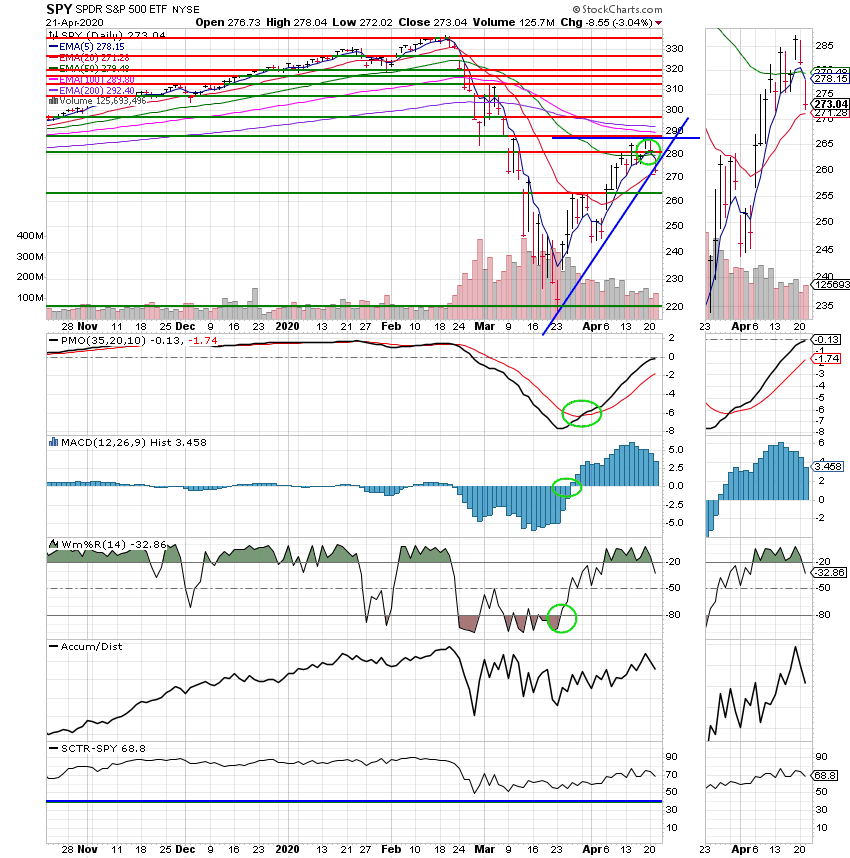

Good Evening, I’ve received more than a few E-Mails asking if anything has changed in the charts. It seems that I always get them when the market has a few bad days and the last two sessions definitely qualify! The market sold off hard today after oil contract futures dropped to zero. That’s right you didn’t read it wrong. I wrote Zero!!! Why??? Because we are nearly out of storage. Those that buy oil bought as much cheap oil as they could store and why not? Secondly, folks have been sheltering in place. So travel has been down. Oversupply, no demand. It’s really simple economics. Last week we talked about the fact that we are in the market and why we are in the market. We talked about the fact that there would likely be more selling. I use the word likely because nobody and I mean nobody knows for sure. We talked about needing to be positioned when the stimulus finally lights this rocket and it leaves the launching pad. Yes, we were fortunate enough to have a few good days and some folks thought we were moving up now. Unfortunately, that’s not the case, but eventually it will and when that comes it will probably be fast and furious. There will be little time to decide whether we should enter the market or not. So we bought in at a nice discount and are waiting for things to recover. As far as the charts go it looks like we could be heading for a retest of support at 2635 for the S&P 500. If that level is breached we will probably retest the March lows at 2200. I’m going to go out on the limb and say that I don’t think we’ll move lower than that if we go that low. One thing is for sure. This market will eventually move back up and when it does we locked in a nice profit. Like I said last week. All we have to do is wait. I have added an excerpt from last weeks blog that was written when the market was moving up….. I think it still applies now. Plus, I want you to remember that I warned you about more selling!

On 04/14/2020 I wrote “The market rose again today on positive sentiment that cases of corona virus in epicenters in the US may be starting to peek. It was also buoyed by signs that the Chinese economy may be beginning to recover. Stocks have now recovered close to half of their losses during the bear market. The major indices all have around 15% to go before they regain their pre bear market levels. While this is all really good, we are not out of the woods yet. There will still be economic and earnings reports that will show the full extent of the damage caused by this pandemic. We must also remain aware that the economy will not reopen all at once and that there will likely be out breaks of the virus as a good deal of our population still has no immunity. Those issues as well as others will all cause shifts in the market in the coming days and weeks. So we must be patient with our investments. Right now it’s all about positioning. It is necessary to be in the market now as high speed algorithm trading fueled by massive government stimulus make it virtually impossible to time the recovery. As you have seen in recent days, you can be left behind in a hurry if you are not already positioned when the buying begins. I’m sure many of your coworkers thought you were crazy if you followed us and got back into stocks. Be aware that there will surely be more selling before this pandemic is in the history books and when it comes the naysayers will come out again and say I told you so. Don’t let them distract you and get your eye off the ball or you will strike out. Don’t bail out of the batters box! If you lose your nerve and sell out you will lose out! If you hang in there you will hit your home run when earnest recovery gets underway. Ultimately the massive stimulus that has been put in place will propel this market to new highs and all you have to do now is nothing at all but wait. Patiently wait……”

I say again, patiently wait. I’m not an advocate of setting it and forgetting it but in this case it might be a good idea to leave it be and come back when you see the news improving. It is not a matter of whether or not the market will move to new highs it’s only a matter of when. By the matter of fact. congress has passed another 450 billion dollar stimulus package as I have been writing this blog. You can add that to the already record stimulus that has been applied to this economy. Yes Sir/Mam the bears are correct when the say we’ve never seen anything like this pandemic before. However, I’ll remind them that we have also never seen anything like the current level of stimulus either. I’m riding with the stimulus and I’m betting on America. We will survive!!! It simply does not make any sense to try to short the market again. We’ve got a good deal right where we are. Be patient and wait.

The days trading left us with the following results: Our TSP allotment gave up -3.07%. For comparison, the Dow lost -2.67%, the Nasdaq -3.48% and the S&P 500 -3.07%. It was a rough day to be sure.

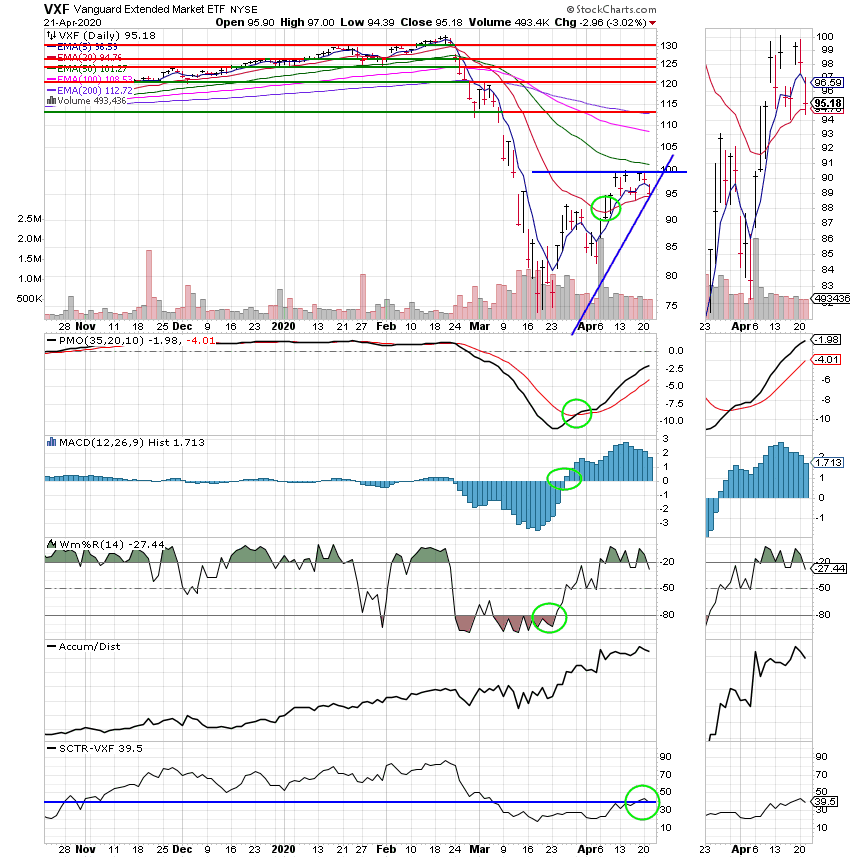

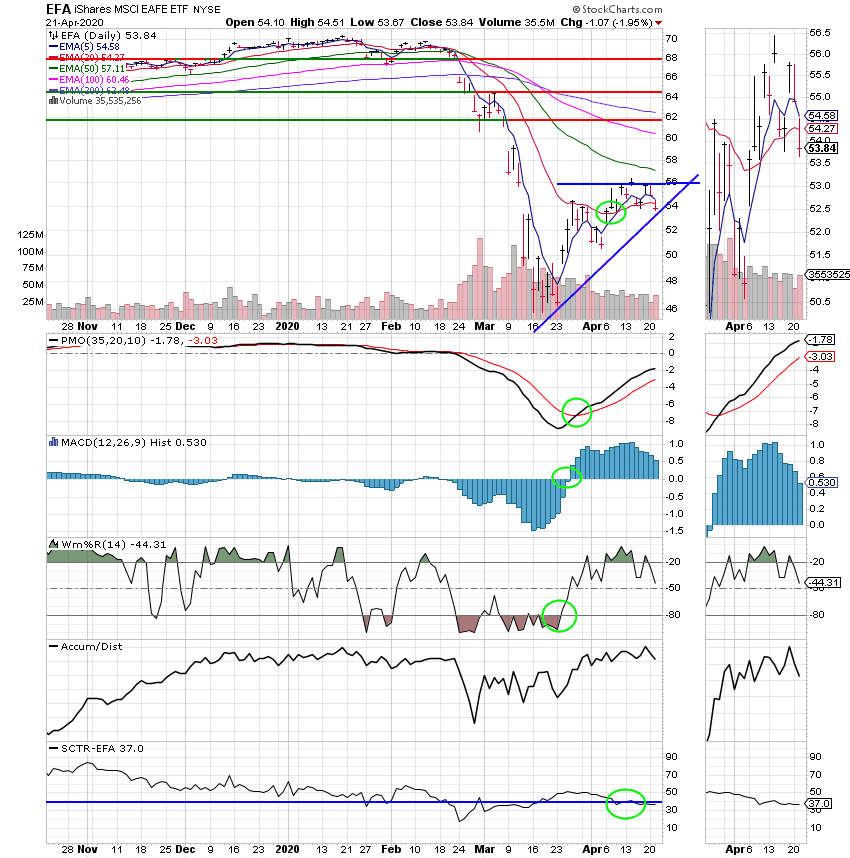

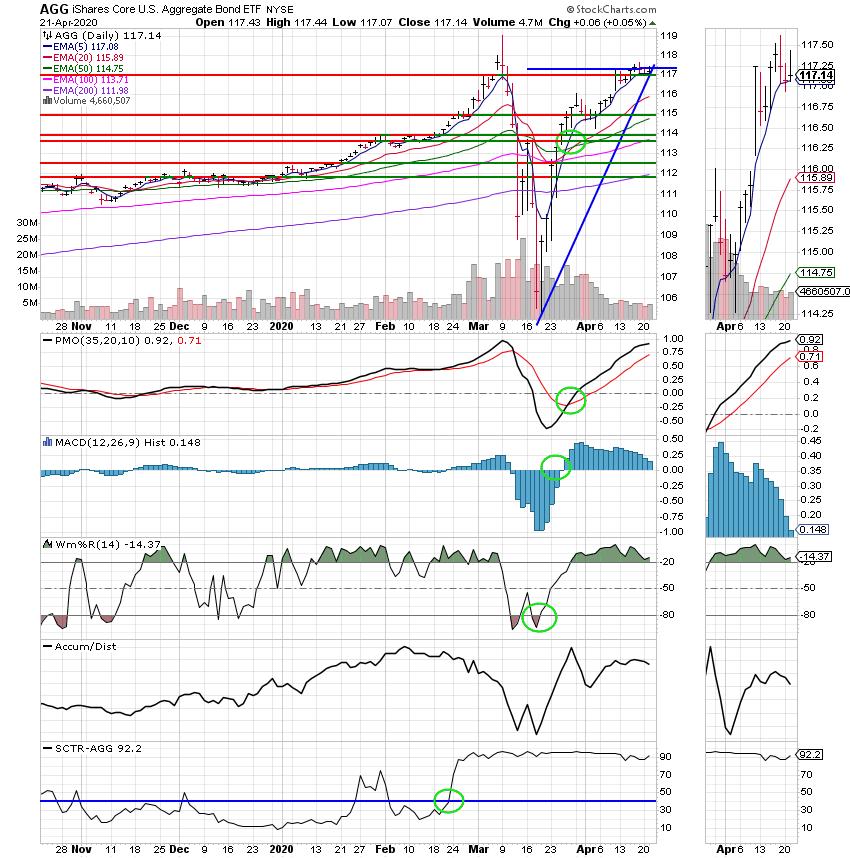

The days action left us with the following signals: C-Buy, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/C. Our allocation is now +2.88% on the year not including the days results. Here are the latest posted results.

| 04/20/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4237 | 20.6534 | 41.5151 | 43.787 | 26.016 |

| $ Change | 0.0011 | 0.0106 | -0.7591 | -0.5589 | -0.2928 |

| % Change day | +0.01% | +0.05% | -1.80% | -1.26% | -1.11% |

| % Change week | +0.01% | +0.05% | -1.80% | -1.26% | -1.11% |

| % Change month | +0.05% | +1.60% | +9.33% | +8.28% | +2.88% |

| % Change year | +0.45% | +4.75% | -12.16% | -22.19% | -20.48% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 20.5539 | 28.2405 | 31.494 | 33.9578 | 19.4715 |

| $ Change | -0.0664 | -0.0976 | -0.2842 | -0.3647 | -0.2373 |

| % Change day | -0.32% | -0.34% | -0.89% | -1.06% | -1.20% |

| % Change week | -0.32% | -0.34% | -0.89% | -1.06% | -1.20% |

| % Change month | +1.65% | +1.68% | +4.29% | +5.09% | +5.78% |

| % Change year | -2.98% | -3.64% | -9.64% | -11.64% | -13.39% |