Good Evening, As we anticipated early last fall this market is starting to check all the boxes. The overall cases of Covid 19 are starting to to drop just a little and the distribution of the vaccine is starting to accelerate, check. Over 80% of companies that have reported so far this earnings season have beaten estimates, check. A large 1.9 Trillion with a T dollar stimulus bill is on it’s way through congress (paying for it all will come later), Check. The tripled headed beast that keeps this rally rolling is alive and well! No one can tell the future but this is what we thought would likely happen. Can you believe folks were wanting to sell over the Game Stop fiasco? Proof positive that Panic is not a strategy! The bottom line is that the charts still look good and we’re in the midst of a long “green flag” run. We haven’t changed our allocation for a good while for good reason. It keeps working! This is what we like to see. All those things said and noted it’s never too early to ask yourself what your going to do when this run finally does come to and end. Will you panic and sell? Will you freeze like a deer in the headlines and let all your profits slip away? Or….will you calmly watch your charts and make a decision to sell when you have studied all the data and determined that the market is indeed experiencing some sustained downside? It’s best to have a solid plan as it is not a matter of if this wonderful run will come to an end but when. They always come to an end! I know, I know! It sounds easy but it’s not!! It’s hard when it things start to go down and your portfolio drops a few percent! That’s when you have to tell yourself (it’s OK to say it out loud) I am not going to panic. When the time comes you will have plenty of time to make an informed decision. I can hear it now “but Scott I’m losing retirement money. This is serious!” That’s when you take a big breath and look at the profits you have piled up during this rally……. It’s money that you have made because you didn’t panic and stayed in the market! You have plenty of profits to buy the time you need to make the best decision you can make. Time is money and money is time so to speak. In February of 2020 when the market our allocation dropped to a negative 3.5% on the year before we sold. It really looked bad at the time. Like we waited too long to sell and lost what would have been a sure albeit small profit for the year. After all the sky was falling and the great pandemic was going to destroy the entire market forever. Panic panic panic……. So you now ask, weren’t the people who panicked and sold early the ones who were better off. Nah, they were way behind you because they also panicked and sold the last three or four dips. My Dad always used to say that a leopard never changes it’s spots and this is a great time for that illustration. That said, it you panicked before will you do it again? Not if you learn from your mistakes. The definition of experience ATS (according to Scott) is having made mistakes. Learn from you mistakes and you indeed have experience. Never forget your charts will greatly reduce your risk if you will just take the time to calmly read them and that means taking a little time when your think the sky is falling. You all already know the rest of the story. We watched our charts and got back into stocks after a sizeable drop and turned that 3.5% loss into close to a 50% gain. I would be amiss to add that we didn’t freeze like a deer in the headlights when it came time to buy back in either. Neither did we get greedy and try to time the exact bottom. That can cost a lot of gains as well. What did we do?? The same thing we did on the other end. WE CALMLY (that means without panic) read our charts and jumped back in when it looked like things might start to improve. We didn’t worry that the market would drop further. We knew that we had already bypassed around 30% in losses!! We didn’t get greedy and try to time the exact bottom. We knew that we could lock in over 30% in profits and as they say “a bird in the hand is worth two in the bush. Folks this is not rocket science as the so called experts would have you to believe. With a little discipline, a little work, and a lotta faith in God you can do this too. Which brings me to the conclusion of this rather lengthy blog. What is the real secret to not panicking? Faith in God. When has he ever failed this group?? Give Him all the praise for He and He alone is worthy!!

The days trading left us with the following results: Our TSP allotment posted a gain of +0.41%. For comparison, the Dow slipped -0.03%, the Nasdaq was up +0.14%, and the S&P dropped -0.11%. Praise God for another good day!

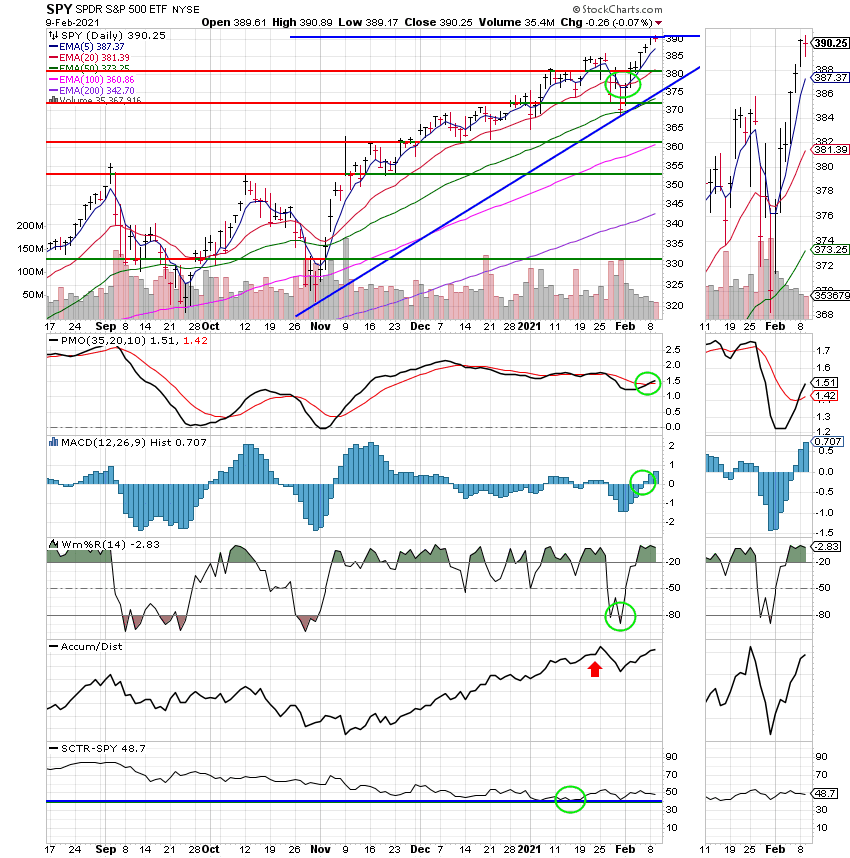

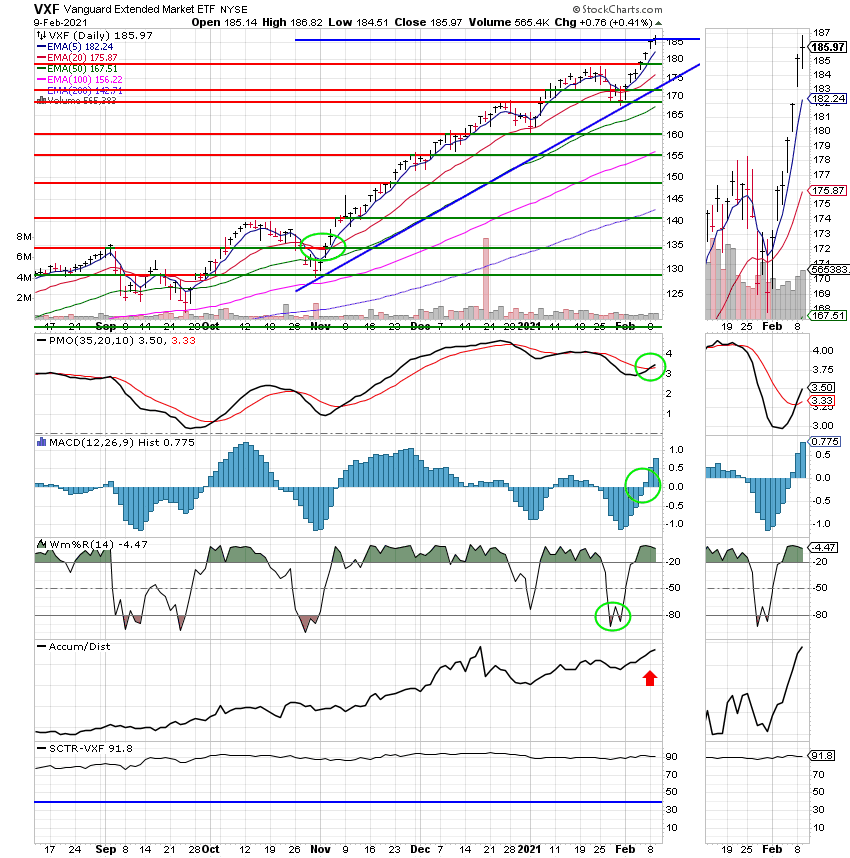

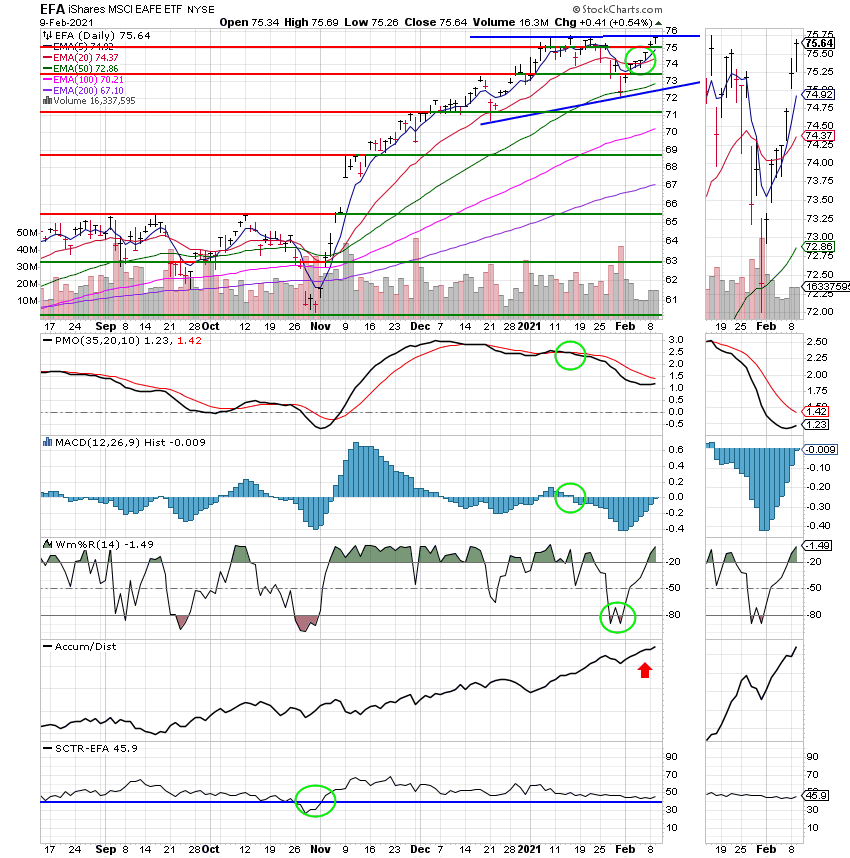

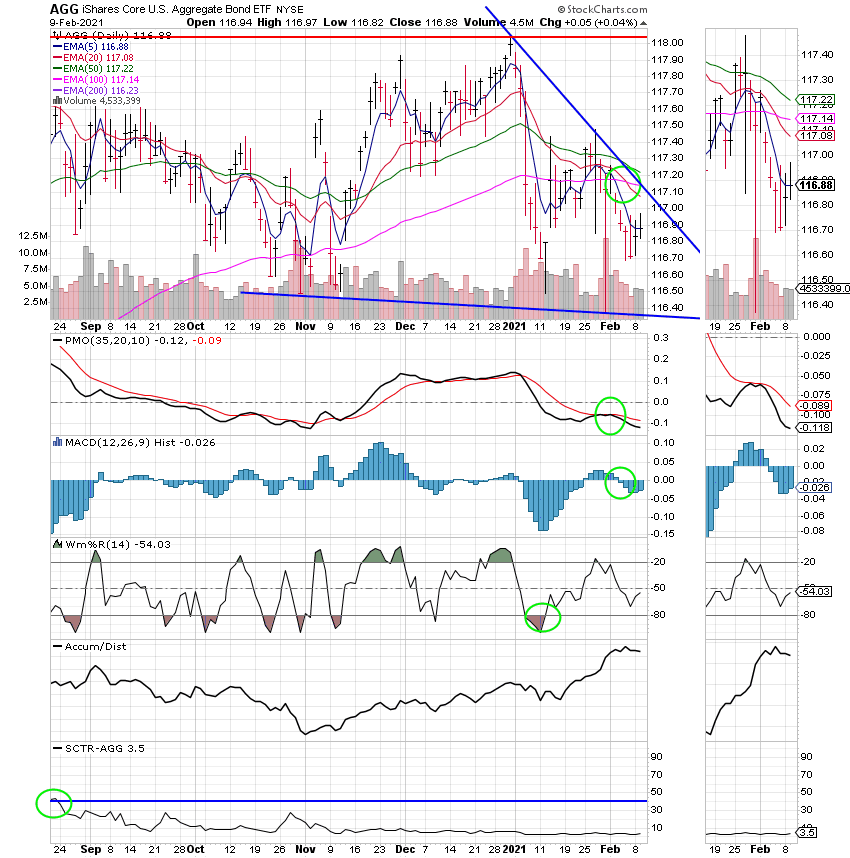

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now +12.59% on the year not including the days results. Here are the latest posted results:

| 02/08/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5239 | 20.9885 | 58.3606 | 83.5447 | 36.3007 |

| $ Change | 0.0015 | 0.0220 | 0.4301 | 1.4903 | 0.3348 |

| % Change day | +0.01% | +0.10% | +0.74% | +1.82% | +0.93% |

| % Change week | +0.01% | +0.10% | +0.74% | +1.82% | +0.93% |

| % Change month | +0.02% | -0.27% | +5.45% | +9.47% | +3.71% |

| % Change year | +0.09% | -0.98% | +4.38% | +12.59% | +2.58% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.5183 | 11.4139 | 39.8926 | 11.9351 | 44.9928 |

| $ Change | 0.0509 | 0.0531 | 0.2330 | 0.0765 | 0.3145 |

| % Change day | +0.23% | +0.47% | +0.59% | +0.65% | +0.70% |

| % Change week | +0.23% | +0.47% | +0.59% | +0.65% | +0.70% |

| % Change month | +1.18% | +2.53% | +3.20% | +3.52% | +3.85% |

| % Change year | +1.08% | +2.28% | +2.88% | +3.16% | +3.46% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.2897 | 26.8383 | 13.0235 | 13.0236 | 13.0237 |

| $ Change | 0.0923 | 0.2148 | 0.1247 | 0.1247 | 0.1247 |

| % Change day | +0.76% | +0.81% | +0.97% | +0.97% | +0.97% |

| % Change week | +0.76% | +0.81% | +0.97% | +0.97% | +0.97% |

| % Change month | +4.13% | +4.42% | +5.39% | +5.39% | +5.39% |

| % Change year | +3.73% | +3.99% | +4.93% | +4.93% | +4.93% |