Good Evening, We’ve been saying it here for over a year. We’ve talked about it in the blogs and we’ve talked about it on Facebook. Yet many folks are in panic mode because the market isn’t bouncing back the way that it did for the past 10 years. I told you then and I’m telling you now. That was not normal! Artificial market stimulus created by the Fed put support under the market for that entire time. Now that support is gone. If anything it’s quite the opposite with the unwinding of the Feds balance sheet. That is the say the selling of the Treasury notes and mortgage backed real estate securities that the Fed bought to prop up the economy all those years. Actually, I’m relieved. Things should reset and go back to normal with the exception of high speed computer trading which will never be the same. A side bar on that. This high speed trading effects us in that we can no longer pay attention to our short term indicators the way we did in the past. Doing so makes it easier to get faked out. So we simply use intermediate to long term indicators and think more in a long term time frame. A slight inconvenience…. Anyway back to the main subject…. The other thing we have been repeating over the same time period is that it’s all about inflation!! If you can’t remember anything else you’ve read here then remember this. I will say it once again!! The Feds target for inflation. is 2%. In other words what the Fed considers the normal rate of inflation is 2%. So….As long as the rate of inflation remains above 2% then the Fed will take action to control it. How do they do that? Mainly by increasing interest rates, but now also by reducing their balance sheet as I noted above. You really don’t have to understand every little detail of this process. Lets just keep it simple. The higher that inflation rises over 2% the more volatile the market will became. The closer inflation gets to 2% the less volatile the market will be. For those of you that simply know nothing about the market just think of volatility as a playground swing. The more inflation rises the more you will swing. So…..really all you have to know is that 2% inflation equals NORMAL and that no market stimulus means less V Shaped recoveries and longer dips. The moral of that story is that you’d better learn to sell first and ask questions later. Sell is not a dirty word. If you sell and get out to the market, you have really lost nothing. However, in a market void of stimulus, the one time you don’t sell it may take you more time than you think to regain what you lost during the dip and you know the old axiom, ‘Time is money and money is time.’ The buy and holding mentality that you have use the past decade will not work as well now. You will underperform. In order to be a top performer in this type of market you will have to become more active in the management of your investments. That’s not to say that buying and holding will not work! It is to say that it will underperform. Things are not as they were and the sooner you realize that the sooner you can get back to making good returns. So don’t panic! You got this!! Also, never forget to pray to our Lord from whom all blessings flow. All good things come from Him. Give Him all the praise, for He and He alone is worthy!!

Ok, I didn’t say anything about today’s market. I know! The same pressure that weighted the market down last week when we talked is doing it again this week. Interest rates, Inflation, the Ukrainian conflict, and Covid. Until those things moderate expect more of the same. As far as yesterday’s interfund transfer goes, I had a sell signal on the chart for the S Fund that was likely generated due to anticipation of a greater Fed rate increase (of a half point instead of a quarter point) at the upcoming meeting. The C Fund had a buy signal which reflected the increased emphasis that investors are putting on quality as they move out of tech and high valuation investments into safer value plays. Whether the C will hold up or not we will see. This market is headline driven on a day to day basis and we will just have to be vigilant and watch closely the action that unfolds before us.

The days trading left us with the following results: Our TSP allocation ended the day at -0.34%. For comparison, the Dow fell -0.26%, the Nasdaq -0.30%, and the S&P 500 -0.34%.

The days action left us with the following signals: C-Hold, S-Sell, I-Sell, F-Sell. We are currently invested at 100/C. Our allocation is now -16.58% for the year not including the days results. Here are the latest posted results.

| 04/11/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8231 | 19.1839 | 66.8766 | 72.5597 | 36.1152 |

| $ Change | 0.0035 | -0.0879 | -1.1483 | -0.4657 | -0.3373 |

| % Change day | +0.02% | -0.46% | -1.69% | -0.64% | -0.93% |

| % Change week | +0.02% | -0.46% | -1.69% | -0.64% | -0.93% |

| % Change month | +0.07% | -2.51% | -2.57% | -4.19% | -1.78% |

| % Change year | +0.52% | -8.15% | -7.05% | -13.04% | -8.43% |

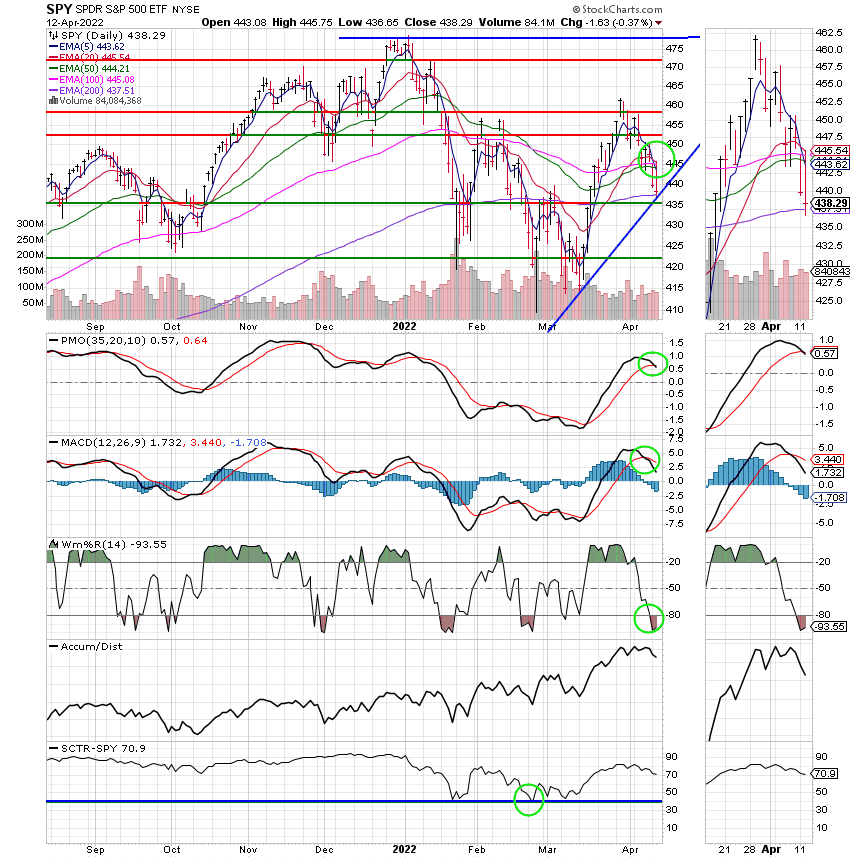

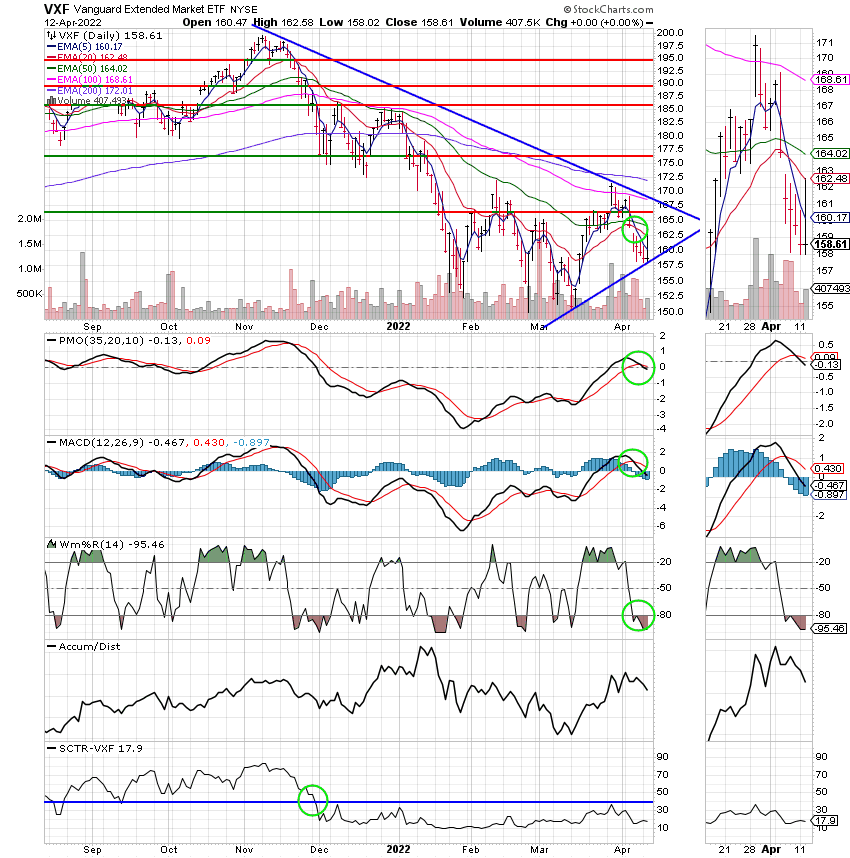

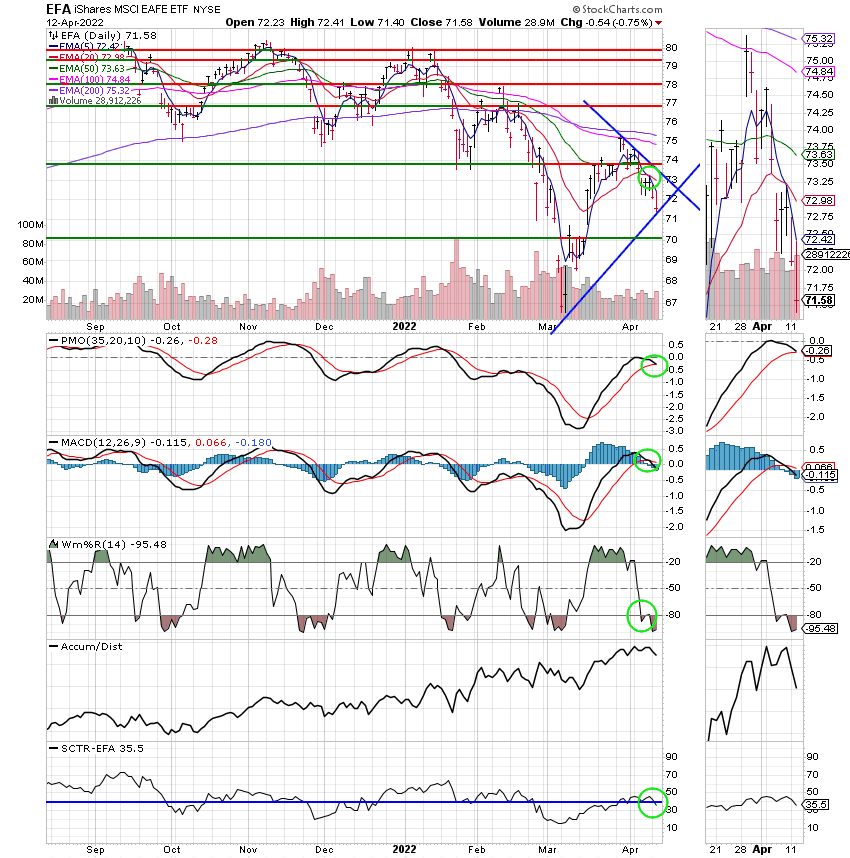

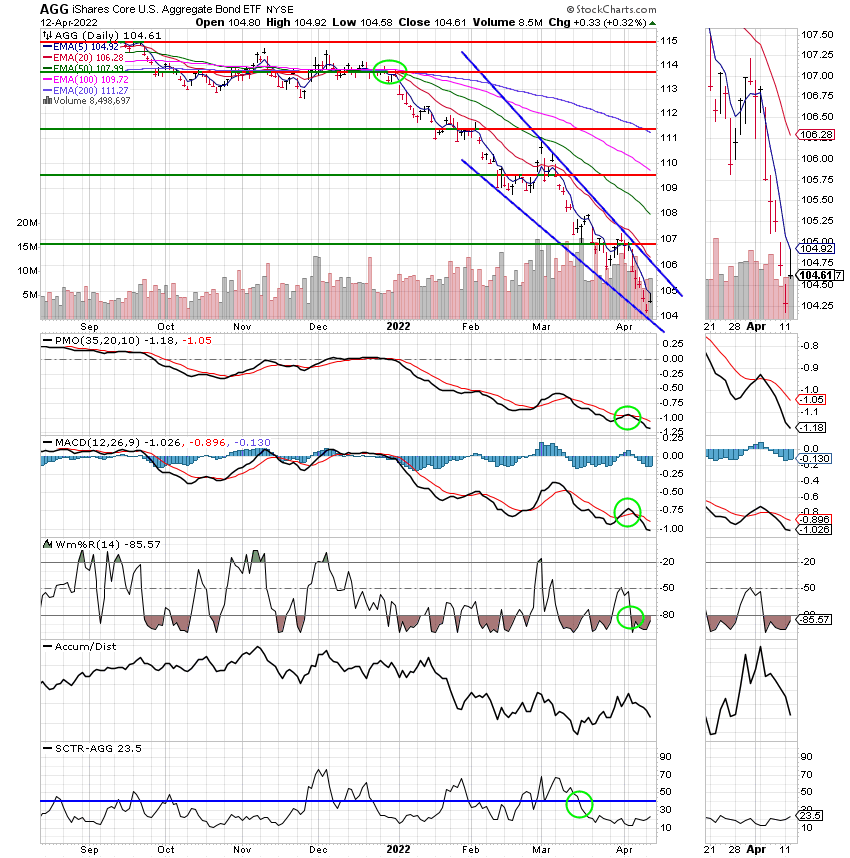

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

This is a rough year but it’s not over! That’s all for tonight. Have a great evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.