Good Afternoon, First things first! I’ll probably be writing more of these blogs on Tuesday morning rather than Tuesday night. As most of you may or may not remember I also have a music ministry which takes up more than an equal amount of my time. We will be playing praise and worship for Celebrate Recovery group that meets on Tuesday evenings and that is about the last evening that I still have available. So I’ll likely do them on Tuesday mornings if I keep playing there….. I covet your prayers for that ministry as well if you are so inclined.

Now on to the business at hand. As I have been saying and saying in the end it’s all about inflation. Yes we still have the war in the Ukraine going on which has the ability to change things quickly over the short term, but right now that is pretty much a stalemate. I guess the big concern there is that Vladimir Putin will become so desperate for a victory that he will resort to the use of chemical or possibly even nuclear weapons. However, concerning that, you just have to admit that some things are beyond our control and that we just have to turn them over to God. I believe this is one of those things. Last week the FOMC raised their short term interest rate by a quarter point and said that they would raise rates a quarter point each month for the rest of the year. Last week we talked about he fact that a lot of investors were looking for a half point increase prior to the escalation of the war in the Ukraine. However, due to those pressures the Fed caved in and only raised rates by a quarter point even though a half point was what was needed. Fast forward to this week and you have Fed Chairman Jerome Powell making the following statement in a speech “If we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so,” said Powell on Monday to the National Association for Business Economics. Folks, this is plain and simple. They are sorry that they didn’t increase the rate by a half point last Wednesday and will likely do so at the next meeting or two. Of course the market which had been moving higher since last Wednesday’s announcement stepped back a little for a day to consider the change. As I have often told you the biggest thing that the market doesn’t like is uncertainty. That uncertainty was erased to a certain degree last week when the Fed made clear what their plans were for the rest of the year, but then the water was muddied again when Jerome Powell made his speech yesterday. Nonetheless, after investors thought about it they had an Ah Hah moment where they remembered, Oh yeah, we thought they were going to increase rates by a half point anyway. Thus you have today’s renewed rally. The market is fickle though. Investors may need to be reminded anew when the Fed actually increases rates by a half point next month. So we’ll see how much of that actually gets priced in before then. One dynamic that you must consider here is that even though the market historically doesn’t like interest rate increases investors realize rate increases are necessary to control the current high inflation. So the Fed is walking a tightrope. They need to increase rates but how much will they market tolerate?? Now that’s the ten million dollar question! We will see and all while we keep an eye on Vladmir Putin…….

The days trading is producing the following results: Our TSP allotment is currently up +1.41%. For comparison , the Dow is up +0.58%, the Nasdaq +1.88%, and the S&P 500 is +1.00%. I thank God for a good day so far!!

Stocks rebound Tuesday, Dow gains about 200 points led by Nike

The days action is generating the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now -13.87% for the year not including the days results. Here are the latest posted results:

| 03/21/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8017 | 19.6568 | 67.5707 | 74.9155 | 36.6213 |

| $ Change | 0.0028 | -0.1792 | -0.0255 | -0.6430 | -0.2403 |

| % Change day | +0.02% | -0.90% | -0.04% | -0.85% | -0.65% |

| % Change week | +0.02% | -0.90% | -0.04% | -0.85% | -0.65% |

| % Change month | +0.11% | -2.83% | +2.10% | -0.19% | -0.73% |

| % Change year | +0.39% | -5.89% | -6.08% | -10.22% | -7.15% |

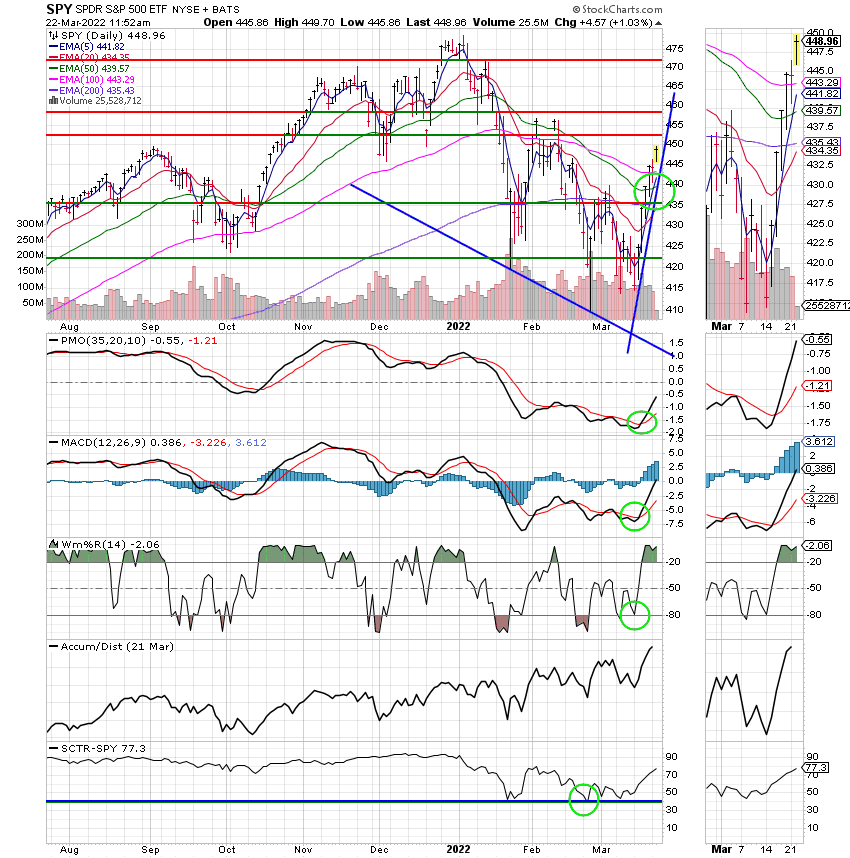

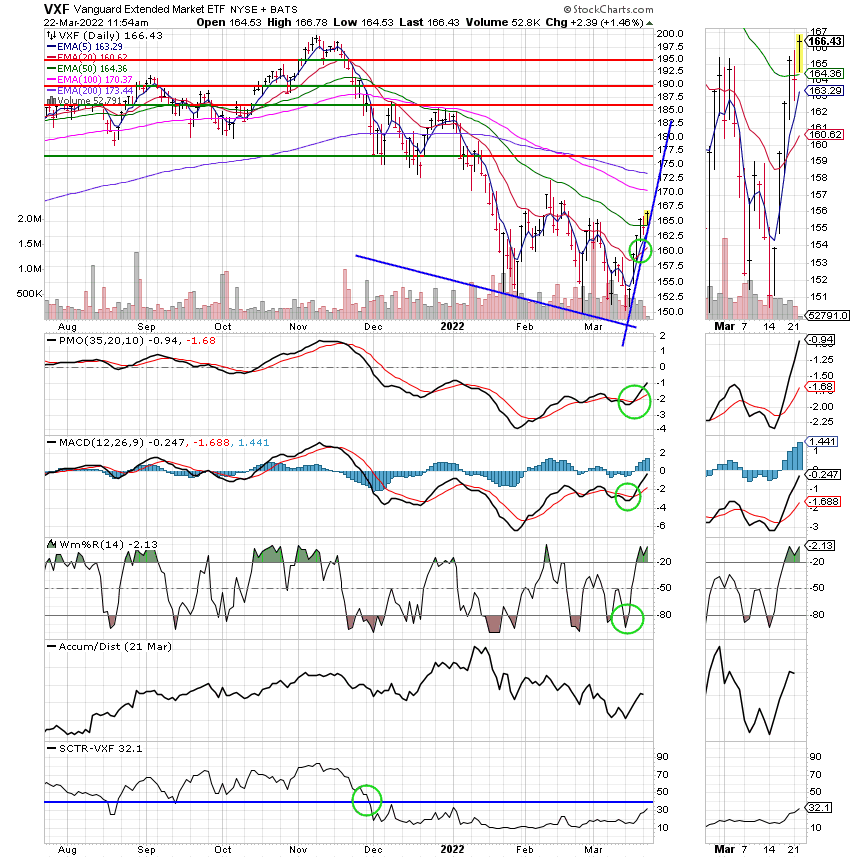

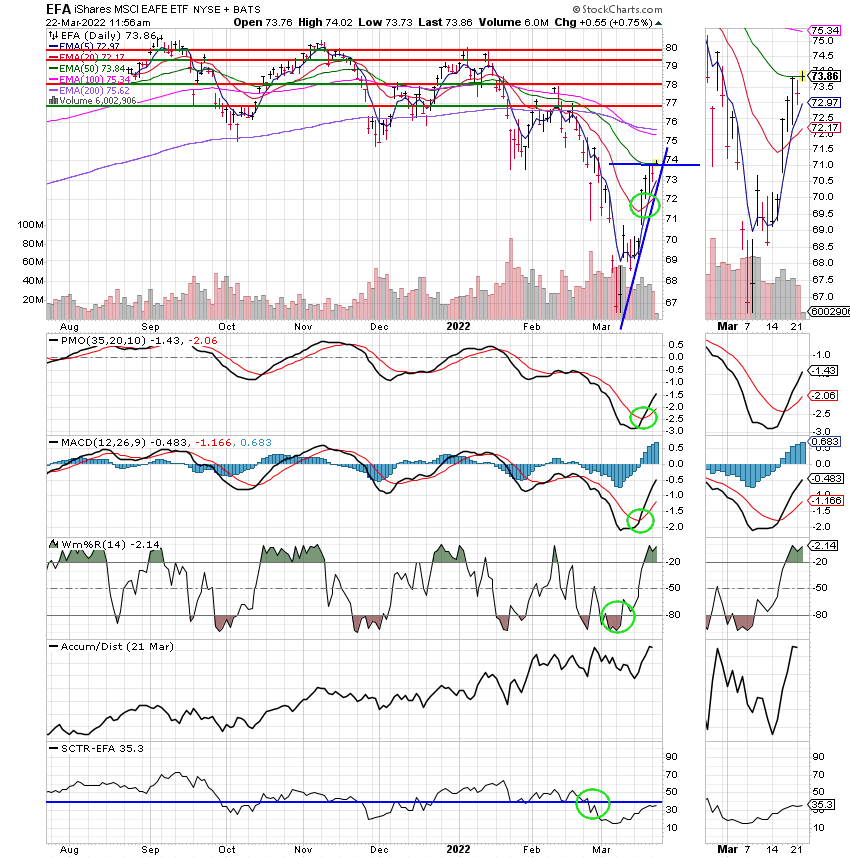

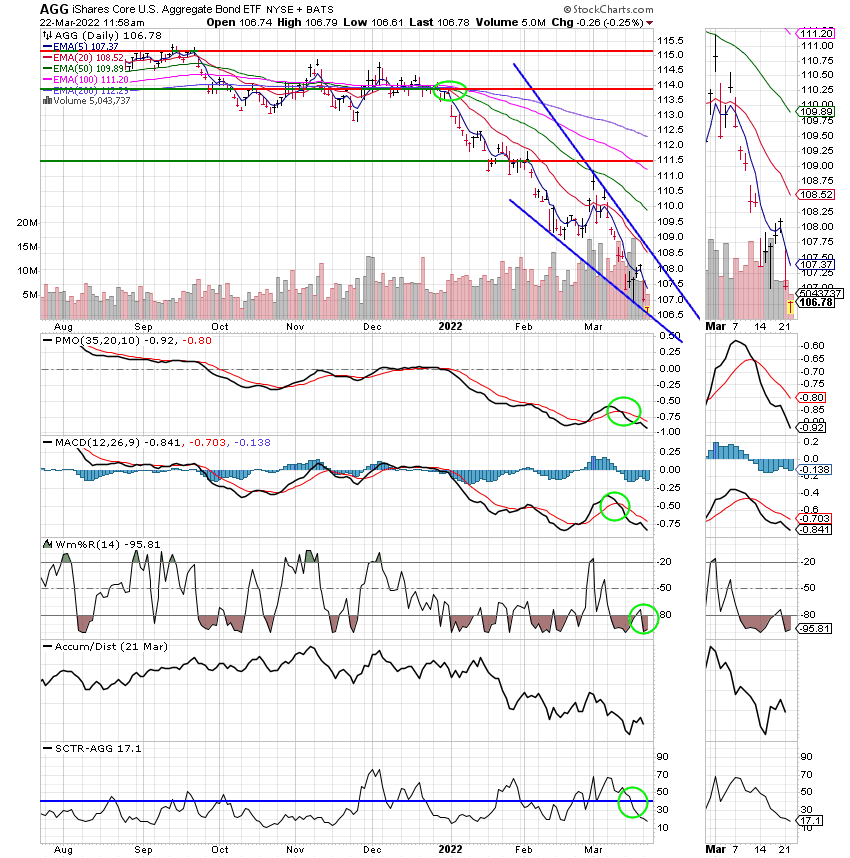

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

You can be stubborn and stick to your guns because you believe your right and/or you can be right. They are not always the same thing. It is important to understand that there is only one right place to be and that’s not always where you think it should be. Don’t let pride, or ego, or envy, or fear or any of those other emotions get involved with your investment decisions. That is the path to failure! Remember always what scripture tells us. “Pride goes before destruction. And a haughty spirit before a fall.” Proverbs 16:18 That’s all for today! Have great rest of your day and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.