Good Evening, Just a reminder to all those of you who are panicking because the market dropped over 5%. Actually 10% in the Nasdaq. It is normal for a healthy market to experience three or four dips and at least one correction of 10% or more in a year. Add to that the fact that September and October are the worst months of the year for the market coupled with the recent strong run in stocks and the sell off of the past three sessions should not come as a surprise. Also, don’t forget that the VIX is currently above 30 and never fully reset from the bear market earlier this year and volatility is well…..volatility. So if this type of action stresses you out you may consider reducing your exposure to stocks because it’s here to stay for the foreseeable future. My mail box is always clogged with Emails each time the market drops as it did the past three sessions. Each one of you has to determine what his or her risk tolerance is and invest accordingly. While our goal is to reduce risk it is impossible to eliminate it entirely. All that said, I don’t know anybody that every made any substantial money without being in stocks….You have to be in it to win it as they say. The above statement is a repeat of my post on our Facebook page earlier today. I know a few of you have now read it twice, but there are many who did not as not everyone is on Facebook.

The market was oversold and due for a bounce after three sessions of heavy selling in the tech sector and that’s exactly what it got. Overall the economy is slowly clawing to get back where it was prior to the pandemic and while it will be a while before it fully recovers it is making progress which is the best we can ask for. Given the time of the year and the upcoming elections you can expect stocks to continue to trade in a choppy fashion in the coming weeks while encountering these headwinds. Given the current progress and earnings we can reasonably expect stocks to gain into the coming year. However, should a less market friendly government be formed in the upcoming election, all bets on stocks moving higher are off. That is the only thing that can knock this train off the rails and let there be no doubt that is exactly what it will do. There are a lot of important issues out there beside just the economy. I am aware of that. Nonetheless, be an informed voter. If you want your Thrift account to grow do not support candidates that are for increased regulations. They strangle the market and ultimately the economy. The bottom line is that if corporate America has a though time making money you will too. Let me say one more thing that borders on being political. There are many candidates out there that support socialism. They make there programs sound pretty good, but one cold hard fact remains and you can take it to the bank. Socialism and Capitalism don’t mix. Regardless of what they tell you Socialism will destroy the market and will destroy your ability to create wealth. Folks don’t drink the Kool Aid. There are candidates from multiple parties that advocate these kind of policies. Don’t support them.

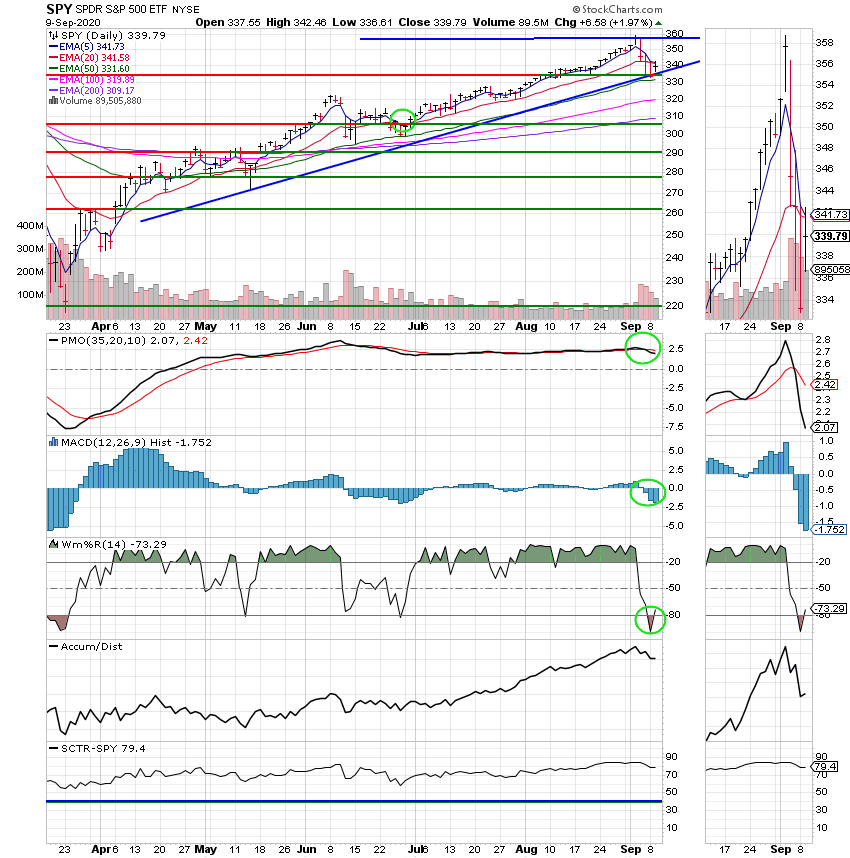

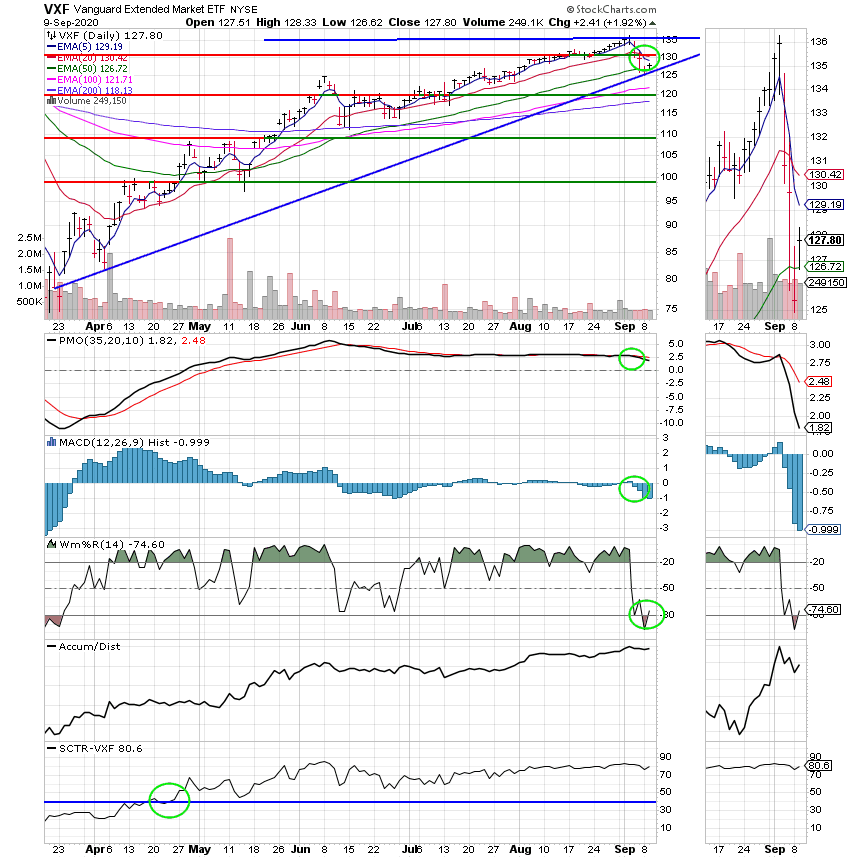

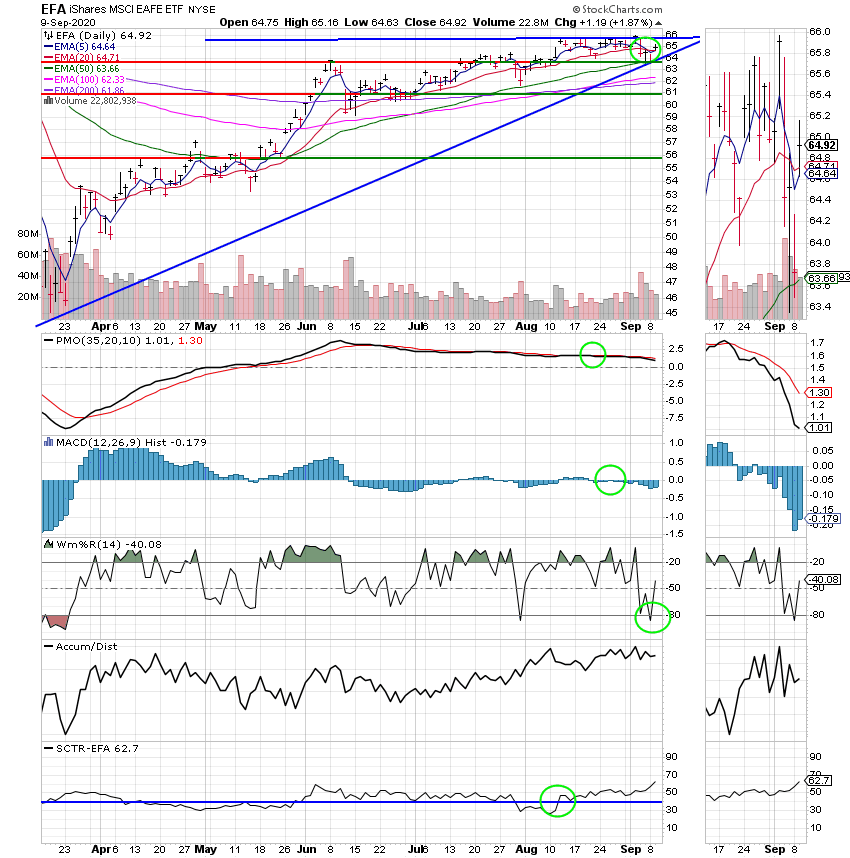

The days trading left us with the following results: Our TSP allotment rebounded today posting a gain of +1.92%. For comparison, the Dow was up +1.60%, the Nasdaq which took the biggest beating the past three sessions +2.71%, and the S&P 500 +2.01%. Praise God for a day in the green!

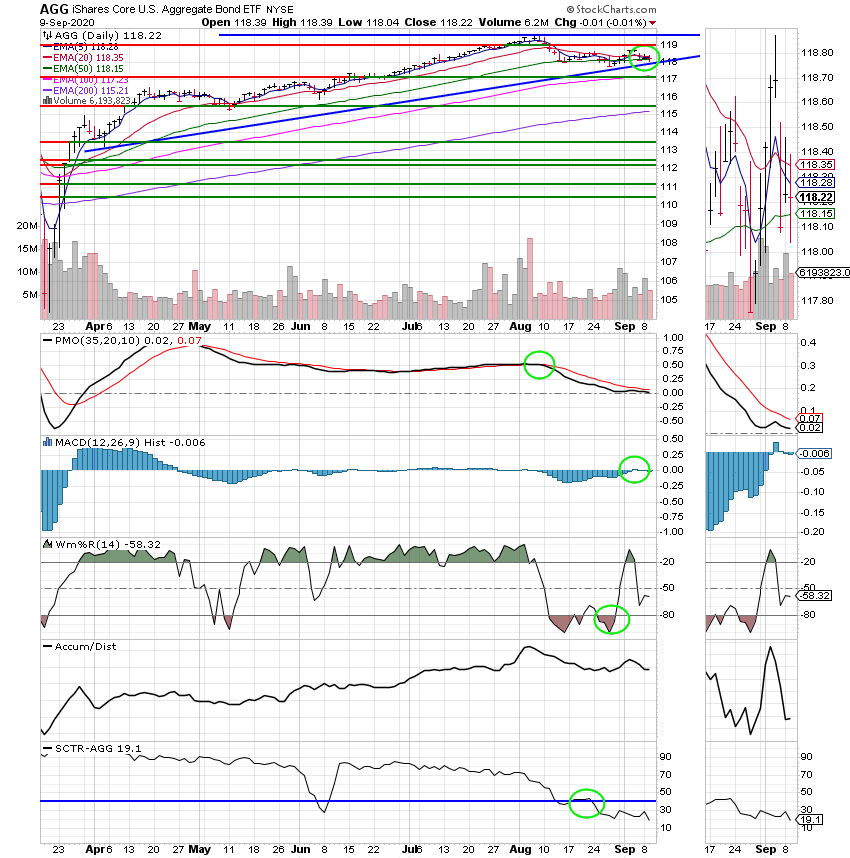

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +20.95% not including the days results. Here are the latest posted results:

| 09/08/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4678 | 21.0762 | 49.3524 | 56.138 | 30.5456 |

| $ Change | 0.0014 | 0.0343 | -1.4058 | -1.9547 | -0.3205 |

| % Change day | +0.01% | +0.16% | -2.77% | -3.36% | -1.04% |

| % Change week | +0.01% | +0.16% | -2.77% | -3.36% | -1.04% |

| % Change month | +0.02% | +0.10% | -4.78% | -6.51% | -2.39% |

| % Change year | +0.72% | +6.89% | +4.43% | -0.25% | -6.64% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.4723 | 10.3232 | 35.2529 | 10.4215 | 38.8147 |

| $ Change | -0.1025 | -0.1154 | -0.4764 | -0.1550 | -0.6303 |

| % Change day | -0.48% | -1.11% | -1.33% | -1.47% | -1.60% |

| % Change week | -0.48% | -1.11% | -1.33% | -1.47% | -1.60% |

| % Change month | -0.90% | -2.08% | -2.51% | -2.75% | -3.00% |

| % Change year | +1.35% | +3.23% | +1.15% | +4.22% | +1.00% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.4874 | 22.6617 | 10.6178 | 10.6179 | 10.618 |

| $ Change | -0.1828 | -0.4221 | -0.2425 | -0.2424 | -0.2424 |

| % Change day | -1.71% | -1.83% | -2.23% | -2.23% | -2.23% |

| % Change week | -1.71% | -1.83% | -2.23% | -2.23% | -2.23% |

| % Change month | -3.22% | -3.44% | -4.17% | -4.17% | -4.17% |

| % Change year | +4.87% | +0.79% | +6.18% | +6.18% | +6.18% |

S Fund:

I Fund:

F Fund:

Will it move higher again tomorrow? It’s hard to say if the selling is over. As of the writing of this blog the futures for tomorrow are slightly in the red. But as you already know, a lot can happen between now and tomorrow morning. That’s all for tonight. Have a nice evening and may God continue to bless your trades.