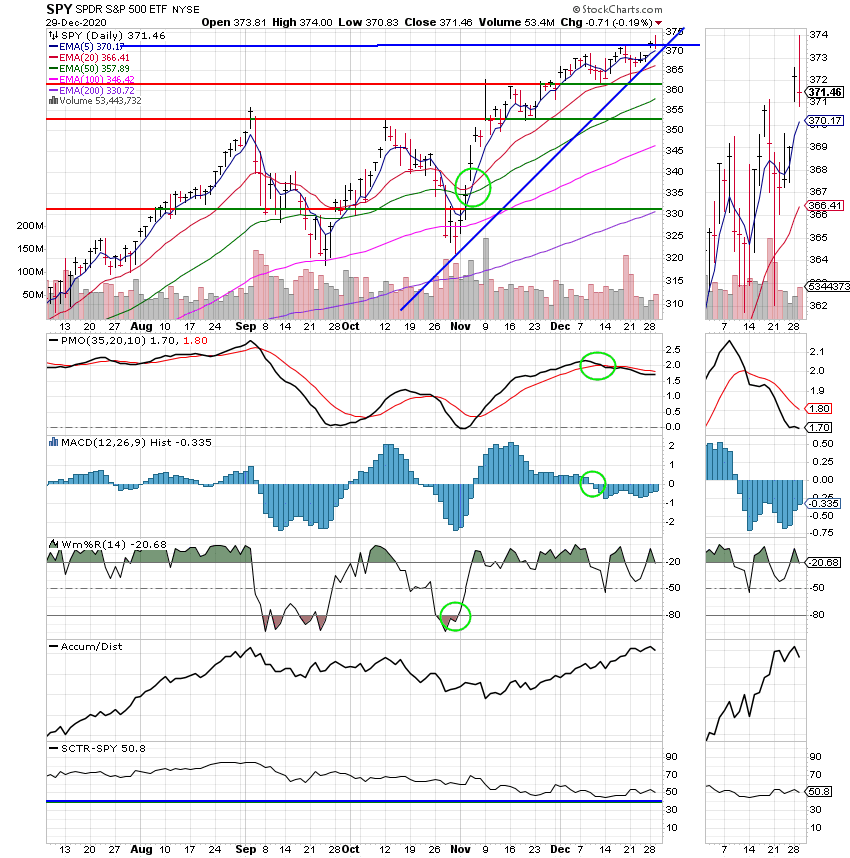

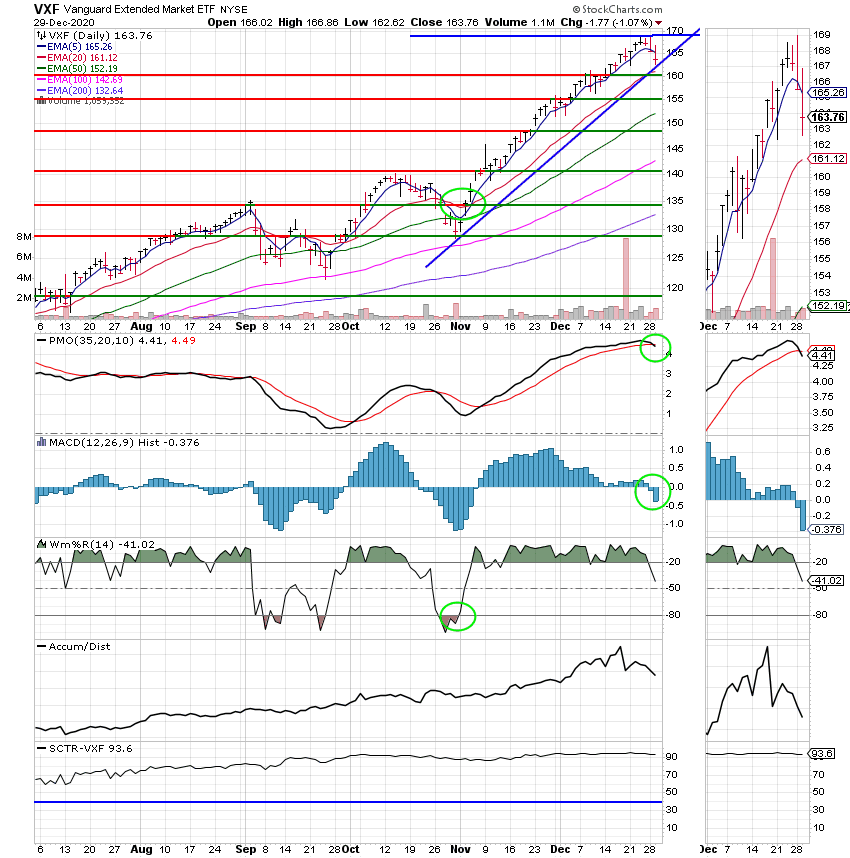

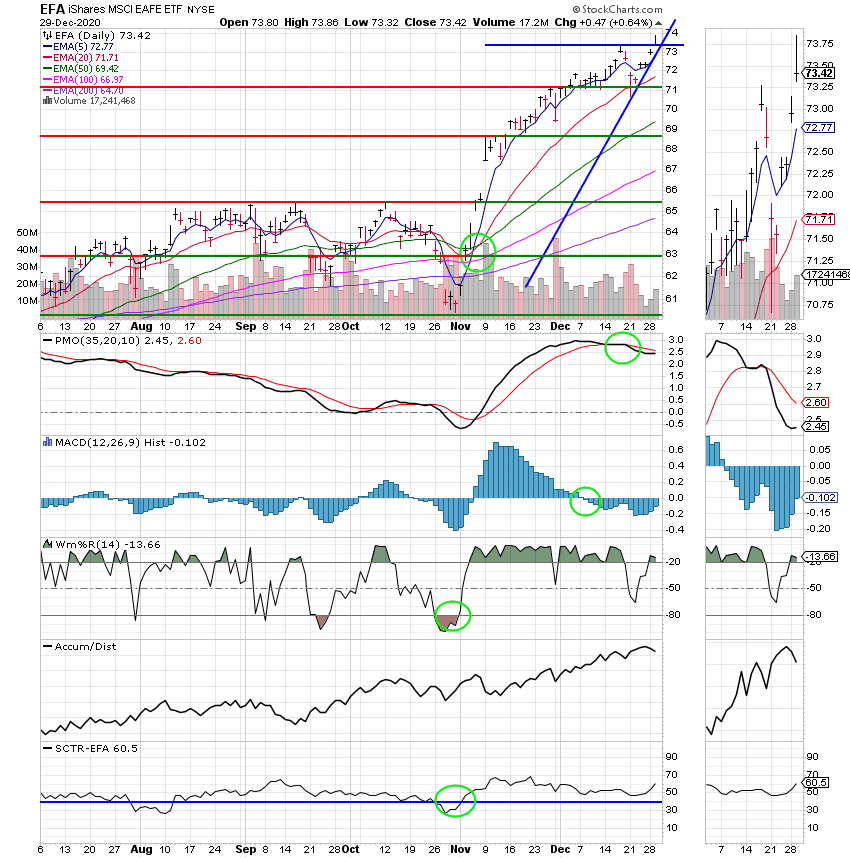

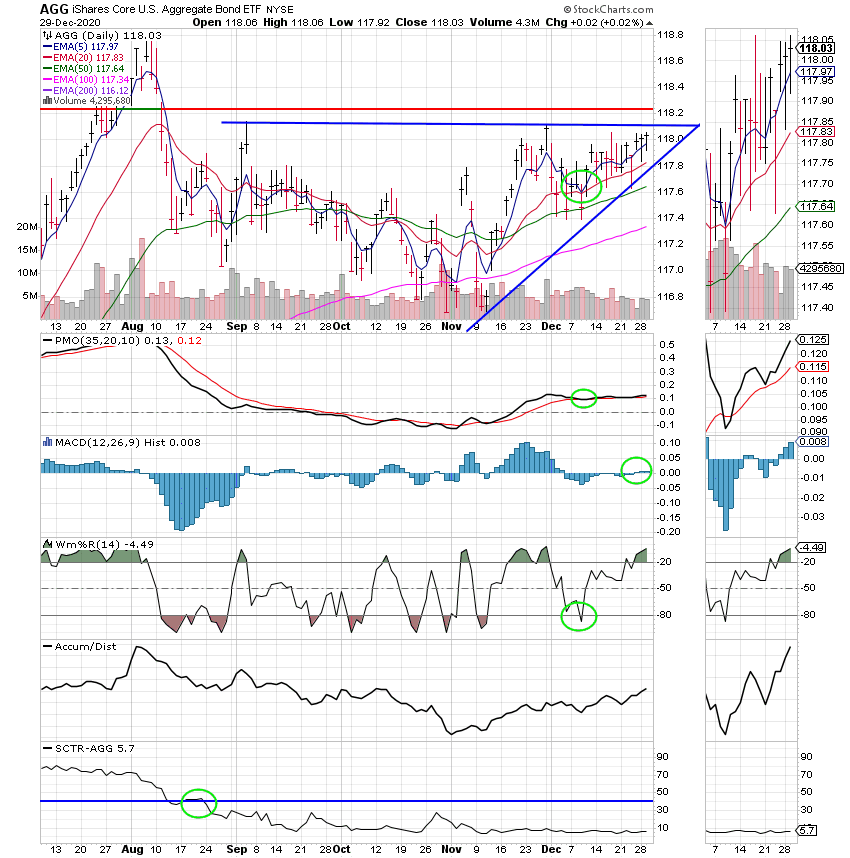

Good Evening, Happy New Year! And might I add, good riddance to the old one…..Although I must say that it’s been a surprisingly good investment year. I guess that’s a whole lot better than nothing! I know the market went down today. I know it’s volatile. Let me say that the last two weeks of the year are the worst two weeks to make any investment decisions based on what your seeing in the market. Why? Low volume. A lot of big traders are away from their desks and won’t return until after New Years Day. It’s always that way. And low volume means high volatility. What does that mean to you? The market can be easily pushed around. So you can’t really trust what is going on as indicator of where the market might be going. Compounding that is the fact that there is a lot of profit taking and tax selling. And speaking of profit taking…..what made the most money for investors in 2020? Tech and small caps. So let me make this clear. When investors take profit they are taking it largely from small caps. Not because their bad. NO! Because that is where they made the money!!! That is the reason your S Fund (a small cap/ mid cap blend) dropped. Small caps and tech are still good investments! They were not sold because something is wrong with them. Momentarily, they are a victim of their own success. With that said, investors may shift into value (large cap) stocks after the first of the year with a new stimulus package boosting the economy and that’s fine. We’ll deal with that when we see it on the charts. but right now is no time to make that decision. It is impossible to tell where the market may be moving with so many investors still at home. So don’t panic when you experience this volatility and remember….Panic is not a strategy!!!!!!!! Overall, my indicators are still pointing up. At some point that will eventually change, but all I can say now is that it is not this point!! Not yet. So hang in there.

The days trading left us with the following results: Our TSP allotment fell back -1.07%, For comparison, the Dow dropped -0.22%, the Nasdaq -0.38%, and the S&P 500 -0.22%. Today was rough but I thank God for the year we’ve had. We have been truly blessed.

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/S. Our allocation is now +48.90% for the year not including the days results. Here are the latest posted results.

| 12/28/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5072 | 21.1587 | 55.5933 | 74.7005 | 35.1518 |

| $ Change | 0.0016 | 0.0090 | 0.4809 | -0.7761 | 0.2629 |

| % Change day | +0.01% | +0.04% | +0.87% | -1.03% | +0.75% |

| % Change week | +0.01% | +0.04% | +0.87% | -1.03% | +0.75% |

| % Change month | +0.07% | -0.04% | +3.25% | +7.96% | +3.94% |

| % Change year | +0.96% | +7.31% | +17.63% | +32.74% | +7.44% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.2517 | 11.1338 | 38.6689 | 11.5342 | 43.3473 |

| $ Change | 0.0312 | 0.0318 | 0.1334 | 0.0431 | 0.1733 |

| % Change day | +0.14% | +0.29% | +0.35% | +0.38% | +0.40% |

| % Change week | +0.14% | +0.29% | +0.35% | +0.38% | +0.40% |

| % Change month | +0.95% | +2.03% | +2.51% | +2.75% | +3.01% |

| % Change year | +5.03% | +11.34% | +10.95% | +15.34% | +12.80% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 11.8077 | 25.7157 | 12.3606 | 12.3607 | 12.3609 |

| $ Change | 0.0494 | 0.1131 | 0.0649 | 0.0649 | 0.0650 |

| % Change day | +0.42% | +0.44% | +0.53% | +0.53% | +0.53% |

| % Change week | +0.42% | +0.44% | +0.53% | +0.53% | +0.53% |

| % Change month | +3.23% | +3.45% | +4.19% | +4.19% | +4.20% |

| % Change year | +18.08% | +14.38% | +23.61% | +23.61% | +23.61% |