Good Evening, The market took a break today with the S&P 500 falling -0.22%. There were several factors at play to slow down the current rally. The earliest drag this morning was bad guidance issued from several companies in the retail sector. Their reports were good but their guidance was poor. The most notable of those reporting today was Lowes which is considered a bellwether stock. Also worth noting, just last week the CEO for Walmart who knows a thing or two about how the economy is going predicted that there would be deflation in the near future. For those of you that aren’t familiar with economic terms, deflation is the opposite of inflation which is a fancy way to say that prices will fall, that things will be worth less. I’m all for that but the thing you must remember is that a deflationary environment is usually brought about by a recession. Folks, we’re not out of the woods yet!! When will we be out of the woods? Why when the rate of inflation reaches the two percent level of course. Until that happens there will be more of the same. Rinse and repeat! The next and probably biggest issue was the release of the minutes from the last Fed meeting which indicated that (surprise surprise) policy would likely stay restrictive for a longer period of time than investors are anticipating. And… this news surprised someone??? Okay, alright……just don’t forget what the Fed wants to do and that is to reduce the rate of inflation to what????? Why two percent of course. I first mentioned this over two years ago and not to say I told you so but…….. The third big issue of the day was a slowing housing market. As rates remain “higher for longer,” housing data shows last month was difficult for prospective homebuyers. Existing home sales in October came in at 3.79 million units, versus estimates of 3.9 million, according to the National Association of Realtors. This marked the slowest sales pace since August 2010, and a 14.6% fall from the prior year. So do ya’ll get the theme here?? The economy is slowing. What’s the Fed trying to do? Slow the economy in order to reduce the rate of inflation. Now most investors are looking for and expecting a soft landing which is to bring the rate of inflation back to two percent without causing a recession. That is something that is very hard to do….very hard. So what will happen if we actually get a recession which is a contraction of the economy? These investors will be both disappointed and scared. They will sell! With that in mind I will repeat what I said about this scenario in the past. Prepare for the worst and pray for the best! Sell is not a dirty word. As long as this threat exists we will keep a defensive mindset.

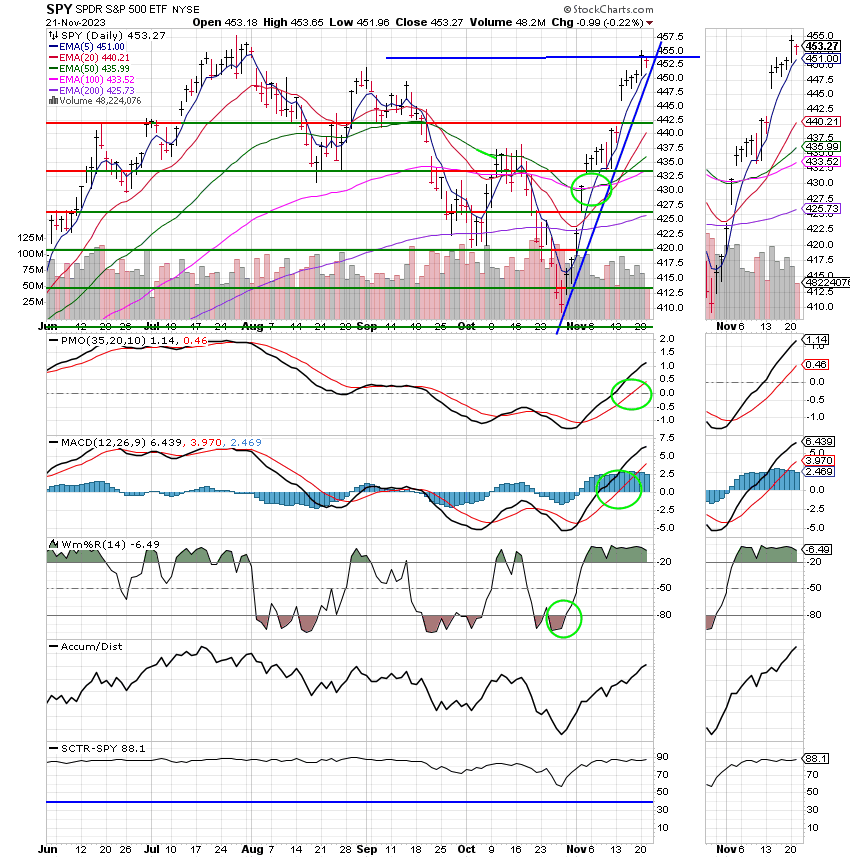

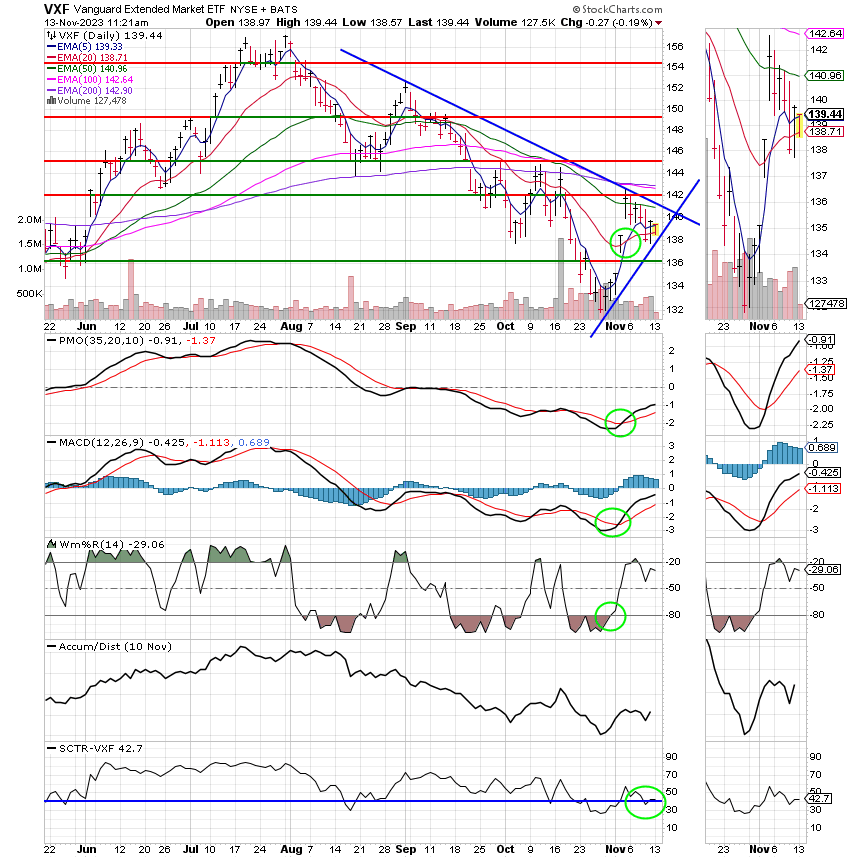

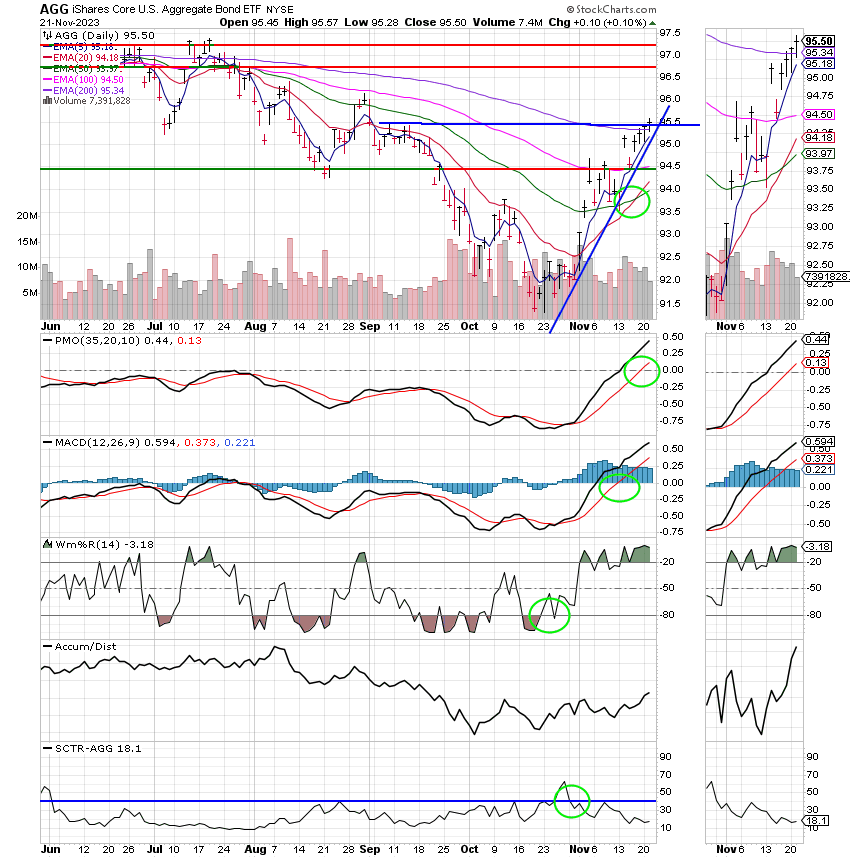

With that in mind we moved our money to the G Fund last week. Why many of you asked? Several of our indicators started to tell us that the market has become extended and in need of a rest. Given that we were sitting on a nice profit we decided to move to the sidelines until the anticipated pullback is over. If all goes according to plan, then we’ll gain some ground when we get back in. That is what we do and that is how we make our money. We just need to be patient and let it play out. Sometimes, the market drops drastically and we make a lot of money and sometimes it moves mostly sideways and we make very little or break even. The most important thing is that we have our precious capital protected at times when the risk is highest. We had a nice discussion about this on our Facebook page so I won’t reinvent the wheel here. You can follow the discussion there if you like.

The days trading let us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow fell back -0.18%, the Nasdaq -0.59%, and the S&P 500 -0.20%.

S&P 500 and Nasdaq snap 5-day win streak as Fed indicates policy must stay restrictive: Live updates

| 11/20/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.8694 | 18.3682 | 70.7779 | 68.7254 | 37.9722 |

| $ Change | 0.0074 | 0.0324 | 0.5264 | 0.4579 | 0.1996 |

| % Change day | +0.04% | +0.18% | +0.75% | +0.67% | +0.53% |

| % Change week | +0.04% | +0.18% | +0.75% | +0.67% | +0.53% |

| % Change month | +0.27% | +3.58% | +8.57% | +9.47% | +8.10% |

| % Change year | +3.68% | +0.88% | +20.16% | +11.69% | +11.87% |