Good Day, I don’t want to come across as negative. Just because the market is not what we want it to be does not mean everything is bad. Quite simply we must play the cards we are dealt. That said, I hate to keep repeating myself but this is going to require patience. Although the major indices have yet to fall 20% to meet the definition of a bear market the majority of stocks have been there for a while. Of the 5500 stocks in the market that are not microcaps, , about 3400 or 62% are more than 20% off their highs and 3700 or 67% are below their 200-day simple moving average. Many folks want to argue that we don’t meet the definition of a bear market but this is bear market action. We are in it whether we like it or not. So we might as well embrace it and deal with it.

I have successfully avoided all bear markets during my investment career until this one (yes I am calling it a bear). However, I got caught in this one just like everyone else. So how did we get here? I hate to repeat myself but this is going to require patience. We are indeed in a bear market and it will not recover like the sell offs of the last decade. There is no stimulus to fuel a V Shaped recovery like the ones we had during that time period. We missed the opportunity to side step this sell off when our indicators told us to get out of the market last fall. Initially, we did get out, but then we jumped right back in. After all, in retrospect, it was difficult to judge the point at which the market would change as stimulus was reduced. Add that to the economic recovery from the pandemic and reacting to those market conditions became the difficult task that led us to where we are today. So we must now deal with this as best we can until the market recovers. This might be a few months and it might be a year or more. It’s just hard to say. If you can tell me whether we’re at a bottom or not then I can tell you whether we need to remain invested or move to safety. For now I will not exit the market. The C Fund does not have a sell signal and until it does I will not risk being out of the market when it does rally. In hindsight, how we got where we are at is not a mystery. The market traded this way for 80 years prior to 2009. It would be presumptuous of us to think that the last dozen years or so marked a permanent change in market behavior. The only thing that changed during that time was the then unprecedented market stimulus applied by the Fed. We wrote about it then. We all knew there would be a price to pay when it was over and this is it. It’s just a little hard to see because it happened to coincide with the end of a pandemic. Well that market manipulation is now gone leading us to where we find ourselves today! This market can and will recover, but it will only do so in it’s own timeframe. It will not happen quickly within the unrealistic expectations that have come to accept as the norm during the last decade. Welcome to the old/new world!

Had we been trading under the old rules I wouldn’t even be in the market now. Period! The removal of stimulus changed everything. So now all we can do in move on from here. We need to be oh so careful not to make bad decisions based on what we have come to know as the norm in the past dozen years. Those rules no longer apply! We need to watch our charts for a bottom to the current selling. Again!! Understand! As we have been screaming!!! Nothing will change until inflation drops to 2%. Nothing!!!! If you want to understand this market then you need to go back and study the market prior to the stimulus. The rules that applied from 2009 to 2022 no longer apply and the sooner you realize that fact the sooner you will get back to making money. As I said this market will eventually recover and we will recover with it and don’t forget the most important aspect of all this. Keep praying for our group. It makes a profound difference!

The days trading so far has produced the following results: Our TSP allotment is having a nice day with a gain of +1.38%. For comparison, the Dow is currently trading at +1.34%, the Nasdaq +1.91% and the S&P 500 +1.38%. Praise God for a good day so far!

Dow gains 400 points, Nasdaq jumps 2% as investors digest latest batch of corporate earnings

Recent action has produced the following signals: C-Hold, S-Sell, I-Sell, F-sell. We are currently invested at 100/C. Our allocation is now -16.96% not including the days results. Here are the latest posted results:

| 04/18/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8311 | 19.0786 | 66.5773 | 72.5096 | 35.8058 |

| $ Change | 0.0046 | -0.0415 | -0.0133 | -0.7154 | -0.2313 |

| % Change day | +0.03% | -0.22% | -0.02% | -0.98% | -0.64% |

| % Change week | +0.03% | -0.22% | -0.02% | -0.98% | -0.64% |

| % Change month | +0.12% | -3.04% | -3.01% | -4.26% | -2.62% |

| % Change year | +0.57% | -8.66% | -7.46% | -13.10% | -9.22% |

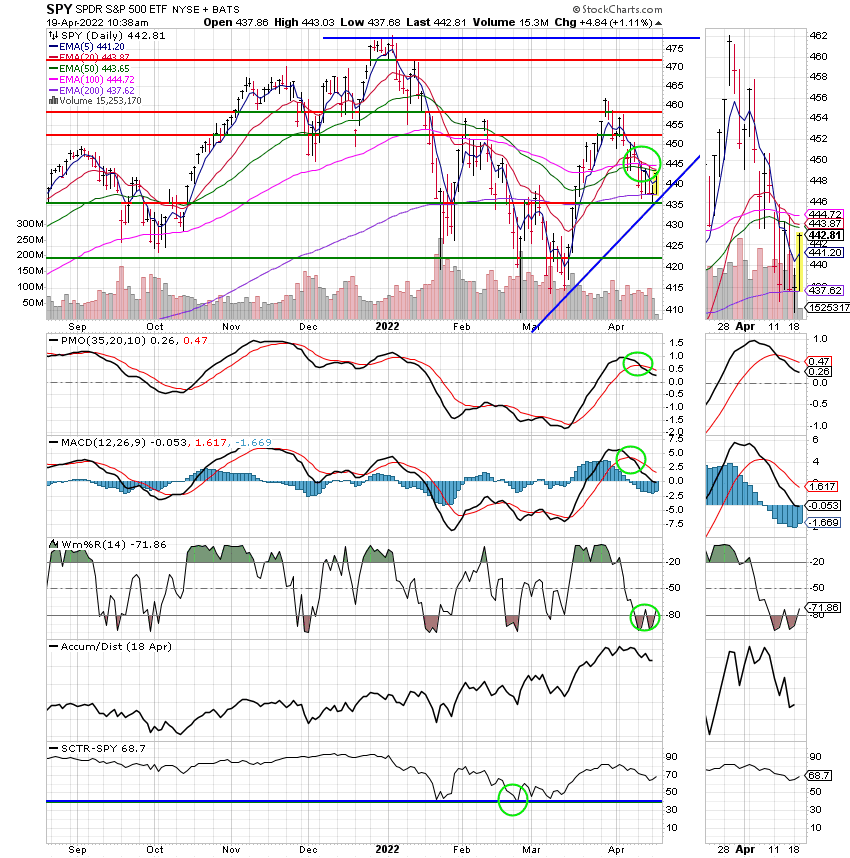

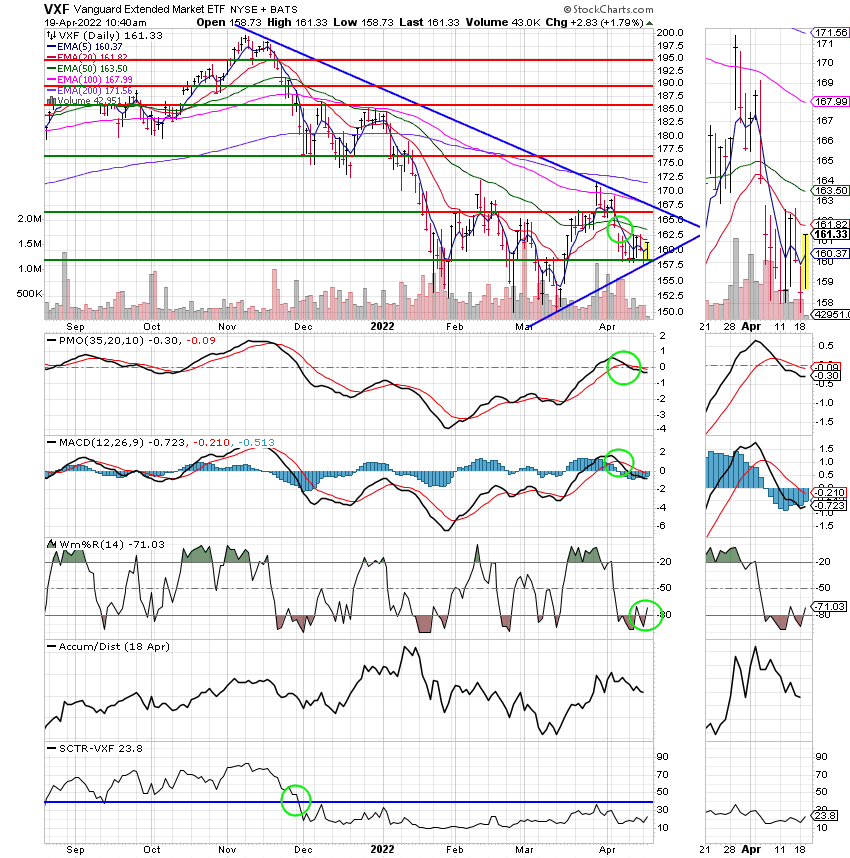

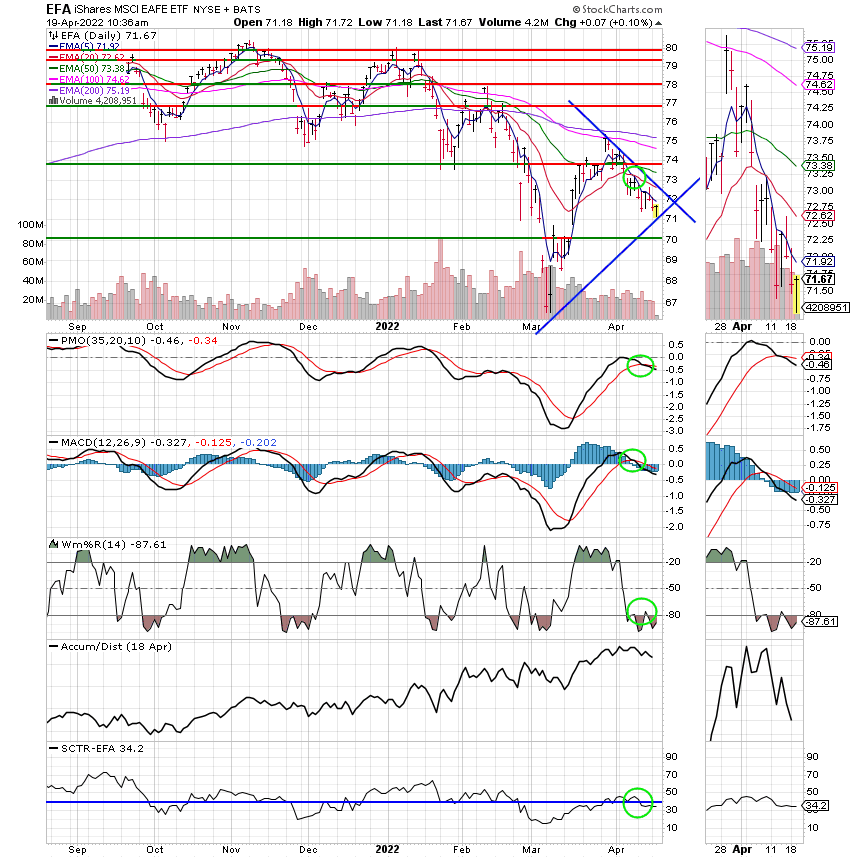

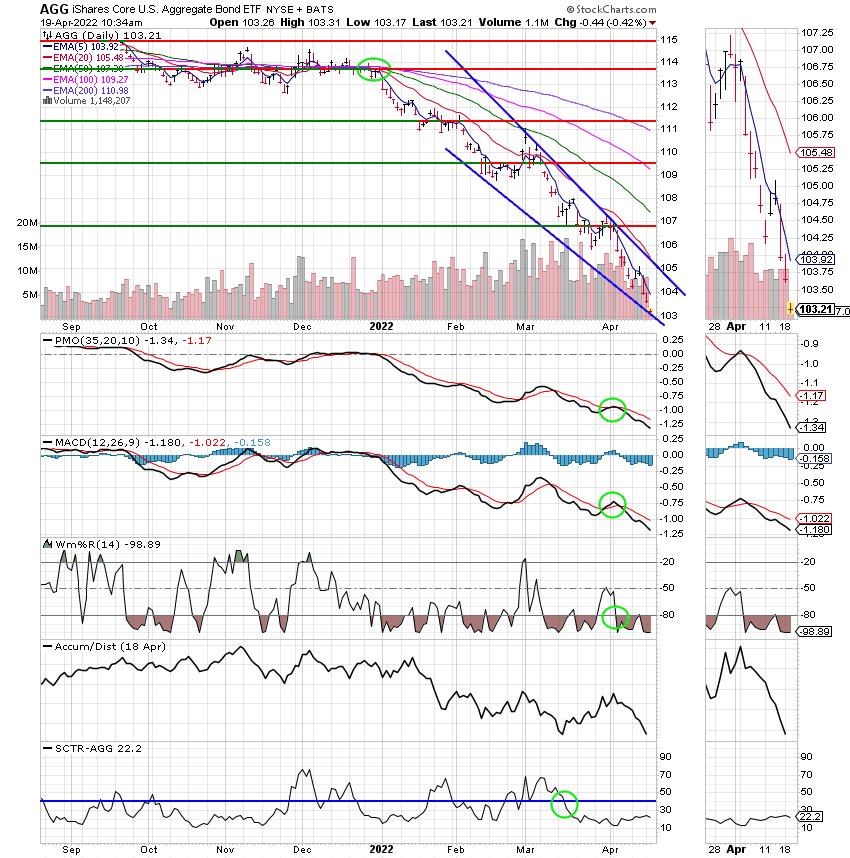

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

If I were forced to describe this market in one phrase if would be “post stimulus”. That’s all for today. Have a wonderful afternoon and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.