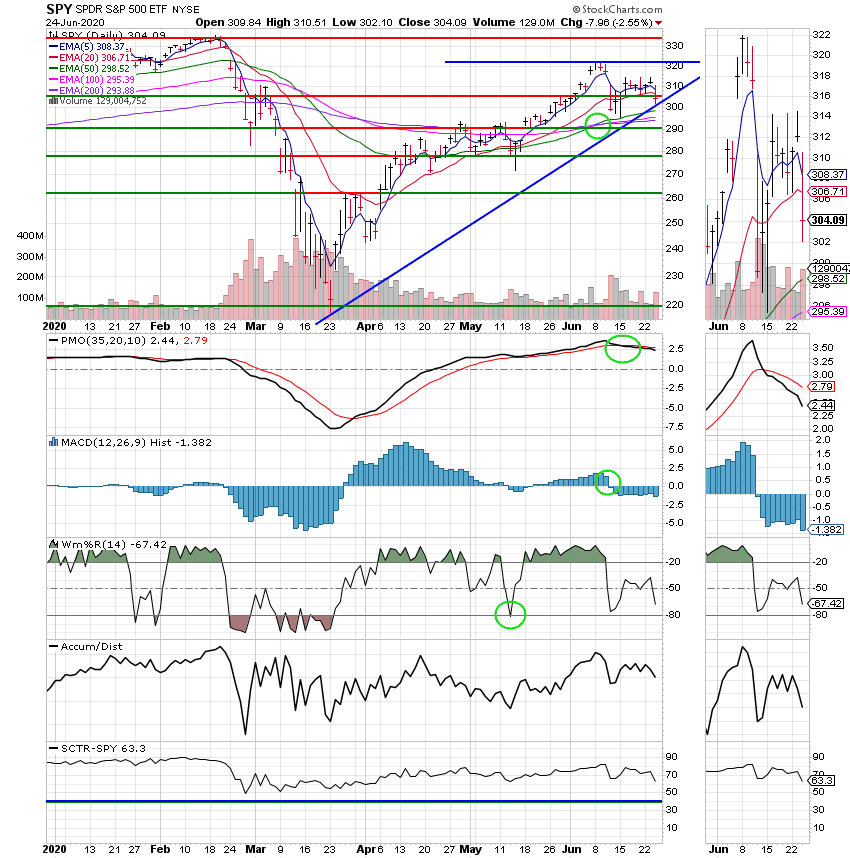

Good Evening, It was so many blogs ago when we discussed future action like we had today that I can’t even remember for sure when it was. I would have to look in the archives to find that. You can do so if you want….My point by saying this is not that I called it. It was as plain as the nose on the end of your face. We all knew it was going to happen. You certainly didn’t need me to point that out. So nobody should be surprised at this point. You got in at a good price and now you have to ride it out. My contention has always been that as long as the S&P 500 remains above 2200 we will be fine and there are at least three areas of support between where we are now and there. So what happened today? The market sold off in a strong fashion on news that new cases of Corona Virus are spiking again in Florida, Texas, Arizona and California among some of the more prominent hot spots. Particularly upsetting to investors was a report that New Jersey and Connecticut would now require people traveling from those hot spots to quarantine for 14 days. I’ve got to scratch my head on that one……didn’t folks from that area travel to Florida and other vacation spots to ride out the Virus when it hit their states most likely bringing it with them as they came…. I guess it must be those same folks traveling back to the Northeast???? Anyway it looks like we’re going to have another significant downturn at this point but that’s only an educated guess. As you all know I am a reactive trader. I’m in the camp that says nobody has a crystal ball. Or….as Carl Swenlin who founded Decisionpoint.com often says “Technical Analysis is more like a windsock than a crystal ball.” The bottom line is that we believe that market will remain volatile until there’s a vaccine for COVID 19. So we got in at a good price and we’re prepared to see it through. Days like today are just part of the process.

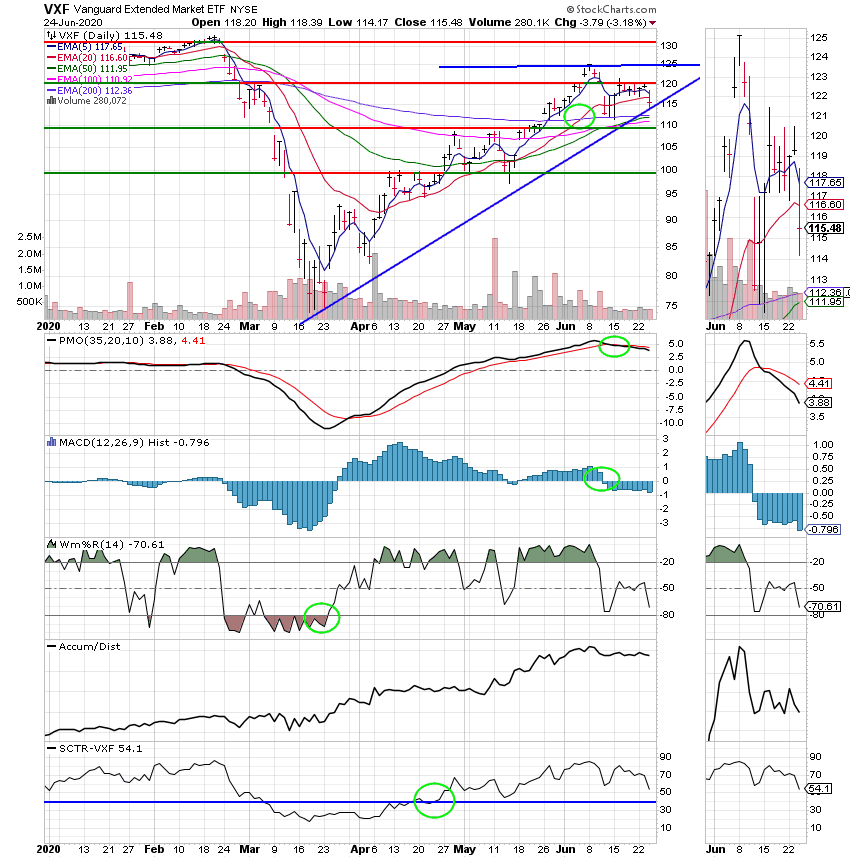

The days trading left us with the following results: Our TSP allocation dropped -3.18%. For comparison, the Dow lost -2.72%, the Nasdaq -2.19% and the S&P 500 -2.59%. It was a see of red…

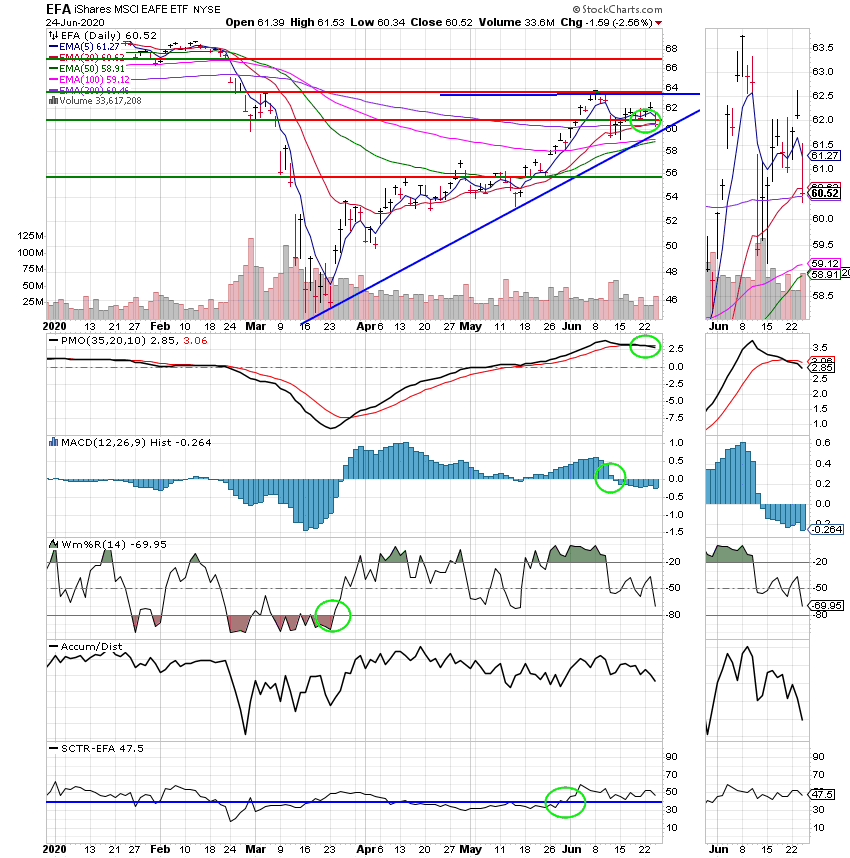

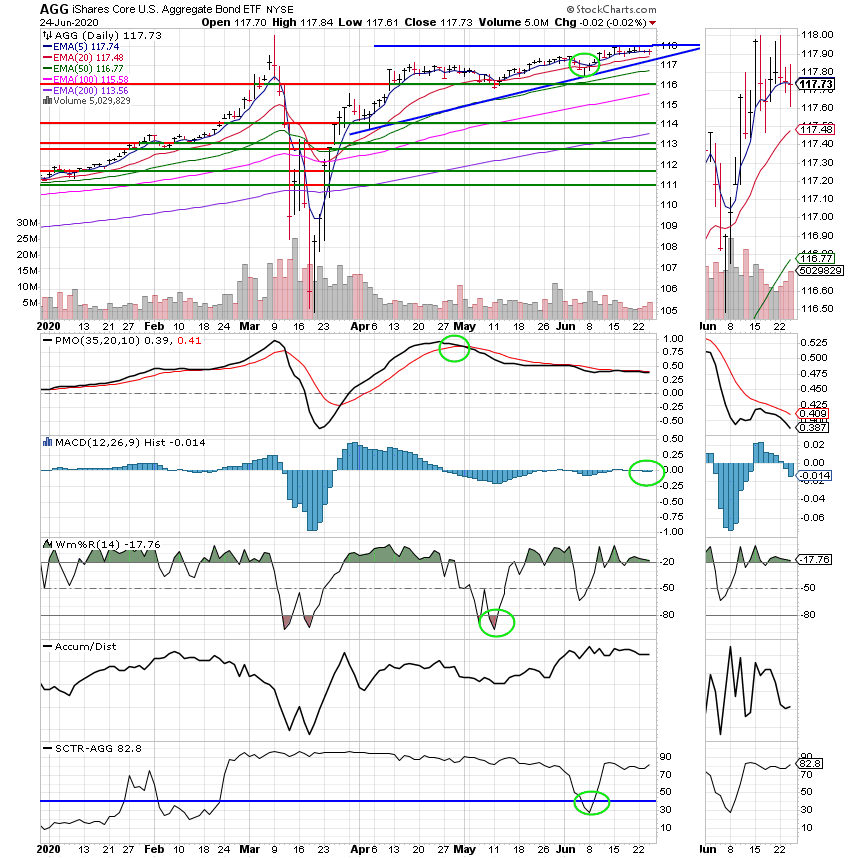

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +14.58% on the year not including the days results. Here are the latest posted results.

| 06/23/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4448 | 20.862 | 46.2165 | 53.1796 | 29.9137 |

| $ Change | 0.0003 | -0.0120 | 0.1976 | 0.1245 | 0.5062 |

| % Change day | +0.00% | -0.06% | +0.43% | +0.23% | +1.72% |

| % Change week | +0.01% | -0.06% | +1.09% | +0.87% | +2.14% |

| % Change month | +0.04% | +0.37% | +2.98% | +4.38% | +6.37% |

| % Change year | +0.58% | +5.80% | -2.21% | -5.50% | -8.57% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 21.2015 | 29.1876 | 34.1789 | 37.4265 | 21.7509 |

| $ Change | 0.0391 | 0.0575 | 0.1736 | 0.2261 | 0.1492 |

| % Change day | +0.18% | +0.20% | +0.51% | +0.61% | +0.69% |

| % Change week | +0.31% | +0.33% | +0.86% | +1.02% | +1.16% |

| % Change month | +1.04% | +1.10% | +2.72% | +3.22% | +3.66% |

| % Change year | +0.07% | -0.41% | -1.93% | -2.61% | -3.26% |