Good Evening, I’m absolutely sure this week finds you all in much better spirits than last week. Five straight days of gains will tend to do that for you….. Many times in the past we’ve talked about the number one thing that makes the market move. It’s what it’s all about. It’s why the market exists. It is earnings. In a way earnings kind of reminds me of the scripture on love in the Bible. It says that if you don’t have love you don’t have anything. Whatever you do without love is worthless. It’s the same thing for earnings as they relate to the market. In the market we ultimately invest in companies. Yes I know there are ETF’s (Exchange Traded Funds) but they are nothing more than a basket full of stocks. So if you own ETF’s you ultimately own company stocks. When earnings are bad everything is bad. Good news means little and bad news is taken even worse than it sounds. The market expects to go down on bad earnings and it will find a way to do so. Conversely, good earnings make everything better. Good news is wonderful and bad news is not such a big deal. So rally on!! You get the picture. There are many things that shape the market but they are all perceived through the lens of how they will effect the profitability of the corporations that make up the stock exchange. Again, when earnings are good everything is seen through rose colored glasses and when earnings are bad the the proverbial glass is always half empty. Which brings me to the current market. The earnings so far have been stellar starting off with the big banks last week and following through to today’s report from Netflix. What does Netflix have to do with us?? Everything. Netflix is one of a group of highflying tech stocks better known as FAANG. Those are Facebook, Apple, Amazon, Netflix, and Alphabet formerly known as Google. So goes these stocks so goes tech and with tonight’s blow out report from Netflix the current rally is hitting on all cylinders. I won’t be the least bit surprised so see stocks go up tomorrow as well. The bad news about inflation and Covid and the Supply chain and all the other negative stuff will continue to be shrugged off until it effects these quarterly reports or is perceived by investors as something that will effect them next quarter. I’m going to show my age now. I remember when Bill Clinton was President and he said “It’s all about the economy stupid” or something very close to that anyway. Well when it comes to the market “It’s all about the earnings” always has been always will be. All roads lead to the corporate ledger book.

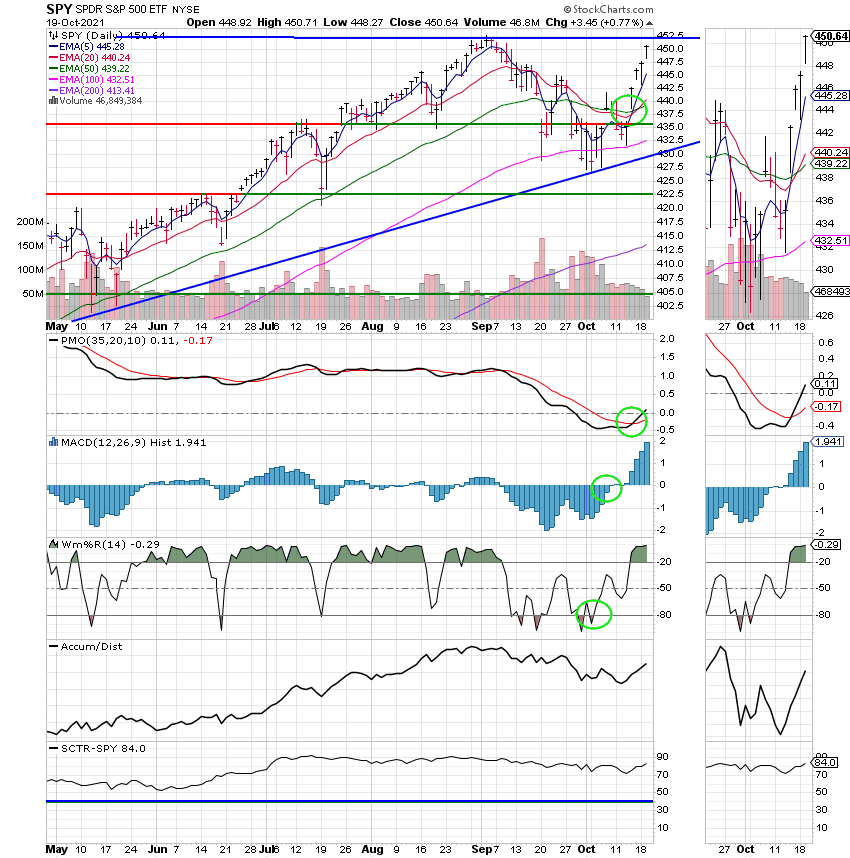

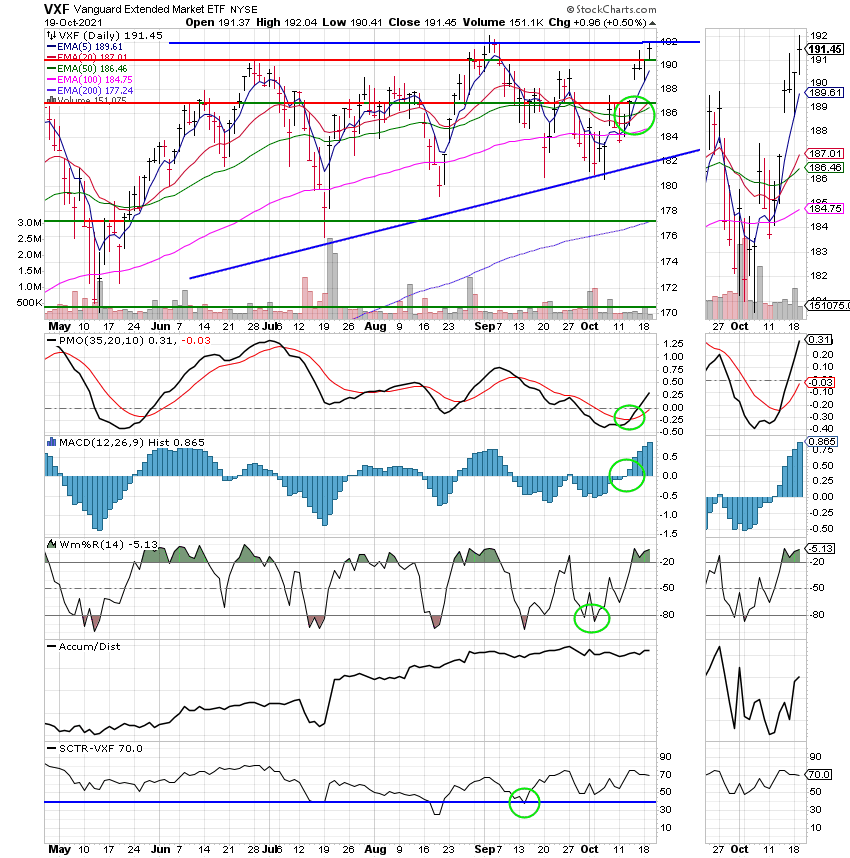

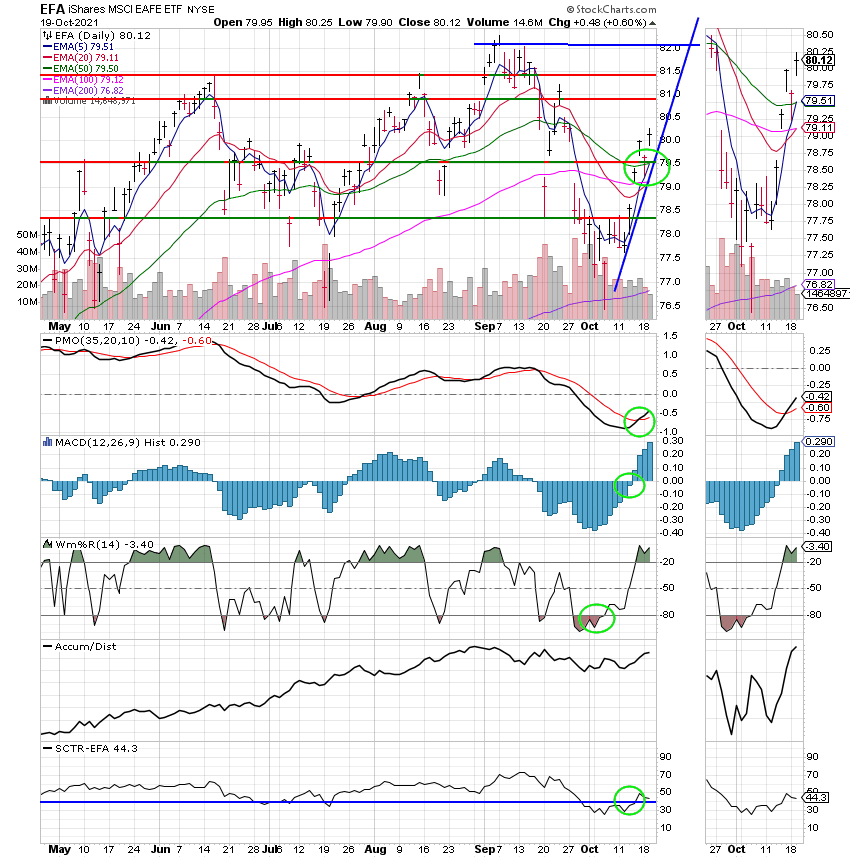

The days trading left us with the following results. Our TSP allotment posted a gain of +0.74%. For comparison, the Dow was up +0.56%, the Nasdaq +0.71%, and the S&P 500 +0.74%. And for those of you keeping score the S Fund posted a gain of +0.50% and the I Fund +0.60%. We had them covered today!! Praise God for that and for the other 4 days worth of gains as well. We really needed a good run and He blessed us with one!

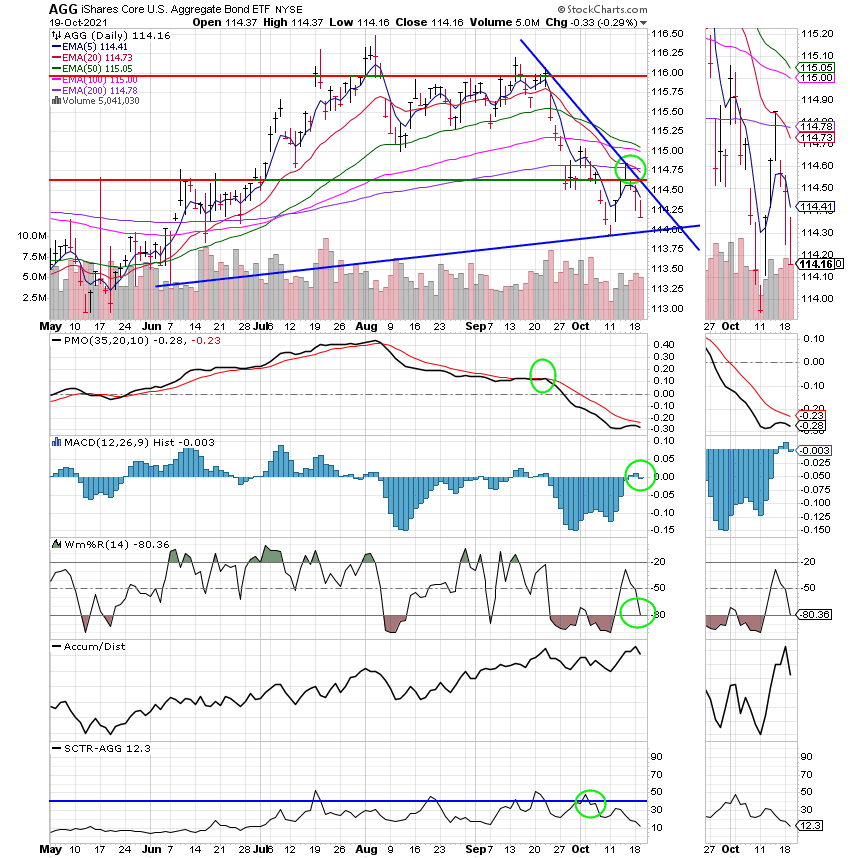

The days action let us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/C. Our allocation is now +15.74% for the year not including the days gains. Here are the latest posted results:

| 10/18/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6847 | 20.8592 | 67.5316 | 86.5236 | 38.9905 |

| $ Change | 0.0021 | -0.0048 | 0.2276 | 0.3505 | -0.1662 |

| % Change day | +0.01% | -0.02% | +0.34% | +0.41% | -0.42% |

| % Change week | +0.01% | -0.02% | +0.34% | +0.41% | -0.42% |

| % Change month | +0.07% | -0.19% | +4.21% | +4.43% | +1.49% |

| % Change year | +1.07% | -1.59% | +20.78% | +16.61% | +10.18% |