Good Evening, I honestly think that do to all the additional readily available sources of news that we have nowadays that news gets over sensationalized and causes oversized reactions to everything. The market rallied again today after last weeks sizable selloff caused by the short squeeze of Game Stop (GME) stock which was fueled in turn by the unprecedented use of social media by smaller investors to embarrass some well known hedge funds who were attempting to make money by shorting (manipulating lower) Game Stop and a few other routinely shorted stocks. The media fed on the situation like a bunch of piranha and that started the selling and the selling begot more selling all fueled by the incessant news stories about the squeeze. Rather than go into the thing again in great detail I won’t reinvent the wheel. We discussed the issue as it was taking place on our Facebook page. Here was the post: It’s sure been a busy day hasn’t it? I wouldn’t even have to look at my charts to know that as I have several messages from folks that are shall we say concerned. So what happened? The little guys won one. Actually, they routed several large short selling hedge funds. So the hedge funds got squeezed on their short positions and were forced to sell long positions to cover their losses. That Ladies and Gentlemen is what made the broader market drop. That leaves politicians like Elizabeth Warren calling for the SEC to regulate this behavior. Well, the only difference I can see between this and what has gone on since I started trading was that the little guys won. Short sellers and high speed computer algorithm’s have pushed the market around for years. It seems that a bunch of day traders got together in an online chat room and decided to buy shares of GME (Gamestop) and AMC (AMC Entertainment) and ran them up several hundred percent. Here’s the CNBC take on it… “But it was intensifying speculative behavior among retail investors that was causing the most concern. Heavily shorted names, including GameStop and AMC Entertainment, continued to be pushed higher by amateur day traders in online chat rooms. Some investors are worried about mounting losses by hedge funds spilling over to other areas of the market as those funds sell other securities to raise cash. Investors are also concerned the speculative behavior is a sign the market is overvalued and a pullback is near.” Just for the record I dislike both short sellers and day traders equally….. Anyway after looking at my charts I decided to hang around. The S Fund is still trading well over it’s 50 day moving average. So I’m not going to get too concerned unless it moves lower than that. It is my expectation that this situation will last a day or so and then the uptrend will resume. That said, I’m a buyer. If there’s any spare change in the G Fund I’d put it to work at these bargain prices. I could always be wrong but I just don’t think we’ve reached the top of this mountain just yet. The FED released a very accommodative statement today. They are going to do whatever it takes to help this economy start humming again. So as the old saying goes “Don’t fight the FED”. That is what we talked about and it turned out to be dead on. Check out our Facebook page if you want to keep of with the latest! The moral of the story is that what goes up must come down and as we always say…panic is not a strategy. Any one that got wrapped up in the media induced panic of this short squeeze and sold paid for it by missing the recovery rally yesterday and today!! Usually the market will make moves over a lengthy period of time. Very seldom will it drop on a dime. Flash crashes like the one that occurred in October of 1987 are few and far between. By the matter of fact, they are so few since the market started trading that you can be count them on one hand……….

The days trading left us with the following results: Our TSP allotment posted another nice gain of +1.83%. For comparison, The Dow added +1.57%, the Nasdaq +1.56%, and the S&P 500 was 1.39%. Praise God for another wonderful day. He has been so good to us!!

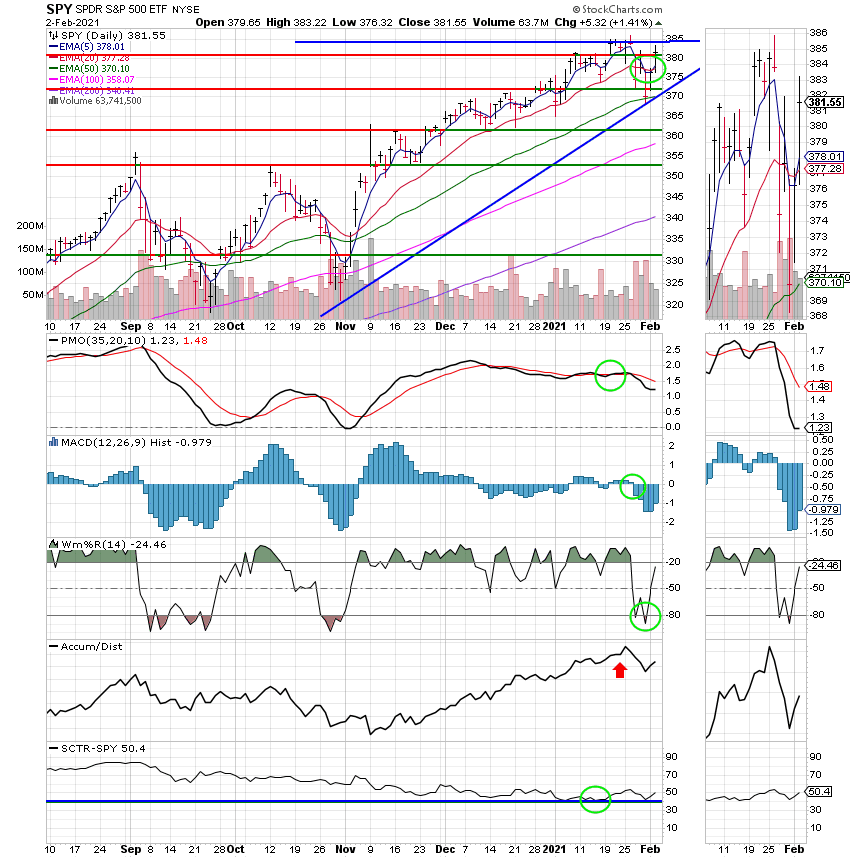

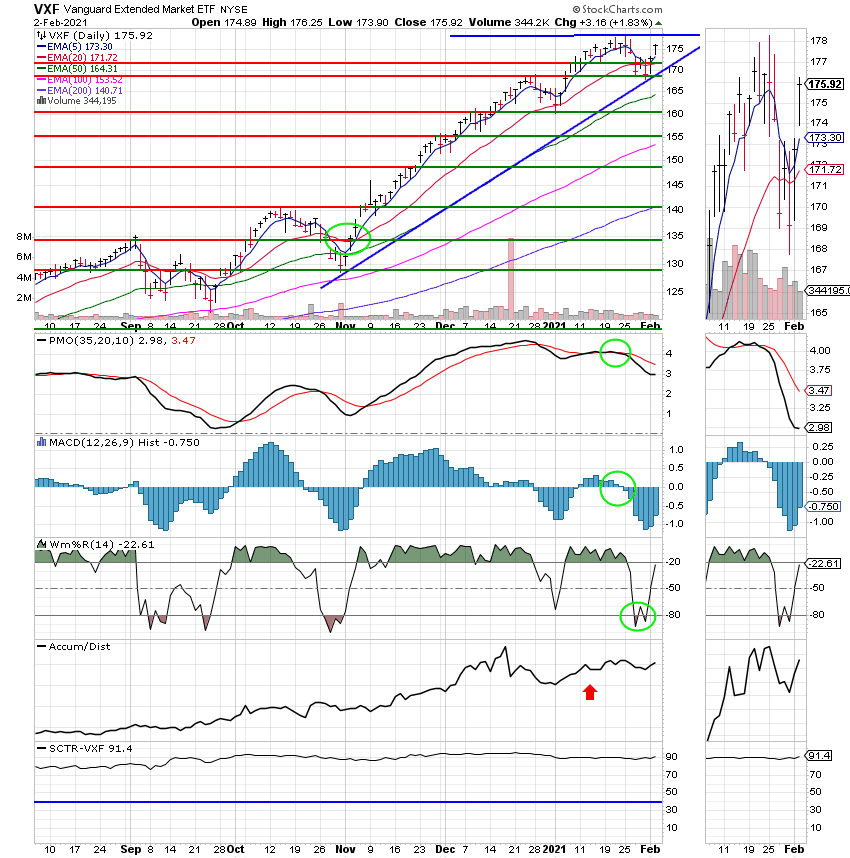

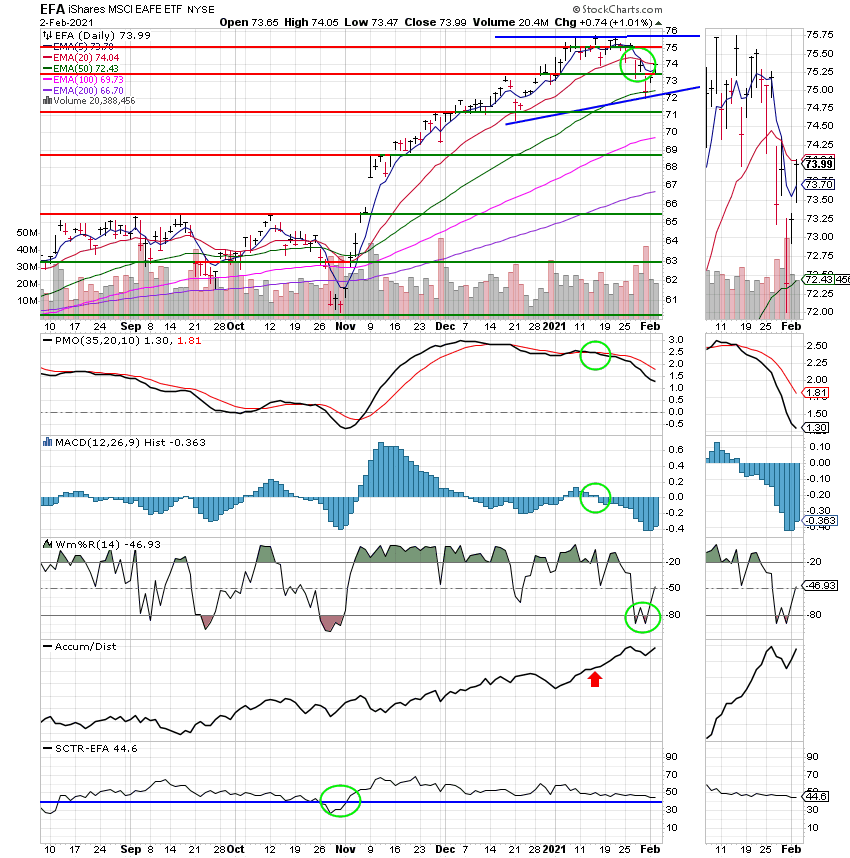

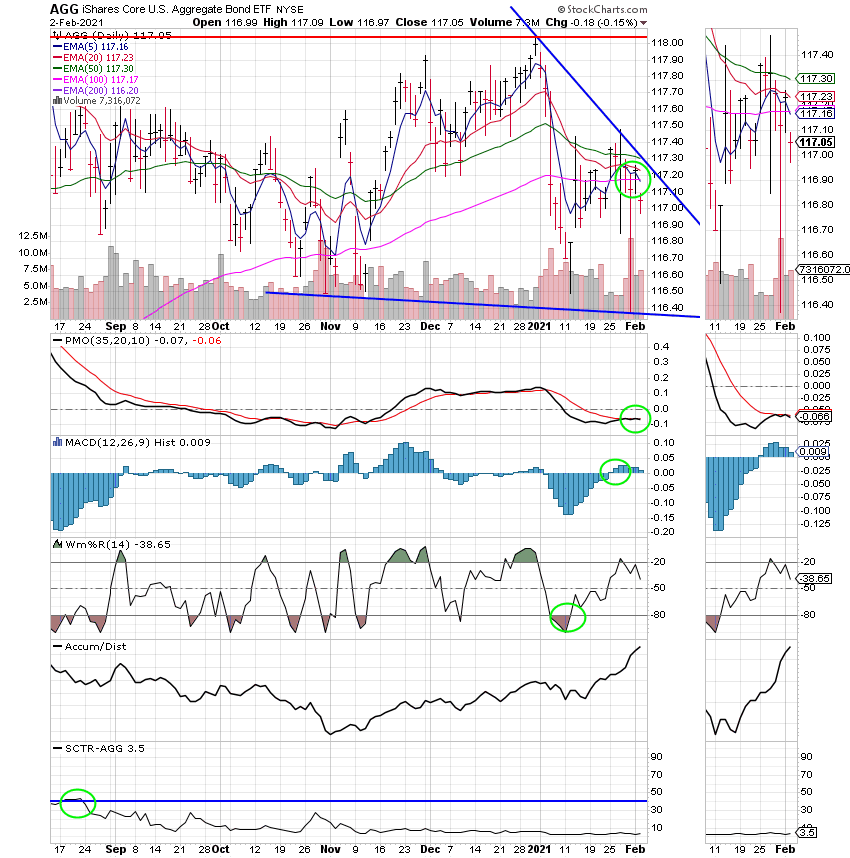

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now +5.17% on the year not including the days results. Here are the latest posted results:

| 02/01/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5205 | 21.0586 | 56.2338 | 78.0376 | 35.2537 |

| $ Change | 0.0004 | 0.0131 | 0.8885 | 1.7203 | 0.2504 |

| % Change day | +0.00% | +0.06% | +1.61% | +2.25% | +0.72% |

| % Change week | +0.00% | +0.06% | +1.61% | +2.25% | +0.72% |

| % Change month | +0.00% | +0.06% | +1.61% | +2.25% | +0.72% |

| % Change year | +0.07% | -0.65% | +0.58% | +5.17% | -0.38% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.3238 | 11.2055 | 38.9759 | 11.6343 | 43.7578 |

| $ Change | 0.0691 | 0.0732 | 0.3211 | 0.1053 | 0.4316 |

| % Change day | +0.31% | +0.66% | +0.83% | +0.91% | +1.00% |

| % Change week | +0.31% | +0.66% | +0.83% | +0.91% | +1.00% |

| % Change month | +0.31% | +0.66% | +0.83% | +0.91% | +1.00% |

| % Change year | +0.21% | +0.41% | +0.51% | +0.56% | +0.62% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 11.9281 | 25.9961 | 12.5275 | 12.5276 | 12.5277 |

| $ Change | 0.1262 | 0.2932 | 0.1706 | 0.1706 | 0.1706 |

| % Change day | +1.07% | +1.14% | +1.38% | +1.38% | +1.38% |

| % Change week | +1.07% | +1.14% | +1.38% | +1.38% | +1.38% |

| % Change month | +1.07% | +1.14% | +1.38% | +1.38% | +1.38% |

| % Change year | +0.68% | +0.73% | +0.93% | +0.93% | +0.93% |