Good Evening, I’ve talked my friend and fellow government servant Wayne into giving us his spin on the market again this week. I don’t know if you all followed up on the last analysis he gave us but it turned out to be petty good. I particularly liked his use of a variety of indicators some of which give you a little different perspective of the market than mine. Wayne introduced himself a few weeks back when he wrote his first of what I hope will be many guest blogs. So if you aren’t familiar with him just look in the archive of past blogs and read his introduction. So once again, here’s Wayne….

Hello Again,

Below is my analysis about S&P 500 and TSP allocation:

The US indices were pushed higher as the majority of the big tech names reported earnings last week. While the money flowed to those big name tech companies, it outweighed the negative effects on the indices from other sectors. The tech earnings success overshadowed the economic contraction in this period from the Pandemic. There are many more earnings reports to come next week.

If you click on the charts they will become larger.

IMHO, we are in bull market from VIX(Volatility Index), Copper, lumber, put/call ratio, and new highs new lows, etc.

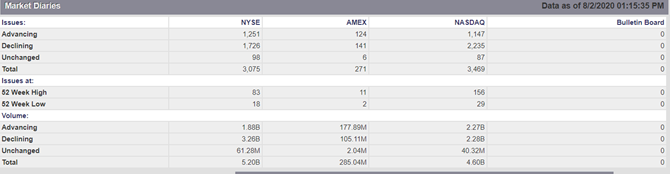

New highs new lows ratio: NYSE and NASDAQ are healthy.

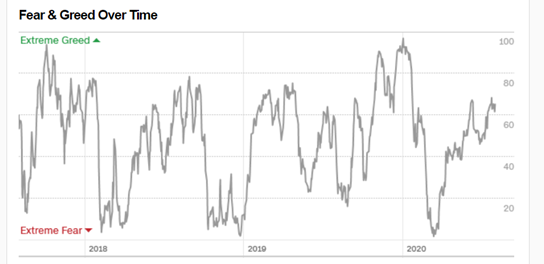

Fear & Greed Index is now 65, which is not too extreme but still under our radar.

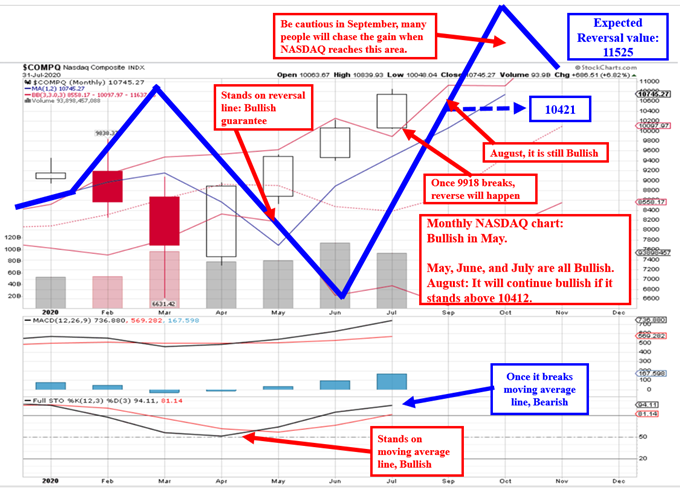

NASDAQ monthly chart shows strong bullish in May, June, July. It will continue bullish in August if it stands above 10412. However, we will see how the reversal line go in September – October.

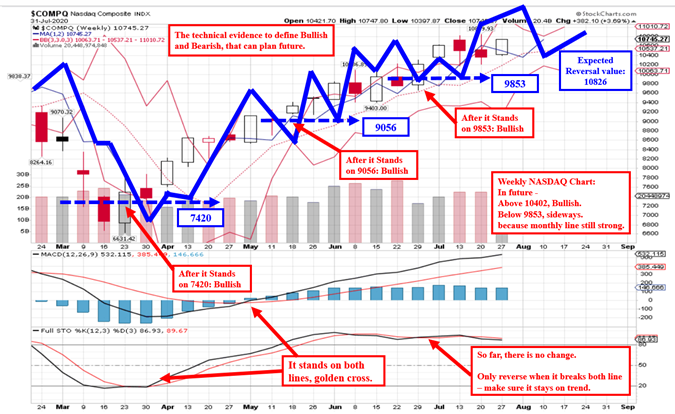

NASDAQ weekly chart shows it will reach 10826 in near term.

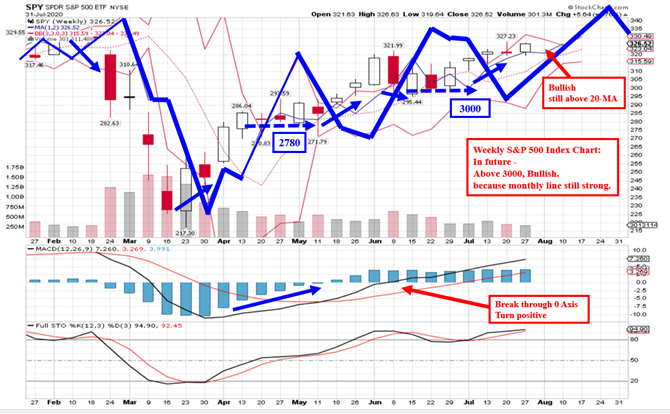

S&P 500 Index weekly chart: It stands above 3000, still bullish. We may see a slow bull while it takes breather, which is common. Weekly MACD stays above 0-Axis, good for long run.

The resonance from both DMI & MTM turned positive was a good signal. Also, both DMI & MTM are still positive now.

From reading the analyst Tom Bowley, the market is picking up the signal that the worst of the economic crisis is over, we likely won’t see another leg down.

Last time we discussed that the S&P index would continue which at the time was around 3121.

This coming week, we will see S&P index continue higher. However, we may see a little pull-back as hourly KD will have dead cross. It will not be a surprise if S&P index hits it;s 20-MA (Moving Average) or 30-MA and then pulls back. If there is no “black swan” again, so the market should continue UP until September.. Then we will see how it goes at that time.

“By knowing the exact vibration of each individual stock I am able to determine at what point each will receive support and what point the greatest resistance is to be met.”

– WD Gann

May God Bless.

Wayne

“After exhaustive researches and investigations of the known sciences, I discovered that the Law of Vibration enabled me to accurately determine the exact points to which stocks or commodities should rise and fall within a given time. The working out of this law determines the cause and predicts the effect long before the Street is aware either.”

Every movement in the market is the result of a natural law and of a Cause which exists long before the Effect takes place and can be determined years in advance. The future is but a repetition of the past, as the Bible plainly states:

What has been will be again, what has been done will be done again; there is nothing new under the sun. Ecclesiastes 1:9

“I have studied the Bible very carefully because I believe it is the greatest scientific book every written. The laws are plainly laid down how to make a success. There is a time and season for everything, and if man does things according to time, he will succeed. The Bible makes it plain that not all are born to be prophets, not to be farmers, doctors or lawyers, but each can succeed in his own special line.”

“If men would only follow the Bible and know that there is a time to stop try making money and to keep what they have, then wait for another season when the time is ripe, they would continue to succeed indefinitely”

“Remember, everything in this universe is elliptical or circular in motion; that applies both to the abstract and the concrete, the mental, physical and spiritual. Every thought you think makes a circle, and it comes back to you. It may take years but you will get the effects, good or evil, according as the thought was either good or evil. That is a truth we should learn, and the world will be the better for it. ”

Gann