Good Day, Are we out of the woods yet? Well…..no. Are we getting out of the woods. Yes, yes we are…. There is little doubt that this market is a pain. I will even go as far as to say that it has been the greatest pain of my entire investing career. Eventually it will come to an end. All things do, but for now we must endure this volatile action to get to the other side. What other side you ask?? The other side were the rate of inflation levels out to two percent of course. I can’t reiterate that enough. Until that happens you will not be satisfied with this market and you will not be satisfied with your results whatever they may be. So lets get back on track. How are we getting out of the woods?? This market is in the bottoming process. It is not there yet but it is bottoming and now is the time to get into position for the next run. If your in equities stay there. If your out of equities then its time to start building a position or positions. The volatility of the current market makes it very hard to determine what direction it is moving in. It doesn’t matter if you in or if you are out, you will have to endure some pain to stay the course. While there are a few opportunities to get in and out of the market y0u must pick and chose them carefully as this market continues to experience many quick and shallow sell offs followed by equally quick and furious rallies both of which leave your portfolio about where it started in the first place. It is the very definition of frustration. As I just said, this will come to an end, but that time is not now!

So where does all this leave us? The market just completed a tumultuous week in which market players had to watch the government come to the brink of shutting down which created very stiff headwinds. We chose to stay in equities as it was our belief that the politicians would not shut the government down so close to an election year…… and we were correct. Many folks thought that the market would shoot right back up if a shutdown was averted, but so far that has not been the case. It merely refocused on the issues that it was considering prior to the budget crisis. Those are the the economy, possible recession, interest rates, corporate earnings as interest rates increase, and of course last but not least, the FED and how they will react to all of this. Are they done increasing rates?? If so how long will they leave rates at elevated levels? and…..How long before they will start to cut rates? Every Fed meeting will be the same in that the Feds action and statement will be picked apart in consideration of these issues. You all know when this will end… at a 2% rate of inflation and not one day before.

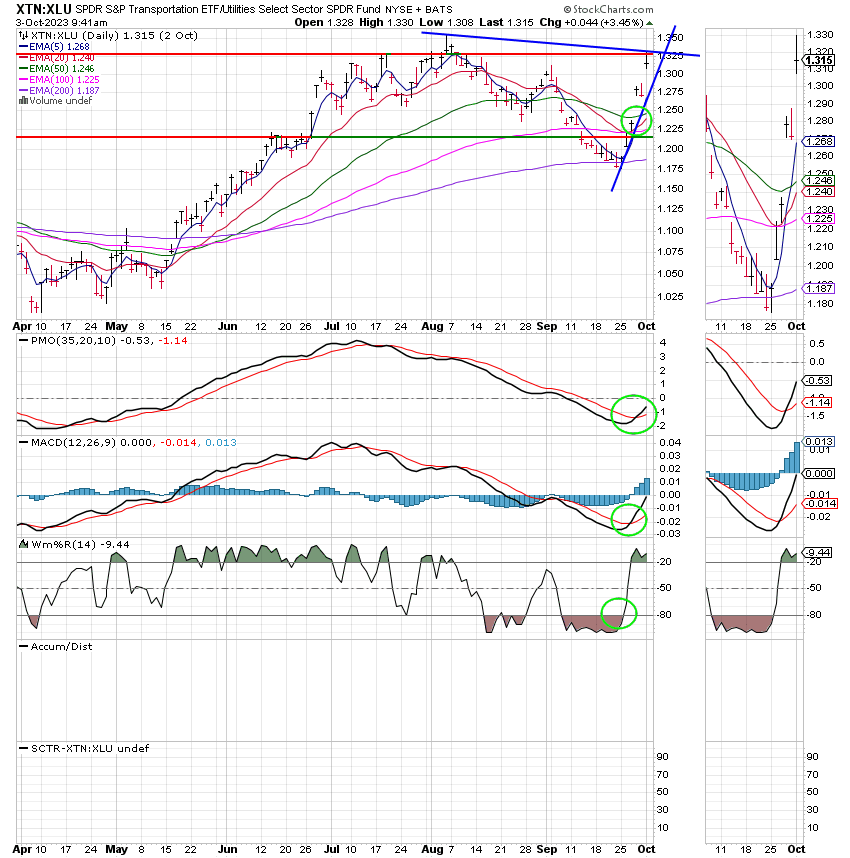

As I mentioned above the market is indeed bottoming. As a technical analyst I will tell you that I would just as soon throw all of the above away. All it is, is an explanation for what we are seeing on our charts. You want technical analysis. Okay, I do too. So why do I believe the market is bottoming? I already wasted all that time writing about the fundamentals above because most folks understand them and not the charts, but lets take what little time I have and discuss the charts. Why do I really think this market is bottoming…. Here we go Sean….. One thing that tells me that it is bottoming is the Transportation vs Utilities ratio. Transportation, Copper, and small cap stocks are my canaries in the coal mine. My early indictors if you will. Transportation has begun to significantly outperform Utilities which is considered a safe haven. This most often occurs early in a new cycle or uptrend. In the chart below you will see that transportation has clearly taken the lead in recent trading sessions. This tells us that it is time to get in position for the next move higher….. The chart is annotated in my usual fashion.

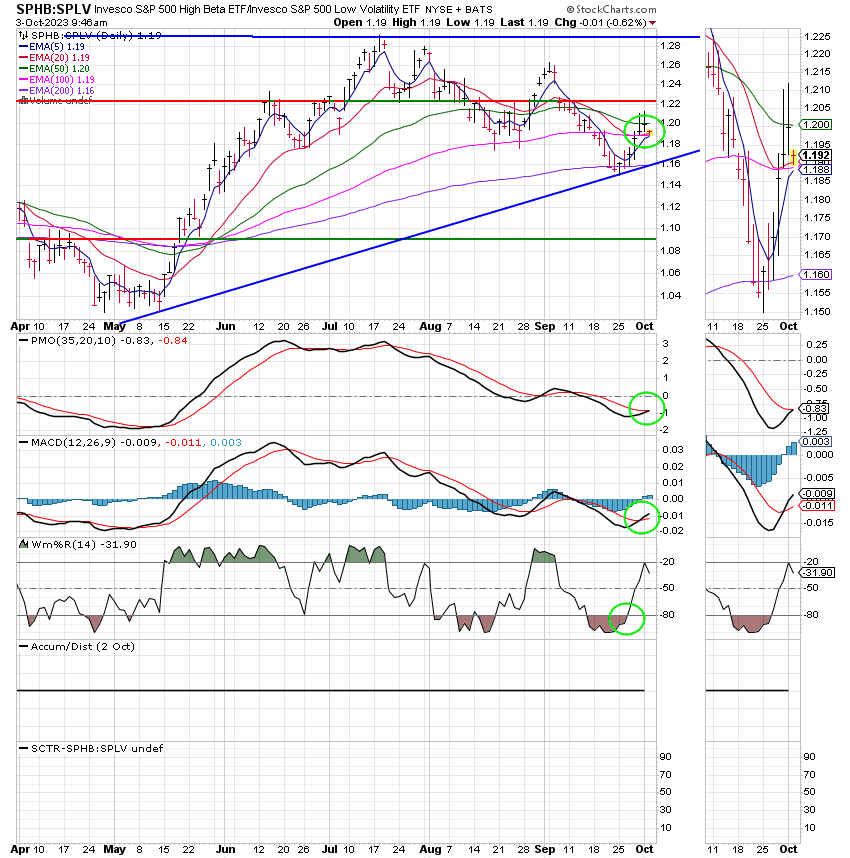

One word of caution about this chart. The recent surge in treasury yields is effecting Utilities which is often viewed as a bond proxy. So the under performance of Utilities with regard to transportation is more dramatic, but that does not totally negate the fact that transportation is performing better in recent sessions. If it (transportation) were not the chart would move sideways instead of higher. Thus, my conclusion is that this market is starting to bottom. Now let consider some more evidence that this market is preparing to move higher. When inspecting my charts I came across the next chart which is a favorite of mine. It compares a High Beta (in other words aggressive) Fund SPHD to a safer low volatility fund SPLY. Both funds are large enough to provide a fair representation of what is going on in the broader market. I have found it to be a very accurate measure of whether money is flowing into higher risk growth stocks or into safer stocks with lower risk. I have found it to be an excellent indicator of an uptrending market. As you can see from the chart below money was clearly flowing into higher risk stocks in recent sessions.

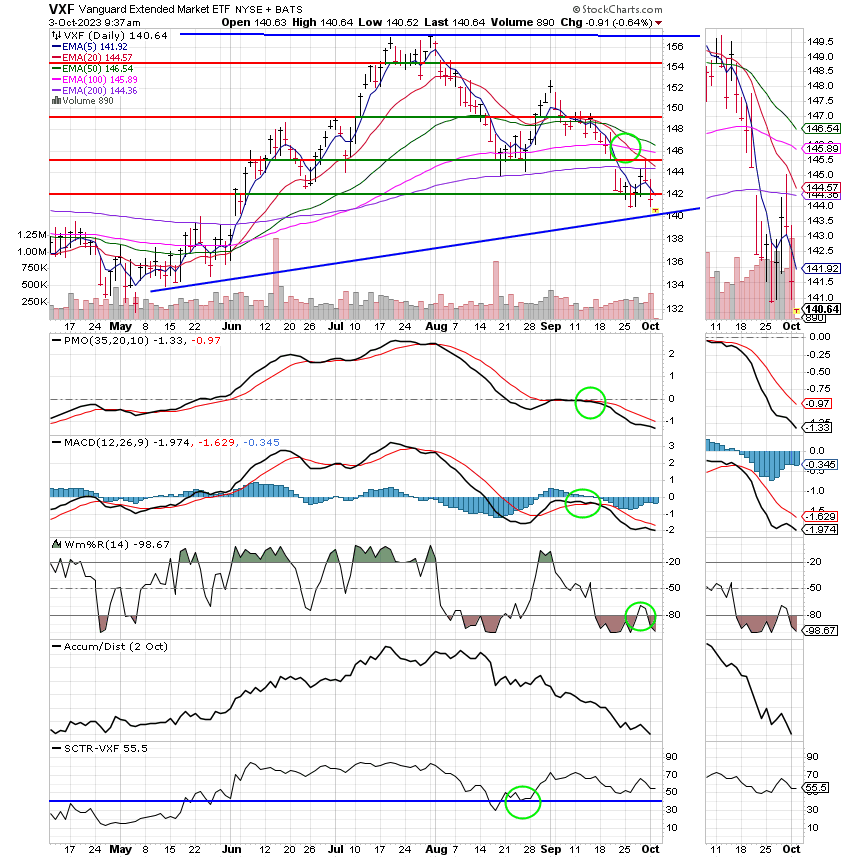

This is why I believe the market it bottoming… Is that in conflict with our other charts? Yes and no. A more accurate way to think of it is that it precedes or predicts where the chart for the C fund is going. That is what determined our strategy. For this reason, we chose to ignore the sell signal that was generated by the C Fund. These charts tell us that the C Fund is likely to reverse and move higher. Thus, we need to remain positioned for that reversal. If we sold now we would/could be left holding the bag.

Now Speaking of the chart for the C Fund. (Chart posted below) Currently, the 5 EMA is still trading above the 200EMA. As long as that is the case we will not consider selling. Also, there is solid support at 420 for the SPY (That’s 4200 for the S&P 500 index). That is our true line in the sand. Today there is some panic selling going on as the 10 Year treasury has reached highs not seen since 2007. If our analysis is correct that should wash out the remainder of the weak hands in this market leaving a clear path higher. There is an old saying that you have to stand for something or you’ll fall for anything. I think it applies here. We will hold fast as long as our support holds. The risk reward ratio is favorable for those that are in the market or those that buy into the market now. The bottom line is that this market is extremely oversold.

The days trading so far has generated the following results: Our TSP allotment is currently off -1.26%. For comparison, the Dow is trading lower at -1.10%, the Nasdaq -1.60%, and the S&P 500 is -1.26%.

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/C. Our allocation is now -6.35% for the year not including the days results. Our monthly return is +0,01%. Here are the latest posted results:

| 10/02/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.7531 | 17.8913 | 66.5952 | 66.1459 | 35.7699 |

| $ Change | 0.0041 | -0.1257 | 0.0052 | -0.8237 | -0.5269 |

| % Change day | +0.02% | -0.70% | +0.01% | -1.23% | -1.45% |

| % Change week | +0.02% | -0.70% | +0.01% | -1.23% | -1.45% |

| % Change month | +0.02% | -0.70% | +0.01% | -1.23% | -1.45% |

| % Change year | +3.00% | -1.74% | +13.06% | +7.50% | +5.38% |