Good Day, Wow, I could write a book about this market. Yes indeed, I could write a book and it all could change as soon as I write it. The key word here is volatility. I can remember some volatile markets, but thinking back as hard as I can I can’t really remember one this volatile. So how volatile is it? This is the fourth fastest decent from an S&P 500 high to a technical bear market which of course is -20%. Since 1929, the S&P 500 has experienced more than two dozen bear markets. This year’s declines have marked a quicker-than-average descent into bear territory, at 111 trading days since the index’s Jan. 3 record high, according to Dow Jones Market Data. Only the 1987, 2009 and 2020 bear markets took fewer trading days to achieve a 20% drop among the past 10 bear markets. The big difference here is the volatility leading up to and since this event. It’s unprecedented. Let me use myself as an example. I have been trading since 1987 and the my worst year in TSP to date as -1.86%. Our thrift allocation is currently off a whopping 25.22%. Now, there’s one of two things going on here. Either I’ve gone to heck in a handbasket over night or something has changed. I’ll let you be the judge. If you think I’ve gotten that bad overnight then you probably ought do something better with your time than read this. I really mean that. However, if not, then you need to look at what changed and learn from it. I have already pointed out several times that trading now would be different than it was the past twelve years due to the discontinuation of quantitative easing and the introduction of quantitative tightening. The selloffs will be deeper and longer. Is there anyone out there disputing that now?? Ok, but beyond that we have entered the perfect storm. Add it all together and this is what you get. #1The Fed is behind- I hate to say it but the Fed has been too timid in raising rates. They were so concerned with bringing the economy in for a soft landing that they failed to increase rates as much as they should early on and now they are behind. We are likely looking at an aggressive .75% hike in interest rates at tomorrows meeting. In reality it should be more. The Fed will likely now bring about the very thing they sought to avert. A recession and speaking of a recession the bond yield inversion a few months ago predicted one sometime in this time period. It should be noted that the yield curve even more drastically inverted yesterday. Folks we will have a recession. There is little doubt about that!! #2 Recovery from a pandemic- Simply put we have an economy that’s running hot after begin shut down for Covid. Supply has not yet met demand for things that weren’t produced during the shut down. Add that to continuing Covid outbreaks such as the one that occurred in China and you have demand out stripping supply. Anyone that has ever studied economics knows that price is set from supply and demand. So, short supply coupled with high demand is leading to even higher prices #3 The War in the Ukraine- There are two issues here. Energy and Food. Ukraine and Russia produce an abundance of both and while we aren’t reliant on it Europe and several countries around the world are. Couple that with the current administrations war on fossil fuels and you have record high costs for energy. This not only effects the cost that consumers pay for fuel at the pumps and to heat their homes which is bad in and of itself, but the greatest effect of these energy prices is that everything that is produced in a world economy has to be transported and that cost is passed on to consumers in everything they buy…everything. Now about the food. Many countries around the world are reliant on the grain supply coming from Russia and the Ukraine to feed their people. With this supply diminished or gone they are forced to find other sources of grain. This results in an increased demand for a smaller supply. Thus food prices are increasing at unprecedented rates. Add that to supply chain issues and you are starting to see empty shelves even here in America. This issue will likely result in famine in many third world countries that are unable to compete for this diminishing supply. So……lets wrap this discussion up for today. There is so much more that I could write but I am running out time. You can monitor all this stuff and go nuts doing it or if you choose you can look at one thing and that one thing is inflation. The Feds target rate for inflation is 2%. The higher we are above that the worse things will be…including and especially the market. Where are we now?? This is not good news. The producer price index, a measure of the prices paid to producers of goods and services, rose 0.8% for the month and 10.8% over the past year. The monthly rise was in line with Dow Jones estimates and a doubling of the 0.4% pace in April. That is a long long way from 2%…… All you can really do about it is what you should be doing to start with…Praying to the Lord God who is the only one that can truly get us out of this mess which extends far beyond the market. By the matter of fact the market pales in comparison to some of these issues, but make no mistake, Our God is equal to the task and he inhabits the praises of the faithful. So keep praying and praising. He will never forget His children. I am very old and I have never seen the righteous forsaken or their seed begging bread!

I will be on the road for a few days. So my face book posts may be spotty! We will be playing for an evangelistic outreach at the Bonnaroo music festival in Manchester TN. If any of you happen to be in the area stop by the Canvas Church tent. I will be playing with the husband and wife Evangelist Team Justin and Amanda Walden. I’d love to visit with any of you so stop on by!!

The current action is producing the following results: Our TSP allotment is steady in the G Fund. For comparison: The Dow is currently off -0.69%, the Nasdaq is slightly higher at +0.13%, and the S&P 500 is lower at -0.36%. I will praise Him in the storm!

Stocks give up earlier bounce, S&P 500 is about little changed

The days action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now -25.22% for the year. Here are the latest posted results:

| 06/13/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.9049 | 18.4131 | 56.991 | 60.0195 | 32.0306 |

| $ Change | 0.0042 | -0.3015 | -2.2985 | -3.3609 | -1.1364 |

| % Change day | +0.02% | -1.61% | -3.88% | -5.30% | -3.43% |

| % Change week | +0.02% | -1.61% | -3.88% | -5.30% | -3.43% |

| % Change month | +0.15% | -3.86% | -7.52% | -8.14% | -8.04% |

| % Change year | +1.01% | -11.84% | -20.79% | -28.07% | -18.79% |

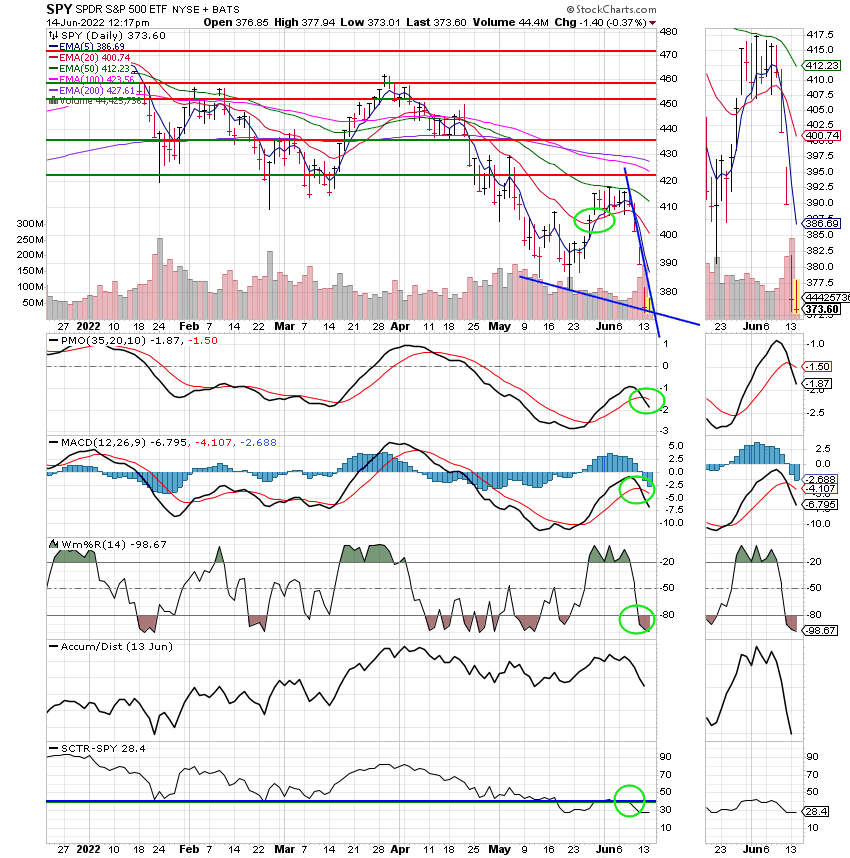

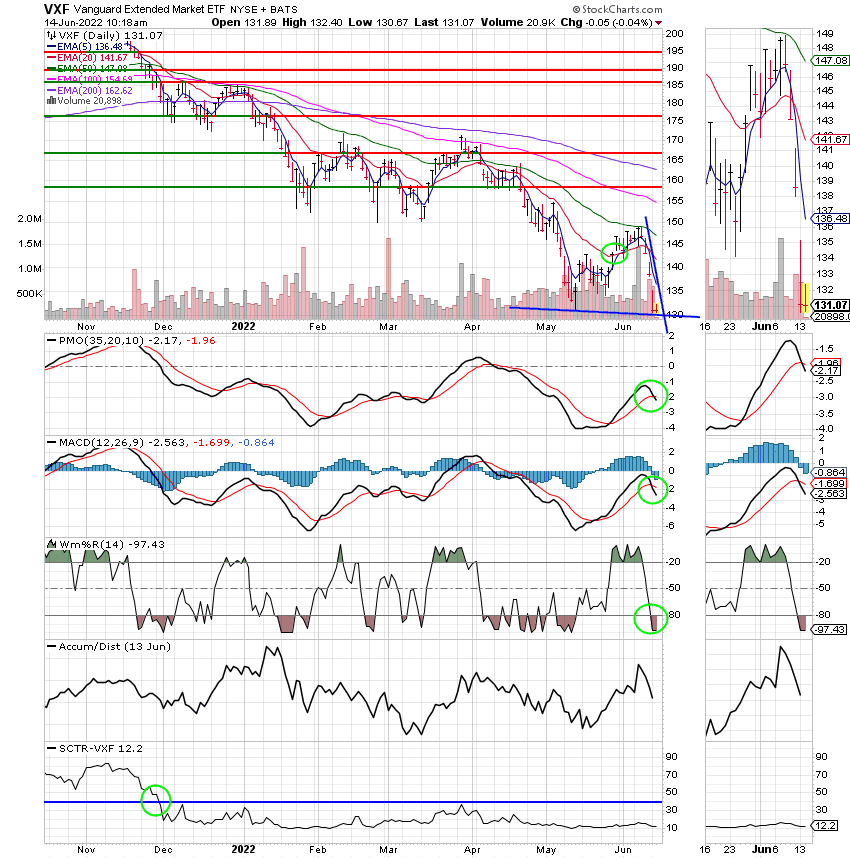

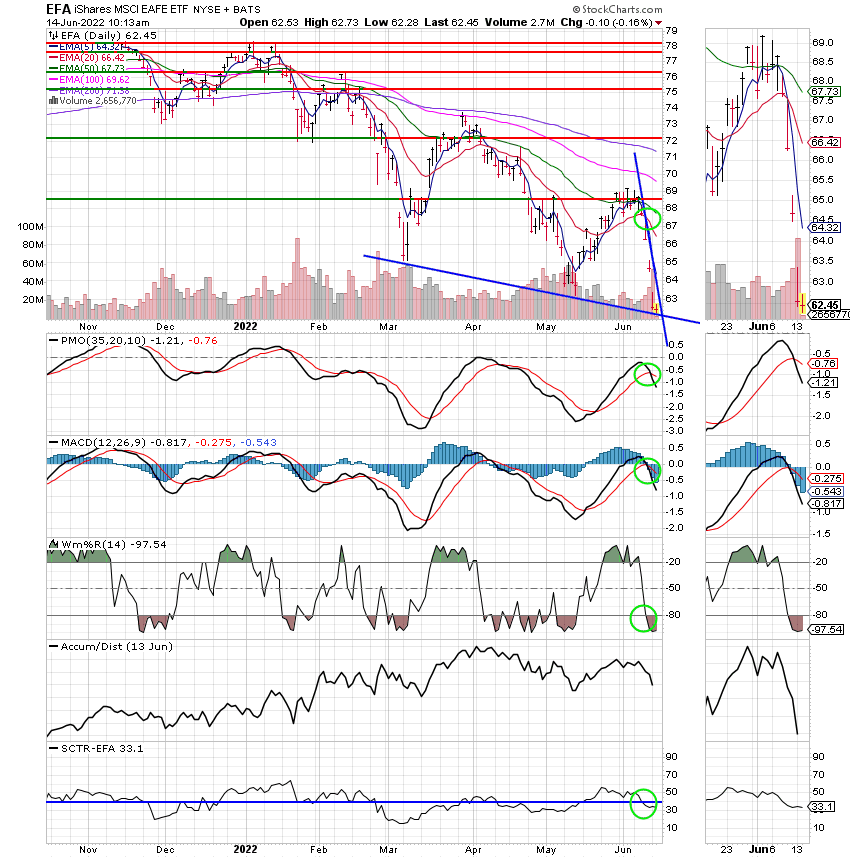

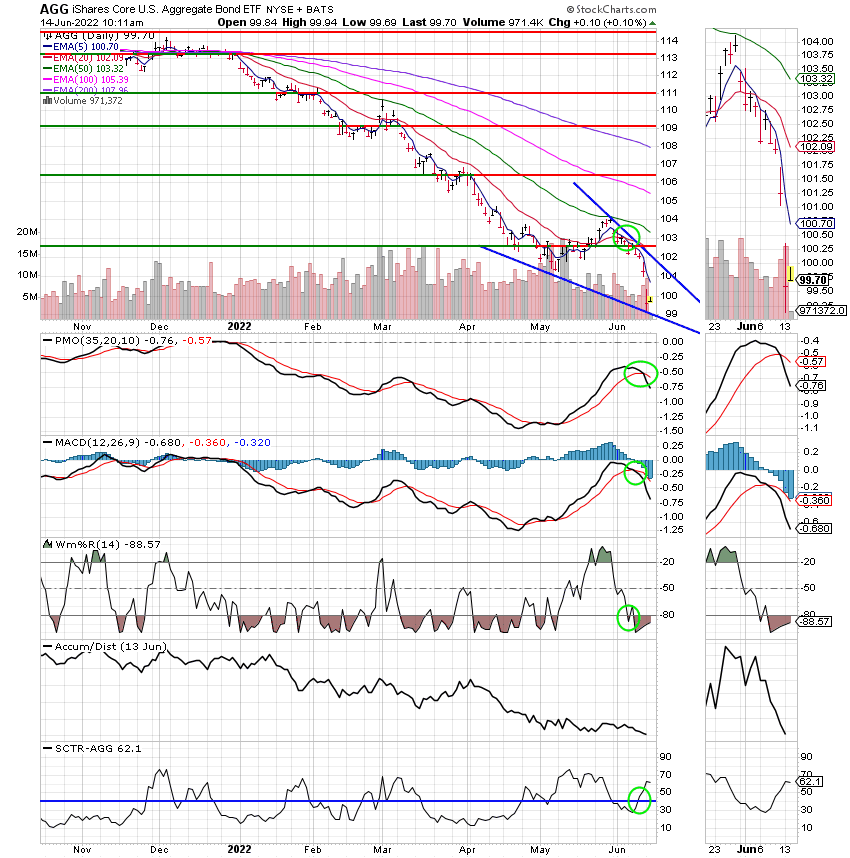

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

I Fund:

F Fund:

Keep praying! That’s all for today. Have a great afternoon and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.