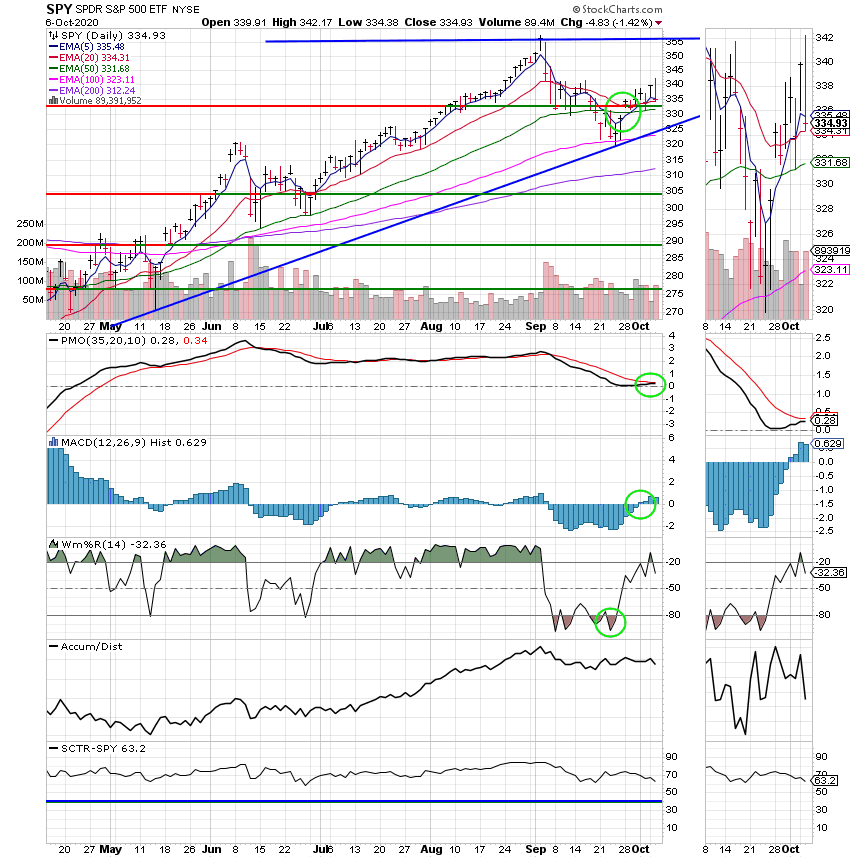

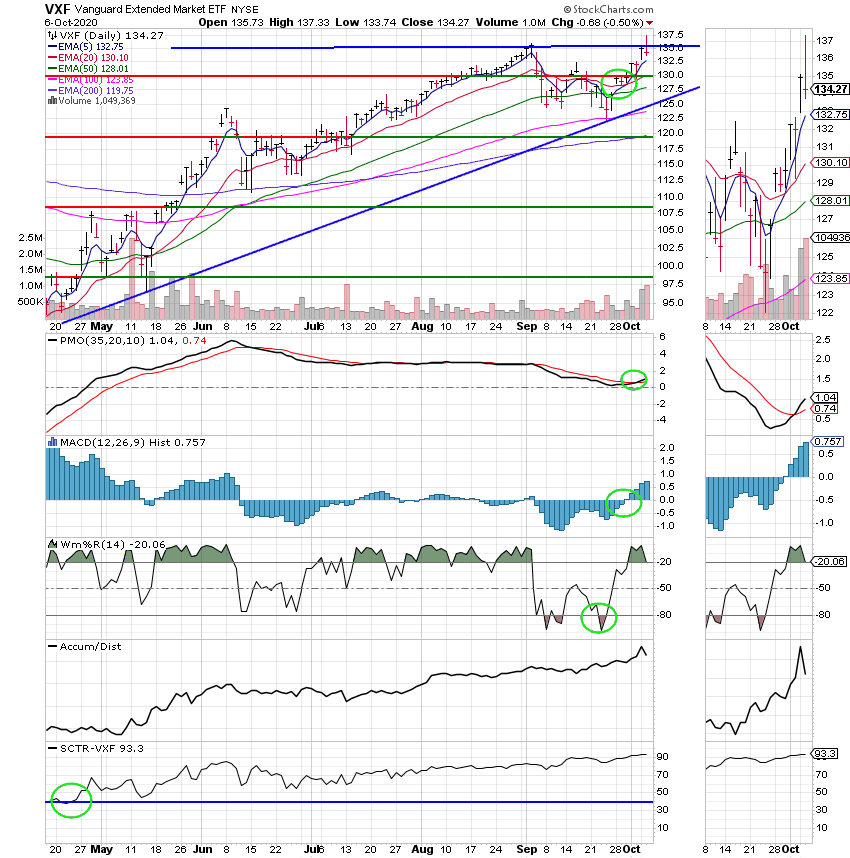

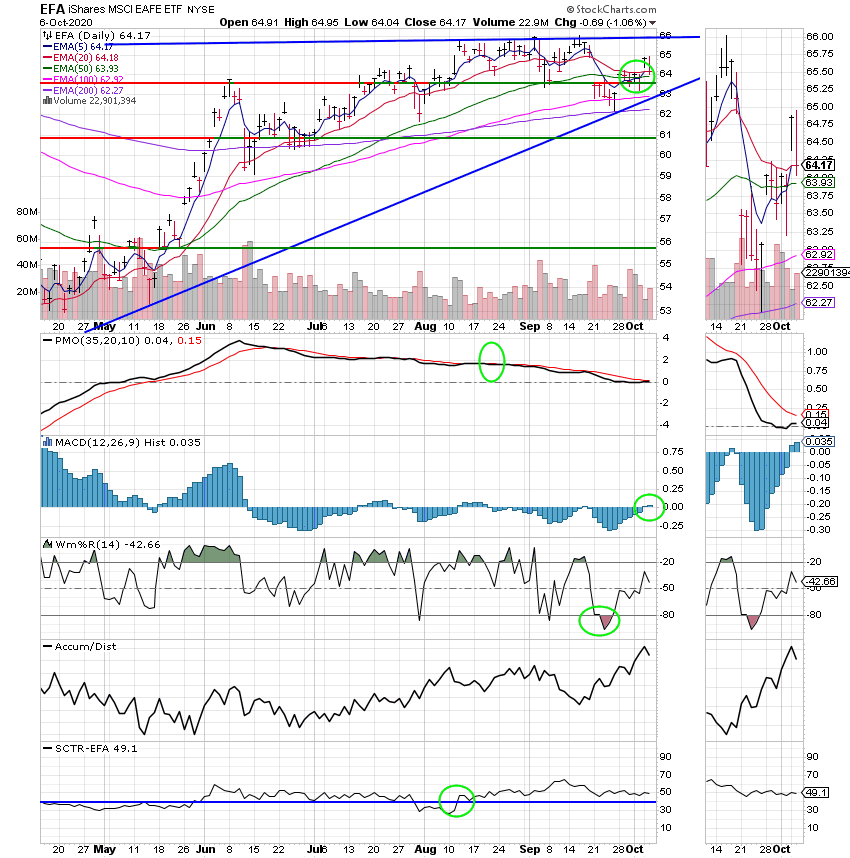

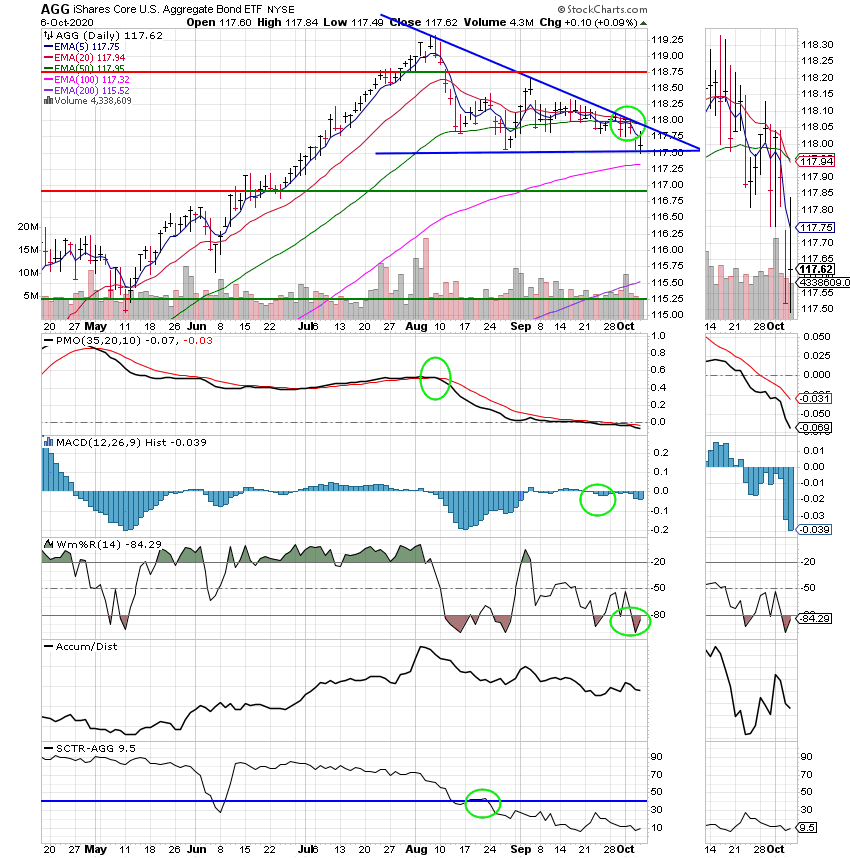

Good Evening, Wow, where do I start? Yesterday afternoon I received a new buy signal on the chart for the S Fund. Actually, for both the C and the S Funds. I said I would ignore the charts and stay out of the market until after the election. After all it was an extremely weak signal that I sold on. I would have been more patient but the fundamental issues kept piling up and the stock prices kept going down so I decided to sell which in retrospect was not a good decision. I own that. It was a safe decision, but not the best decision. As I have said in the past, we make our investment decisions based primarily on the charts but sometimes it is hard to ignore the fundamentals and this was one of those times. Fundamentals can be fickle and that was the case here. The negotiations between Nancy Pelosi and Steven Mnuchin were back on and progressing well and the charts were reflecting that progress. Stocks where rising and an agreement seemed inevitable. Being well positioned in the market prior to an agreement became the priority. Fast forward to todays signal and the decision was made to reenter the market. It almost appeared that we were going to be left behind with stocks making another strong move up as we put in our interfund transfer requests. Then it all disappeared in a vapor when President Trump tweeted that he was instructing his negotiators not to negotiate on a stimulus package until after the election. I looked at the push notification on my phone in disbelief. How could they do this after the Fed Chair Jerome Powell repeated this very day that the economy needed another round of stimulus to get through the Pandemic. Ok alright, slow down here and think about this…. Is he negotiating…after all one of his biggest tactics is to leave the table…Well I guess we will see. The short term battle is definitely in doubt, but the charts aren’t short term. No, they are intermediate term to long term and they are still strong as you will see. There is little doubt that market will not respond well to this news at least for the short term. Nonetheless, we are committed now. We have jumped into the deep water and will have to swim to the shallow part of the pool before we can get out. So where do we go from here?? Should we panic (not a strategy) and jump back out where we will likely find our accounts lighter than they are now….So what do the charts tell us. Right now they are on a solid buy. They are bullish. What do we want to see happen fundamentally? We want to see a stimulus package passed and a clear outcome to the election on November 3rd. Had the stimulus package been passed, we would have no doubt made a lot of money right now and found ourselves way ahead before the election. Such as it is we now have to pass through a valley to get there which may include a long drawn out election. I had hoped to avoid that but we were just too close to making a sizable profit to ignore the opportunity. So here we are. We are in this thing until the election is settled or the charts get so bad we are forced out. One or the other. There is always a slight possibility that we could have a positive surprise and an agreement could be miraculously be reached. We can always hold out hope for that. However, the most likely scenario is one where whoever is in power after the election will pass a stimulus package and the rally will resume at that time. Two things to remember. This market is strong and the charts are actually pretty good. That is the good news. The not so good news is that we will have to have the patience of Job to get through this. In the end we will make more money than we have now, but we are now committed to walk through the valley. All that doom and gloom said I am reminded of the 23rd Psalm and who it is that walks through the valley with us. Yea though I walk through the valley of the shadow of death I will fear no evil, For Thou art with me; Thy Rod and Thy staff they comfort me. Thou preparest a table before me in the presence of mine enemies; Thou aniontest my head with oil; my cup runneth over. Surely goodness and mercy shall follow me all the days of my life and I will dwell in the house of the Lord for ever. Yes, this is not a conventional newsletter or blog. It never has been. We put our faith in the Lord Almighty and He has always been with our group. He has always guided our hand. We have always prospered. He is with us now both in this market and in this pandemic. He does not give us the Spirit of Fear and we should not be afraid of this market or this demonic virus. We shall overcome this just have we have overcome all the other obstacles that this world has put in our path. The bottom line. Keep praying and praising the one got you to this point. Never forget what He has done for you and look forward to what He has for your future. There is no place I would rather be than in His will.

The days trading left us with the following results: Our allocation was steady in the G Fund. For comparison, the Dow fell -1.34%, the Nasdaq -1.57%, and the S&P 500 -1.40%. What a reversal!

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are now invested at 100/S. Our allocation is now +20.12% on the year. Here are the latest posted results:

| 10/05/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4765 | 20.984 | 50.5446 | 60.5835 | 30.9627 |

| $ Change | 0.0010 | -0.0554 | 0.8974 | 1.3545 | 0.4781 |

| % Change day | +0.01% | -0.26% | +1.81% | +2.29% | +1.57% |

| % Change week | +0.01% | -0.26% | +1.81% | +2.29% | +1.57% |

| % Change month | +0.01% | -0.31% | +1.38% | +4.06% | +1.58% |

| % Change year | +0.77% | +6.42% | +6.95% | +7.65% | -5.36% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.607 | 10.4657 | 35.8482 | 10.6152 | 39.6041 |

| $ Change | 0.0827 | 0.0890 | 0.3753 | 0.1219 | 0.4953 |

| % Change day | +0.38% | +0.86% | +1.06% | +1.16% | +1.27% |

| % Change week | +0.38% | +0.86% | +1.06% | +1.16% | +1.27% |

| % Change month | +0.39% | +0.87% | +1.08% | +1.19% | +1.30% |

| % Change year | +1.99% | +4.66% | +2.86% | +6.15% | +3.06% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.7176 | 23.1948 | 10.9243 | 10.9244 | 10.9245 |

| $ Change | 0.1434 | 0.3311 | 0.1910 | 0.1911 | 0.1910 |

| % Change day | +1.36% | +1.45% | +1.78% | +1.78% | +1.78% |

| % Change week | +1.36% | +1.45% | +1.78% | +1.78% | +1.78% |

| % Change month | +1.40% | +1.50% | +1.85% | +1.85% | +1.85% |

| % Change year | +7.18% | +3.17% | +9.24% | +9.24% | +9.25% |

One response to “10/06/2020”

Thank you so much for what you do for us, you are a blessing!