Good Morning, The only consistency that this market has is inconsistency. They say that there’s nothing new under the sun and that is true when it comes to the inflation and interest rates, but I would argue that’s not the case with regard to computer algorithm trading. It is indeed new and the effect that it has on the market is for lack of a better word frustrating. Most of the algorithms are written to anticipate what the market will do, not to react to what it is doing. Therefore every piece of news that comes along impacts where the market. The algorithms are programed to quickly react to certain words and phrases such as rate increase or inflation or inverted yield curve etc. Thus the programs buy or sell first and ask questions later. That’s the reason you often see the market move drastically in one direction or the other and then back again. The term we use to describe that type of behavior is whipsaw. I would say that it favors the buy and hold systems but there is not even enough consistency for them. Yes, I know the major indices are all up for the year, but tell me this. What have they really gained since May?? This market is basically adrift in a sea of uncertainty that is intensified by the storm of algorithms. The only thing and I mean the only thing that will bring even a small measure of stability to this market will be when the rate of inflation is finally reduced to two percent. Even then I would question if things will ever return to what they where say in the early 2000’s. My guess is that will never happen. I feel sorry for those folks that have to base their retirements on this market. I can honestly say that this market has totally exhausted me in the past three years. I have never worked this hard for so little. Nonetheless, we must all deal with it. Our new indicators continue to see well and we have done about as good as anyone since we put them in place in late June. I have little or no doubt that we will do extremely well if we can ever get a run that lasts longer than three or four days or a week. Until then, no one will gain much ground and that is simply the nature of the beast. All that said, I know that God will make a way for us as He has always done. We must continue to be patient and trust in Him.

This weeks market is nothing new. Investors are totally fixated on what the Fed will do in their meeting next week. Today the market is trading l0wer because of an increase in the price of oil. Nothing effects inflation like oil because it has such a drastic effect on transportation which sends shock waves throughout the entire world economy. I have to wonder out loud what the politicians in DC where thinking when they willingly gave up our energy independence in recent years in the name of global warming. So what caused the current increase in oil prices? Why an agreement to continue to limit the production of crude by Saudi Arabia and Russia. Yeah, there’s two countries that have our best interest in mind….. It was only a short four years ago that we had them on their knees, but no, we had to kill pipelines and limit oil production in the US. After all, electric cars will save the day, right? That might eventually be true but it’s far from that today. So tell me, how much natural gas and coal is it taking to charge those EV’s???? How about the rolling blackouts in California? What ever happened to supply and demand in a free market economy? Just as it did when we transitioned from horse and buggies to fossil fuel powered transportation the market will decide when oil production will decrease. The market will decide what mode of transportation is the most efficient. The market will decide when it’s time for Electric Vehicles to totally replace Fossil Fuel powered transportation. The bottom line is that our politicians are more interested in social engineering than they are scientific engineering, They are more interested in imposing their values or lack thereof on our country than they are in security and energy independence. Today’s market is no more than a direct result of their attempt to manipulate and control a free market society. I said it before and I’ll say it again. Socialism and Capitalism don’t mix!! So they can take their socialism and go somewhere else. Sorry if some of you don’t agree with what I just said, but you must stand for something or you will fall for anything. Don’t let them pour water down your back and tell you it’s raining!!! Your smarter than that…. I’m not done ranting, but I’ll quit for lack of time. On with the market. Later this week investors will be focused on on Wednesdays CPI (Consumer Price Index) and Thursday’s PPI (Producer Price Index reports. Those along with the CPE report (Consumer Personal Expenditure) are the economic data that the FED considers the most when they formulate their policy. As it stands today, most market players believe that they will hold rates steady during next weeks meeting and remain divided on whether or not they will increase rates again in November. We will watch our charts and react to what we see….. any attempt at prognostication remains a futile endeavor.

The days trading is generating the following results: Our TSP allocation is currently trading lower at -0,31%. For comparison, The Dow is slightly higher at +0.12%, the Nasdaq is lower at -0.61%, and the S&P is off -0.29%.

Stocks open lower Tuesday as oil prices rise, Oracle drops 12%: Live updates

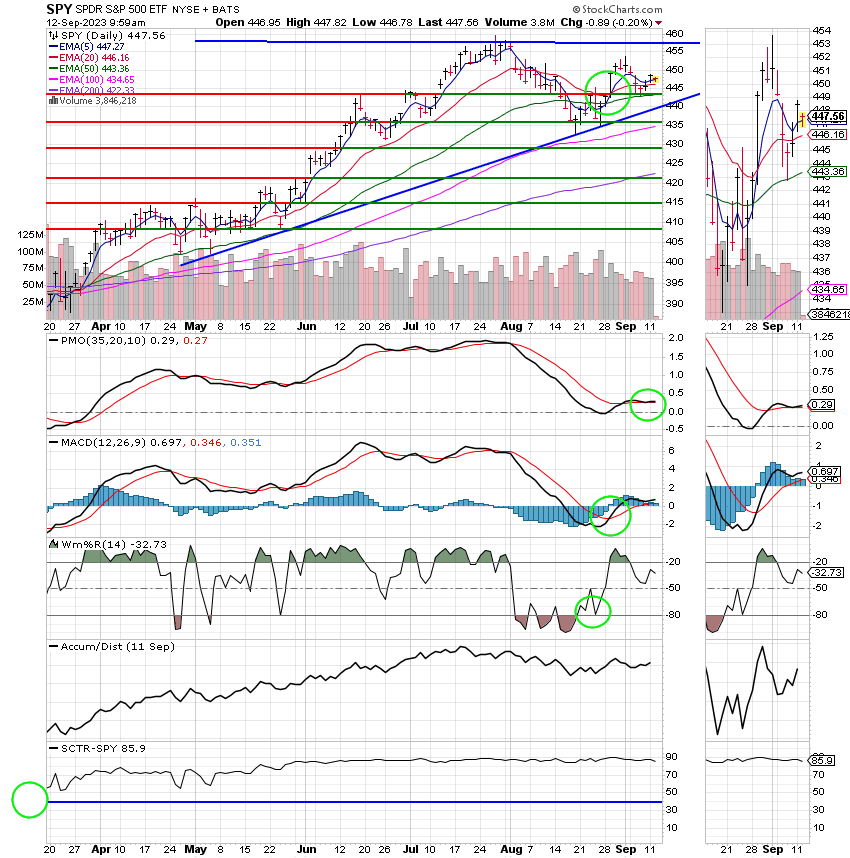

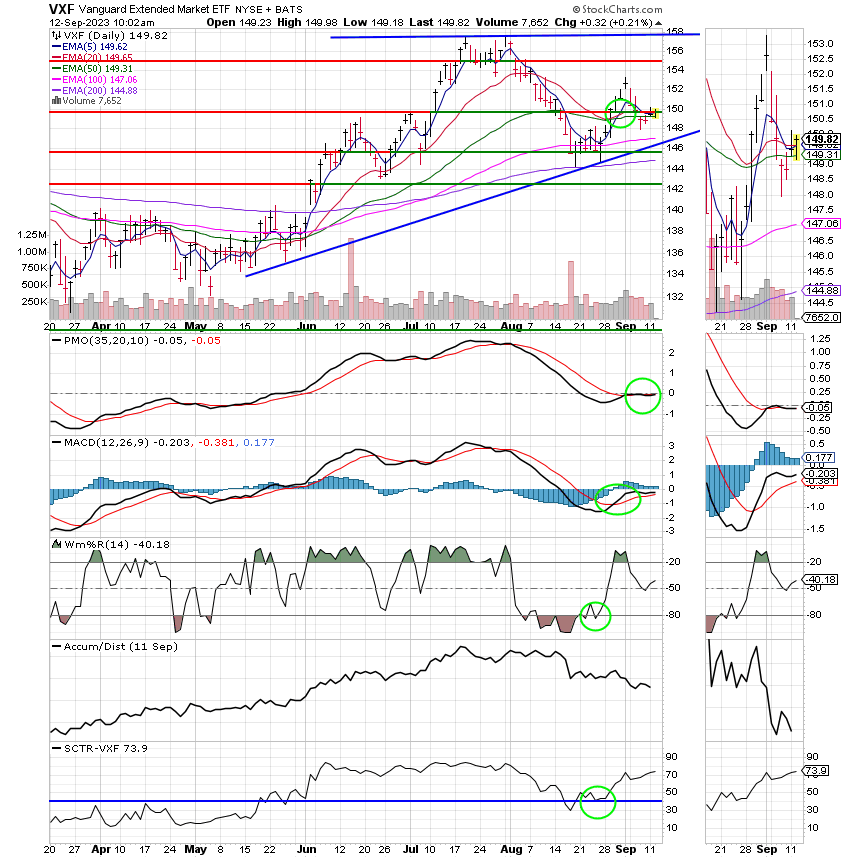

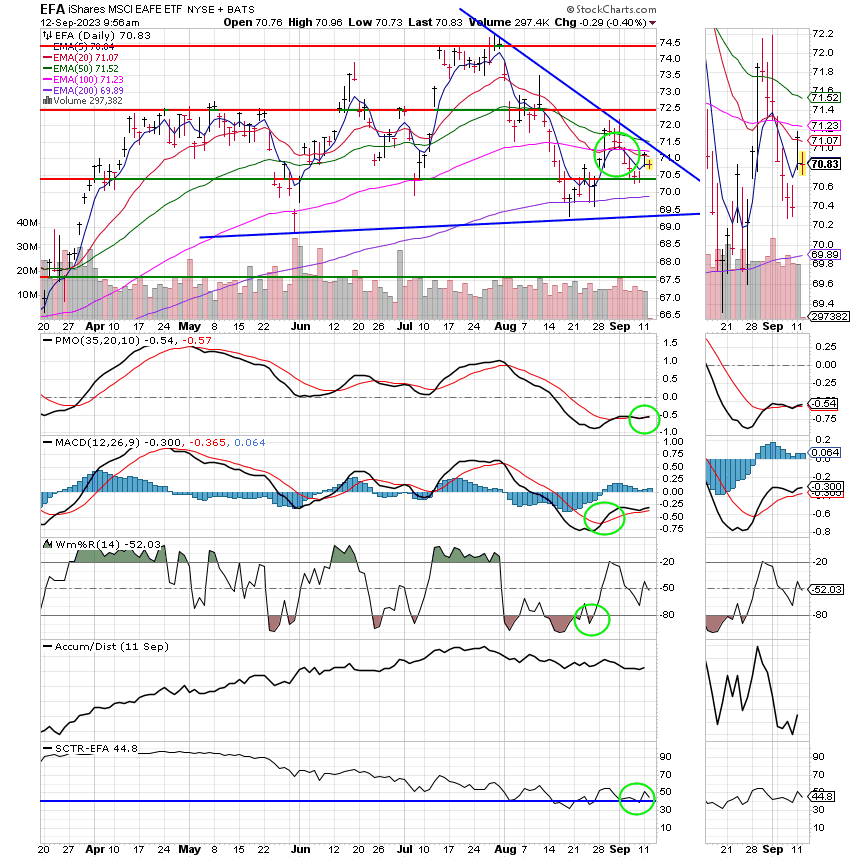

Recent action has left us with the following signals: C-Buy, S-Buy, I-Hold, F-Hold. We are currently invested at 100/C. Our allocation is now -2.07% on the year not including the days results. Our current monthly return is -0.42%. Here are the latest posted results:

| 09/11/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.7097 | 18.3183 | 69.6351 | 69.6378 | 37.3818 |

| $ Change | 0.0063 | -0.0267 | 0.4648 | 0.3005 | 0.3490 |

| % Change day | +0.04% | -0.15% | +0.67% | +0.43% | +0.94% |

| % Change week | +0.04% | -0.15% | +0.67% | +0.43% | +0.94% |

| % Change month | +0.13% | -0.91% | -0.42% | -1.11% | -0.62% |

| % Change year | +2.75% | +0.61% | +18.22% | +13.18% | +10.13% |