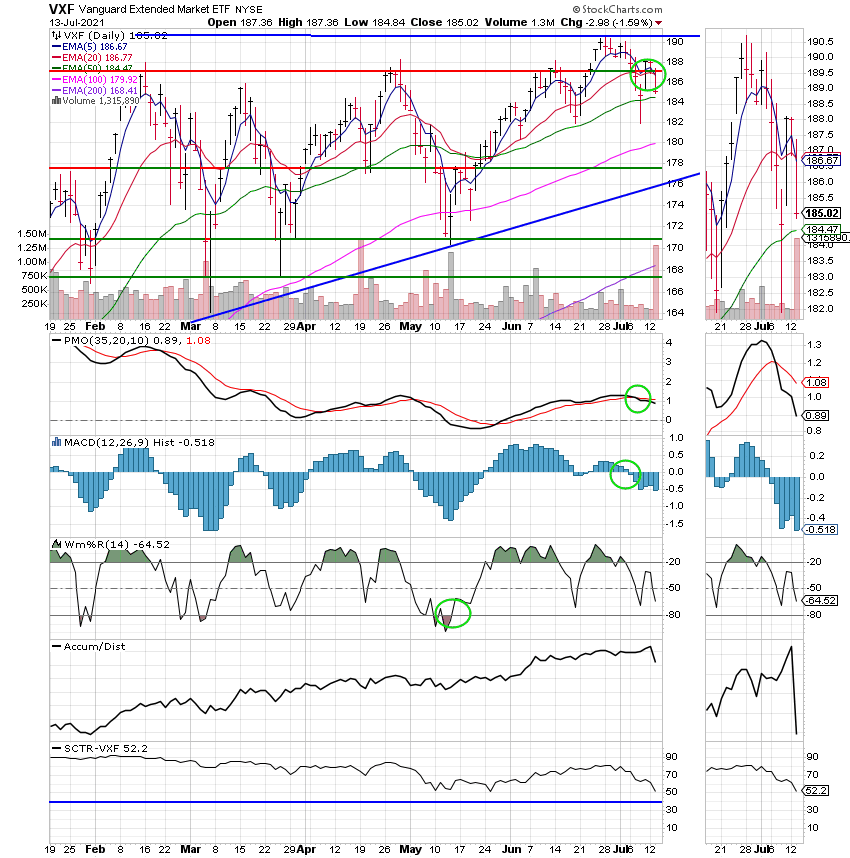

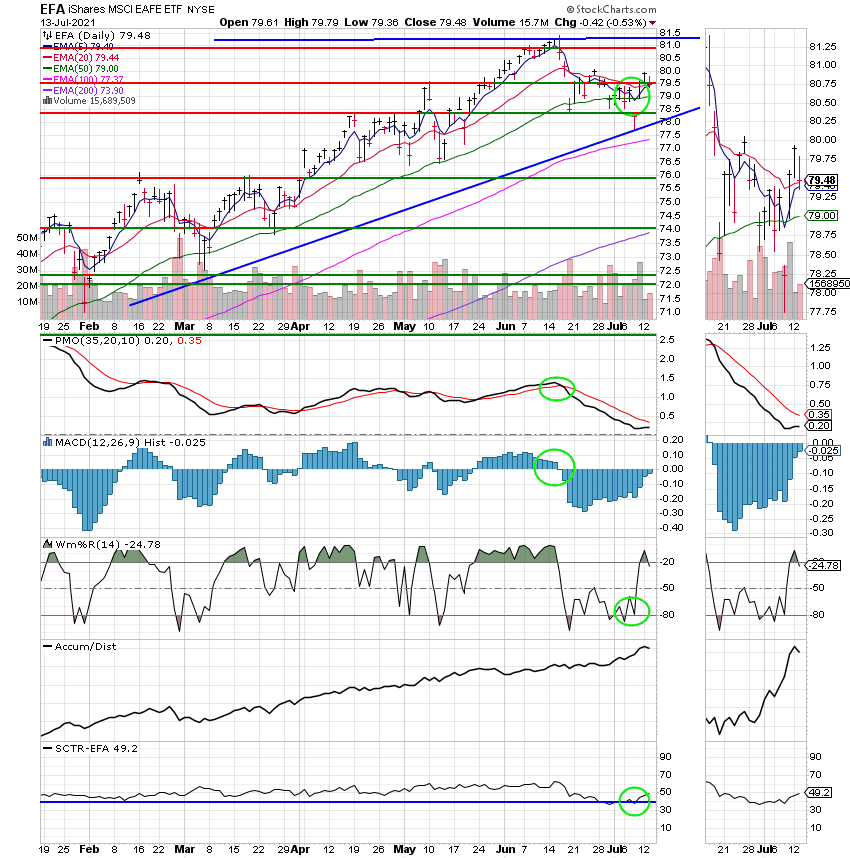

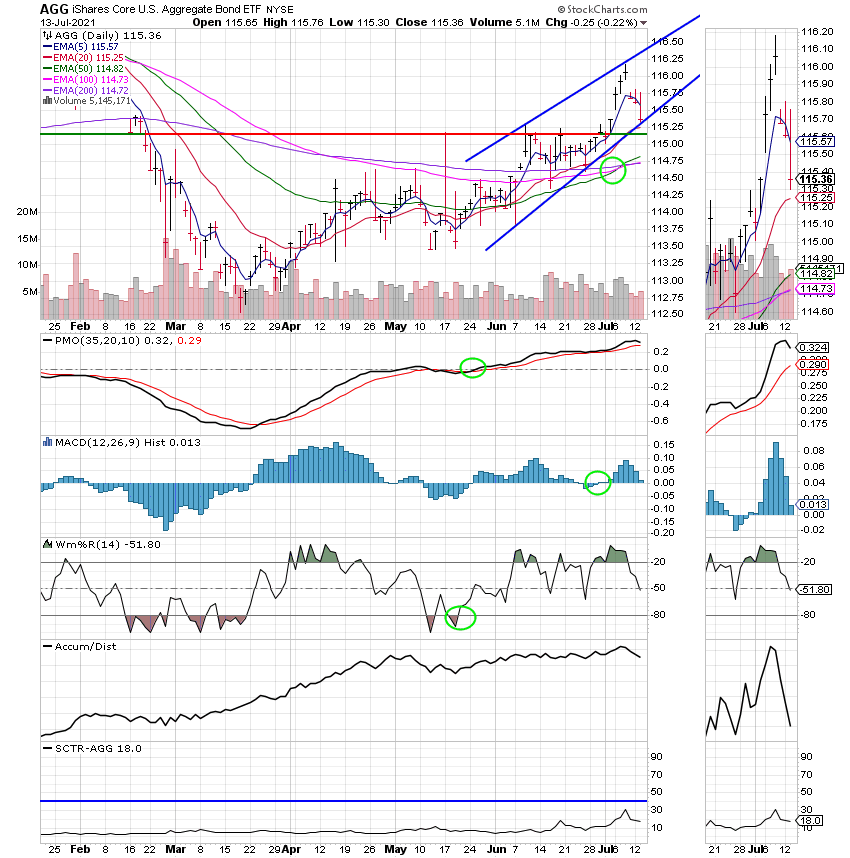

Good Evening, The market continues to be dominated by the two big issues, bond yields and inflation. As we discussed a few weeks back pretty much everything is tied to them in some way. Today the market started off flat but then sold off after investors digested a hot inflation report. Inflation rose at its fastest pace in nearly 13 years, the Labor Department reported Tuesday. The consumer price index increased 5.4% in June from a year ago; economists surveyed by Dow Jones expected a 5% gain. Core CPI, excluding food and energy, jumped 4.5%, the sharpest move for that measure since September 1991 and well above the estimate of 3.8%. Our move to the C Fund kept us in the game for now. Overall the charts are not in bad shape and as reactive traders they tell us to stick with the market. So my official stance is that we are all in. That said I don’t often talk about my feelings separate from the charts but I have been investing for a long time and more often than not my “gut feeling” is correct. While I don’t make decisions based on those feelings they do give me a certain level of expectation of where the market might be going and right now I feel like the market is getting a little toppy. It feels like we are due for a pullback. After all we normally have two or three pullbacks in the 5% range and one or more that is over 10% during a normal year. I’ll be the first to tell you that this year and last year are anything but normal. Nonetheless, it has that toppy overall feeling that we are due for a pullback. Don’t get me wrong. I am not expecting a bear market at this time, but I do feel that a healthy correction could be in the cards. Thankfully I have the charts and don’t have to make decisions on what I think or feel. Let me make one thing clear. I am not sounding the alarm. All I am saying is that I won’t be surprised to see a healthy correction sometime in the next three months. For those of you that are new to the group and/or investing the official definition of a correction is a decline of 10% or more. A bear market is a decline of 20% or more. What I am saying is don’t set it and forget it. Keep a close eye on things. In the event that a correction takes place we will likely move our money and you won’t want to miss out on the resulting gains! That’s a wake up call for those of you who may have fallen asleep at the wheel during our long run in the S Fund. A run lasting that long in the same fund is an exception not a rule!!!

The days action left us with the following results: Our TSP allotment dropped a little at -0.35%. For comparison, the Dow fell back -0.31%, the Nasdaq -0.38%, and the S&P 500 -0.35%.

The days action left us with the following signals: C-Buy, S-Hold, I-Hold, F-Hold. We are currently invested at 100/C. Our allocation is now +15.59% for the year. Here are the latest posted results:

| 07/13/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6241 | 20.9199 | 65.5356 | 83.9521 | 39.0871 |

| $ Change | 0.0006 | -0.0483 | -0.2311 | -1.3307 | -0.0234 |

| % Change day | +0.00% | -0.23% | -0.35% | -1.56% | -0.06% |

| % Change week | +0.02% | -0.25% | -0.01% | -1.66% | +0.27% |

| % Change month | +0.05% | +0.19% | +1.71% | -2.01% | +1.34% |

| % Change year | +0.70% | -1.30% | +17.21% | +13.14% | +10.45% |