Good Evening, I’ve got great news for all of you. Yes the market went up today but that’s not it! Well not all of it…. We were finally able to get our E Mail situation corrected and will be sending out a test E-Mail to all of you that are signed up soon. After that we will be able to send out E Mail alerts again in addition to the push notifications that you receive on your smart phones. I know a lot of you really need this and I apologize for taking so long to get it corrected but is was necessary in order to keep our service free. The problem was that we grew too big and the E Mail service we use started charging us a somewhat hefty fee. I thought about paying it myself but it was just a little more than I could do. No Problem though, God blessed our group once again as we had someone volunteer to pay the fee. I will keep them anonymous as I know that is their wish but please pray with me that God will bless them abundantly for helping our group!

Well back to the main subject. The market rallied again today as investors looked past surging Corona Virus cases to close out the strongest quarter since 1987. The market moved higher this quarter fueled by economic stimulus, the partial reopening of the economy, slowing down of the virus in the northeast and progress toward a Covid 19 vaccine. That’s pretty much it in a nutshell. Fed chairman Jerome Powell and Treasury Secretary Steven Mnuchin testified before the House Financial Services Committee today. The purpose of the testimony was to address the Fed and Treasury’s response to the pandemic. Powell stated that “Output and employment remain far below their pre-pandemic levels. The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus.” “A full recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.” He also added that “The path forward will also depend on the policy actions taken at all levels of government to provide relief and to support the recovery for as long as needed.” Mnunchin told the committee that the economy is in a strong position to recover from the coronavirus. There was a small dip after news of the testimony was released but the market picked back up and rallied into the close.

It as a successful quarter for our group as well. I want to take the time to thank God for guiding us through the selloff and into the recovery! That said, I would caution each one of you that this market will continue to be volatile until this virus is behind us. So it is important not to panic each time the market drops and there will be more selling. It’s all about positioning right now. Question, where does the market go each time there is good news about Covid 19? Question, where do you want to be when the news finally declares the virus to be behind us? Sure you can try to sit it out until it moves up, but you won’t be there for the initial push back up and more likely that will be fast and furious. Each persons tolerance is different. So you’ll just have to decide what your comfort level is because it will continue to be volatile for the foreseeable future. If you can’t stand the market swings then the G Fund is probably where you need to be. It is nice that we made money to be sure, but it is more important to be in the market when the news is finally released declaring that the Corona Virus is history. So unless you believe that day will never come remember one thing, Panic is not a strategy. Folks it is going to have to go pretty low to go lower than the great price that you got back into the market at. That being the case, why would you sell unless you could improve your cost basis? If it does drop that low then we’ll deal with it. I don’t think it will but you never know for sure. Never! You let the price action make all your investment decisions. After all, it worked pretty well this quarter when so many folks were selling at the drop of a hat….I leave you with that thought.

The days trading left us with the following results: Our TSP allotment posted a gain of +1.50%. For comparison, the Dow added +0.85%, the Nasdaq +1.87%, and the S&P 500 +1.54%. Praise God for a good day!

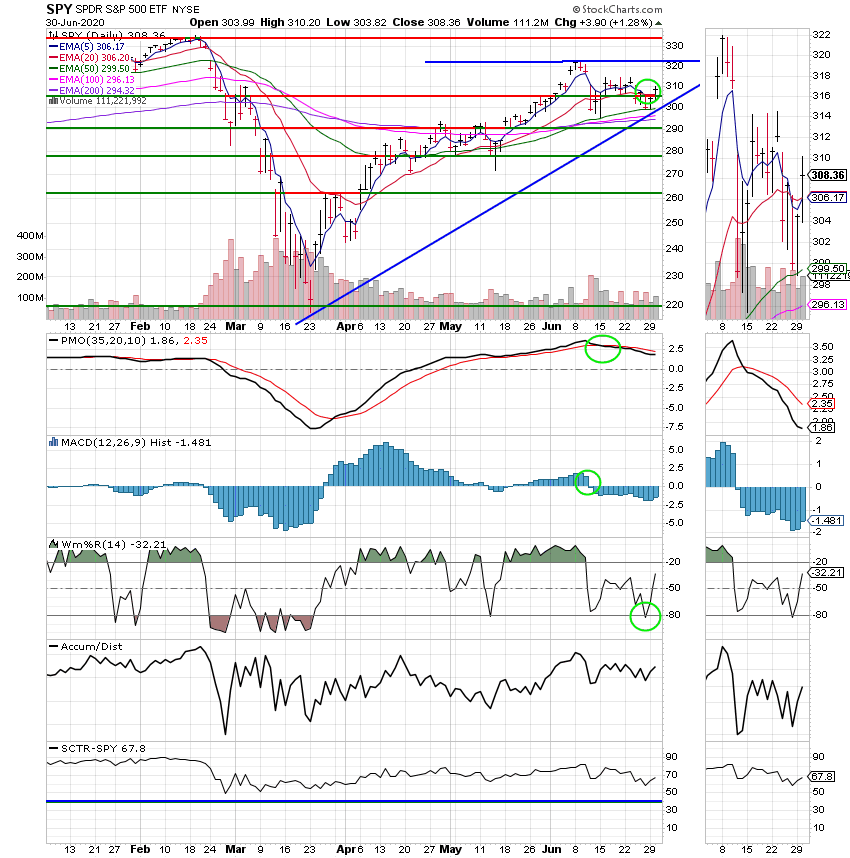

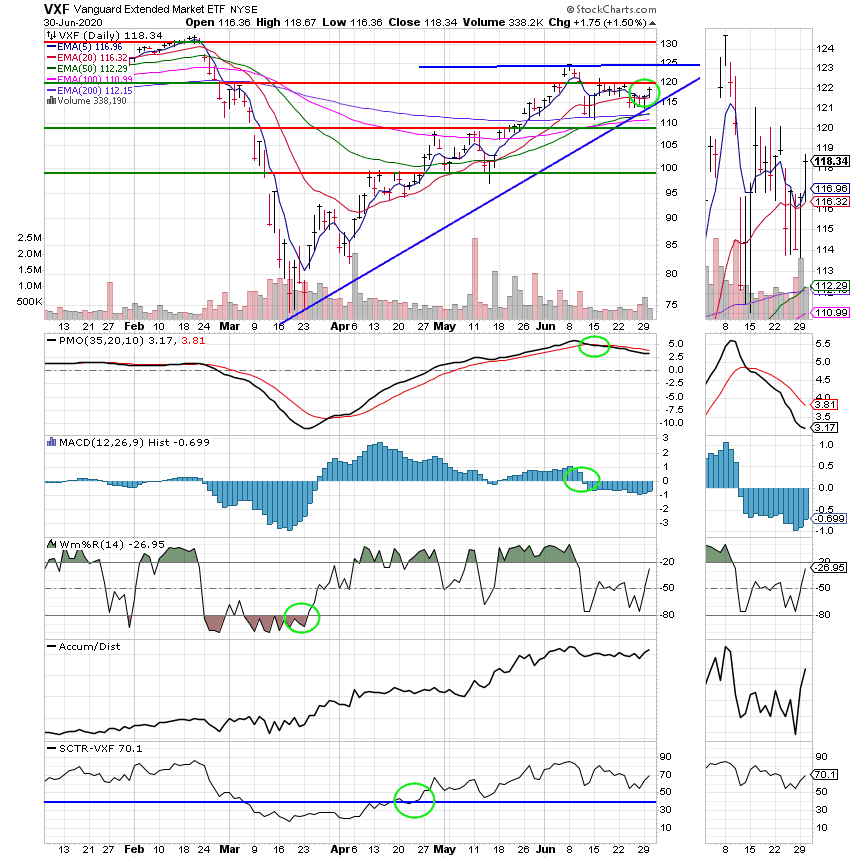

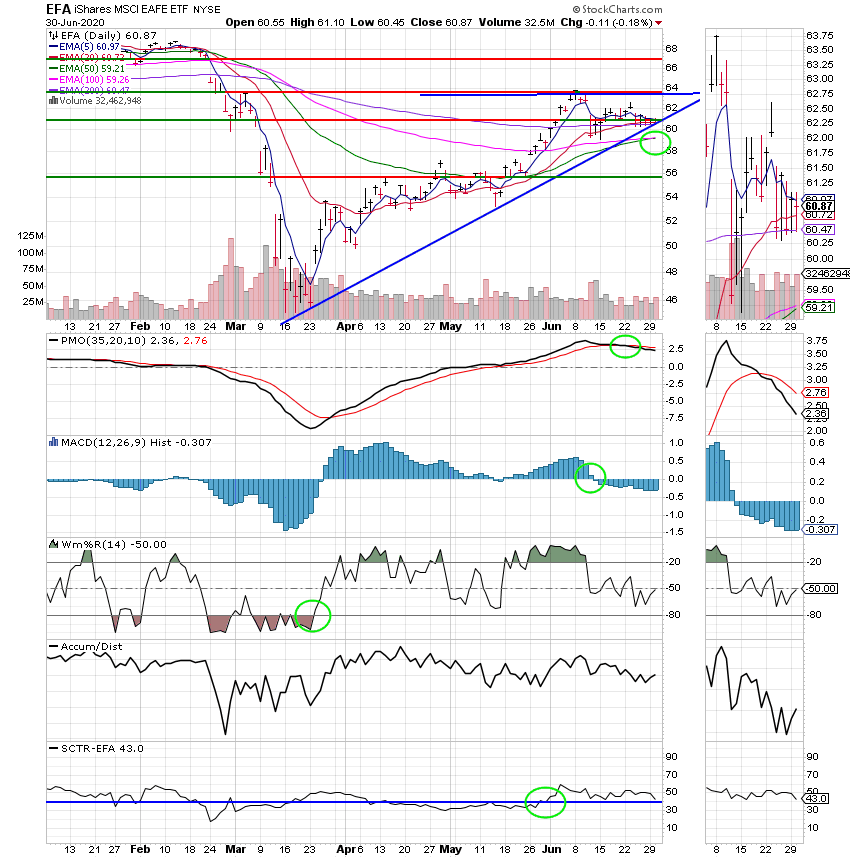

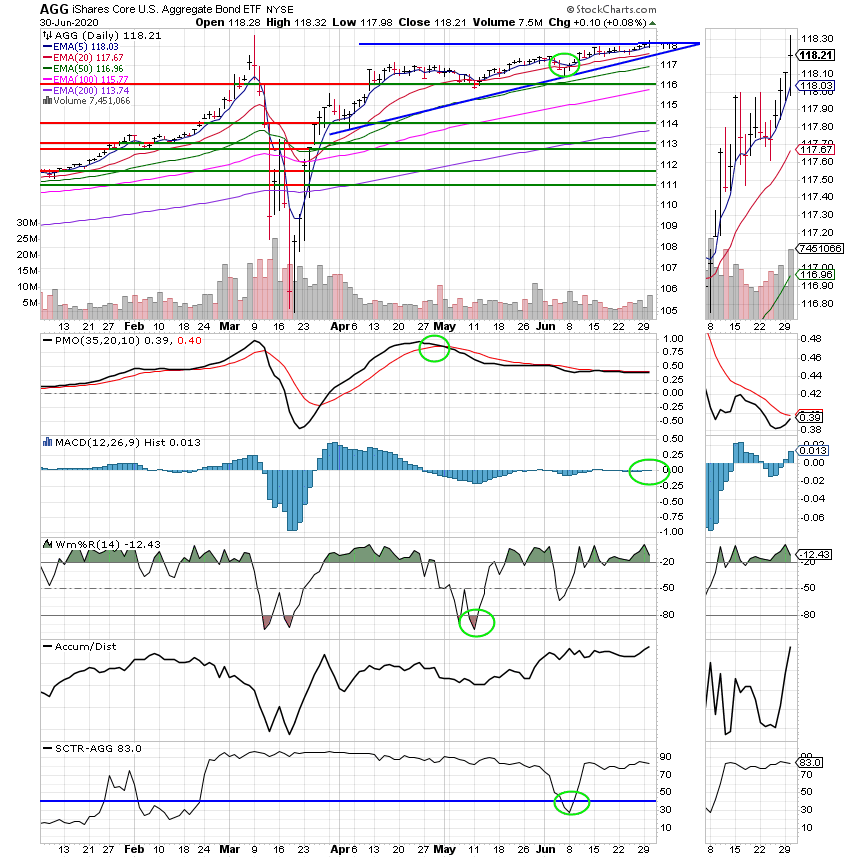

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Buy. We are currently invested at 100/S. Our allocation is now +14.16% on the year. Here are the latest posted results.

| 06/30/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.447 | 20.9168 | 45.7718 | 52.9859 | 29.0909 |

| $ Change | 0.0003 | -0.0006 | 0.6976 | 0.8513 | -0.0666 |

| % Change day | +0.00% | +0.00% | +1.55% | +1.63% | -0.23% |

| % Change week | +0.01% | +0.00% | +3.05% | +3.70% | +0.12% |

| % Change month | +0.06% | +0.63% | +1.99% | +4.00% | +3.44% |

| % Change year | +0.59% | +6.08% | -3.15% | -5.85% | -11.08% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 21.1365 | 29.0273 | 33.8766 | 37.0319 | 21.4901 |

| $ Change | 0.0438 | 0.0000 | 0.1920 | 0.2500 | 0.1650 |

| % Change day | +0.21% | +0.00% | +0.57% | +0.68% | +0.77% |

| % Change week | +0.46% | +0.27% | +1.27% | +1.52% | +1.73% |

| % Change month | +0.73% | +0.55% | +1.81% | +2.14% | +2.42% |

| % Change year | -0.23% | -0.96% | -2.80% | -3.64% | -4.42% |