Good Afternoon, The market continues to be pressured by threats of a recession which is defined as two successive quarters of negative economic growth measured as GDP. Folks, I agree with several notable analysts and brokers who insist we are already in a recession. To me it’s the same as when there was so much debate about whether we were in a bear market or not. The media was waiting for a decline from the previous high of the S&P 500 of 20% and by golly they weren’t going to say it was a bear market until that happened. It didn’t matter that the majority of tech stocks were off buy 50% or more. It didn’t matter that the Nasdaq was off by over 30%. It didn’t matter that the Russel 2000 was off over 20%. The market had to meet their technical definition of a bear market before they would say it was official. Many investors continued to buy every dip while applying bull market rules to what in all actuality. was a bear market. That resulted in sizeable losses in their portfolios. Unnecessary losses! Bear market rules would have had them selling into strength. When it walks like a duck and quacks like a duck then it’s probably a duck. It felt like a bear market and that’s exactly what it turned out to be. It was little solace to the folks that were sitting on big losses that the media finally declared it was a bear market. They had been feeling it for a while and their portfolios were clear and substantial proof! That said our current situation is no different. Market pundits continue to wait for the economy to meet the textbook definition of a recession before they will declare one officially. All while many investors continue to watch the losses mount. Last week Kathy Woods who ramrods ARK investments declared that we are already in a recession and I agree with her totally. If I wait for these so called experts to declare one I’ll probably wait until I have little or nothing left. We are already feeling the effects of a recession and we certainly don’t need them to tell us that what we are experiencing is indeed a recession! The bottom line is that most of the commentary and news is little more than noise. Be distracted by that noise and you will take your eye off the ball and strike out. In times like these you need to focus on your charts and do what they tell you to do. Don’t worry about what you think will happen and especially don’t worry about what they say will happen. They make their money off of selling news. It doesn’t necessarily have to be correct for them to make money. It simply has to generate interest…. In essence, it doesn’t matter how many times they were wrong. The only thing that will be remembered was the one time they were right. So following them is definitely not an effective way to manage risk. The goal in managing risk is to be correct the greatest percentage of the time that you possibly can……. Enough said. So where are we now? We’ve entered the dog days of summer and even more so than usual. After spending a couple hours looking at charts it is obvious that this market is trading sideways with a negative bias. While I don’t have a crystal ball it appears like it will continue to trade this way for the foreseeable future with the substantial risk of moving another leg lower. There is really not much reason to be in equities right now. Investors should not focus on how much their accounts have dropped or how much upside they will miss if they are not in at the exact bottom of the bear market. That is a recipe for more pain. When this market finally does turn up there will be weeks and months of time to get back in and it will be more than obvious what you should do and when you should do it. Don’t focus on your account balance!!!! If you do that you will not be able to make objective decisions. Your account balance will continue to move up and down until the day you retire and the only way to avoid that is to stay invested entirely in the G Fund for your entire career. That will guarantee that your account will always move higher and will never dip. You know what else it will guarantee???? That you will retire with six figures less in your account!!!! So play it safe if you will. You have to be in it to win it and that means moving up and down. Keep focusing on being in the right place as much as you can and know that you will make some bad trades along the way. That’s part of the journey!!!!! Let me use myself as and example. Generally speaking I gained in the neighborhood of 60% over the past three years. I freely admit that I am currently having the worst year of my investment career and I started in TSP in 1987 (yeah that’s right, dinosaurs still roamed the earth in those days). I am currently off to to the tune of 25% so far in 2022. (Remember though that the year is not over). Lets assume the worst case scenario that I don’t make any of that money back. Where would that leave me? 60% minus 25% would leave me with a net gain of 35%. Had I remained in the G fund that entire time it would have netted me a return of 1.45% per year or 4.35%. OK. lets do the math. 35% – 4.35% = 30.65%. So…..if you stayed in the G Fund for those three years you would have lost nothing…..and had a net gain of 4.35%. While I moved my money an average of four times per year in and out of the TSP equity based funds and suffered a loss of (ouch) 25%! Even with the maximum possible loss of 25%. I’ll finish with 30.65% more gains than you. For the sake of making it even clearer that would be a total of 30,650.00 dollars more over a three year period. Extrapolate that out over a hypothetical 20 year career and it would be in the neighborhood of 150,000-180,000. I’m allowing a few years to get the ball rolling but you get the picture and most careers are longer than 20 years…. These figures don’t have to be exact to show you that while your balance will vary you will complete your career with more money if you invest in equities. Much more!

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow finished the day at -0.42%, the Nasdaq +1.75%, and the S&P 500+0.16%.

Stocks stage big comeback Tuesday with S&P 500 finishing slightly higher after erasing 2% loss

The days trading left us with the following signals: C-Hold, S-Hold, I-Sell, F-Hold. We are currently invested at 100/G. Our allocation is now -25.11% on the year not including the days returns. Here are the latest posted returns:

| 07/01/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.93 | 18.9074 | 58.1977 | 61.0308 | 31.9617 |

| $ Change | 0.0014 | 0.1269 | 0.6084 | 0.8872 | -0.0075 |

| % Change day | +0.01% | +0.68% | +1.06% | +1.48% | -0.02% |

| % Change week | +0.06% | +1.33% | -2.18% | -2.90% | -1.87% |

| % Change month | +0.01% | +0.68% | +1.06% | +1.48% | -0.02% |

| % Change year | +1.16% | -9.48% | -19.11% | -26.86% | -18.96% |

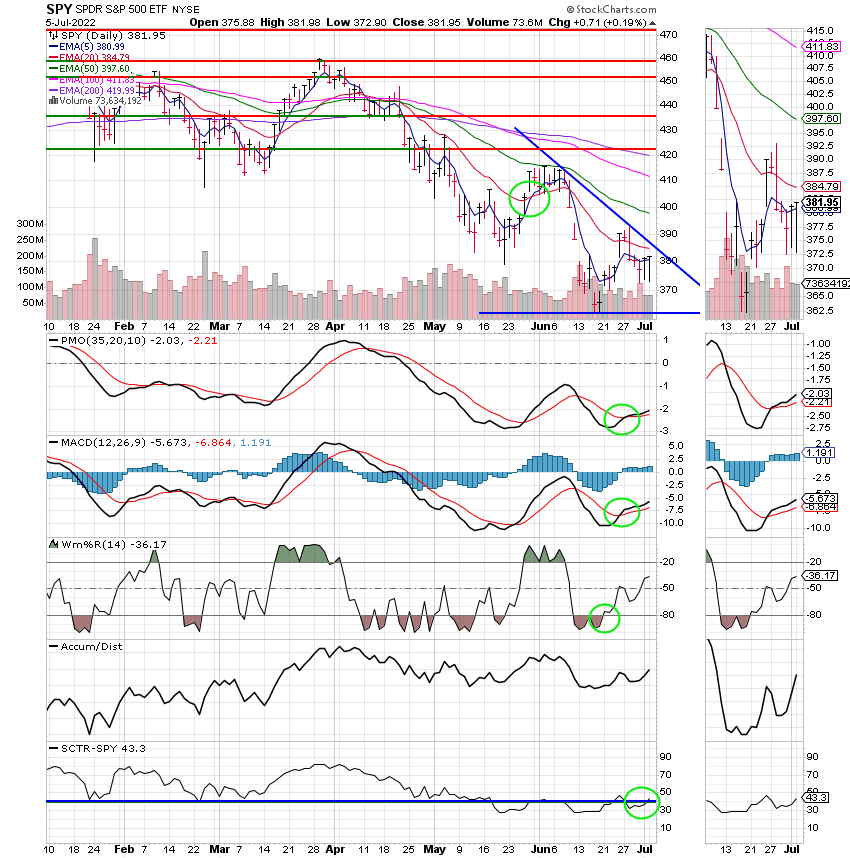

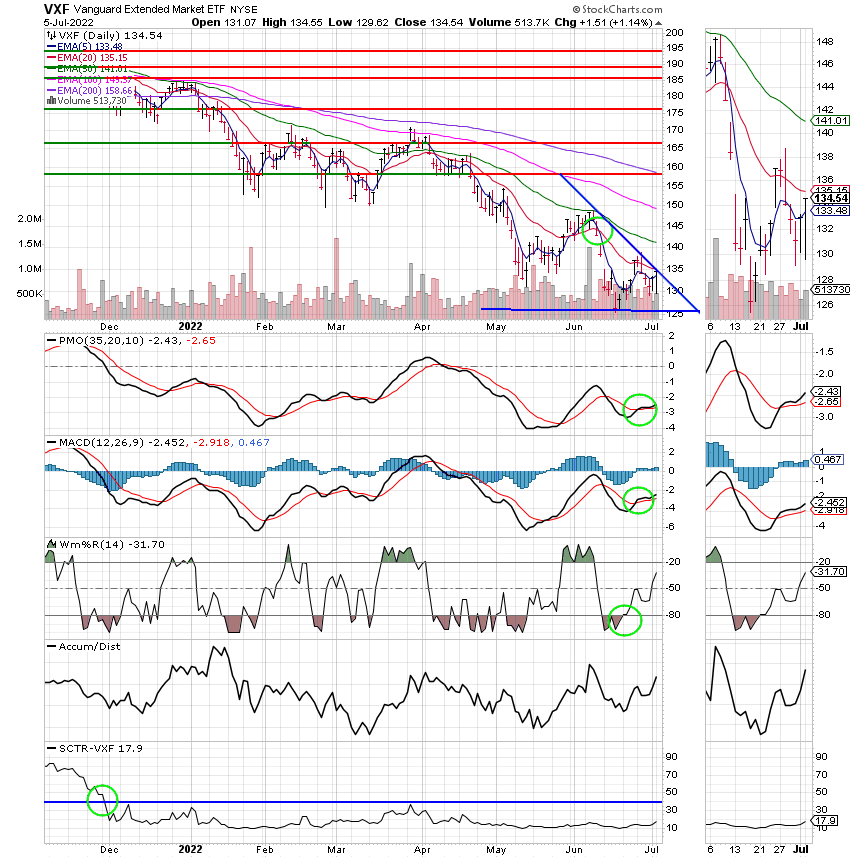

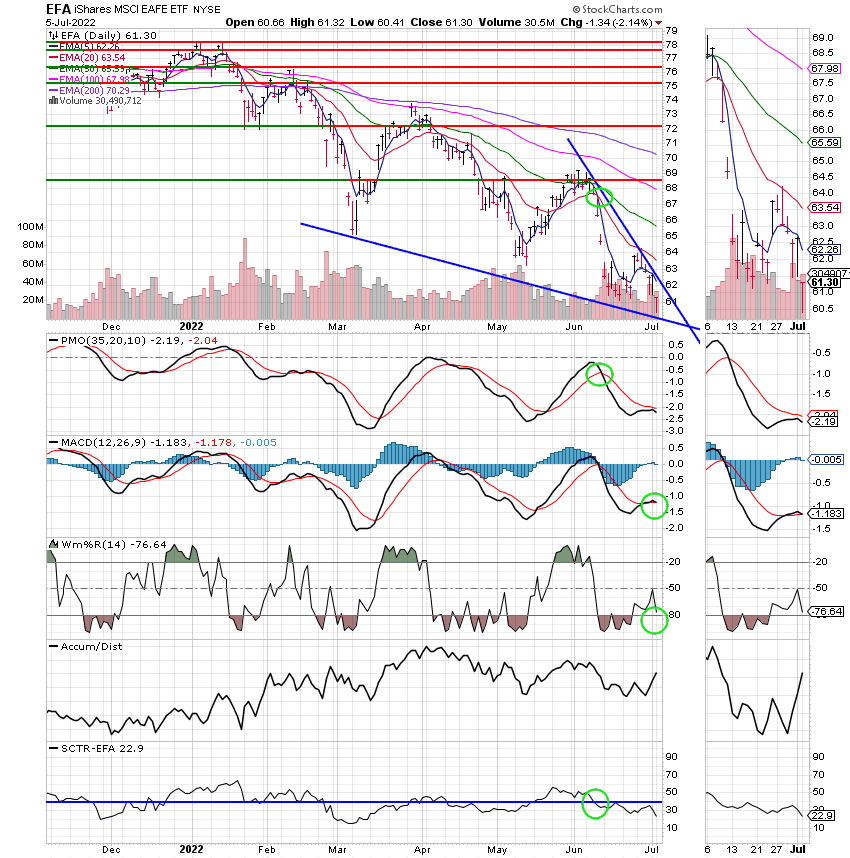

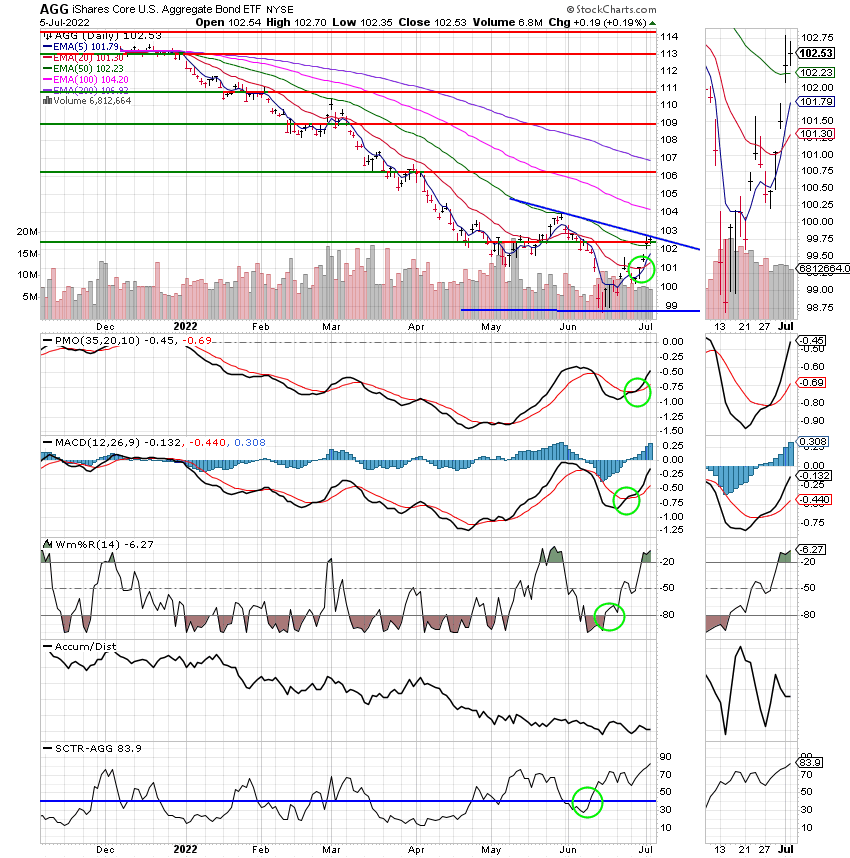

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Nothing to add here. Keep praying and keep watching the charts! have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.