Good Evening, So what’s changed? Not much although we did have a little relief rally today. The war in the Ukraine is still shaping the market over the short term and inflation is influencing the long term. Speaking of inflation, the Federal Reserve kicked off it’s two day policy meeting today. It is widely expected that the Fed will raise short term interest rates a quarter point this month for the first time since 2018 . There was a lot of talk earlier that they would even raise the rates a half a point but the war between Russia and the Ukraine quelled that noise. You never know for sure though. We won’t know what the Feds policy decision is until 2:00 PM tomorrow afternoon when Fed Chairman Jerome Powell addresses the press. The predominant train of thought is that a quarter point rate increase has already been priced into the market. To me that’s just useless speculation. I’ll be doing the same thing the folks that made those predictions will be doing tomorrow afternoon at 2:00 PM. I’ll be watching my charts and reacting to whatever I see. Speculation is a waste of time. It is good to have a plan to react to the action whatever it may be, but it is a total waste of time to try and predict the future. Nevertheless, they will keep doing it because that is what sells…. One more word about inflation. We’ve talked about it a lot lately, but we really haven’t traded in a rising rate environment since oh say 2008? (2018 was only a brief attempt to raise rates which was quickly back tracked) So it’s been a long time. Longer than a lot of you have been trading. Long enough that even some of you old timers may have forgotten what is was like before the Fed started propping the market up. Looking back at the past twelve to fourteen years it’s easy to see why those years were different than any in the history of the market. Back in 2009 we entered uncharted territory when the government got involved in the market by providing unprecedented market stimulus though the purchase of bonds and later even mortgage backed securities. That of course was in addition to the Fed reducing rates to record lows. So to say it in another way it was a period of artificially low interest rates resulting in a plentiful supply of cash that fueled an ongoing rally. As we know the result was an extended bull market with very few and sometimes no pullbacks. Pretty much all you had to do was buy and hold. We all had to adapt to a market that would leave you behind if you weren’t in it. Those who began trading and/or got used to that environment of having a safety net are not prepared to invest without it. Why? It’s simple the pullbacks without stimulus are deeper and last longer. In other words it pays to keep an eye out for corrections and bear markets. Why is this particular month and time so important?? This is the month that the Feds purchase of bonds ends and this it the month that we will get the first interest rate increase in over a decade. Folks, times are a changing! That doesn’t even take into account the unwinding (selling) of the bonds on the Fed’s balance sheet which will put even more pressure on the market. Don’t worry though, you’ll all be fine! You just need to be more aware of market pullbacks than you have been in past years. Oh yeah, and keep praying. Our Heavenly Father we’ll guide you though it just as he has done in the past. Well, there by the matter of fact is one thing that never changes! Our mighty God that guides our every step. Give Him all the praise!!

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow gained +1..82%, the Nasdaq +2.92%, and the S&P 500 +2.14%. It was nice to see and rally. It would be even more nice to see some follow though to lead us into a new trend……

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -13.15% for the year. Here are the latest posted results:

| 03/15/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7962 | 19.7313 | 64.5497 | 70.2617 | 34.8026 |

| $ Change | 0.0009 | 0.0068 | 1.3550 | 1.2021 | 0.2001 |

| % Change day | +0.01% | +0.03% | +2.14% | +1.74% | +0.58% |

| % Change week | +0.02% | -0.90% | +1.41% | -0.41% | +1.26% |

| % Change month | +0.08% | -2.46% | -2.47% | -6.39% | -5.66% |

| % Change year | +0.36% | -5.53% | -10.28% | -15.79% | -11.76% |

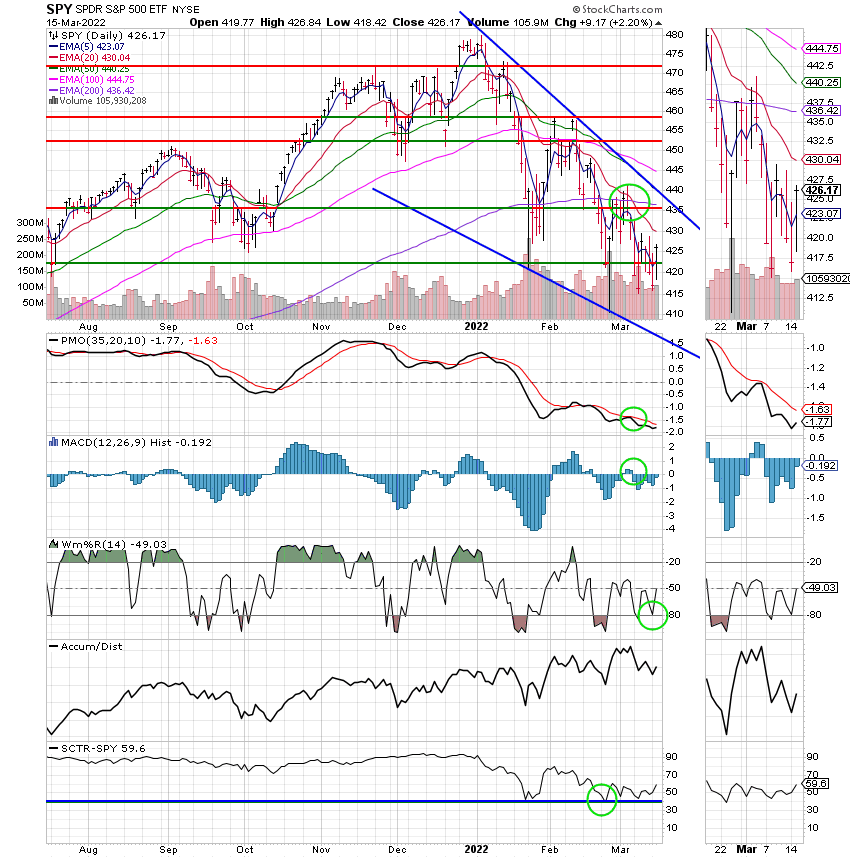

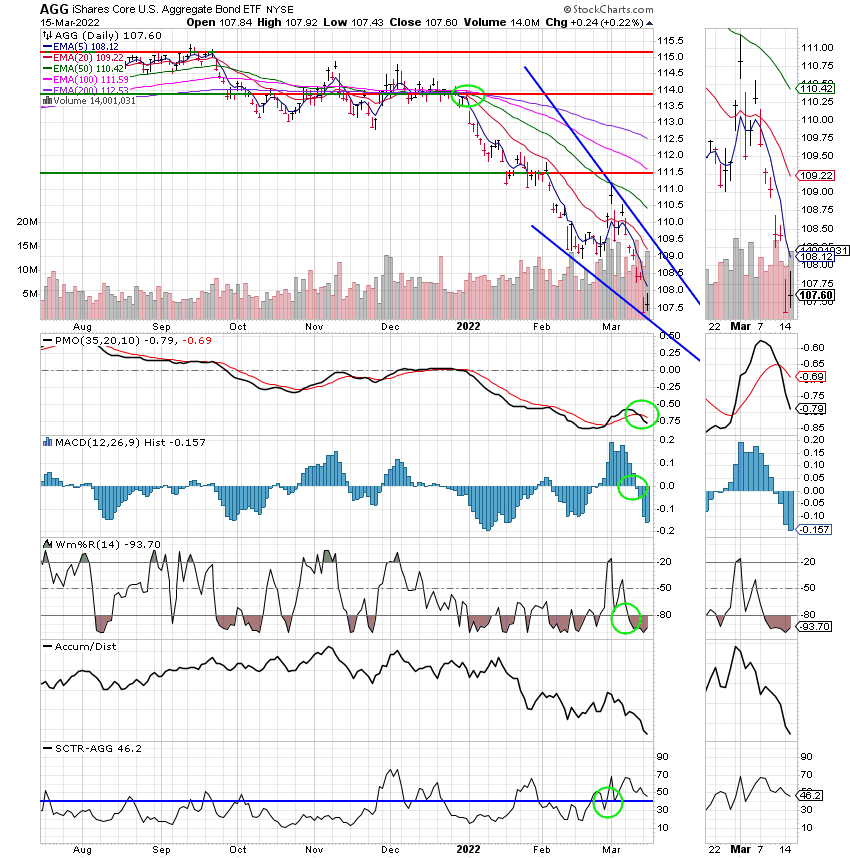

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Our task remains the same. To stay vigilant and watch our charts for a meaningful trend change. Never forget. One day in either direction does not make a new trend. Several days or a week? Maybe then. Don’t forget to keep praying for the war in the Ukraine. Pray that God will bless and protect those folks. That He will give them the peace and freedom that they so strongly desire. That’s all for tonight. Have a nice evening and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.