Good Afternoon, Today is the last day of a surprisingly good month with all the major indices poised to finish higher. Stocks have rallied this month, with the S&P 500 up 2.9% and on pace for its fifth positive month in a row for the first time since its seven-month streak ending August 2021. The tech-heavy Nasdaq Composite has gained 3.8% and is on track for its fifth straight winning month. The blue-chip Dow has jumped 3% in July. Last week, the index posted a 13-day advance that matched its longest streak of gains going back to 1987. Most importantly we’ve finally got our indicators straightened out. We are seeing clearly for the first time since before the pandemic. Although we struggled it turned out to be a blessing in disguise as we retooled our indicators to analyze the market from a different perspective than we had ever used before. It was touch and go for the first half of 2023, but we have adapted and are now seeing clearer than we have ever seen before and as those of you who have been with us for a while know, that was pretty good before the government started manipulating the market by buying bonds. Just a side note, our old indicators are working good again now and though we used them for close to 30 years we feel like the new ones are clearly better. Our intention is to monitor both sets of indicators which will allow us to see through any market manipulation from the algorithm boys….. and uh girls. How accurate are the new indicators? When we back tested them the results for accuracy were in the mid to high 90’s. Folks it doesn’t get much better than that. Give God all the glory and all the praise! We are so excited!!!

Most of the focus this week will be on Fridays jobs report and on continued earnings reports. As we have oft repeated, it’s all about how these economic issues effect FOMC policy. Most investors believe that the Fed is done increasing rates. Any news going against that would be the catalyst for a new bout of selling. Although I must say, I don’t think that will be the case as investors in recent weeks have grown increasingly more hopeful about a soft landing scenario with economic data showing ongoing strength in the labor market and cooling inflation. Second-quarter earnings also continue to tickle in better than expected. “Earnings are coming in not as bad as feared, clearly that’s a good thing for the market,” said Independent Advisor Alliance’s Chris Zaccarelli. “Part of the reason the market’s rallied this whole month is that in addition to the good news to the economy that we’ve seen all year, we’re also seeing that corporate earnings really seem to have not been impacted as much as people have been concerned about.” We talked about this soft landing scenario in recent weeks. For those of you new to our group, the term soft landing refers to the rate of inflation being reduced to the Fed target of 2% without pushing the economy into a recession. Thus, the term “Soft” landing. There are a couple of things to note about this scenario. All areas of the economy must be just right or commonly referred to as goldilocks warm for this to occur. The market is clearly expecting this to take place and we all know what happens when things don’t go as the market thinks they will. If for no other reason than that reason, keep a close eye on this. You don’t want to be in the market if the word recession is mentioned. I am fairly confident that things will be okay. However, I have learned the hard way to never say never in this business. Oh yes, and one more thing before we move on… I know there are a lot of seasonality charts that clearly define a negative period for the market starting in September. That’s worth noting as this is not an exact science, but I’m going to add my two cents worth right here and now. My experience overall is that the market under performs for a period of time starting on or about the middle of August until middle or late October. So don’t be surprised if you are forced to take a short break sometime during that period….. You just can’t bet on seasonality. That’s the reason, we follow our charts. In my years in the market, I have seen m0ney made and lost in every month. That noted, there is a stronger headwind for stocks during this period. So, like I said, keep a close eye on things and don’t forget to keep praying for God’s guidance.

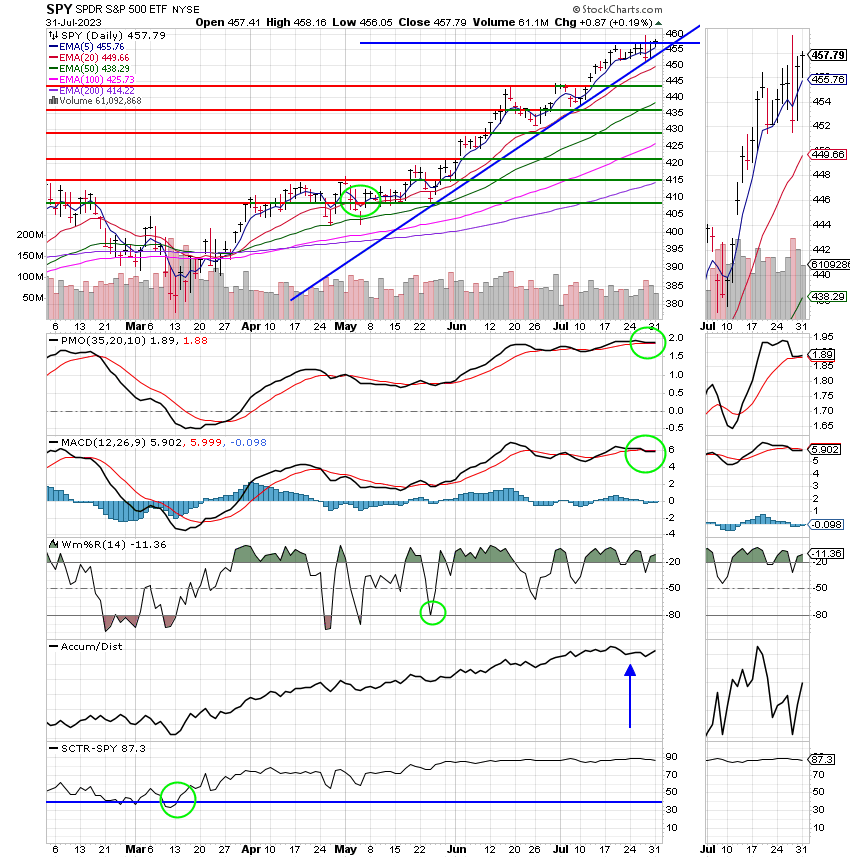

Today’s trading left us with the following results: Our TSP allotment ended the month with a last minute rally adding +0.19%. For comparison, the Dow posted a gain of +0.28%, the Nasdaq +0.21%, and the S&P 500 +0.19%. Thank God for a good day and a good month!

S&P 500, Nasdaq notch modest gains Monday, rise for the fifth straight month: Live updates

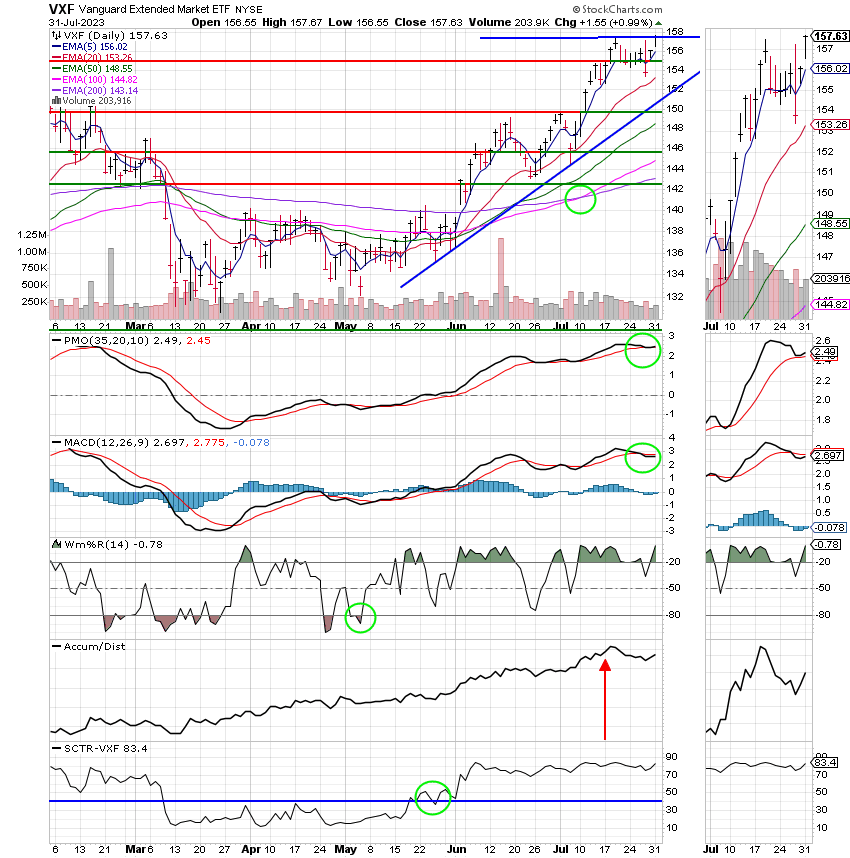

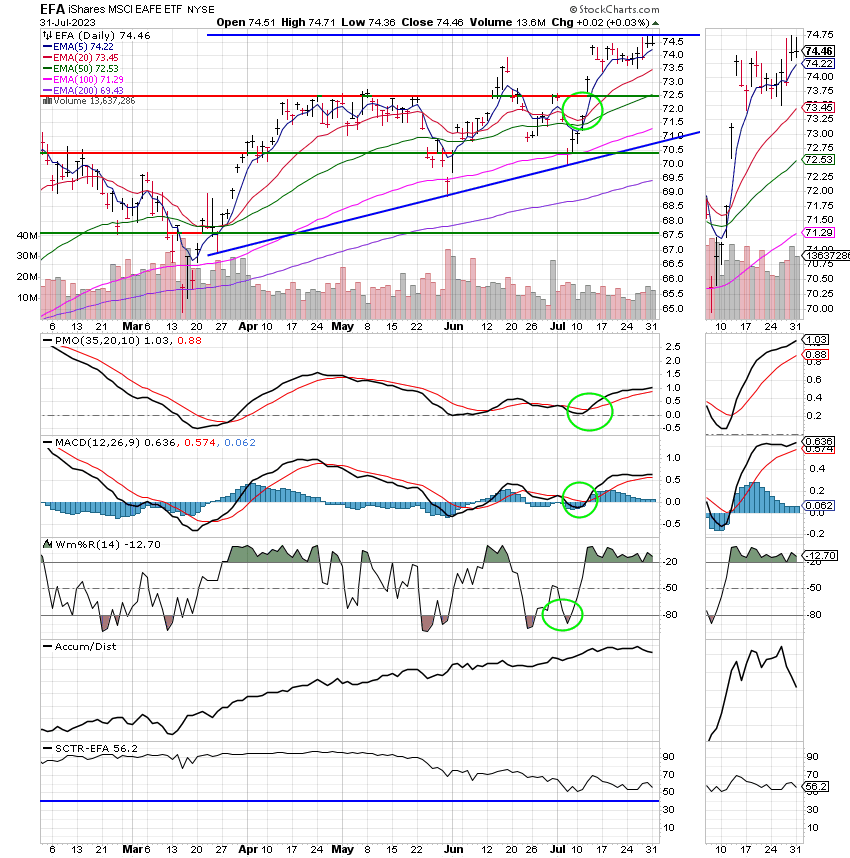

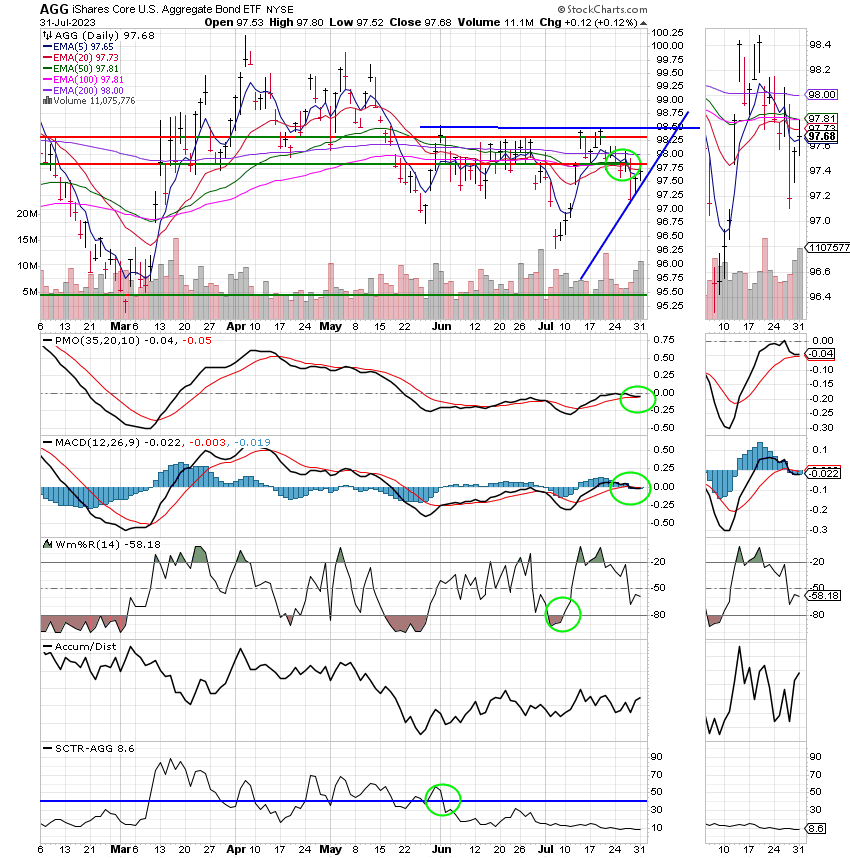

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/C. Our allocation is now +0.45% for the year not including the days results. Our monthly return was +3.24%. Here are the latest posted results:

| 07/28/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.6191 | 18.582 | 70.9459 | 72.693 | 39.1484 |

| $ Change | 0.0019 | 0.0656 | 0.7002 | 1.0387 | 0.2664 |

| % Change day | +0.01% | +0.35% | +1.00% | +1.45% | +0.69% |

| % Change week | +0.08% | -0.40% | +1.03% | +0.79% | +0.79% |

| % Change month | +0.31% | -0.19% | +3.05% | +4.88% | +2.84% |

| % Change year | +2.23% | +2.06% | +20.44% | +18.14% | +15.34% |