Good Evening, Wow, I just got done checking our Facebook page….It appears that there are other services that are spending as much of their time writing about us as they are writing about their own allocation. Their outlining every move we made and how wrong it was and how their allocation is the best. Here’s what I have to say about that. If their allocation is not better than ours so far this year it never will be. To date this is the worst year I have had and they know it. So their spending their time taking apart every move that we made. Why are they doing it? I don’t remember going on their pages and hating on them?? I’ve got far more important things to do than that. I have never hid the fact that this has been a bad year so far. I could say that my Dad died and I was distracted or offer a myriad of other excuses, but I won’t do that. I won’t even mention the other services by name. That’s not what we do here. We’re just trying to make decent returns and most of the time we do but occasionally we don’t. Unlike them, we are not perfect and have never claimed to be. All that said, I do feel that I have the right to one rebuttal. My allocation has not been good for the past six months! Did I ever say it was??? Have I ever been less than honest? You all already know the answers to those questions. How many of you who have been with me for the past five, ten, fifteen or twenty years have failed to not only make money but to also outperform all the equity based funds? These other services keep talking about the past 6 months. How about the past 6 years, ten, fifteen, or twenty? You all know what you made so you know the truth. God has blessed us. Being hated on to this level is a new experience for me. I have never attempted to do anything other than help people and serve God. So I would ask this favor of those of you who have been here for the long haul. Go to our Facebook page and tell these haters how our system has worked for you. I have never charged anyone a dime for anything that has been done here. It is freely received and freely given. If this service has benefitted you over the years please mention it on the page. I appreciate each and every one of you.

Enough of that. The market weathered the Fed increasing rates by another 0.75% and a GDP report that showed a second consecutive decline ( the definition accepted by many for a recession) to turn in one of the best weeks in 2022. This resulted in our charts making big moves in the right direction. Ultimately, all the charts we follow generated buy signals. That not only includes the chart for the C Fund but also all of the broad based market wide indicators that we follow such as the ratio of Consumer Staples to Consumer Discretionary Stocks or the ratio of Utilities vs Transportation Stocks. Things such as the VIX, the IWM, the Nasdaq Composite, the Put Call Ratio, the ratio of stocks trading over their 50 day moving average, Gold, Copper, the Dollar, treasury yields and the list goes on and on. I generally look for the greater weight of the signals to make a decision but do to the recent market volatility as well as our recent performance which our competitors have so aptly pointed out I waited until pretty much all of the indicators showed a buy. Of course that meant forgoing some gains which we talked about in earlier blogs. We said we would wait for the longer indicators to come in and we did. Taking all this into regard we issued an alert for an interfund transfer to 100/C. How long will we stay? As long as the majority of the aforementioned indicators stay in the green. Folks the only thing we can do is keep investing. This is still a volatile market. Expect ups and downs. That noted, todays market ended up closing slightly in the red after coming off it’s lows for the day. Stocks turned back up after The Speaker of the House, Nancy Pelosi touched down in Taiwan. The market was relieved when nothing took place after Chinese Authorities made several threats prior to the trip. Geo Political Turmoil, Threat of Recession, and Inflation remain the top risks for stocks. Our task remains the same to watch the news and then look to our charts. We are still praying for inflation to return to that magic rate of 2%. That is what will truly stop the pain.

The days trading left us with the following results: Our TSP allocation fell -0.67%. For comparison, the Dow lost -1.23%, the Nasdaq -0.16%, and the S&P 500 -0.67%.

Dow futures gain slightly after the three major averages notched a second day of losses

The days trading left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/C. Our allocation is now -25.13% on the year not including todays results:

| 08/01/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.9745 | 19.3403 | 62.7209 | 66.3715 | 33.7045 |

| $ Change | 0.0015 | 0.0958 | -0.1774 | 0.0192 | 0.0875 |

| % Change day | +0.01% | +0.50% | -0.28% | +0.03% | +0.26% |

| % Change week | +0.01% | +0.50% | -0.28% | +0.03% | +0.26% |

| % Change month | +0.01% | +0.50% | -0.28% | +0.03% | +0.26% |

| % Change year | +1.42% | -7.40% | -12.82% | -20.46% | -14.55% |

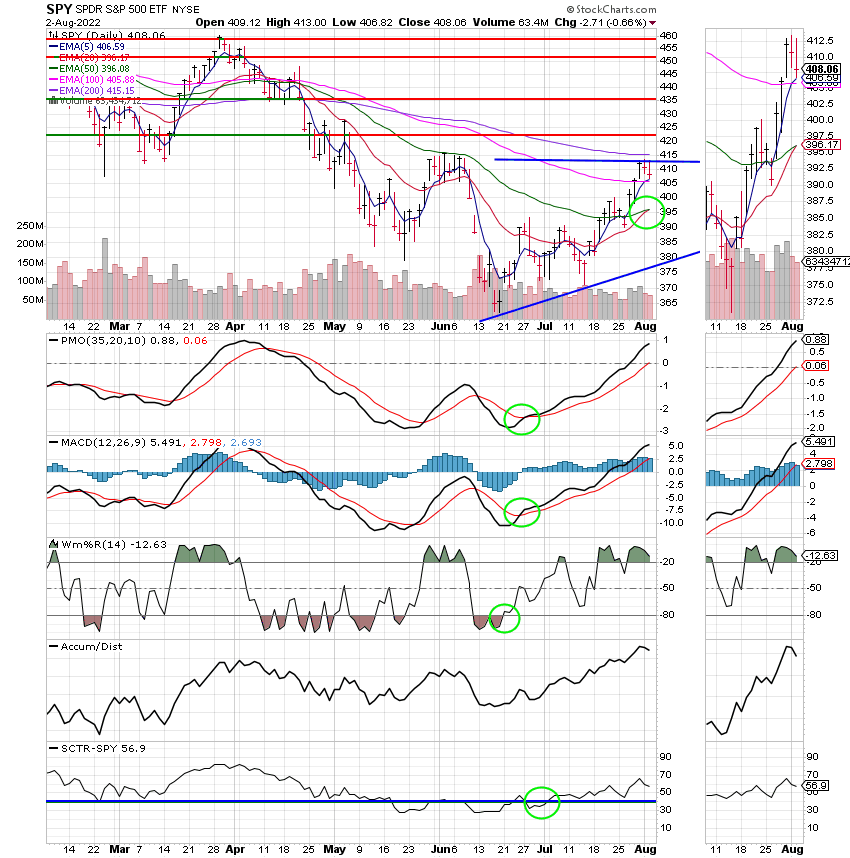

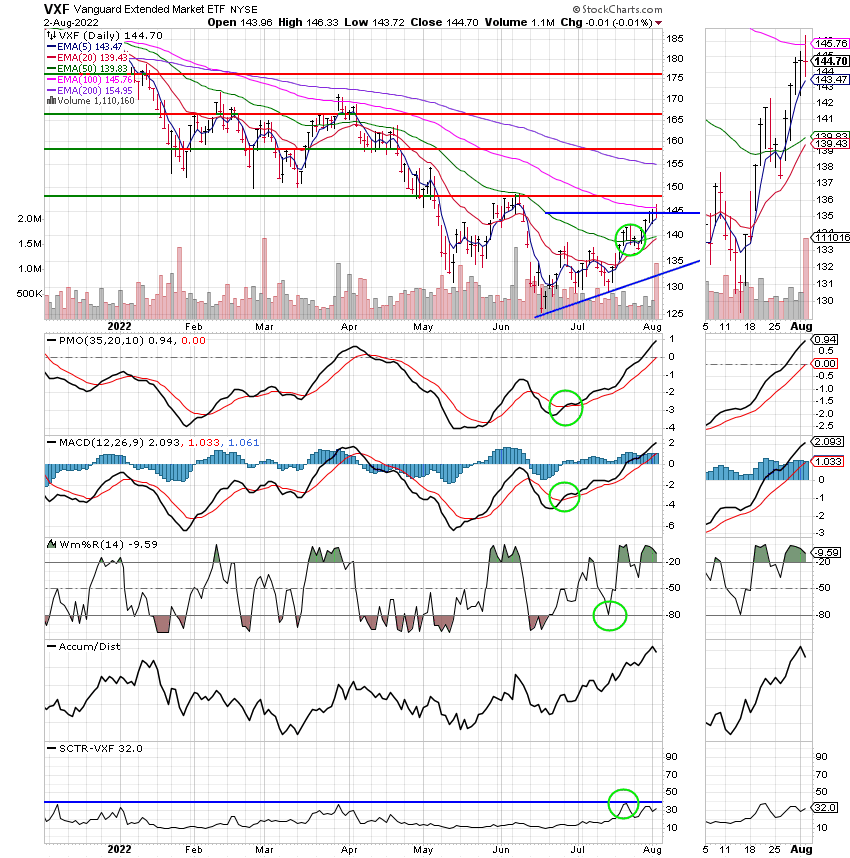

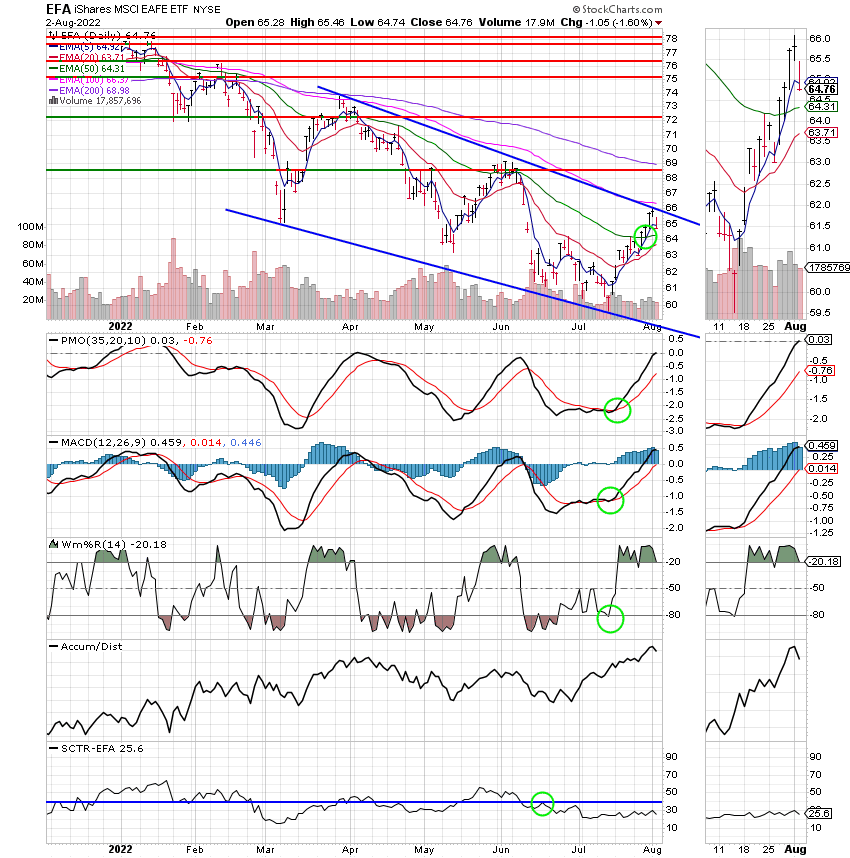

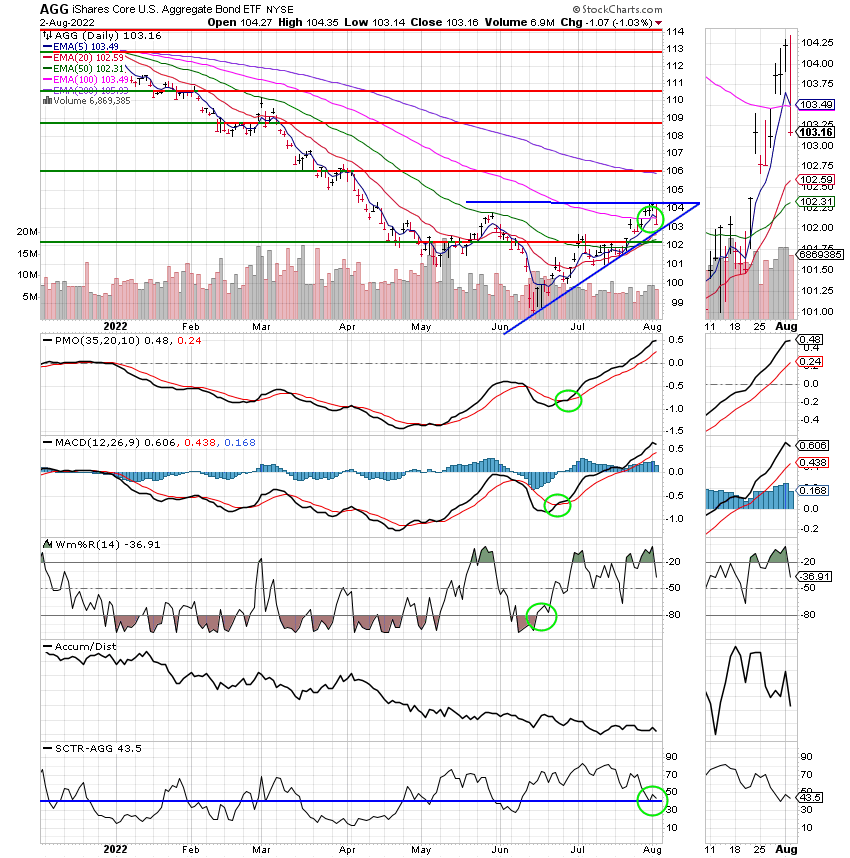

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Keep praying for our group. God will deliver us from this bad market just like has all the others! That’s all for tonight. Have a nice evening and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.