Good Evening, These are wild days to be sure. Short term trading continues to dominated by the war between Russia and the Ukraine. The narrative there is that Russia will ultimately occupy the Ukraine but it hasn’t happened yet. Every day that the Ukrainians live to fight another day leaves hope that somehow they will outlast Russia. The conflict leads to a great deal of uncertainty about how western sanctions on Russia will effect the world economy. Just today the Biden administration announced that they were banning imports of Russian Oil, Gas, and Coal. Coal?? Are you kidding me. West Virginia is the Saudi Arabia of Coal and many of those folks have been out of work for a good while. Why in the world would we buy coal from Russia or anybody else for that matter? Why would we buy oil? Weren’t we a net exporter of oil in 2019? I know I can hear it now, Scott your getting political! Well purchasing oil and coal when you have the ability to be an exporter of both is ignorant! Especially when you are funding an evil calculating man like Vladimir Putin. We have had to jump so many hurtles to try to make money in the past six months or so and that man has added skyrocketing energy prices and the threat of nuclear war to the equation. I’d like to say that I have a clear picture of where this is all going but I do not and neither does anybody else. All we can do at this point is react to the action we see before us and that is changing directions like the wind. All this is a lot to consider when your investing your precious retirement money and that’s only the short term issue. We still have the elephant that’s quietly sitting in the corner of the room that is inflation. Of course the war is effecting that as well. $4.17 a gallon for regular unleaded definitely applies there! However, while the war may make inflation a little worse it was an issue before the war and it will likely be with us for a while. Next week the Federal Reserve will meet to discuss monetary policy. It is a foregone conclusion that they will raise short term interest rates by a quarter point, but there has also been talk that they could raise them a half point. I don’t think they will but it says here that if they do that the selloff will begin anew. Many investors think they need to be more aggressive with a half point raise but others are saying that won’t happen now due to the war. The rate of inflation is currently running over 7 percent which well exceeds the Fed target of 2 percent. This issue of a quarter point raise vs. half point raise is just creating more uncertainty and the market hates uncertainty. There is one thing that we know about inflation. The Fed will do what they have to do to bring in down to 2%. So if they don’t raise it enough now then they will have to raise it more later. It is pretty well a foregone conclusion that inflation is not just temporary like the Fed thought it was last fall. We are going to have to deal with it and when we deal with it there will be pressure on the market period. So at least for now you can expect the volatility to continue. I said it many times in recent weeks. When inflation moderates the market will moderate. Until then the risk will remain high. Right now I’m not seeing a lot of good on the charts as all of our equity based funds are all generating sell signals. That noted, it can all change in a day. Just let there be a real cease fire or maybe even a pie in the sky truce and this market will rally hard. Nonetheless, when it is all finally over the focus will return to inflation. Never ever forget! It’s all about the inflation. My guess here is that 4 dollar a gallon gas is not going to help (Sarcasm noted)……… Bottom line the risk remains high.

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow fell -0.56%, the Nasdaq -0.28%, and the S&P 500 was -0.72%. It turned out to be another good day to be in the G. Stocks sold pretty hard in the last 30 minutes of the session. I thank God again for His guidance.

Dow gives up 585-point gain and turns negative in wild trading session

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Hold. We are currently invested at 100/G. Our allocation is now -13.19% for the year not including the days action. Here are the latest posted results:

| 03/07/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7889 | 20.1734 | 63.5842 | 69.6051 | 33.5408 |

| $ Change | 0.0027 | -0.0903 | -1.9338 | -2.6008 | -0.9218 |

| % Change day | +0.02% | -0.45% | -2.95% | -3.60% | -2.67% |

| % Change week | +0.02% | -0.45% | -2.95% | -3.60% | -2.67% |

| % Change month | +0.04% | -0.27% | -3.93% | -7.26% | -9.08% |

| % Change year | +0.31% | -3.42% | -11.62% | -16.58% | -14.96% |

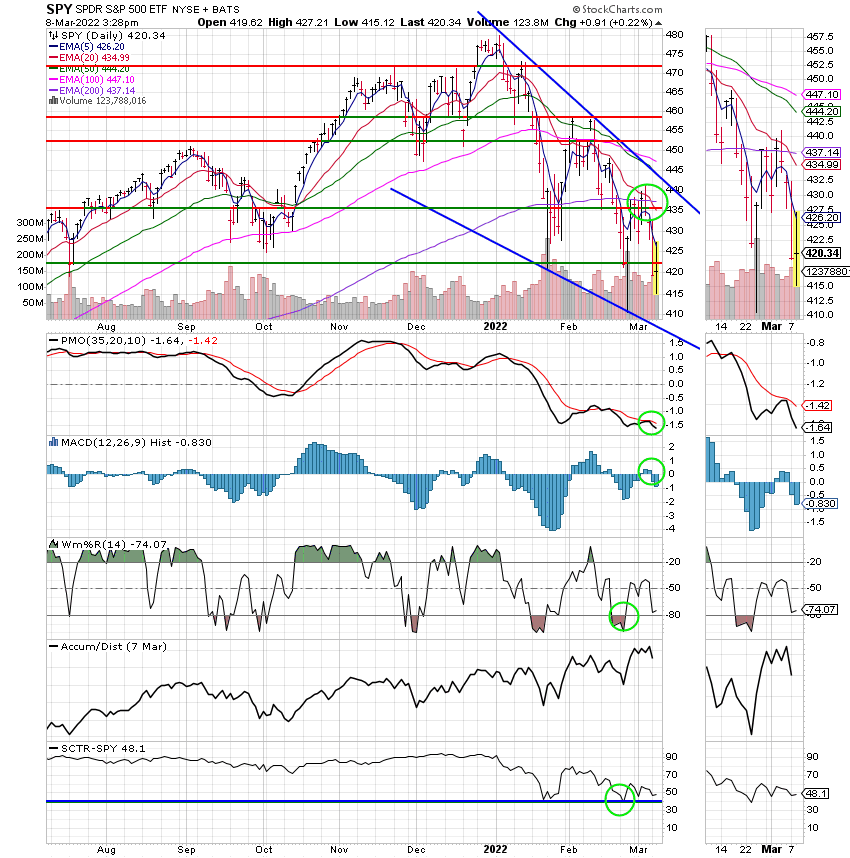

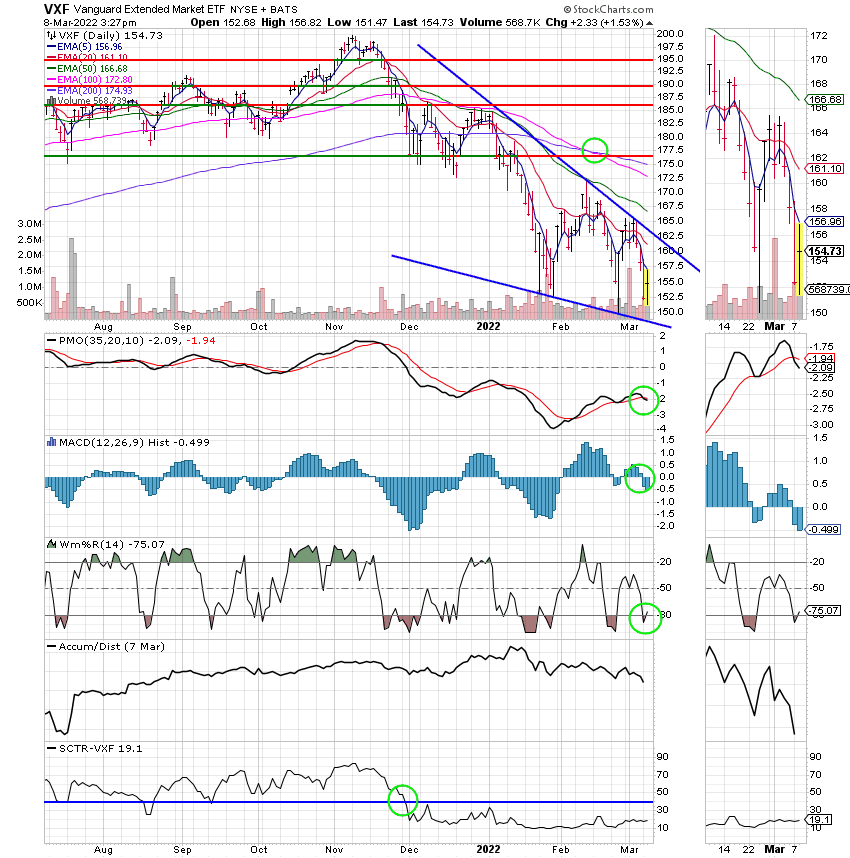

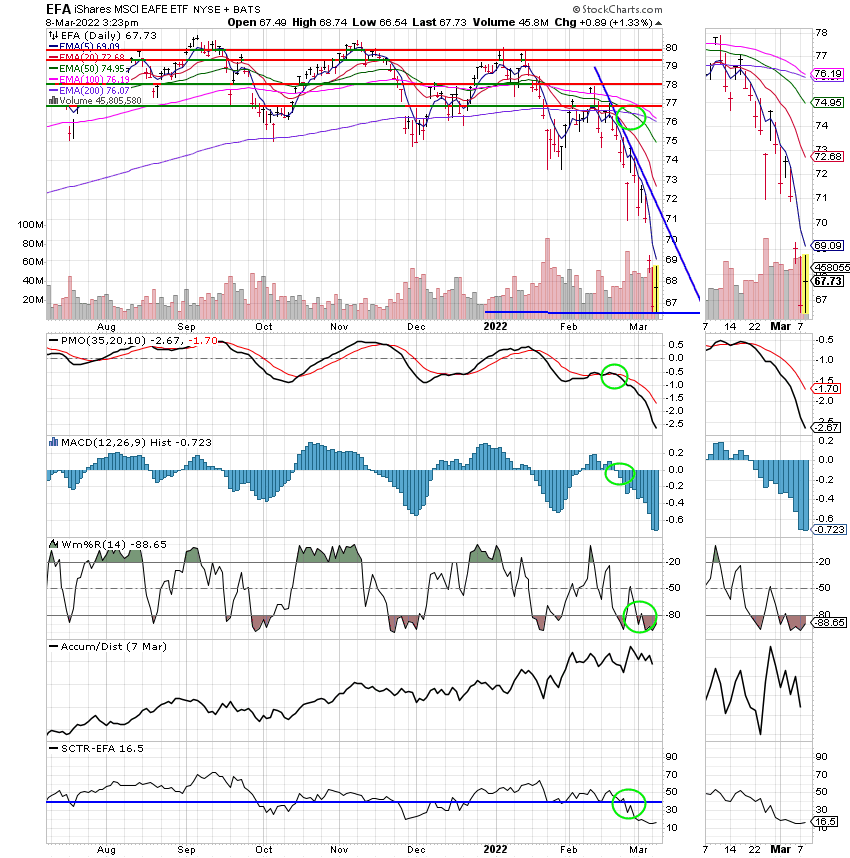

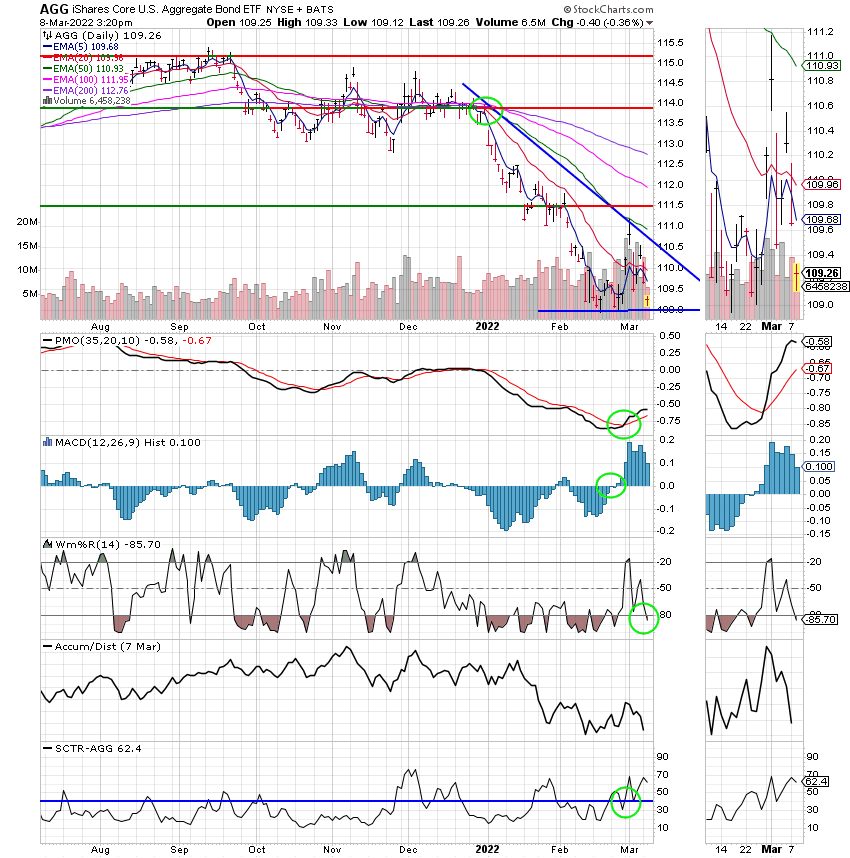

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Pray for the Ukrainians. Pray for the Market. Pray for our Group. That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.