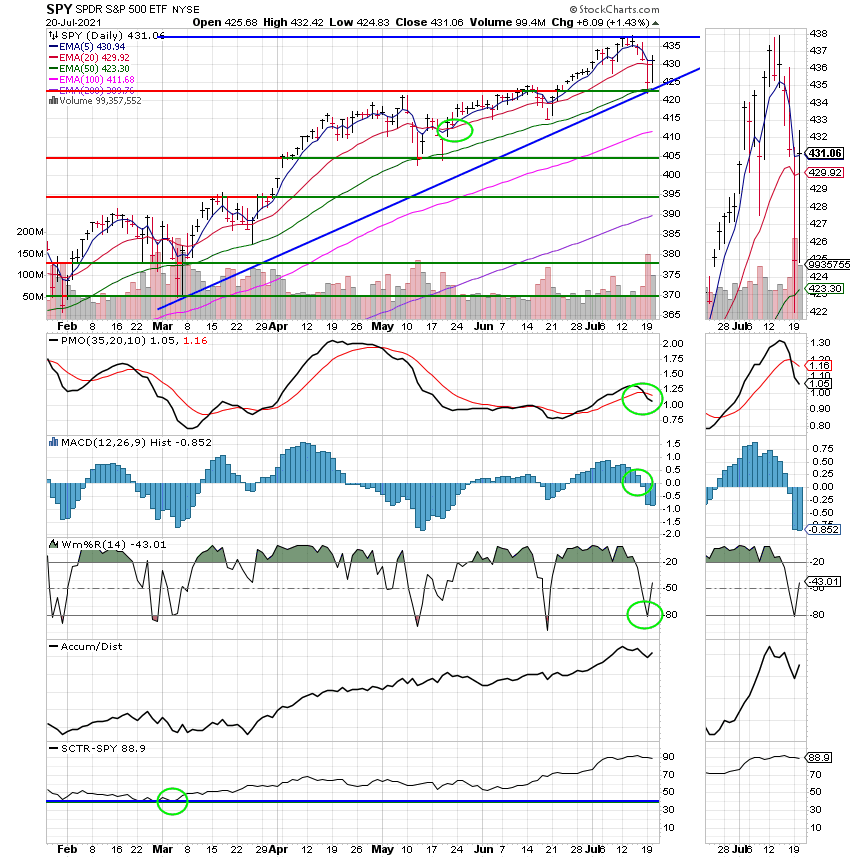

Good Evening, Last week we talked about being due for a pullback and we got a hard selloff to begin the week as investors fretted about a possible slowdown in the economic comeback based on a resurgence in COVID 19 infections via the Delta Variant. Today, we got the bounce that we anticipated might come as we looked at our charts yesterday afternoon. The question is now which one will follow through? The dip or the bounce?? Personally, I would be surprised if there is not more downside coming. However the strength of todays snapback has me wondering if that might not be it. Either way we will see. For now all is well with the C Fund regaining it’s 20 day moving average. As long as it continues to trade above it’s 50EMA and the other indicators remain reasonably healthy we are all in. As we talked about a few weeks back the focus was again on the 10 year bond yield as it moved back over 1.20 after dropping to 1.17 yesterday. Without a doubt todays bounce intensified when the 10 year yield moved back above 1.20. I’m saying the same thing now as I said in that earlier blog. If you want to know where this market is going just watch the bond yields paying particular attention to the 10 Year Treasury Yield. The ticker for that is $TNX for any of you that are so inclined. Normally, the bond yields will move higher as the economy heats up and with the current yields so low I find it very hard to believe that yields will not continue to rise when this finally settles down. For that reason it is my belief that the market will ultimately move higher until higher inflation finally overcomes the rally. So why did the bond yields drop recently? It was probably due to foreign investment in US Bonds. Bear in mind that interest rates in Europe are currently negative and are very low if not negative in most other places as well. So even the low yields currently being paid by US Bonds are more than foreign buyers can get in their own countries. To put it simply they are in search of yield and stability. OK Scott, how does that effect our bond yields then? Glad you asked. It is simple bond yields and bond prices move in opposite directions. So the higher the bond buyers drive the price of bonds the lower the yield goes. How does that apply to the market then? Investors look at the lower bond yields as a sign that the economic recovery is faltering! They think and rightfully so that bond yields and ultimately inflation and interest rates should be moving higher in an economy that is heating up. When the bond yields don’t do what they think they should do they simply freak out and sell stocks then ask questions later. This becomes a lot like a snowball rolling downhill when people move to safe havens as the selling begins. After all, what are the two top safe havens when the market is selling off? Precious metals and you guessed it….BONDS. It’s really complicated to be sure but I simply can’t find another explanation for the reason that bonds are behaving the way they are. I think this will finally return to normal as the world economy improves and these foreign bond buyers start to move their money elsewhere. If anything, when that occurs it will have the opposite effect and bond yields will spike. Then might be a good time to head for the hills, but that scenario is a long ways off. Right now we have money to make if we can successfully navigate this market and don’t forget, we are still overdue for a correction. If it doesn’t come now then it eventually will and when it does we need to be ready.

The days trading left us with the following results: Our TSP allotment regained what dropped yesterday posted a gain of +1.52%. For comparison, the Dow added +1.62%, the Nasdaq +1.57% and the S&P 500 +1.52%. Praise God for such a good day!

Dow rebounds more than 500 points, recovering most of Monday’s losses

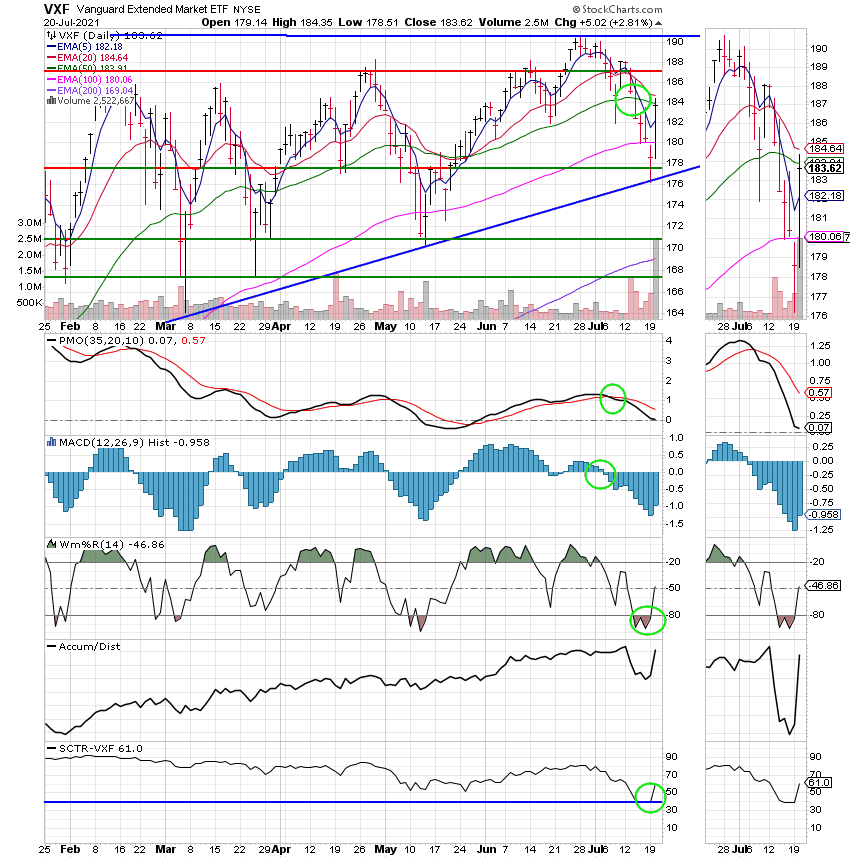

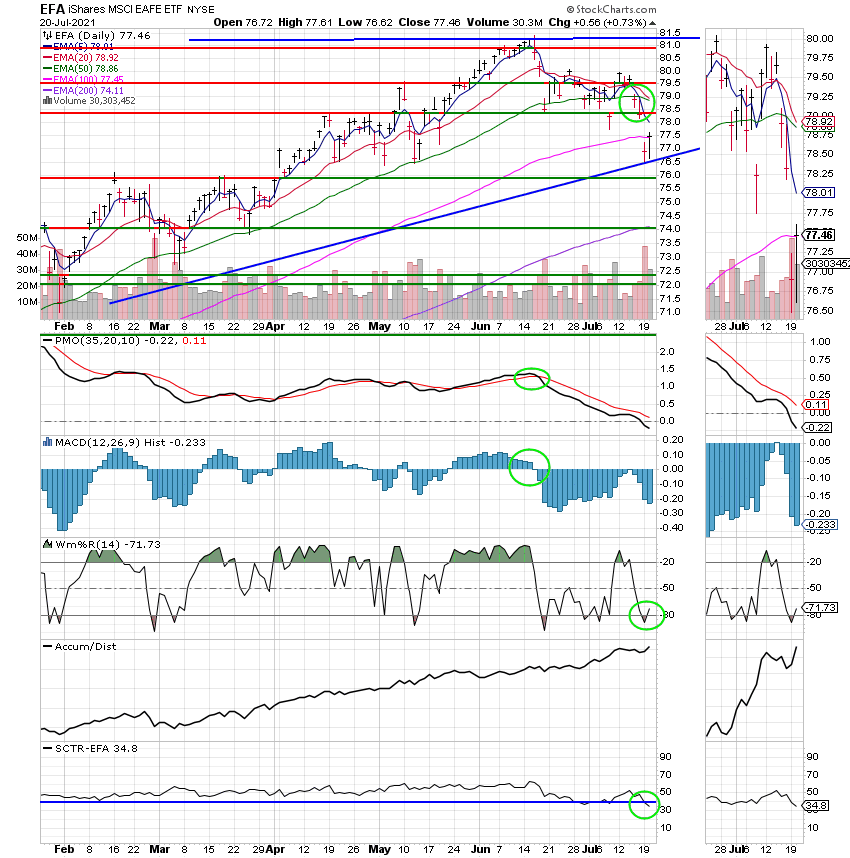

The days action left us with the following signals: C-Buy, S-Hold, I-Hold, F-Buy. We are currently invested at 100/C. Our allocation is now +12.68% on the year not including the days results. Here are the latest posted results:

| 07/19/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.6282 | 21.1284 | 63.8857 | 80.9616 | 37.831 |

| $ Change | 0.0021 | 0.1042 | -1.0287 | -0.8830 | -0.6999 |

| % Change day | +0.01% | +0.50% | -1.58% | -1.08% | -1.82% |

| % Change week | +0.01% | +0.50% | -1.58% | -1.08% | -1.82% |

| % Change month | +0.08% | +1.19% | -0.85% | -5.50% | -1.91% |

| % Change year | +0.73% | -0.32% | +14.26% | +9.11% | +6.90% |