Good Evening, It’s been a wild week. The market was rebounding from the latest tech selloff until it came time for President Biden to appoint a Fed Chairman for the next term. I promise you when I say this I am trying not to let politics get involved but due to the nature of the subject it is impossible to talk about it and not seem like I am. So I’m just going to say that I love you all Red and Blue…. All President Biden had to do was quietly nominate Jerome Powell for a second term as Fed Chairman and all would be well. You’d think he could do that one simple thing, but no he could not. He had to bring politics into the situation and publicly consider Lael Brainard as his nominee. Even though this is supposed to be a politically neutral appointment he had to appease the progressive members of the Democratic Party and interview Brainard for the position. As it is she was nominated for Vice Chairman. What President Biden succeeded in doing was bringing the markets attention to interest rates. I know what your thinking and How Scott did he do that?? Glad you asked, I’ll Tell you. Ms. Brainard is one of he most Dovish fed governors on the board. What I mean by dovish is that she totally supports artificial stimulus meaning she would most definitely keep interest rates lower for longer. Interest rates are the main tool that the Fed uses to control inflation which it prefers to keep at or close to 2.00% as measured by the Consumer Price Index (CPI) which is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Currently inflation is running higher than the Fed’s 2.00 % target. Jerome Powell has stated that the Feds view is that the current level of inflation is due to supply chain issues resulting from the pandemic and thus is transitory and will naturally become lower with time. Given that view Powell has stated that the Fed will be slow to raise interest rates and that any decision to do so will be data driven. That and in and of itself allows inflation to run higher than the two percent target. It is said that Ms. Brainard favors and even more accommodative fed policy than that and would leave rates lower even longer which would ultimately lead to even higher inflation. Wow, that’s the simple version of this. It’s actually more complicated than that but you probably don’t want to read all that and I definitely don’t want to write it!! So in a nutshell things where going fine until this nomination process (dare I call it a process) drew attention to that unmentionable word once again, INFLATION. You’ll probably remember things were sailing along fine back in August too when this same issue rose up and small caps and tech started selling off and eventually caused the entire market to take a nice dip. Why was/is that? As I pointed out then and I will point out now small cap companies and tech companies grow more efficiently when they have cheap capital to fuel the growth. When money becomes tighter it makes it harder to justify the future (high) valuations. When that happens market players sell those stocks and that is what happened in August and that is what is happening again now. All they had to do was leave it alone and we would have rallied into the new year but no they had to shine a spotlight on the I – word. Dare I say it again. Oh what the heck, the horse is out of the barn anyway. Inflation! So who are these progressives. As far as I’m concerned they are no more than a group of socialists who would like to impose their socialism on us. Progressive is just a code word for socialist. One of my favorite Senators in either party who happens to be a Democrat, Senator Joe Manchin of West Virginia said this when the progressive caucus was attacking him over his economic policy. “Why do you folks keep asking me about the progressives? I am not nor have I ever been a progressive. If the American people want the progressive agenda then they need to elect more of them. I am not changing my stance. The most I will support in the infrastructure bill is 1.5 trillion. Anything higher than that is fiscal insanity!” At the time they were debating the newly passed bipartisan infrastructure bill and the progressive caucus were saying many nasty things about Joe and the other Democratic Senators that were blocking their version which was trillions more actually 9.7 trillion. That is trillions with a capital T!!!!! Your grandchildren’s grandchildren would be paying for that! Oh I can’t help myself in this point! Folks make no mistake These so called progressives are the enemies of capitalism and of the free market. Think not?? Lets just look at todays news. President Joe Biden said Tuesday that the administration will tap the Strategic Petroleum Reserve as part of a global effort by energy-consuming nations to calm 2021′s rapid rise in fuel prices. The coordinated release between the U.S., India, China, Japan, Republic of Korea and the United Kingdom is the first such move of its kind. The U.S. will release 50 million barrels from the SPR. Of that total, 32 million barrels will be an exchange over the next several months, while 18 million barrels will be an acceleration of a previously authorized sale. U.S. oil dipped 1.9% to a session low of $75.30 per barrel following the announcement, before recovering those losses and moving into positive territory. The contract last traded 2.5% higher at $78.67 per barrel. International benchmark Brent crude stood at $82.31 per barrel, for a gain of 3.2%. My My My……… so fuel prices have gotten so high after Keystone XL pipeline was cancelled under pressure from the progressives and shale oil production was brought to it’s knees again by pressure from the progressives. Global warming, the green new deal…. whatever just leave the economy and the market alone! Ok alright the gauntlet is down. I got really upset while I was writing this. I’m sorry but I must speak the truth. These people are not our friends. Anyone that is an enemy of the constitution of the United States of America as written, is a socialist or is an enemy of free market capitalism is my enemy period! That said I will continue to pray for my enemies as well as my friends but I will never say what these people are doing is right. Not ever…… So what does all that mean for us?? Our move to the S Fund has not gone as we’d hoped. The chart for the S Fund caught and surpassed the chart for the C Fund for a total of two days. The day we moved our money and the day after. Then it whipsawed which is to say it reversed leaving the chart for the C Fund on top. The gap between first and second charts has been increasing ever since with the resulting performance of each following suit. So why not change the allocation? If you all chose to change back to 100/C I will definitely say that’s alright. However, I have decided not to do it yet myself as the chart for the S Fund is signaling a possible bottom and reversal. That being the case the small cap driven S Fund will realize gains much faster than the large cap C Fund which would result in diminishing our performance should we move back to the C at this time. Sometimes you can move to quickly and cost yourself and this looks like it could be one of those times. That said I’m sticking with the S Fund just a little longer to see if I can get that reversal. If not I will be satisfied with what the Lord has provided for me in 2021 and pray for another good year in 2022.

The days trading left us with the following results: Our TSP allotment fell back -0.51%. For comparison, the Dow added +0.55%, the Nasdaq dropped -0.50%, and the S&P 500 gained +0.17%.

Dow climbs nearly 200 points but Nasdaq falls again as rising rates divide the market

The days action left us with the following signals: C-Buy, S-Hold, I-Hold, F-Sell. We are currently invested at 100/S. Our allocation is now +16.66% on the year.

| 11/23/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7105 | 20.713 | 70.7074 | 86.5063 | 38.9987 |

| $ Change | 0.0008 | -0.0814 | 0.1175 | -0.4487 | -0.2827 |

| % Change day | +0.00% | -0.39% | +0.17% | -0.52% | -0.72% |

| % Change week | +0.02% | -0.84% | -0.14% | -1.85% | -1.41% |

| % Change month | +0.10% | -0.85% | +1.97% | -0.97% | -0.93% |

| % Change year | +1.22% | -2.28% | +26.46% | +16.58% | +10.20% |

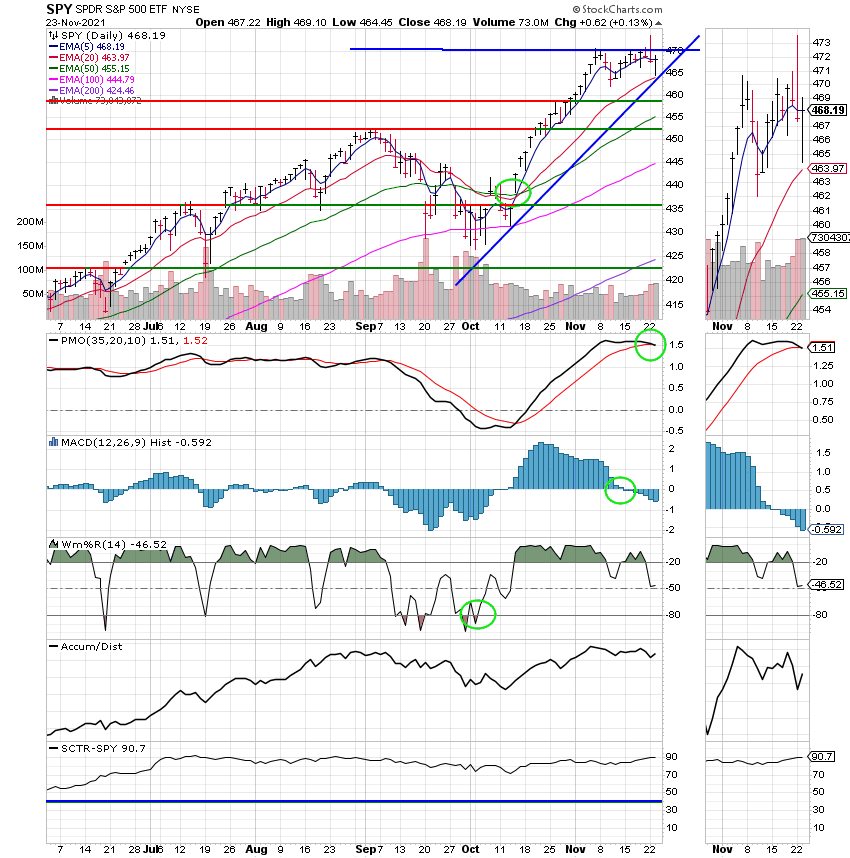

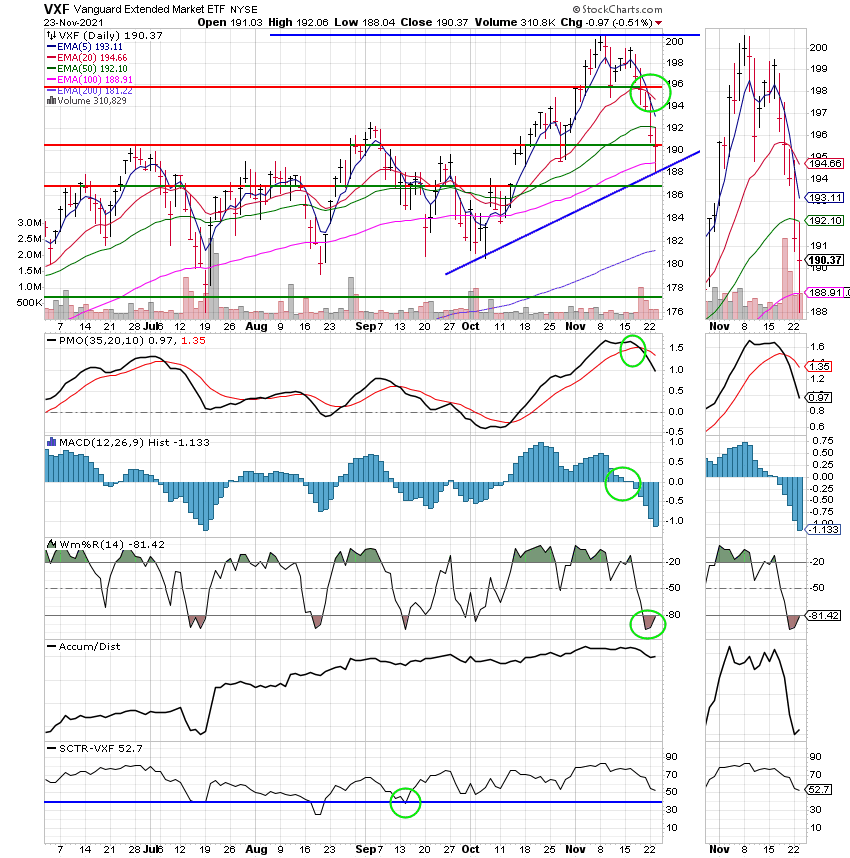

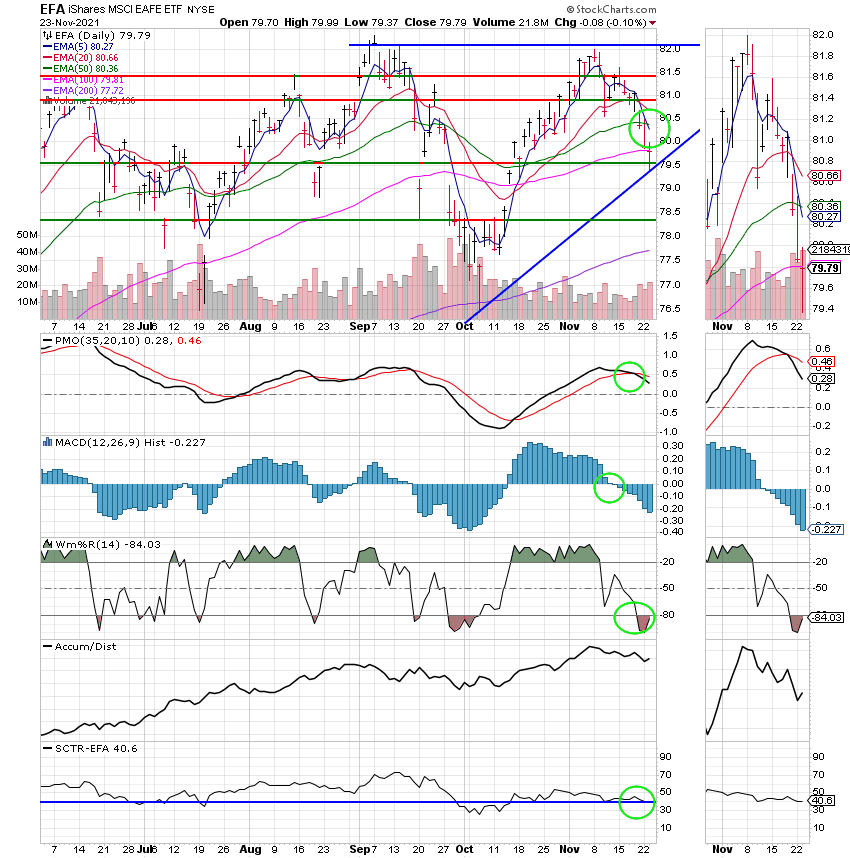

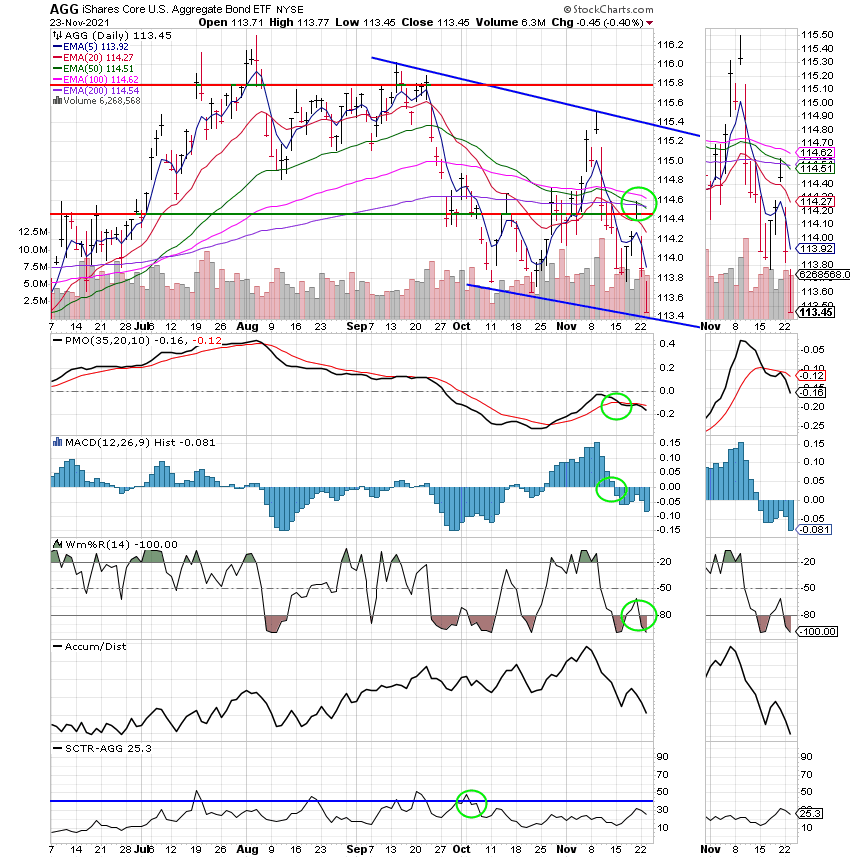

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Nothing to add here. I’ve said enough tonight to be sure. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.