Good Afternoon, The market has behaved pretty much as we anticipated it would so far in August. Our new indicators called for a pullback and that’s exactly what we got. So far they have been right on! Last week we talked about the slow period for stocks starting in the middle of August and heading into October and this action has done nothing to prove us wrong. This week the market is being influenced by three things. Continued Earnings Reports, rising treasury rates, and J. Powell’s speech at Jackson Hole Wyoming on Friday. The earnings reports have been nothing earthshattering but not bad so far. Tech seems to be showing some renewed strength. Palo Alto Networks is moving higher after a strong earnings beat and Nvidia is moving higher into it’s report on Wednesday. It’s pretty clear at this point that that the NVDA report in and of itself could be a market moving event. Nvidia, which sharply outperformed its megacap peers with gains of nearly 6% last week, climbed 4.5% as HSBC raised its price target on the stock to $780, the second highest on Wall Street. The company is expected to forecast quarterly revenue above analysts’ estimates when it reports results on Wednesday. Its results will help determine whether this year’s stock market rally, fueled by optimism around the potential for artificial intelligence, will continue.

“(Nvidia earnings) are important for the next step in the market. If they were to disappoint, you would see risk-off (sentiment) for a number of days until we get more information from the Fed on Friday,” said Thomas Hayes, chairman at Great Hill Capital LLC.

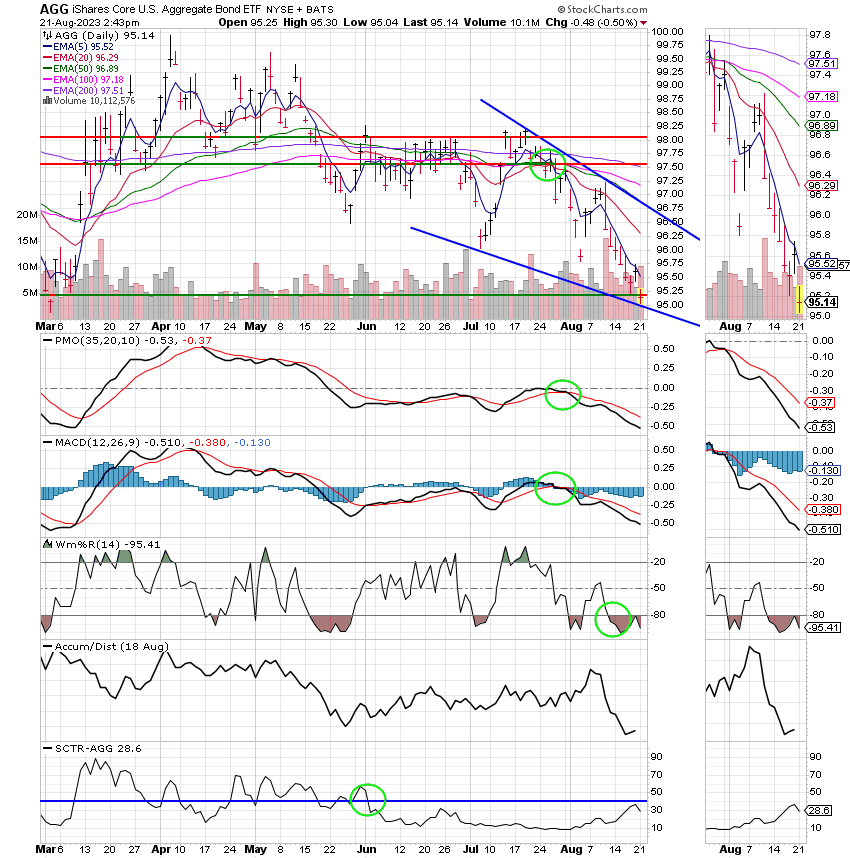

Next you have rising treasury rates which are definitely creating headwinds for the market. The benchmark 10-year Treasury note yield hit a high of 4.35%. That’s its highest level since November 2007. Treasury rates are a big deal and this is why.

“I think the path of least resistance is the momentum that you’ve seen coming into this week,” said Jeff Schulze, head of economic and market strategy at ClearBridge Investments. “The 10-year Treasury continues to rise here, and although you did see positive impulse for markets and in particular cyclicals, I think, ultimately, the 10-year Treasury is going to weigh on valuations and put more downward pressure on the markets as the week develops.”

Another reason is that as you all know interest rates rise as treasury yields rise. That means that things such as cars and houses cost more to finance. Mortgage rates jumped Monday, following a rise in bond yields driven by investors’ concerns that high interest rates and inflation will linger longer than expected. The average rate on the popular 30-year fixed mortgage hit 7.48%, the highest level since November 2000, according to Mortgage News Daily. It has risen 29 basis points in just the past week.

“Investors just aren’t seeing the kind of deterioration in economic data that they expected,” said Matthew Graham, chief operating officer of Mortgage News Daily.

He noted that the Federal Reserve wants to see the same deterioration before considering a policy shift, and that shift would likely favor short-term rates first.

“The net effect is that longer-term rates like 10-year Treasury yields and mortgages are bearing the brunt of the market’s negative rate sentiment. This won’t change until the data forces the Fed to start talking about the first rate cut.”

Remember what we said over two years ago about rate increases and then cuts?? We said then and continue to say now that the next long term move higher will not come until the rate of inflation falls to 2% and the Fed begins to cut rates. We said that all you have to watch the rate of inflation and at to this point we have been 100% correct.

Finally you have Jerome Powell’s speech at Jackson Hole on Friday. Never underestimate what this can do to the market. Never!! When J.Powell talks, everyone listens and whatever he says about future rate increases, how long rates will stay elevated, and when they might make future cuts will have huge market moving implications. The problem here is in which direction will the market move? Personally, I think it is likely to be lower. I believer Powell will not rule out future cuts and will indicate that rates will be higher longer and will say nothing period about when the process of reducing rates will begin. Of course, if I am correct the market will not like it and there will be more selling. Folks, I am in no hurry to jump back into the market prior to this speech. Better safe than sorry! We will see what happens from our safe place. This is not the time to be a hero!

The days trading has so far generated the following results: Out TSP allotment remains steady in the G Fund. For comparison, the Dow is off at -0.22%, the Nasdaq higher at +1.34%, and the S&P 500 is +0.48%. So far it has been a wild day with most of the major indices being in and out of the red. Right now it looks like the market may rally into the close but I’d have to say that this rally has no conviction. It will not last if treasury rates continue higher. Bottom line. I don’t trust this bounce. At least not yet anyway……

Dow falls more than 100 points to start the week as rates march higher: Live updates

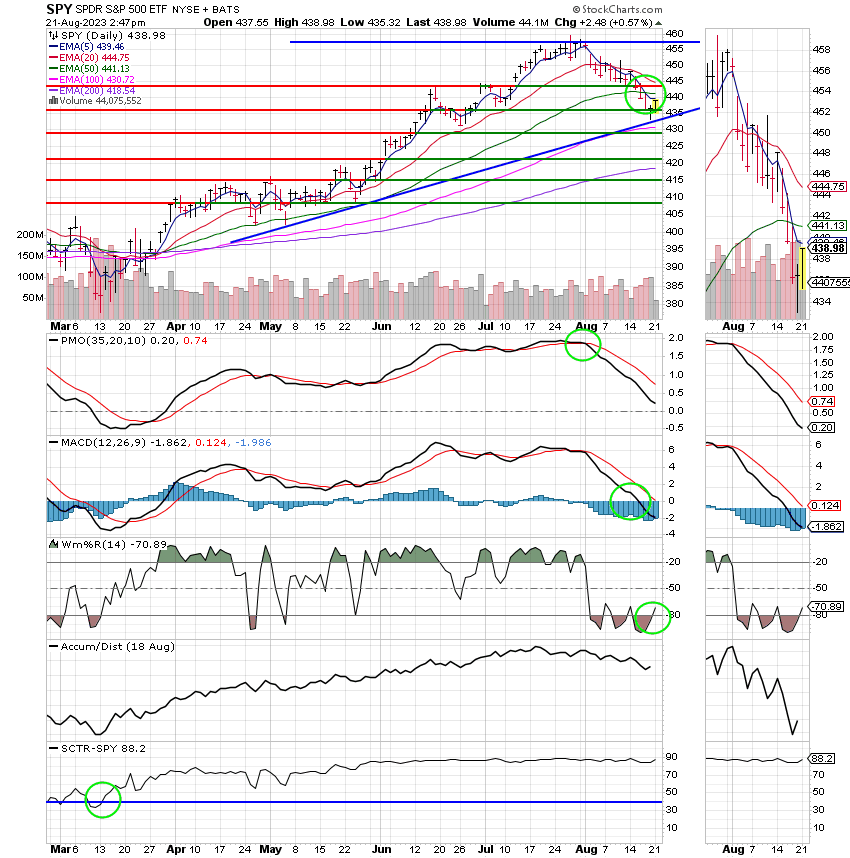

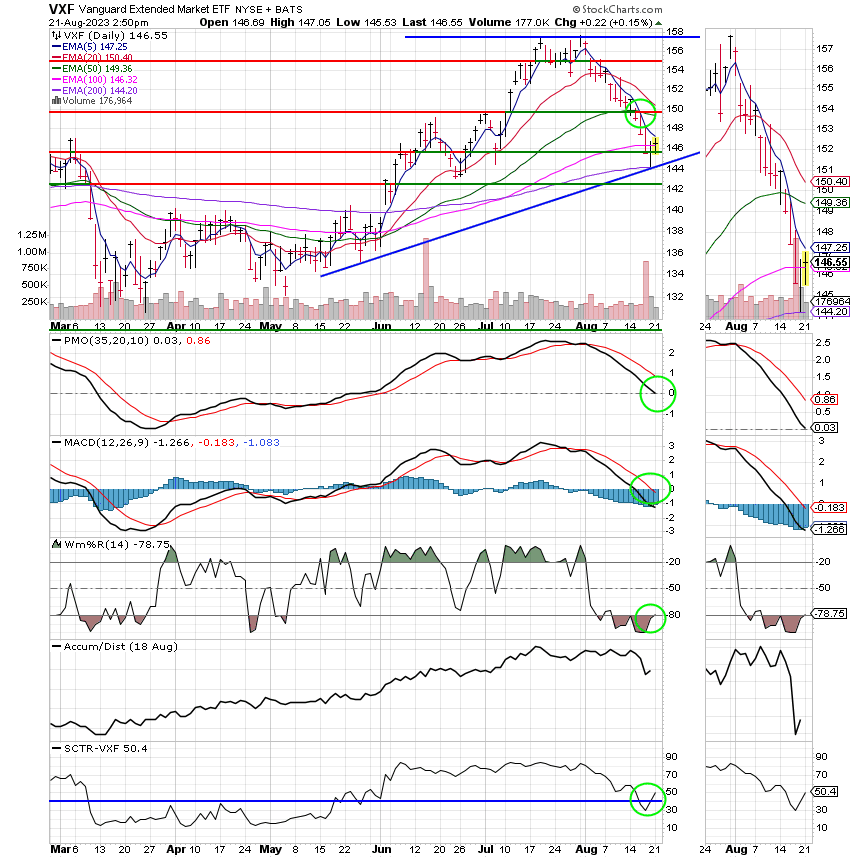

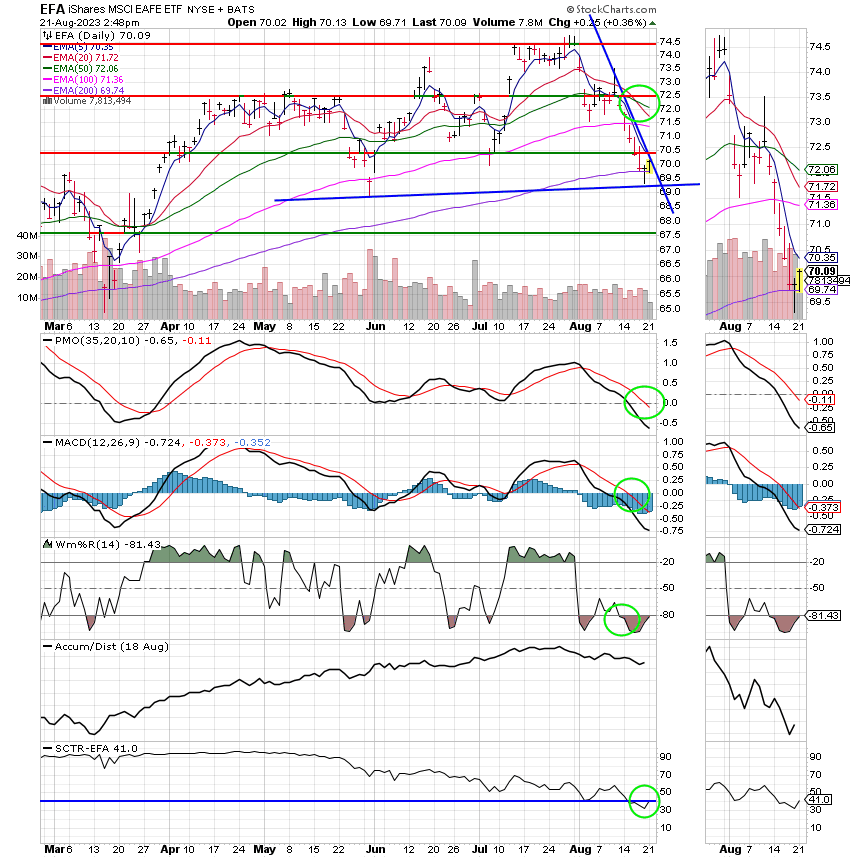

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -1.66% on the year not including the days results. Our monthly return is -2.25%. Here are the latest posted returns:

| 08/18/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.6609 | 18.2605 | 67.7379 | 68.1665 | 36.7288 |

| $ Change | 0.0020 | 0.0385 | -0.0054 | 0.3285 | -0.0604 |

| % Change day | +0.01% | +0.21% | -0.01% | +0.48% | -0.16% |

| % Change week | +0.08% | -0.51% | -2.05% | -2.95% | -3.20% |

| % Change month | +0.20% | -1.85% | -4.66% | -7.14% | -6.16% |

| % Change year | +2.47% | +0.29% | +15.00% | +10.78% | +8.21% |