Good Morning, This week finds the market marking time after a successful run this past week as it waits for the next market moving event. On tap this week are a raft of earnings reports with close to 20% of the S&P 500 reporting earnings. Meanwhile, the Federal Reserve will begin their February policy setting meeting on Tuesday. Investors in the fed funds futures market assigned an almost 97% probability the Fed will not cut rates at the upcoming meeting, Folks, for the past three years this market has been all about the Fed policy as they battled with the pandemic and ensuing inflation. Now nearing the end of the cycle investors are focusing on two things. When the Fed will begin to cut interest rates and to a lessor degree if the economy will avoid a recession. I say the latter is to a lessor degree as recent data has all but ruled out a recession and suggests strongly that the economy is coming in for a soft landing. Those including myself that predicted a recession appear to have been wrong. Barring some catastrophic event it appears that the market will trend higher in the coming months. However that does not mean that it will move straight up and also it does not mean that there will be huge gains. As we have reminded you here several times a healthy market will have periods of correction. I really hate to use the term correction as the technical definition of a correction is a dip in the market of ten percent or more. I guess those that write the text books have to have one, but in reality most of the market dips are less than ten percent. I guess the experts are saying that a dip of say 5-9% is not painful. Well I got news for you. They are painful to me and I’ve spent a lifetime trying to avoid them. That is the reason that I refer to them as resets. To me the term reset means that the market is preparing for another run higher while the term bear means it will move lower. For those of you that don’t know, the experts also have a definition f0r a bear market. It is a market decline of 20% or more. Personally, I don’t intend to wait until I’m 20% down to say “Oh darn, its a bear market”. I have only had one year that the market makers got the best of me and that as you know was 2022. I lost 27.8% that year. We only came out on the short end of the stick 4 other times ever. Most of you will remember them. Three of those were less than 1% and the the fourth was 1.87%. and that is it. 2022 is well documented. If you want to know what we experienced and how we experienced it you can go back in the archives and check those blogs. I said this before and I will say it again. With God’s blessing we came out of that situation better than we went in. Our indicators are the best they have ever been and our group will do better and better as we become used to them. Praise God for that!! All that said we remain invested at 100/C, but I fully expect the market to reset in the coming days or weeks in which case we will move to the G Fund while it does. As I mentioned last week, there will still be some volatility and we will make every effort to take advantage of it and outperform the market.

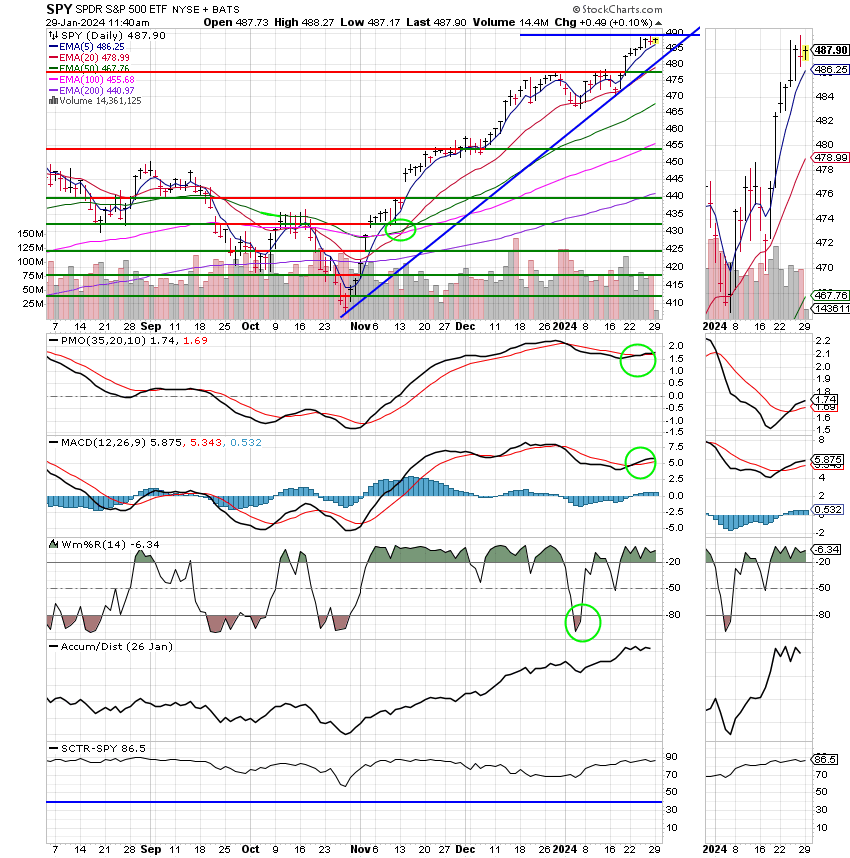

The days trading up to this point has left us with the following results. Our TSP allotment is trading slightly higher at +0.10%. For comparison, the Dow is flat at -0.02%, the Nasdaq is up +0.23%, and the S&P 500 is in the green at +0.10%. It’s obvious that this market is beginning to slow down a bit. We’ll have to keep a close eye on our charts to avoid the next dip if possible.

Stocks are little changed as traders await big tech earnings and Fed meeting decision: Live updates

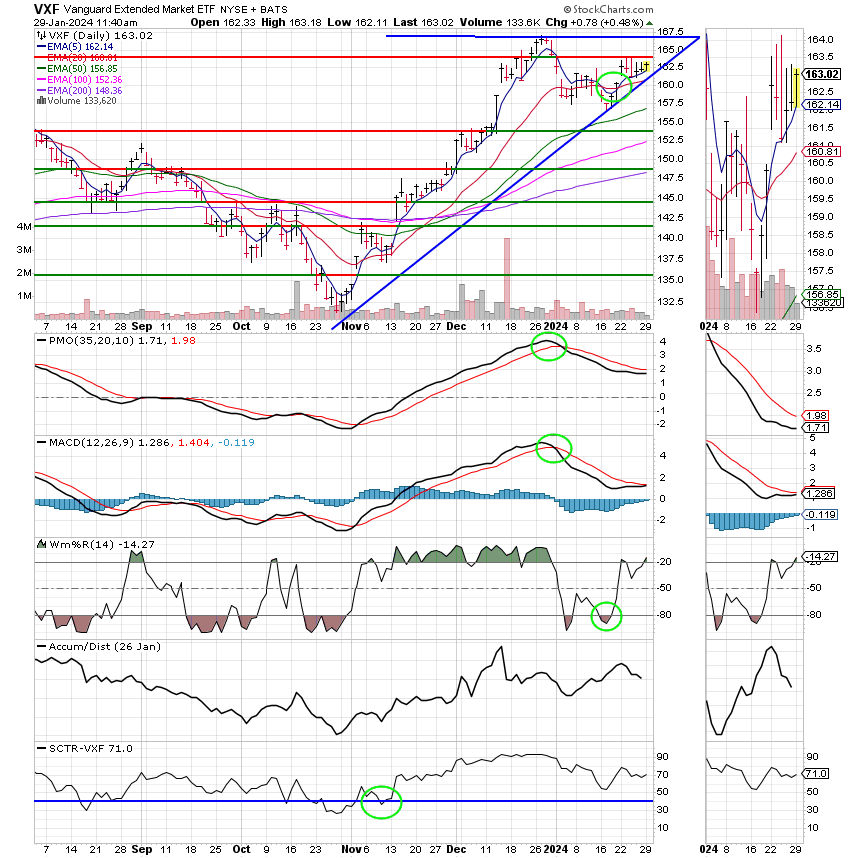

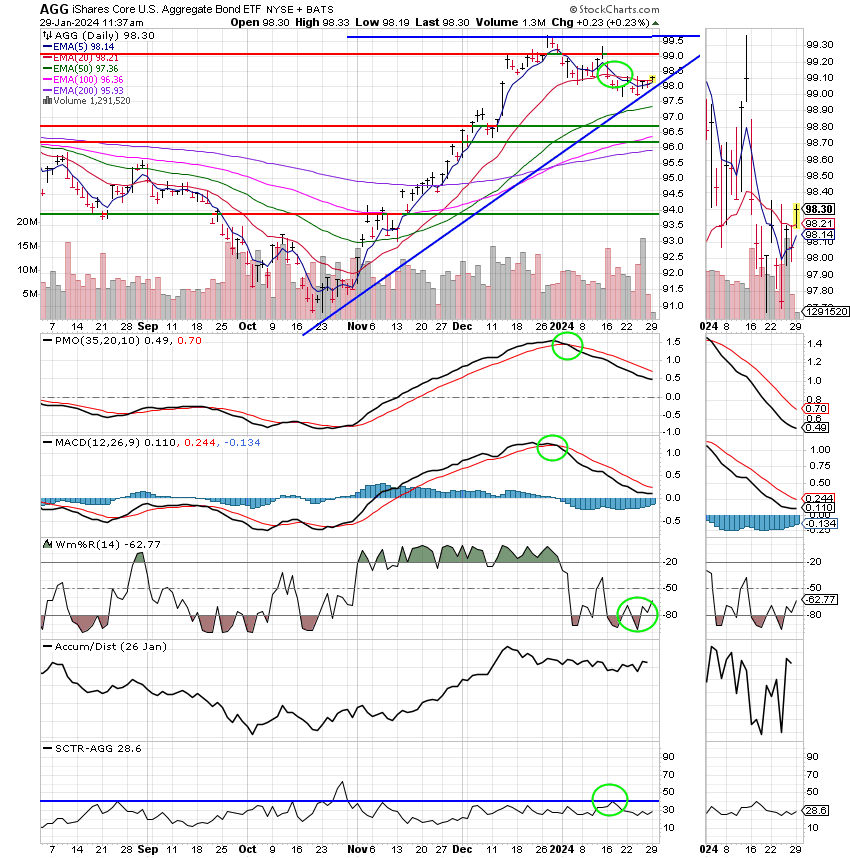

Recent trading has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now +2.01% on the year not including the days results:

| 01/26/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.0149 | 18.9909 | 76.3091 | 76.1147 | 40.0255 |

| $ Change | 0.0020 | -0.0197 | -0.0499 | 0.1472 | 0.1858 |

| % Change day | +0.01% | -0.10% | -0.07% | +0.19% | +0.47% |

| % Change week | +0.08% | +0.09% | +1.07% | +1.21% | +1.62% |

| % Change month | +0.29% | -1.21% | +2.62% | -1.27% | -0.39% |

| % Change year | +0.29% | -1.21% | +2.62% | -1.27% | -0.39% |