Good Evening, We had an energetic rally that sputtered out yesterday and was renewed somewhat again today. In my opinion it’s probably just an oversold bear market bounce but the thing to remember is that all recoveries begin with a bounce. So let me be careful to say that while I’m saying that things may be a certain way and I not saying that they will be that way. That’s prognostication which is 180 degrees the opposite of our philosophy. What we do is to react to the present data on out charts. That said, we do try to look at the most likely outcomes and have a plan for them but have found out many times that it is really just best to be ready for anything. I hate to sound like a broken record but the main driver in the market continues to be inflation. Virtually all the issues we see in the current market with the exception of the war in the Ukraine and Covid are a direct result of inflation and you could even say that they are affecting the rate of inflation. Regarding that subject, Federal Reserve Chair Jerome Powell emphasized his resolve to get inflation down, saying today that he will back interest rate increases until prices start falling back toward a healthy level. “If that involves moving past broadly understood levels of neutral we won’t hesitate to do that,” the central bank leader told The Wall Street Journal in a livestreamed interview. “We will go until we feel we’re at a place where we can say financial conditions are in an appropriate place, we see inflation coming down. “We’ll go to that point. There won’t be any hesitation about that,” he added. So what he is saying is that when they see a trend (not just one day) of inflation falling then they will quit raising rates. I am already on record as saying that the closer the rate of inflation gets to 2 percent the more normal the economy and the market will become. Specifically, he said prices. When they see prices going down they will stop increasing rates, but make no mistake the Fed closely watches the consumer price index. That is their metric for inflation and 2 percent is their acceptable mark. So if you want to make it simple they are saying they will do whatever they have to do as long as they need to do it to get back to what they consider to be normal inflation and once again that is 2 percent. It’s as simple as that and easiest way he can give that message to the American public is to say “When we see prices falling back to a healthy level” and what is a healthy level??? As if you didn’t already know 2 PERCENT!!

So how long are we going to stay in the G Fund?? Until we see SUSTAINED uptrend and sustained doesn’t mean a one or two day bear market rally. That means that at a bear minimum (no pun intended) we’d like to see the five day moving average for the major indices make a good turn higher and in all reality we’d prefer to see the 5 EMA pass back up through the 20 or the 50 EMA. Right now the moving averages are what we refer to as upside down meaning the 5 EMA is on the bottom with the 20 EMA just above that and the 50 EMA just above that. For you folks that are still in technical analysis 101, that is exactly the opposite of a market that is trending higher. In that case the 5 EMA would be on the top followed by the higher EMA’s meaning the 20, the 50, the 100, and the 200 which are the ones that we use. Also while we’re on the subject, I prefer to use what is called an EMA which is different from a simple moving average. An exponential moving average (EMA) is a type of moving average that is similar to a simple moving average, except that more weight is given to the latest data. It’s also known as the exponentially weighted moving average. This type of moving average reacts faster to recent price changes than a simple moving average. A simple moving average is just that, the sum of the price divided by the number of days. There are disadvantages to using the simple moving average when there is a large price movement over a short period of time. I prefer to see that on my charts now. In other words I want to make my investment decisions using the most current data. There are those that do prefer the simple moving average but I am not among them. There you have it! You can make some pretty good investment decisions even if the only thing you know is how to read the moving averages! Of course you can earn all that and more at the education center on stockcharts.com.

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, The Dow gained +1.34%, the Nasdaq was +2.76%, and the S&P 500 was +2.02%. It was a nice bounce but we will need to see more before we can say the trend has changed.

Dow rallies 400 points as market comeback from the year’s lows gains steam

The days action left us with the following signals: C-Sell, S-Sell, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now -18.62% for the year not including the days results. Here are the latest posted results:

| 05/16/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.8661 | 18.9392 | 60.8333 | 63.5527 | 33.56 |

| $ Change | 0.0041 | 0.0395 | -0.2375 | -0.8005 | 0.0563 |

| % Change day | +0.02% | +0.21% | -0.39% | -1.24% | +0.17% |

| % Change week | +0.02% | +0.21% | -0.39% | -1.24% | +0.17% |

| % Change month | +0.13% | +0.00% | -2.91% | -6.17% | -2.50% |

| % Change year | +0.77% | -9.32% | -15.45% | -23.84% | -14.91% |

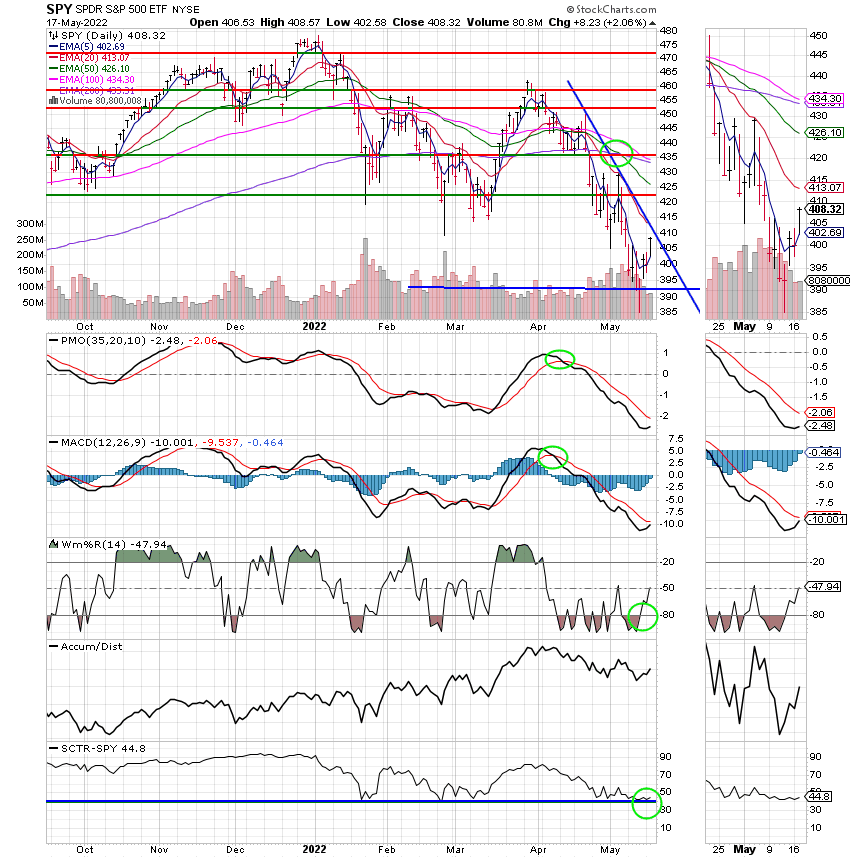

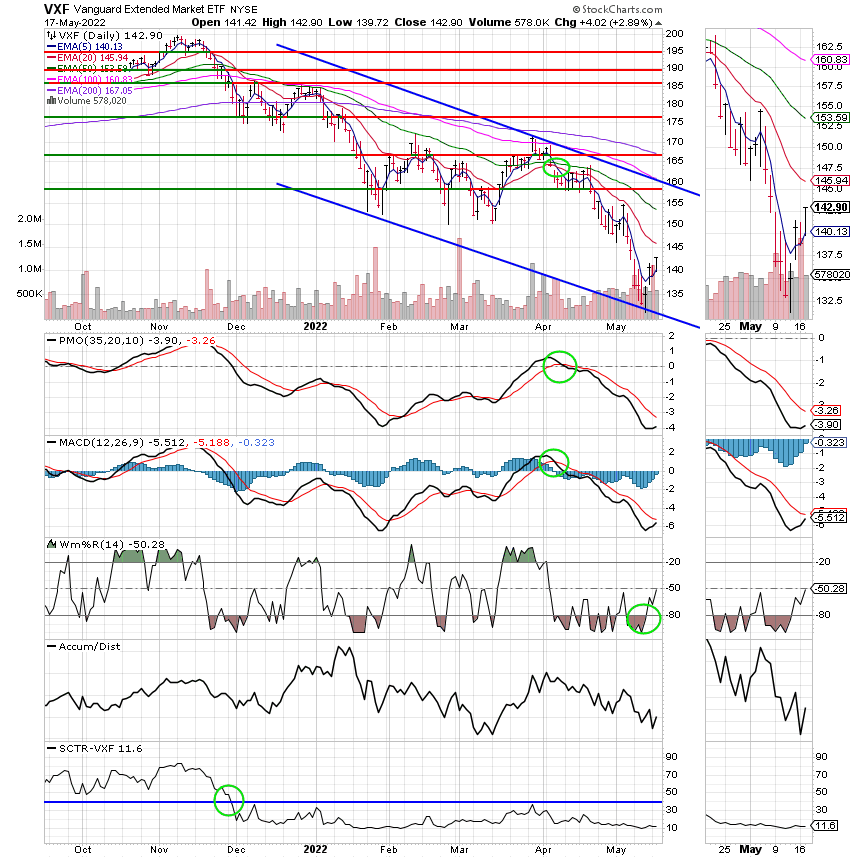

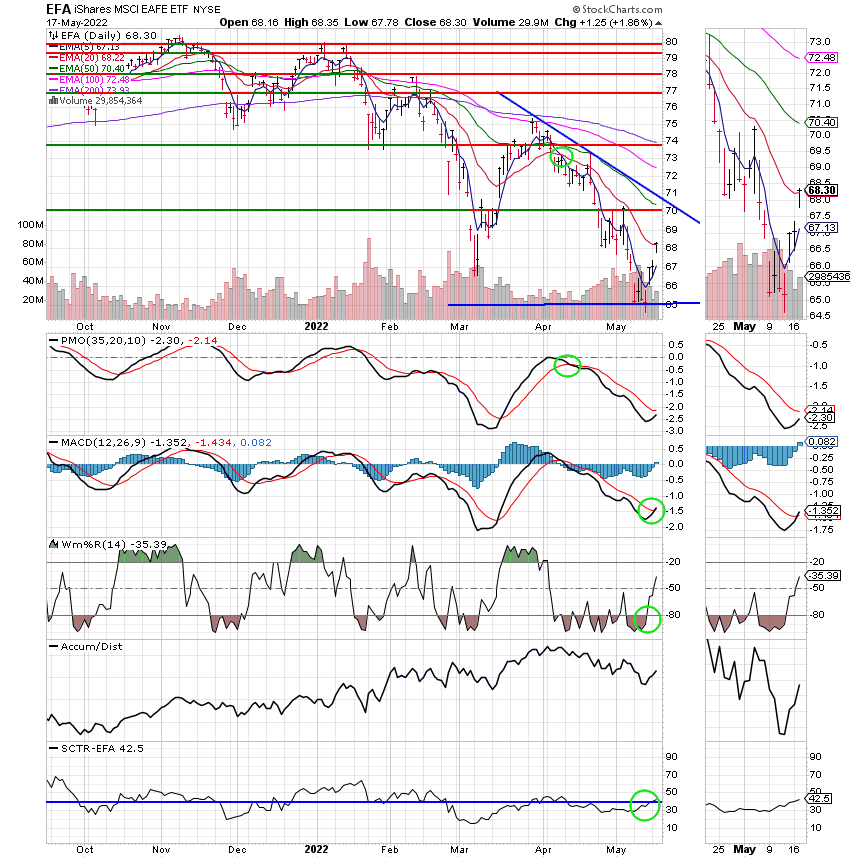

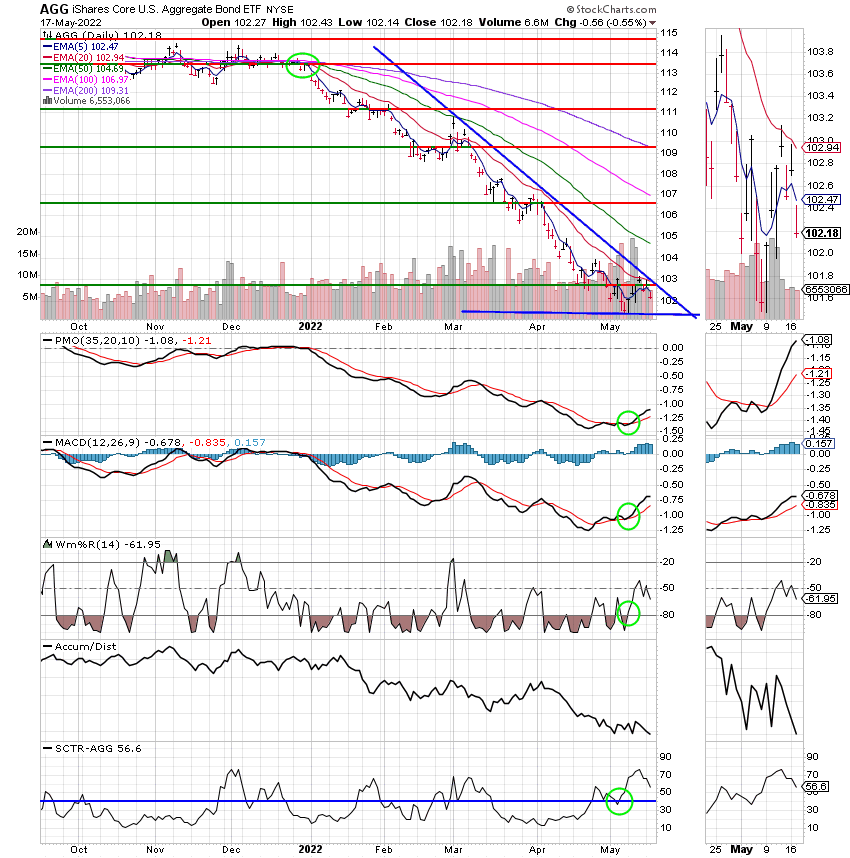

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

This is the part were you really have to be patient. That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.