Good Evening,

This was definitely not a good day for the market. Both TSP and AMP were off again today. The excuse was Apple, but our charts have been predicting this downturn for a few weeks now. That is no surprise, but what we don’t know is how deep it will go. The result was another day when nothing worked. Stocks, bonds, and precious metals all suffered equally. Of course, currency fluctuation and most notably the strength of the dollar contributed to the increased volatility. I have included a little extra news tonight as it takes some more reading to get a real handle on what’s actually going on. This is probably one of the most complex markets that I have ever dealt with……On to the news.

Stocks get dropped as Apple disappoints

Stocks Post Losses for a 2nd Day, Apple Shares Slip

| 09/08/14 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.5178 | 16.5064 | 26.2394 | 35.8814 | 26.217 |

| $ Change | 0.0026 | -0.0007 | -0.0763 | 0.0040 | -0.1143 |

| % Change day | +0.02% | +0.00% | -0.29% | +0.01% | -0.43% |

| % Change week | +0.02% | +0.00% | -0.29% | +0.01% | -0.43% |

| % Change month | +0.05% | -0.46% | -0.04% | -0.05% | -0.30% |

| % Change year | +1.62% | +4.86% | +9.90% | +6.57% | +2.55% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.3211 | 22.8201 | 24.7515 | 26.3401 | 14.9767 |

| $ Change | -0.0075 | -0.0317 | -0.0438 | -0.0525 | -0.0344 |

| % Change day | -0.04% | -0.14% | -0.18% | -0.20% | -0.23% |

| % Change week | -0.04% | -0.14% | -0.18% | -0.20% | -0.23% |

| % Change month | -0.04% | -0.11% | -0.13% | -0.13% | -0.13% |

| % Change year | +3.00% | +4.70% | +5.51% | +6.06% | +6.49% |

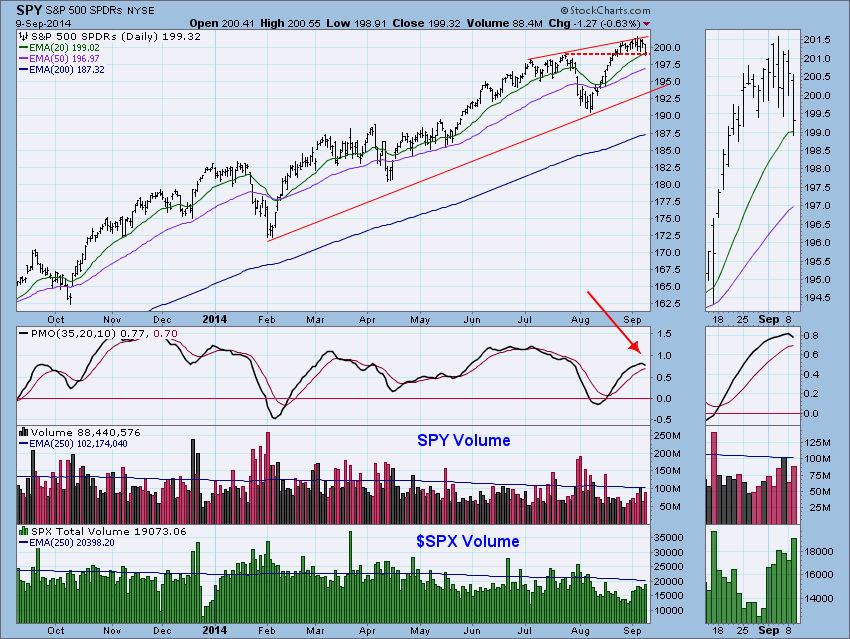

“Today’s low dropped slightly below the horizontal support line drawn from the July top. Support held but it likely won’t continue to. The PMO has topped in overbought territory and is very close to a negative crossover. We saw an increase in SPX volume on a down day which is bearish.”“Conclusion: Indicators across the board are now bearish. Initiation climaxes were detected in the ultra-short term and short term. While price was able to close above horizontal support today, it probably won’t hold up long. Indicators tell us to expect more decline.”