Good Afternoon, Someone on our Facebook page asked me if I could comment on the many news articles that I post there. I am certainly flattered that they value my opinion, but at the end of the day it’s only just that, an opinion. I thought the question worth mentioning here though. The allocation of your time when your working full time, taking care of your family and trying to maintain an investment account is critical. If you spend too much time in the wrong area it can be extremely injurious to one or all of the others. Back when I was performing this balancing act, I put forth my best effort to spend an hour each evening on my investments and you know what??? I had very little time for the news. Most of the time I didn’t even scan the headlines. Not that I didn’t want to, but when there was a school or church activity I was luck to get home and get ready for work the next morning. So I chose to spend my limited time on technical analysis. On nights when things really got crazy or at times when I had to be away for work I simply checked my charts to determine if they were a buy, sell ,or hold then made any changes that were necessary and called it an evening. Don’t get me wrong, when I had extra time I spent it on improving my technical analysis. The key was that I maintained a chart for each thrift fund so that when I became busy all I had to do was make a quick check of four thrift charts and an adjustment if necessary. I didn’t worry about timing or anything like that. My only concern was getting in the long trends up and avoiding the long trends down. News? Are you serious?? When was there time for that. Of course there was always the option to set it and forget it. Todays version of that are the L Funds. I’m not knocking them. Not at all. TSP is the best retirement system in the world for building wealth and those funds are the best option for some one that knows little about investing and has no time. All I am saying is that a little extra effort is worth a lot of extra money. So I did what I could and managed to average over 17% annual returns during my career. I believe those returns might have been better had we had all the funds that are available today and been able to access them quickly. In the beginning all we had was the G,F, and C Funds and you had to use a phone in order to make a change. A lot of folks just let it all ride in the G Fund in those days. I will add that you could make 5 or 6 percent doing that at the time. My don’t bond yields make a difference. I believe you’ll see the returns for the G fund approach that range again some time in the future but that’s another subject for another day. As for as the question on Facebook goes I try to post as many relevant news articles as I can to help members of our group be aware of the news feed and how it might relate to our analysis. It helps us know what might be coming and what we should look for on our charts, but it has zero bearing on our investment decisions. We base those decisions on the solid mathematics of our charts. We often refer to the news feed as noise that can interfere with your decision making process, if you let it. I can honestly say that I don’t have an opinion on the majority of the news and/or commentary that I post. I want our group to know what I am looking at to get a feel for what’s going on in the market. It is important to know what the psychology of the herd is. That way you can determine whether they might be inclined to buy or to sell. Have you ever seen investors buy or sell when the fundamentals totally fail to support what they are doing? What the market players are thinking in my opinion is the most important aspect of market analysis. When they buy or sell it’s the price action that determines where we are going and we track that via our charts. So for the most part, I don’t comment on the news feed. That said, I do express my opinion on the current state of the market here each week. That and the charts I post are my opinion. The most important thing is to be aware of the news but don’t get tangled up in it. If you watch your charts like you should and know how to read them you will have little use for the news. Everything I do here is based on what would have benefitted me the most when I was working. If you follow our Facebook page you should be able to efficiently scan the news with out wasting to much of your precious time. I can promise you one thing too. Even when you do retire your time will still be precious. If your like most folks you’ll wonder how you ever had time to work…..

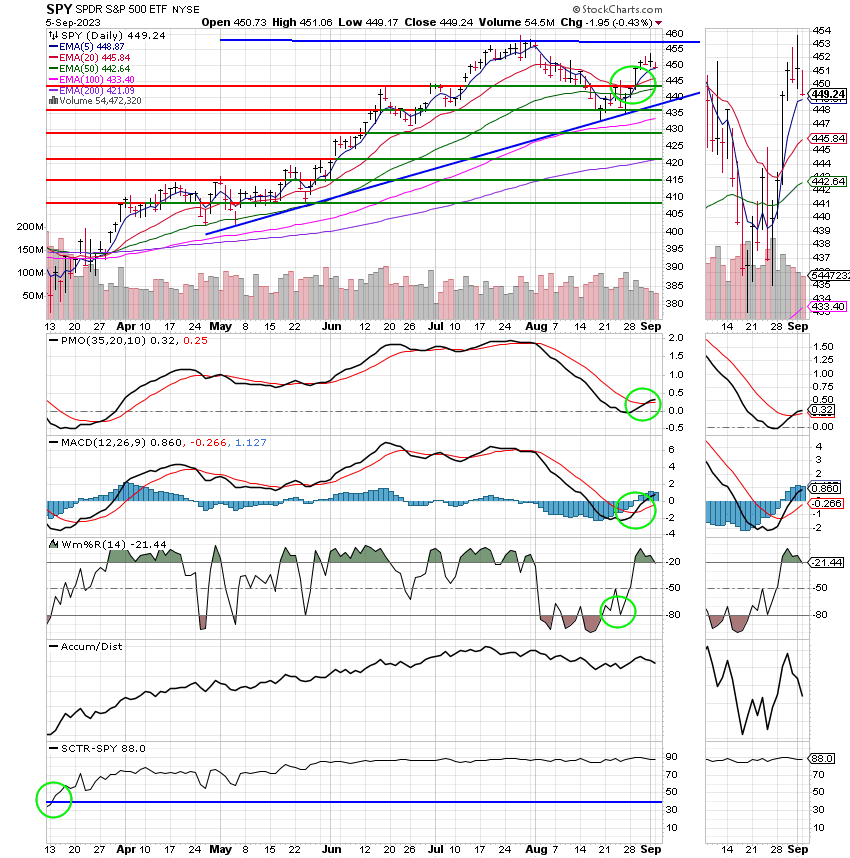

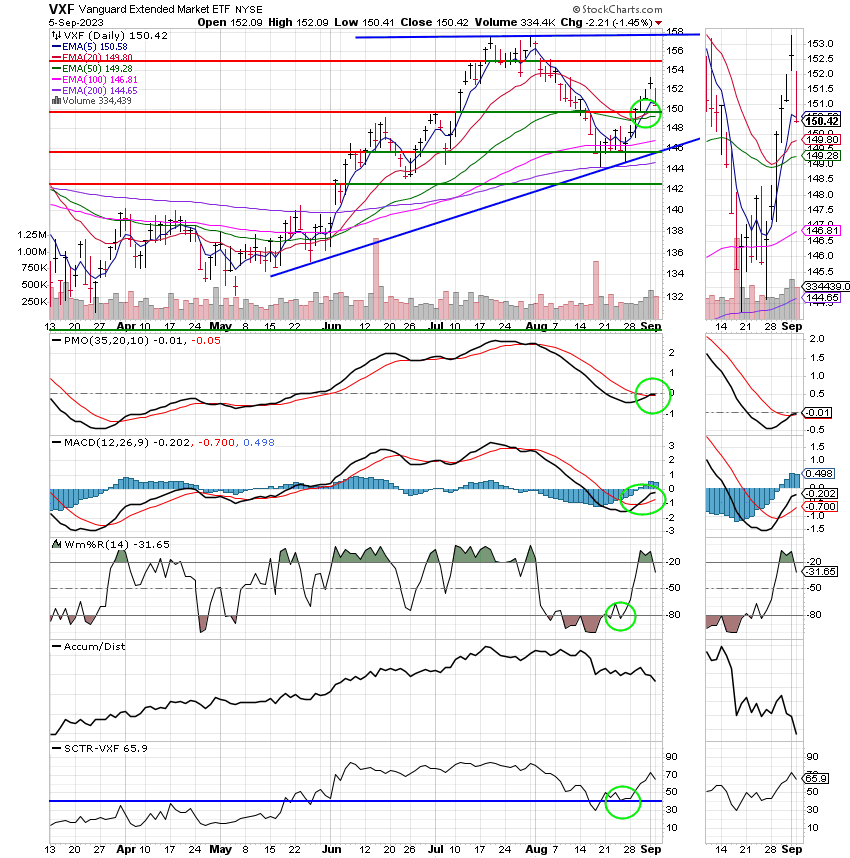

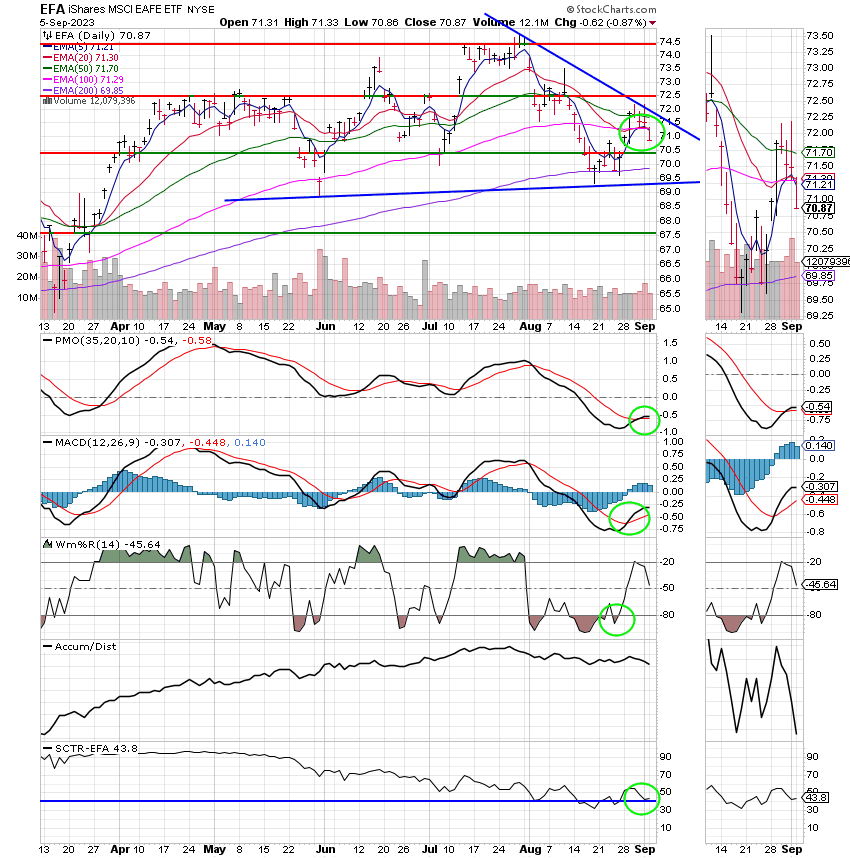

As far as the market today, It reopened a little flat after having a stellar week last week. The surge higher was fast and furious. It shoved our charts higher and produced buy signals on our equity based funds. While I was inclined not to buy, I remained disciplined and invested in the C Fund when it produced a buy signal. The C Fund had the strongest chart statistically with an SCTR of close to 90 and that pretty much went along with the state of the market. A lot of folks are investing part and in some cases all of their allocation in the S Fund. However, given the volatility of the current market the S Fund will drop much faster than the C Fund. Our mantra here is it’s not how much y0u make that’s important, it’s how much you keep. In this case the C Fund allows us to be exposed to equities with less risk than if we were invested in the S Fund. There will come a time when we utilize the S Fund in a big way but this is not that time. A case in point is todays market which is on the negative side of the ledger. The C Fund is currently off -0.32% while the S Fund is down by -1.35%. That folks is exactly why we’re not invested in the S Fund at this time…..

As I mentioned stocks are lower today. That’s a combination of some healthy consolidation and higher oil prices. Saudi Arabia decided to extend their voluntary crude production cut in order to maintain higher oil prices. The result is that crude oil as well as energy prices as a whole were higher today. You got to love some of these news commentators. There was one analyst that said the focus was no longer on the Fed and Inflation. Today it is on energy. I’m like really??? That’s not about inflation???? What planet did that guy come from because it sure wasn’t earth! I take it back, news is good for something else. Entertainment!!! I laughed so hard I cried when I read that one. Let me tell you (if you don’t already know) why the Saudi Production cut effected the market in a negative way. Higher energy prices effect the rate of inflation and the rate of inflation effects what the Fed does with regard to whether or not to raise interest rates. I’m gonna say it again right here! All paths lead to the Fed target rate of inflation of 2 percent. You can focus on whatever you want but in the end it will lead you to the Fed. That said we have an important Fed meeting coming up in a couple of weeks. Investors and economists have been debating since back in May whether or not and if so by how much the Fed will increase rates at this meeting. As it sits right now the majority of market participants believe the Fed will hold rates steady. For the record, I do too. For the most part recent data has been soft and favors that scenario. Last Fridays employment report actually showed that employment decreased for the first time in a long time. This is something the Fed has been watching closely to determine their rate hike strategy. They feel that there needs to be a little softness in labor and wages for inflation to come under control. For that reason I believe they will not raise rates. It they do end up holding rates steady the market should respond in a positive way. Inversely, if I am wrong, then there will probably be some selling. It could be said that it’s a risky time to be exposed to equities. As usual we’ll keep a close eye on our charts!!

The days trading left us with the following results: Our TSP allotment fell back -0.43%. For comparison, the Dow dropped -0.56%, the Nasdaq -0.08%, and the S&P 500 -0.42%. For those of you that were wondering the S Fund ended up at -1.45%. Again, that is the reason we aren’t in it…..

Dow closes nearly 200 points lower as rising oil prices drag down stocks: Live updates

| 09/01/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.6889 | 18.3996 | 70.0555 | 71.1349 | 37.56 |

| $ Change | 0.0020 | -0.0866 | 0.1289 | 0.7122 | -0.0566 |

| % Change day | +0.01% | -0.47% | +0.18% | +1.01% | -0.15% |

| % Change week | +0.08% | +0.48% | +2.55% | +4.24% | +1.98% |

| % Change month | +0.01% | -0.47% | +0.18% | +1.01% | -0.15% |

| % Change year | +2.63% | +1.06% | +18.93% | +15.61% | +10.66% |

F Fund:

September is a difficult month for investors at best, but any time we have a buy signal we need to try. We’ve made money on more than one occasion in the month of September so keep praying! That’s all for this week. Have a nice evening and may God continue to bless your trades!